Those Lazy, Hazy, Crazy Days of Summer

By Douglas Porter

August 9, 2024

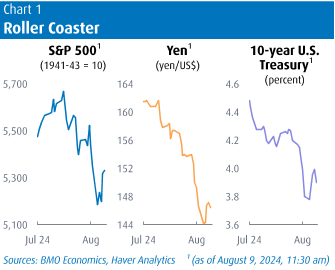

For the multitudes on vacation this week, don’t fret, you didn’t miss much. Aside from the Nikkei’s biggest two-day swing since the 1987 crash, very little happened. Well, yes, there was that spike in the VIX on Monday to above 60 at one point, and, okay, 10-year Treasuries did plunge below 3.7%, 100 bps lower than barely three months ago. And, yes, the dollar did drop below 142 versus the yen at one stage from over 155 a week earlier, an 8% move on one of the most important exchange rates in the world. Okay, the brief volatility and rising U.S. jobless rate did unleash recession chatter even outside of the cloistered world of financial markets. But, aside from that, all was calm.

A tad more seriously, markets did manage to find their equilibrium after a rapid-fire series of unsettling events. Stocks fought back to near post-payrolls levels, while yields actually nudged up on net (albeit after a furious rally), and even exchange rates are ending the week almost precisely at week-ago levels. Helping calm the waters was the light U.S. economic fare on offer, which came in a bit firmer than expected. After the troubling drop in its factory counterpart last week, the non-manufacturing ISM was a decent 51.4 in July. Initial jobless claims had their moment in the sun as well, pulling back to 233,000 after last week’s jolt to 250,000. And the Fed’s Senior Loan Officer Survey found no significant tightening in standards, and even some relaxation for mortgages. Overall, just as the markets were getting wild, the economy was reading mild.

This is not to suggest that we are entirely out of the woods. U.S. growth is expected to cool in coming quarters after a surprisingly (amazingly?) resilient performance in the past year and a half, which will create some stresses. And, until recently, equity markets had not only climbed the wall of worry: they had pole-vaulted over it, leaving them open to a correction. And, of course, we are approaching the most challenging seasonal period of the year, with plenty of U.S. election drama on offer, alongside some very real geopolitical risk.

We’re not going to need to wait long before the next potential hurdle for markets, with the July CPI due Wednesday, followed by retail sales the next day. Our call and the consensus are looking for a stable inflation picture, with 0.2% increases on both headline and core, keeping the yearly rates mostly steady—we have core holding at 3.3%, and headline finally dipping just below 3% for the first time in more than three years. However, with markets now assuming aggressive Fed rate cuts totaling 100 bps by year-end, any detour on the inflation front could cause upset. On the other side, we’re expecting a non-descript 0.3% rise in retail sales; the market could be rattled by a softer result, as bad economic news is now, in fact, bad news. And now, even weekly jobless claims can move markets, so beware our expected uptick to 240,000.

Looking beyond the U.S. economic outlook, there is also the issue that we don’t yet know the full extent of the rapid unwinding of the yen carry trade. Playing a supporting role in recent gyrations was the hawkish 20 bp hike by the Bank of Japan last Wednesday, which, along with the U.S. jobs surprise, suddenly sent the dollar skidding versus the yen. BoJ Deputy Governor Uchida definitely helped calm the waters this week by suggesting that the Bank “obviously” wouldn’t hike rates further if markets remained volatile. But after going from 141 at the start of the year, to 161 by early July, and then almost all the way back down again, the yen’s wild gyrations have undoubtedly left some hurting. Note that a steep reversal in the yen carry trade also played a starring role in summer and fall in 1998, which included a Russian default and the implosion of Long-Term Capital Management, and ultimately required Fed rate cuts, even amidst a tech boom.

And that neatly brings us back to the outlook for the Fed. Forecasters and markets were frantically adjusting their view in the past two weeks but seem to have iterated to a reasonable spot. Casting aside an age-old rule to eschew forecast revisions in the dead of summer, we amped up our call on the Fed following the jobs report, to a steady series of 25 bp cuts starting in September and carrying on well into next year. Now that some of the dust has settled, we are comfortable with that call—i.e., still aggressive, but no need for bigger cuts just yet.

Some are squawking loudly that the Fed has fallen behind the curve; we don’t see it quite that way. The uncomfortable reality is that the inflation upswing earlier this year left them with little choice but to keep the screws tightened, and, yes, that raised the risk of a downturn in the economy—that’s a subtlety that investors chose to largely ignore, until now. Finally, note that the Fed still has the option of responding very quickly if the need arises. The conventional wisdom has it that the Fed only does inter-meeting cuts in extreme situations, but that’s not entirely correct. We cite the case of a 50 bp cut on January 3, 2001, the first reduction of that cycle. It arrived shortly after a weak ISM report, when the S&P 500 had dropped double digits, but not yet in bear terrain, the unemployment rate was still low at 3.9% and core inflation was still a bit high at 2.6%. Sound familiar? We’re not calling for such an abrupt move, but we are saying it wouldn’t necessarily take a crisis to prompt one.

Canada’s job numbers didn’t deliver the clear message markets were craving: another dip in headline employment was countered by strength in full-time jobs and hours worked. Somehow, the unemployment rate defied predictions and recent trends by holding steady at 6.4%. But that was only thanks to a big drop in the participation rate, perhaps reflecting an equally big increase in those discouraged by a much tougher job market. For returning students, it is a particular challenge, with their jobless rate spiking above 17%, and barely half of them employed this summer. While it was a messy report, we’ll clean it up by saying that the Bank of Canada seems to be on track to continue cutting by 25 bps a meeting into early next year. The good news for the BoC is that the Canadian dollar has actually firmed over the past week, despite the massive risk-off move on Monday, owing to the market’s more dovish take on the Fed. As well, the early results from July home sales suggest that the initial BoC cuts have done little to spark the housing market, thereby also giving the Bank freer room to continue easing.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.