Tee Times Two

By Douglas Porter

November 15, 2024

The post-election euphoria for equity markets faded this week, as investors snapped back to reality, and thus came gravity. A combination of cautious comments from Jay Powell, so-so inflation readings, and a dawning realization of the costs and tradeoffs involved in the incoming Administration’s policy proposals weighed on sentiment. And while stocks stalled, the upside for yields and the U.S. dollar regained force. The overriding theme of the week was the letter T, and it seemed to come in couplets:

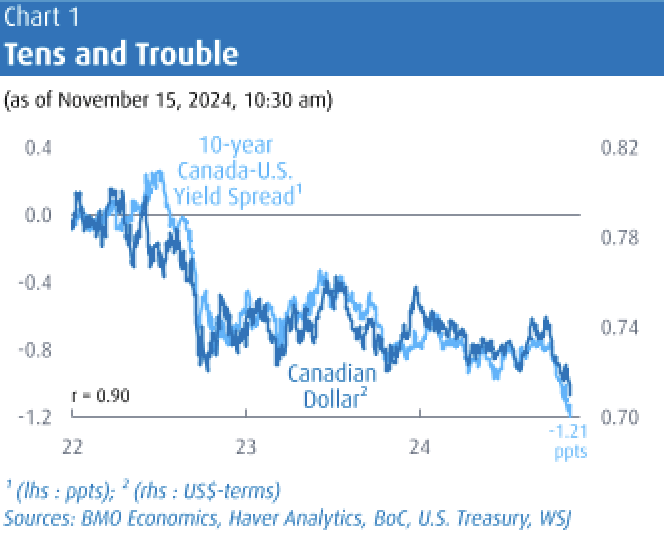

Trump trade and Trauma for the loonie: Yes, parts of the post-election bump in markets reversed this week—the S&P 500 sagged 2% after last week’s 4.7% surge—but the U.S. dollar found a second wind. The currency was juiced by three factors: 1) The prospect of less rate relief from the Fed, per Powell; 2) the growing appreciation that Trump’s tariff threats are real; and 3) the probability that the growth gap between the U.S. and other mature economies will remain wide in 2025. The U.S. dollar powered back up to 155 against the yen and has risen more than 3% against the euro since Election Day. The Canadian dollar has been caught in the greenback tide, falling almost 2% just since last Tuesday to a four-year low of 71 cents ($1.408/US$). It hasn’t helped that BoC Governor Macklem suggested recently that the weak currency isn’t entering into policy decisions, and that deeply negative Canada/U.S. rate spreads are “not close” to their limits. Meantime, 10-year GoCs hit a record -120 bps versus their U.S. counterparts. It’s not obvious what will take the pressure off the loonie anytime soon.

Treasuries and Two per cent: It wasn’t just the dollar that found a second wind this week, as the sell-off in Treasuries regained momentum. Powell’s remarks late Thursday were a catalyst as he noted “the economy is not sending any signals that we need to be in a hurry to lower rates”. And thus, the Fed can deliberate carefully as “inflation is running much closer to our 2% longer-run goal, but it is not there yet”. This followed the October CPI and PPI results, which were spot on consensus and both up 0.2% m/m on the headline, and 0.3% for core. This lifted the annual CPI inflation rate to 2.6% and held core at 3.3%. The latter was no surprise, but “as-expected” does not equal “good”. In fact, the 3-month trend on core CPI is now at a “not good” 3.6% a.r., with the PCE deflator likely to be about a point lower. With retail sales also holding up well in October (+0.4%), the selling in Treasuries resumed. By Friday morning, the 10-year yield was approaching 4.5%, a five-month high. Notably, the sell-off at the longer end has almost normalized the yield curve, with 10s now nearly flat with 3-month T-bill yields for the first time in more than two years.

