The Political Economy: A Tale of Two Elections

By Kam Haq and Kevin Page

June 18, 2024

Will the state of the economy be an important factor for voters in the upcoming Canada and US elections? Yes. Will it be a decisive factor?

James Carville, a political strategist for US President Bill Clinton, famously summed up one of the defining issues of the 1992 presidential election as: “It’s the economy, stupid”. Voters want confidence that the government is a capable economic manager. It is a good bet that economic issues like affordability, growth, and fiscal responsibility will be considered by voters in the next election.

We live in interesting times. According to a Chinese curse that may or may not be apocryphal, interesting times are times of trouble. Populism, polarization and conflict are on the rise. Politics is becoming more personal (nasty), and less policy-oriented.

In the US, former President Trump denies an election result and has been convicted of a felony. He is currently leading in political polls in battleground states. In Canada, Prime Minister Trudeau and the Liberals are trailing in the polls. The debate about climate change policy is being reduced to the size of a rebate. The upcoming elections in the US and Canada are shaping up to be more than “It’s the economy, stupid”.

Political scientists have long studied voting behaviour in democratic elections. In many of the models, the ‘funnel of causality’ flows from socio-psychological factors (e.g., ethnicity, race, class, education) which can drive party identification (i.e., our tribal political connections) to more specific evaluations around candidates, campaigns and policy issues (e.g., like the economy).

Political economy is about how economics affects politics and how politics affects the economy. If trends in headline economic indicators were all that was needed to predict election outcomes, there would be much less public interest in polling.

Our political life is complicated. The guessing game has already started in Canada on what would be the economic impacts of a Biden vs Trump presidency. Bottom lines, at this juncture, a return of President Trump likely means more economic uncertainty, more risk to exchange rates and trade (i.e., higher tariffs) and potentially higher inflation and interest rates.

When economists examine the link between economic performance and election outcomes they tend to focus (our interpretation) on 3 variables – income/output, inflation and (un)employment. It turns out that across different studies in Canada (e.g., Nadeau and Blais, Canadian Journal of Political Science, 1993 and Ferris and Voia, Applied Economics, 2021) and the US (e.g., Fair, Yale Economics, 2018) correlations can be found on income (if the economy is growing, political fortune favours the incumbent) and inflation volatility (voters are not happy when their household balance sheets are being squeezed).

So, what does this mean for electoral prospects for President Biden and Prime Minister Trudeau?

(All charts sourced from Havers Analytics)

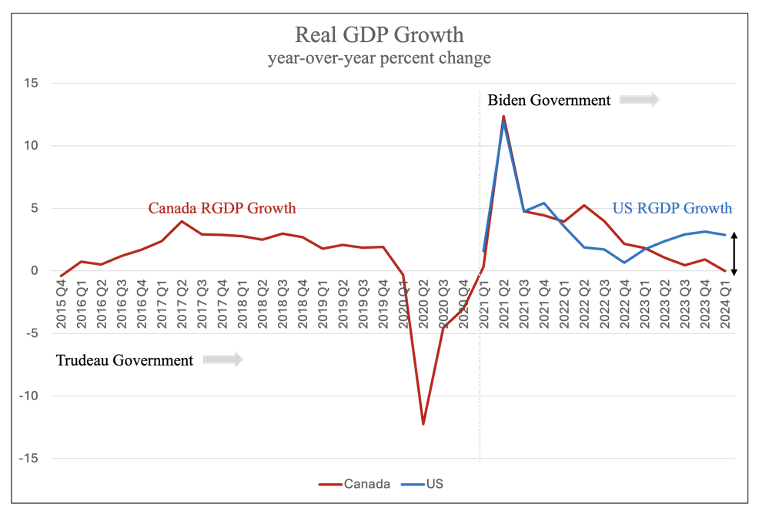

Chart 1

Both the US and Canadian economies experienced significant output declines in 2020 with the onset of the COVID pandemic and strong recoveries in 2021 supported by large fiscal supports and vaccination. While economic growth rates have moderated in both countries, the slowdown is much more prevalent in Canada than the US (Chart 1). Currently, the US economy is out-performing OECD economies. The strength of the US economy, buoyed by a large budgetary deficit, has been impressive.

The relatively strong economic performance under President Biden will support, not hinder, his electoral prospects in November 2024. While much has been written about the decoupling of economic indicators and political polling numbers in the US over the past year, the results that matter will be on election day. We stay tuned.

In Canada, the slowdown in the economy is more strongly correlated with the decline in support for Prime Minister Trudeau and the Liberal government. A key question is whether voters have made up their minds on the capacity of the Liberals to grow the economy based on the cumulative record or will a growth rebound in 2025 spurred by prospects for lower interest rates alter political momentum and improve electoral chances. We stay tuned.

