The Lockdown Recession and the Federal Response: $100 Billion and Counting

In the history of economic catastrophes, the COVID-19 coronavirus pandemic is more akin to a natural disaster or a meteorite than a cyclical or systemic shock. As former Parliamentary Budget Officer Kevin Page points out, the virus has wiped out both supply and demand by paralyzing human activity and mobilizing worldwide fear. Governments have responded accordingly, with outcomes TBD.

Kevin Page

Scientists say we are a planet of microbes—things like bacteria and viruses. The human body could not survive without them. Notwithstanding, the late British biologist Peter Medawar, a Nobel Prize winner said “a virus is a piece of bad news wrapped up in a protein”. It turns out that the novel coronavirus COVID-19 will almost certainly result in the worst economic news since the Great Depression of the 1930s.

What will be the longer-term impact on globalization, the role of the public sector and the way we work are important questions. Which way the world will pivot may depend in part on how governments respond to the pandemic. Either way, “A change is gonna come”, as Sam Cooke famously sang.

Almost since the beginning of the breakout of COVID-19 in China late last year, economists have been progressively revising their projections for 2020 and beyond. The direction has been downward. The storm clouds on the horizon have gotten darker and heavier.

COVID-19 is hitting the world with three shocks at once. It is the perfect storm that depresses both demand and supply.

First, a medical shock caused by a virus that is highly transmissible and many times more deadly than a flu. Second, a double whammy economic shock. In the absence of a vaccine, governments around the world have had little choice but to shut down their economies through containment policies including social distancing and border controls. Also, a commodity price shock, including a dramatic lowering of world oil prices—starting with a geopolitical tussle between the Saudis and Russians and moving to a sharp drop off in global demand. Third, an uncertainty shock. People are living in fear and confidence in the future has plummeted.

Recent economic indicators are hitting policy makers right where it hurts. First-quarter output numbers in China, where this crisis began, indicate that the world’s newly ascendant, second-largest economy has witnessed its first year-over-year decline in output in 50 years.

In mid-April, Statistics Canada released employment and early output estimates for the month of March. The government health containment measures started in mid-March. Employment levels dropped by 1 million in March (wiping out years of net employment gains in one month). Real output is estimated to have declined by 9 percent in March (the largest decline on record). Real GDP is estimated to have declined by 2.6 percent in the first quarter. The recession has already started.

In this environment of uncertainty, both the Department of Finance and the Bank of Canada have shied away from outlining base case (or planning) economic forecasts. The Bank of Canada has developed some recession scenarios but without much public detail. Personally, I think this is a problem. How do you provide confidence in your policy responses if you are not open about the size of the economic problem facing the country?

The most up-to-date forecast numbers are made available by the International Monetary Fund (IMF). They are projecting a decline in global GDP of 3 percent in 2020. This is the steepest decline since the Great Depression. By comparison, global output growth was effectively zero in 2009. Bottom line, the Lockdown Recession of 2020 is much more devastating economically than the global financial crisis some 12 years ago. The IMF developed three alternative scenarios. All scenarios involve a deeper recession and slower recovery reflecting greater struggles dealing with the pandemic and the likelihood of a second wave early in 2021.

IMF is projecting Canada will decline by 6.2 percent in 2020. This is about the same as the US and a little less than projected declines in many European economies. The recovery is expected to be weak. Do not expect to be back to recent GDP levels until 2022.

To provide updated fiscal estimates, the Parliamentary Budget Office developed an economic scenario with an annual decline of 5.1 percent in 2020, including a drop of 25 percent in real GDP in the second quarter. Both economic numbers would be unprecedented in modern times.

The Bank of Canada and the Government of Canada have responded to the COVID-19 pandemic as a crisis like none other. Sadly, this is the reality. The world has not seen a crisis like this since the 1918 Spanish Flu.