Tax cuts and Two Trillion: It’s not just the prospect of firmer inflation or fewer Fed rate cuts driving U.S. yields upward; fiscal concerns are also ramping up. While Trump announced that Elon Musk and Vivek Ramaswamy will head up a Department of Government Efficiency to cut costs, there are serious doubts this can move the needle on the deficit. It’s not at all clear that the narrow slice of overall government spending that isn’t for interest, defense, social security or health can come close to offsetting the price tag for proposed tax cuts. And, crashing the party, the October budget figures revealed a $257 billion deficit for the first month of the fiscal year. This brought the cumulative shortfall over the past 12 months to a towering $2.02 trillion, or just under 7% of this year’s GDP. In his first term, Trump inherited a deficit of closer to 3% of GDP, and core inflation of 2.2%—both leaving much more room to manoeuvre eight years ago.

Tesla and the TSX: Equity markets are still busily sorting out the winners and losers from last week’s political earthquake. Suffice it to say that some of the shine has worn off the biggest initial winners, with the Nasdaq falling just over 3% this week. Even Tesla, which apparently has friends in high places, retreated somewhat from a 35%+ post-vote pop. The TSX has emerged as a notable winner, closing above 25,000 for the first time on Thursday, and still up more than 3% for November even with a late-week spill. The relative strength in Toronto is notable, given that energy prices are under a cloud of soft demand, with oil below $68 on China’s growth woes, and natgas struggling with warm weather. Financials and tech have led the TSX to record highs.

Trade and Tariffs: The sturdy performance by the TSX is all the more notable in light of the very real threat of blanket U.S. tariffs. One question our team fielded this week was around why we have not yet adjusted our inflation outlook, given the high prospect of tariffs, and other inflationary aspects of Trump’s proposals. Good question. The main reasons are threefold: 1) We can’t quantify the impact until we know the precise contours of policy; i.e., will it be 10% across-the-board, or 20%, or zero?; 2) we don’t know how trading partners, companies and markets will respond, and all could dampen the inflationary impact to some degree; and 3) there are already some offsetting factors coming into play. For example, oil prices are currently almost $10 below our assumptions for 2025, putting downside risk on the inflation outlook. Similarly, the US dollar index has popped more than 6% in the past six weeks, which could alone nearly negate a 10% tariff hike. Finally, we’ll just note that the Consensus Economics survey—conducted early this week—revealed that the average forecaster had added just one lone tick to the 2025 U.S. inflation call (2.3% from 2.2% a month ago), while the calls on the Euro Area (1.9%) and Japan were left unchanged (2.1%), and Canada’s has been trimmed a tick (to 2.0%).

Tulsi and Thune: Another T to note this week is that the Republicans hit the Two hundred and eighteen mark in the House, thus retaining control and officially completing the red wave election trifecta. Seemingly emboldened, President-elect Trump made a series of, shall we say, interesting Cabinet nominations, including RFK Jr at Health, Matt Gaetz at AG, and Tulsi Gabbard as Director of National Intelligence. The one possible remaining hurdle for the nominees is the Senate, which saw the majority Republicans pick John Thune as leader this week—reportedly, not the Trump team’s number one choice for the important role. Still, it’s not clear how many, if any, the Senate will block. Without wading too far into the politics, the takeaway for markets should be that the incoming president appears to be going all-in, and past policy pronouncements should not only be taken seriously, but perhaps literally as well.

Taylor and Toronto: On a lighter note… For any of you who do not reside in the known centre of the universe, it was all about Swifties and the Taylor Rule in Toronto this week. Ms. Swift kicked off the start of six concerts in the city, accompanied by an endless array of bad puns. Amusingly, the media pinpointed the precise economic impact of the tour on the city to a net boost of $282 million, or almost 0.01% of Canadian GDP (you have to love the precision!). All we will point out is that StatCan recently discovered that it had underestimated 2023 Canadian GDP by almost $42 billion (or a 1.3% undercount), so let’s not get too fussed on the decimal points on any economic estimates.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.