What’s the Story, Market Glory?

By Douglas Porter

August 30, 2024

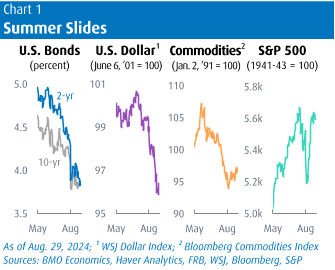

Global markets are ending the summer in a very different place than where it all began, for the most part. Bond yields have been the big story; even with a modest back-up this week, they spent most of the past few months tumbling lower on a combination of generally better inflation news, mostly softer employment data, a variety of central bank rate cuts, and now heavy-duty hints that the Fed is preparing to join the easing parade next month. To pick but one example, the 2-year Treasury yield stood above 4.9% in the last week of May, and it has since melted to just above 3.9%. While 10-year yields have also plunged, the 70 bp drop in the past three months has been a little less precipitous, leaving this 10s/2s portion of the yield curve nearly flat, after more than two years of inversion.

The change in tone by the Fed has also knocked the U.S. dollar off its high horse, with the currency sagging more than 4% on a trade-weighted basis from its late-June peak. Commodities also spent their summer on the back foot, with oil prices dropping below $75, and both metals and crop prices mostly lower. Normally, commodity prices get a bit of a boost from a weaker dollar, but other factors—notably, concerns over China’s economy—undercut one measure of resource prices by 8% in the past three months. The combination of a weaker greenback and lower commodity prices is handing the rest of the world a double-barreled dose of helpful inflation news, reinforcing the bond rally.

Equities meantime, have been a relative oasis of firmness, albeit with a mid-summer squall. The S&P 500 and MSCI World Index are still a touch below their mid-July record highs, but quickly powered back up from the early August rout, and are ending the summer on a solid footing. Indeed, the venerable Dow and the TSX both visited record highs this very week, as there is a gradual rotation underway from previously high-flying tech stocks. The Nasdaq was a relative underperformer both for the summer and this week, with Nvidia’s highly anticipated—shall we say hyped?—quarterly results not quite enough to keep the highest flyer of them all from pulling back. However, we will note that the Nasdaq has still managed a rather tidy 25% advance over the past year.

The economic backdrop has played an important role in supporting equities, and particularly the more cyclically-driven components of the market. Aside from the brief growth scare in early August, most signs suggest that the U.S. economy is still grinding forward, helping keep global growth close to a 3% track. That’s a bit below average, but also a long way from serious trouble. We have actually nudged up our Q3 and full-year estimates for U.S. GDP growth, amid an upward revision to 3.0% for Q2, and the sturdy early read on consumer spending for this quarter. And, yet, inflation trends have remained encouraging, with the three-month annualized pace in core PCE now just 1.7%.

All eyes will now turn to next Friday’s crucial U.S. jobs report. With Jay Powell’s clear declaration at Jackson Hole a week ago that the Fed does “not seek or welcome” any further weakening in the job market, the stakes are high. We suspect that payrolls will produce a decent gain of just above 160,000, and that the unemployment rate will stay steady after July’s two-tick bounce. But, our view is that the jobless rate is almost certainly headed higher from its current 4.3% perch, if not next week, then in the months ahead. And that is going to pave the way for the Fed to follow an expected 25 bp cut in September with a series of such moves in coming FOMC meetings. The only debate now appears to be whether the Fed may opt for a 50 bp gulp at some point, and any seriously sour jobs report could certainly trigger a more aggressive step.

There’s even some speculation that the typically cautious Bank of Canada could accelerate the pace of rate cuts—but likely at a later date. The Bank’s decision next Wednesday is widely expected to produce a third straight 25 bp rate cut, taking the overnight rate to 4.25%, or more than a full point below the current Fed funds target (5.25%-to-5.50%). If anything, the case for BoC cuts is even more airtight than for the Fed, as Canada’s economy has seen a) a much bigger upswing in the jobless rate (to 6.4%), b) even cooler inflation (CPI now just 2.5% y/y), and c) much softer GDP growth over the past year.

The last on the list above was really not affected by the mild high-side surprise for Q2 GDP growth. The 2.1% quarterly advance was flattered by an upswing in government spending. And, even then, the economy has managed to grow by just 0.9% in the past year, which lags badly behind both the 3.1% y/y rise in U.S. GDP over the same period, as well as Canada’s towering 3.3% population growth. Moreover, the decent quarterly growth result was dulled by flat readings for both June and July GDP, prompting us to trim our Q3 estimate to 1.3% annualized (from 1.5%). That’s less than half the pace the BoC pencilled in for the quarter in its latest MPR forecast (in late July). Also keeping the door wide open for further rate relief has been an extraordinarily quiet summer housing market. Existing home sales remain below average, even at a time of decent inventory levels, while new home sales are plumbing the depths, especially in the condo space.

But as much as it would pain the BoC to suggest this, the biggest factor driving a potentially more aggressive series of rate cuts is the changed outlook for the Fed. With markets back to pricing in a series of early and often U.S. rate cuts—frankly egged on by Chair Powell—this has helped firm the Canadian dollar, thus removing one remaining hurdle for the Bank. We are maintaining our call of 100 bps of cuts by January, and then another 50 bps by mid-2025, taking the overnight rate to 3.0% by next June. But the risk is clearly that the Bank moves even sooner, and possibly more. After all, if the jobless rate keeps rising, and the output gap keeps widening, while inflation is better behaved, why would the Bank stop at 3%? That’s our Wonder Wall.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.