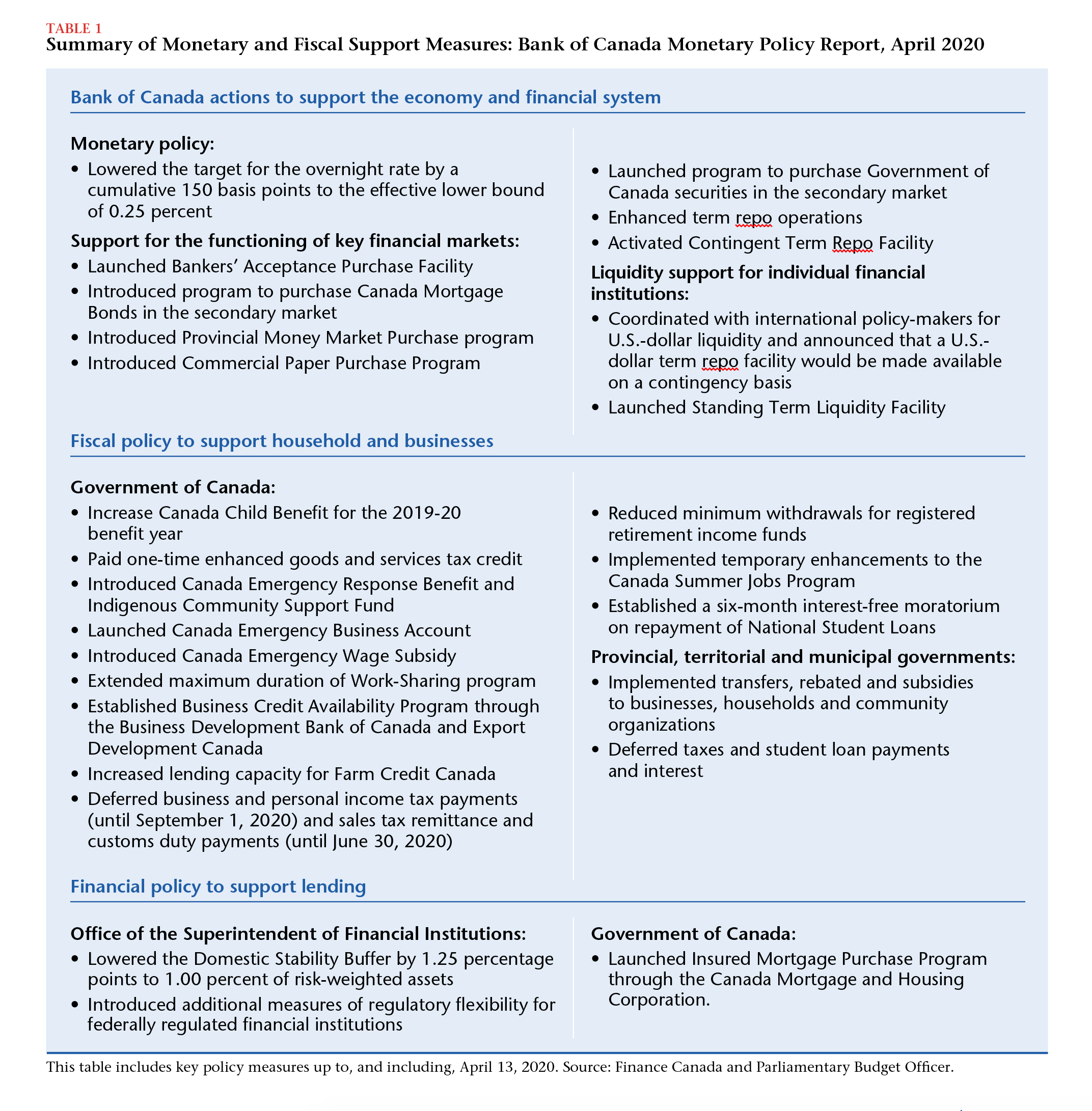

The Bank has unloaded its full tool box and then some. While it is hard to boost demand in an economy while governments are telling people to stay at home, the Bank lowered its policy rate to 25 basis points (effectively zero). The hope is that this will encourage commercial banks to lower their lending rates and give people a break on big-ticket items like mortgages. Every possible instrument to increase liquidity in the financial sector has been eased (Table 1). The Office of the Superintendent of Financial Institutions also eased capital-to-loan ratios. The liquidity measures are valued in the hundreds of billions.

Since mid-March, the federal government has been progressively announcing fiscal support measures to offset the devastating economic impacts of containment.

Since mid-March, the federal government has been progressively announcing fiscal support measures to offset the devastating economic impacts of containment.

With a vaccine still many months away, governments across the world have chosen to lock down their economies as an instrument of public health—to slow the spread of the virus (flatten the epidemiological curve) and ease pressure on health care systems. To flatten the recession curve, governments have provided historic supports.