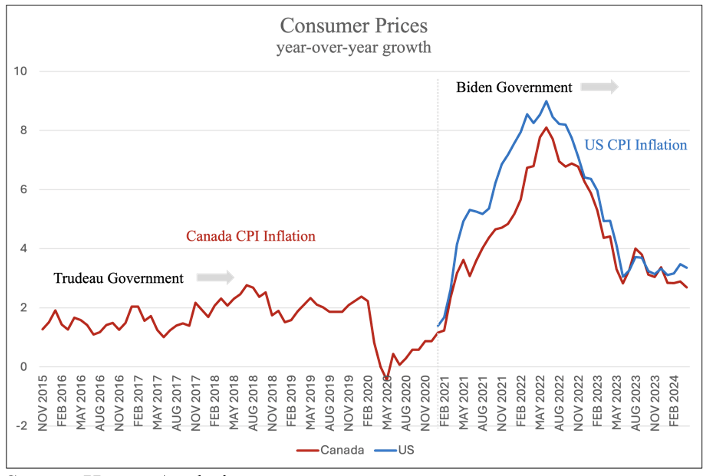

Chart 2

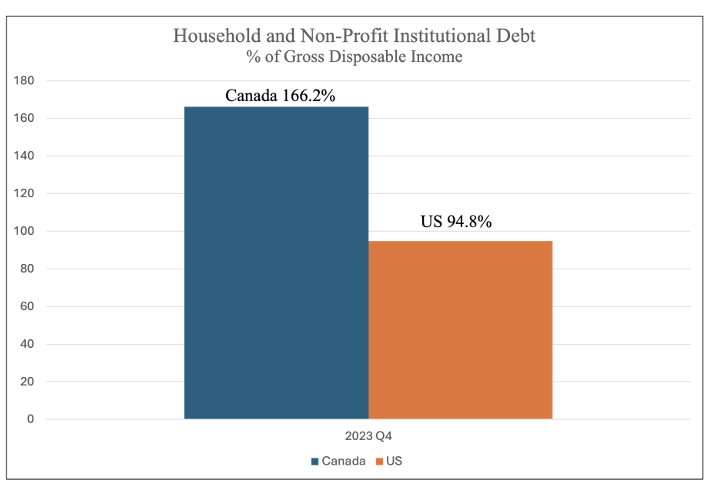

Chart 3

Inflation and affordability concerns have been front-and-centre in political debates in western democracies. Chart 2 illustrates the dramatic rise and fall of consumer price inflation in Canada and the US since 2021. Large fiscal supports and low interest rates combined with COVID-related supply bottlenecks generated (modern) historic increases in prices. In response, central banks in both countries responded with record increases in interest rates. High inflation and high interest rates make voters unhappy. In this environment, incumbent governments will struggle to remain in power.

President Biden could face a large sting from US voters on affordability concerns in the upcoming US election.

It is possible that the negative impact on the electoral prospects of the incumbent Liberal government will be much less if the election takes place in the fall of 2025. With the Canada CPI inflation rate now close to the 2 percent target, there is time for a series of reductions in policy interest rates, possibly lowering the current 5 percent policy rate to the 2.5 to 3 percent range. In a scenario with a soft economic landing (i.e., slow growth to reduce demand pressure on price increases) and modest real wage increases, affordability concerns by Canadians could be much lower when they head to the polls. Time favours Liberal chances.

One distinguishing indicator between Canada and the US is the stock of debt held by households and non-profit institutions (Chart 3). Canada is heavily indebted relative to the US and has been since the 2008 financial crisis. The carry cost of mortgages in Canada is at a record high. In response, Canadians have cut back on the use of credit cards. Higher debt loads and high interest rates are straining household balance sheets. Lower interest rates are critical for households and the incumbent government’s electoral prospects.

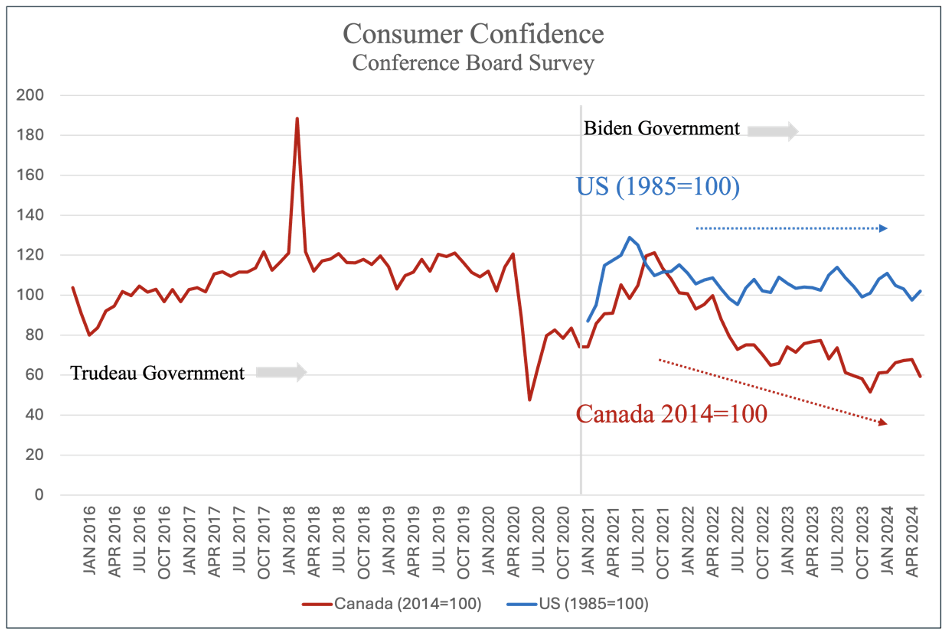

Chart 4

Data on consumer confidence from the Conference Board of Canada generally track the economic performance of the Canada and US economies (Chart 4). Confidence is trending down in Canada. This is not good for the economy and the governing Liberal electoral prospects. Their challenge is to change the trajectory. By contrast, consumer confidence is holding steady in the US. President Biden’s challenge is to translate good economic performance and steady consumer confidence into a good electoral outcome in the fall of 2024.

In 1849, French writer Jean-Baptiste Alphonse Karr wrote “Plus ça change, plus c’est la même chose” (i.e., the more things change, the more they stay the same). It was about the same time John Stuart Mill published the Principles of Political Economy. Mill could not imagine disconnecting the study of the economy and politics. With elections upcoming in Canada and the US, politics and the economy are likely to connect.

Kam Haq is an undergraduate economics student at Skidmore College in the US and a summer research student at Institute of Fiscal Studies and Democracy.

Kevin Page is the President of the Institute of Fiscal Studies and Democracy at the University of Ottawa, former Parliamentary Budget Officer and a Contributing Writer for Policy Magazine.