The PBO Economic and Fiscal Outlook and the Post-COVID Economy

Kevin Page

Institute of Fiscal Studies and Democracy, University of Ottawa

September 29, 2020

Ten years ago, a business book was published titled Difficult Conversations: How to Discuss What Matters Most. It was a New York Times business best seller. One of the authors, Douglas Stone, said “difficult conversations are almost never about getting the facts right. They are about conflicting perceptions, interpretations, and values.” In reading the latest report by the Parliamentary Budget Officer (PBO) on the medium-term economic and fiscal outlook, I wonder if Parliament and we, as a country, are going to struggle with a difficult public policy and political conversation.

What should be the role of the state and fiscal policy in promoting a post-COVID19 economic recovery? What is the appropriate budgetary constraint for the government in the likely environment of weak growth and low-but-rising interest rates?

The September 2020 PBO Economic and Fiscal Outlook lays the foundation for a start of a difficult conversation. They have given us an independent perspective based on what the Canadian economy could look like as the world struggles with the transmission of a virus over the next 12 to 18 months. It is a slow recovery. Real GDP does not return to pre-COVID19 levels until 2022. Business investment remains depressed. There are long-lasting economic scars for important economic sectors. Unemployment rates decline but remain elevated for the next few years.

It is what economists call a status quo (or no policy change) view of the world. Only policies that are backed by legislation are built into the outlook. Fiscal supports for COVID19 are assumed to unwind as scheduled. No costing is provided for political commitments made in the recent Speech from the Throne.

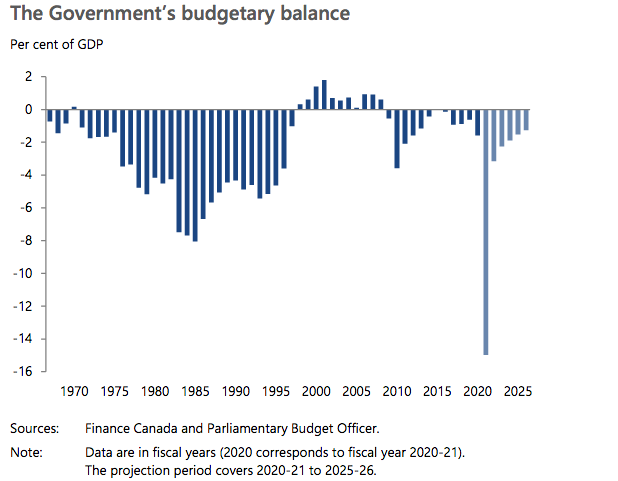

The updated PBO fiscal outlook indicates that the baseline (no new policies) budgetary balance will decline from about $330 billion (15 percent of GDP) in 2020-21 to about $75 billion (3.2 percent of GDP) in 2021-22. In the years following (2022-26) we can expect budgetary deficits in the $55 to $35 billion range (2.5 to 1.5 percent of GDP). The relatively large, medium-term deficits reflect an economy that struggles to operate near its potential (resulting in slower growth in budgetary revenues).

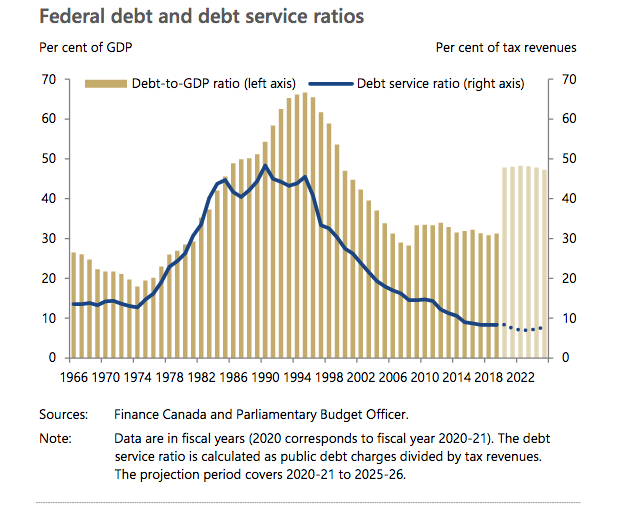

The debt-to-GDP ratio in the no-new-policy scenario will hover around 48 percent — up about 18 percent from pre-COVID19 levels. It is a record increase in debt. While we have experienced debt in these levels in the late 1990s, the government of the day worked hard to reduce it to create fiscal space to address future shocks like the 2008 global financial crisis and the 2020 global pandemic.

These numbers represent a reasonable starting point for the difficult conversations on public policy. They are not facts. They are estimates based on assumptions. Change the assumptions (e.g., virus transmission), then change the estimates for growth and budgetary balances. Add new programs but do not raise taxes, then budgetary deficits and debt will rise.

The stylized facts embedded in the outlook are weak growth, much higher debt (thanks to the pandemic) and a higher medium budgetary deficit track. The carry costs of public debt (public debt interest charges relative to budgetary revenues) stay low as long as interest rates remain low. As interest rates rise, public debt interest charges will rise significantly.

The difficult conversations must be framed around policy objectives and the complexity of reality and trade-offs. Politicians and citizens want to see the end of COVID19 in Canada — but we know the virus has no borders. They want progress against climate change but also a soft landing for our oil industry in a de-carbonized future. They want an economic system that promotes innovation, competitiveness and fair trade but also promotes greater balance in incomes across the population, and opportunities for disadvantaged peoples.

In these difficult public policy and political conversations, Stanford University economist Thomas Sowell argues there are no solutions, only trade-offs.

To be fair to future generations, we need to be careful with future debt buildup. The fiscal resiliency to address the 2020 crisis was largely generated more than two decades ago. Low interest rates, thanks in large part to weak economic demand and low inflation, mask the perceived opportunity costs of higher debt. To some economists, the real burden of the public debt should be measured by the proportion of additional tax relative to income and not the absolute amount of interest charges in a low interest-rate environment.

Can Canada live and remain fiscally sustainable with higher public debt? Yes, but our fiscal room to address the next economic or health shock will be reduced if interest rates rise higher than anticipated and growth struggles. All proposals for future deficit-financed programs must be carefully scrutinized by Parliament and citizens.

By my count, in the recent SFT there were more than 40 proposals for increased federal spending and only a few proposals for raising additional revenues. Time has come for the government to table a medium-term budget constraint. We need a budget this fall.

Policy Contributing Writer Kevin Page was Canada’s first Parliamentary Budget Officer, and is founding President and CEO of the Institute for Fiscal Studies and Democracy (IFSD) at University of Ottawa.