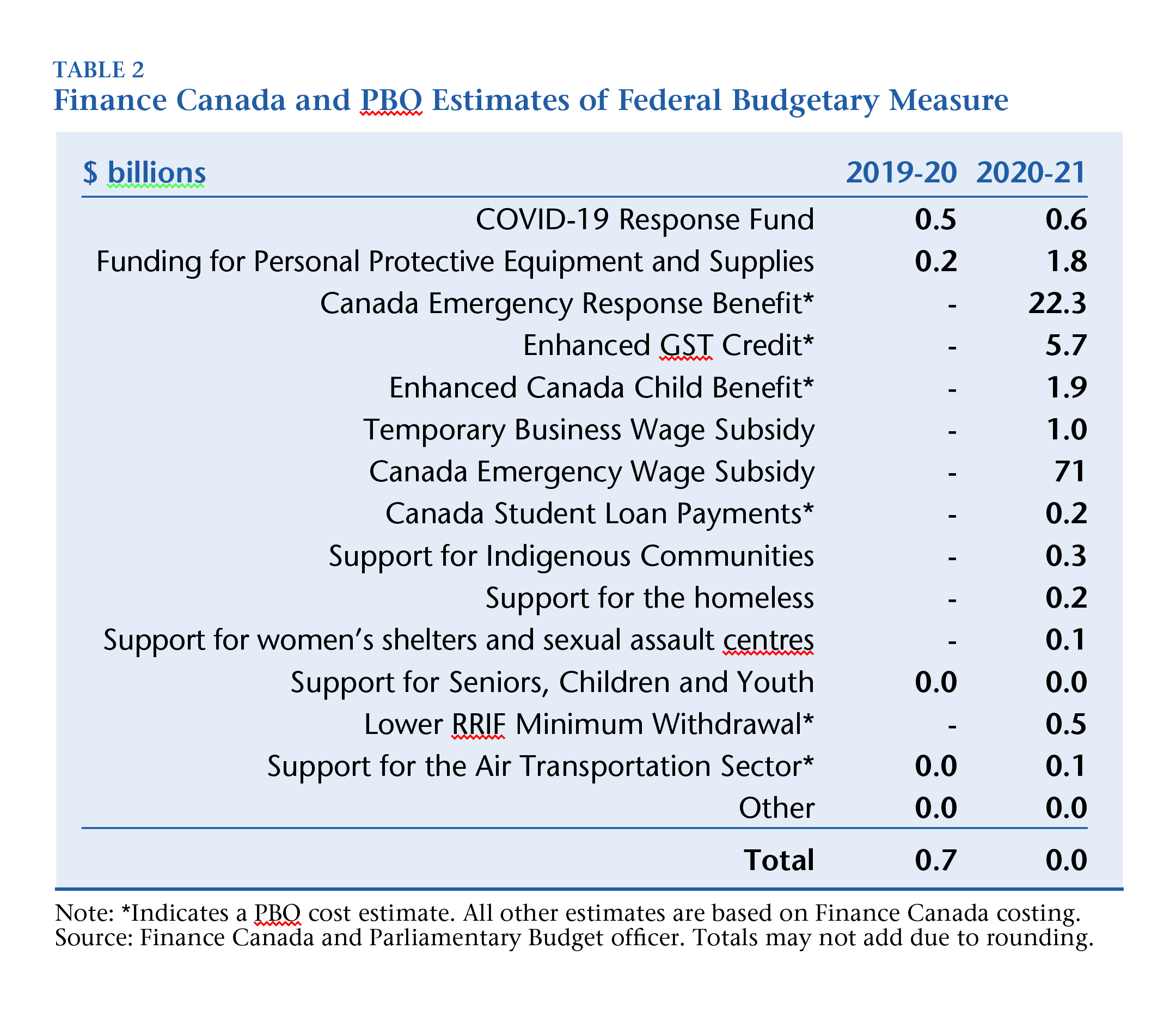

Canada’s fiscal supports total well in excess of $100 billion in budgetary-type measures. PBO estimates in early April totaled $105 billion (Table 2). Additional (un-costed) supports have been announced in recent weeks, including additional funds for Canada Student Jobs, broader access to the Canada Emergency Recovery Program and additional funds for essential workers. The federal government has also introduced its own liquidity measures (delays on tax remittances) and credit supports through organizations like the Export Development Corporation and Farm Credit Canada. Provinces have also introduced supports worth many billions of dollars for households and businesses.

This level of fiscal injection in Canada is without precedent. It needs to be. New budgetary support measures are at least five times greater than the annual fiscal stimulus measures provided in 2009 and 2010. IMF comparisons of fiscal supports highlighted in its April 2020 Fiscal Monitor—both budgetary and non-budgetary—indicates Canada is well within the range of supports provided by countries across the world.

This level of fiscal injection in Canada is without precedent. It needs to be. New budgetary support measures are at least five times greater than the annual fiscal stimulus measures provided in 2009 and 2010. IMF comparisons of fiscal supports highlighted in its April 2020 Fiscal Monitor—both budgetary and non-budgetary—indicates Canada is well within the range of supports provided by countries across the world.

