(Trade) War, What Is It Good For?

By Douglas Porter

February 07, 2025

How was your week? Following the intense North American trade drama over the weekend, and the climax on Monday, markets were notably calm in the aftermath. When economic historians look back at this episode, they will wonder what the fuss was about: bond yields were little changed on net over the past five sessions, stocks were nearly level, and the U.S. dollar was somewhat softer on balance (for a change)—not exactly a trade version of the Cuban Missile Crisis. But, of course, beneath that calm market exterior on the weekly figures was some wild churning underneath. While markets were orderly and rational, they weren’t calm to start the week; the Canadian dollar saw a near-4% swing, short-term GoC rates were tumbling, and stocks globally were under heavy fire. But almost all of that soon reversed, as the trade war was put on pause, at least for Mexico and Canada.

Just to recap: the U.S. was poised to apply 25% tariffs on all imports from Mexico and all non-energy imports from Canada, with 10% for energy goods from the latter, and also 10% on all Chinese imports, starting Tuesday. In turn, Mexico pledged to retaliate, without specifics, while Canada planned to impose a 25% tariff on roughly a quarter of what it imports from the U.S. (with only part of that kicking in immediately). On Monday, first Mexico and then Canada were granted a 30-day reprieve following various pledges to fight the scourge of fentanyl. China was given no such reprieve and partially retaliated in turn and is taking its case to the WTO. The extreme policy flip-flop also forced us to flip-flop on our economic forecasts, bringing them almost back to where they stood a week ago—the lost weekend!—albeit with some shaving of Canadian GDP due to the intense uncertainty for business investment.

While the U.S. backing off for now may seem obvious to those arguing all along that it was a negotiating bluff, it certainly felt real at the time. The very specific carve-out for Canadian energy products and critical minerals, which make up more than 30% of Canada’s exports to the U.S.—as well as the detailed (if highly debatable) rationale for the moves against each country—speaks to some real planning behind the tariff measures. There seem to be two trains of thought that have since emerged: 1) One camp would have it that the President has shown his hand, and/or was dissuaded by the sour market reaction as well as intense lobbying by affected U.S. businesses, and that the major threat is now over. 2) Another camp believes that this is just the opening salvo in what could be a months/years-long series of on-off trade threats that could still easily devolve into serious tariffs. We suspect the latter.

Amid all the trade drama, the world and the economy just kept turning. And, for the most part, the news was solid. While U.S. payrolls were a touch lighter than consensus in January at 143,000, there were big upward revisions to prior months, a strong household survey employment gain, a dip in the jobless rate to 4.0%, and warm wages of 4.1% y/y. Both ISM surveys were above 50 last month, with factories firmer than expected (at 50.9, the best since late 2022) but services a bit softer (at 52.8). Manufacturing may have been lifted by extra activity ahead of possible tariffs, a trend that was obvious in December’s blow-out trade deficit. Let’s just say that the record U.S. $123 billion deficit in goods trade was welcome news to precisely no one. But besides the tariff front-running, the deepening gap is also being driven by a strong greenback and very healthy consumer spending, which are both pulling in imports.

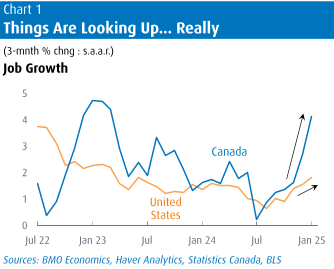

If anything, the Canadian data were even more impressive, but almost completely overshadowed by the trade threat. Auto sales turned in their best January on record, trade swung into a surplus in December on an export pop, and job growth was strong last month (Chart 1). Following an outsized 91,000 rise in December, employment rose another 76,000 in January, no doubt fueled by factories racing to beat the tariffs—manufacturing payrolls soared 33,000. Total hours worked jumped 0.9% in the month, and January’s figure stands a towering 5% above Q4 levels (a.r.); if productivity just stands still in the quarter, that points to a like-sized GDP gain in Q1, more than double the current consensus view.

The combination of an on-off trade war and underlying economic strength leaves central banks in a delicate spot. The widespread view is that a trade war could make the Fed a bit less likely to cut rates, at least initially, due to the increased economic uncertainty and the risk of an inflation flare-up. We estimated that the weekend’s proposed measures would boost U.S. inflation by roughly 0.3 ppts this year and next; and, cut GDP growth by a similar amount. That combo would indeed make the Fed more cautious, especially given the latest round of data, as well as an unnerving pick-up in one-year inflation expectations in the UofM’s survey (to 4.3% in February from 3.3%). Suffice it to say that in the event of a trade war, our call of three Fed trims, re-starting in June, looks aggressive.

It’s a very different set of calculations for the Bank of Canada. The Bank’s own research suggested that a trade war could chop GDP growth by about 2.5 ppts this year and another 1.5 ppts in 2026, leaving growth close to nil over the two years. While the proposed tariffs were a bit lighter than the Bank assumed (10% on Canadian energy, only partial Canadian retaliation), those estimates still look roughly appropriate. Even while the Bank warned that inflation could rise in Canada due to retaliation and a lower loonie, our view remains that the weak growth backdrop would ultimately dominate, prompting the Bank to continue cutting rates steadily as the year progressed—we could see the overnight rate going as low as 1.50% in a true trade fight (from 3.0% now). But as long as the trade war is on pause, the Bank is likely to turn cautious, especially in light of the recent run of robust data. The market is leaning to a cut in March, but we suspect it will pause, assuming the tariffs are still on pause.

The Bank of Mexico had the tariff issue imposed upon it this week, as its decision was inconveniently timed in the middle of the turmoil. In the event, the Bank decided to chop its rate 50 bps to 9.5%, bringing cumulative easing to 175 bps since it began nearly a year ago, but this was the first 50 bp gulp. A cooldown in headline inflation to below 4% has helped pave the way for the central bank to offer some added relief ahead of any trade turmoil. Notably, the peso has been relatively stable throughout the drama, and is almost unchanged at 20.5/US$ since the first direct warning of 25% tariffs in late November. However, unlike Canada, Mexico has been under verbal threat for a longer period, and the currency has weakened by more than 15% in the past year. No one wins a trade war, and least of all the Mexican peso.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.