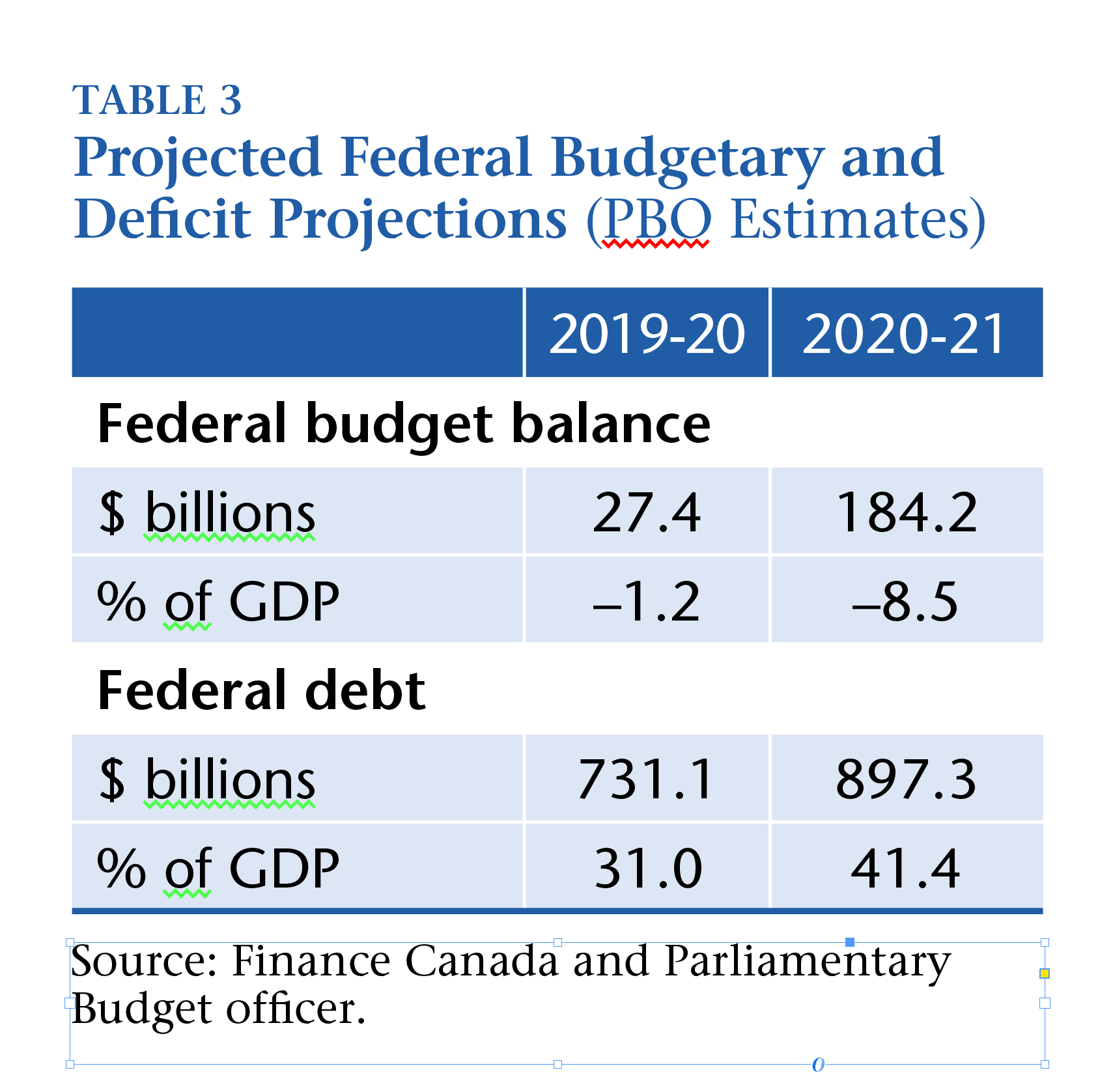

The fiscal supports and expected drops in budgetary revenue will swell federal (and provincial) budgetary deficits and debt (Table 3). PBO currently estimates the federal deficit will rise from $27 billion (–1.2 percent of GDP) in 2019-20 to $184 billion (–8.5 percent of GDP) in 2020-21 while the federal debt will go from $731 billion (31 percent of GDP) to $897 billion (41 percent of GDP). With additional federal supports expected, we can expect deficits and debt to go higher.

How do these numbers look from an historic perspective? They are big but not unprecedented. We have seen federal budgetary deficits in the 8 percent range after the deep recession in the early 1980s. We saw federal debt-to-GDP ratios north of 40 percent in the early 2000s. When the IMF compares Canada’s total government net debt to GDP (gross debt less financial assets) with other countries, we are still less than half the average for “advanced” economies. The saving grace, and what is different now from years gone by, is record-low interest rates.

Is a fiscal reckoning coming? Maybe, but it cannot be anytime soon. Expect many governments across the world to move forward with public investment programs. After the support, we will need fiscal stimulus. It will not be easy to restart a global economy without a COVID-19 vaccine, improved treatment and a lot of testing.

Contributing Writer Kevin Page, Canada’s first Parliamentary Budget Officer, is founding President and CEO of the Institute for Fiscal Studies and Democracy at University of Ottawa.