Take 5 for 50

By Douglas Porter

September 06, 2024

For financial markets struggling to find direction after a jumbled summer, it only makes sense that the most important economic indicator in months failed to send a clear-cut message. The hotly anticipated U.S. jobs report for August was mostly close to muted expectations, with the modest surprises largely offsetting each other. So, the debate on whether the Fed begins with a 25 or 50 bp cut on September 18 will continue to rage, although there is no debate that the rate-cut proceedings will commence this month—after all, “The Time Has Come”. Even with some initial backing up after the jobs report, the bigger move this week was a further deep slide in yields across the curve and a pronounced pullback in stocks from a rapid August recovery.

Cutting to the chase, we continue to lean to a 25 bp rate cut by the Fed this month, followed by a series of moves as we head into 2025, with growing odds that the pace will accelerate. While there are plenty of signs that the U.S. economy is cooling, it did after all just come off a quarter of 3.0% GDP growth. And for every sign that we may have hit a soft patch this summer, there was a counterpunch of strength. On the former, in August, auto sales dipped to their second-lowest level of the past 18 months, the ADP reported just 99,000 new jobs, and the factory ISM stayed weak at 47.2, while job openings and construction slid in the prior month. But on the firmer side, payrolls rose a decent 142,000, the jobless rate fell a tick to 4.2%, wages stayed solid at 0.4% m/m and 3.8% y/y, and jobless claims fell to a low 227,000. Overall, certainly enough to trim rates from very restrictive levels, but probably not enough to prompt a 50 bp gulp… just yet.

Before the FOMC meets, it will still have a chance to see how CPI fared in August (this coming Wednesday), as well as retail sales (the following Tuesday). True, the consumer price report may have lost its “most valuable player” status to jobs, but it still has the power to sway policymakers. For this one, expectations are for a mild 0.2% rise in both headline and core prices, which would chop the headline rate down to 2.6%, but leave core standing at 3.2% y/y. In the event, overall inflation would be the lowest since March 2021, right around the time this whole inflation episode began in earnest. And, the recent drop in oil prices to well below $70/bbl, and an associated plunge in wholesale gasoline prices to below $2/gallon, may prove very helpful in carving even more deeply into headline inflation. In recent days, wholesale gasoline has fallen as much as 27% from year-ago levels.

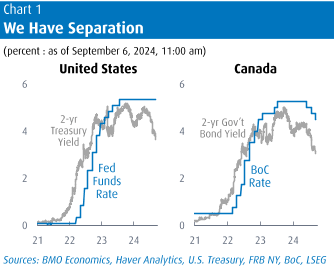

Even if the Fed does begin with more modest rate trims, as we anticipate, the pace may yet pick up, especially if inflation cracks. Markets remain convinced that the Fed will deliver at least one 50 bp cut at one of the three remaining decision dates this year, as they have priced in well over 100 bps of cuts by year-end. Governor Waller’s remarks on Friday morning that he may lean to front-loading such cuts—”if appropriate”—only fanned the flames. Even with the latest moderation in the jobless rate, the fact is that the 3-month average rose further to 4.2%, and that’s well up from the 3.5% low reached early last year. Sahm Rule or not, that shows slack is building and underlying wage and price pressures will continue to ebb. In anticipation of potentially aggressive Fed cuts later on, two-year yields have dropped from a nearby high of 5% in late April to below 3.7% now, the lowest level in two years (Chart 1). And the 2s/10s yield curve inversion has all but finally gone away, with 2s occasionally dipping below their longer-term counterparts.

In Canada, the 25/50 bp rate cut debate is also heating up, just days after the BoC decided to trim by the smaller amount for a third consecutive meeting. Expectations of a more aggressive Bank are being driven both by domestic and international considerations. On the former, GDP growth remains stuck below 1% on a trend basis, which is quite simply weak in the face of 3%+ population growth. And the most vivid example of that mismatch is the relentless upward march in the jobless rate.

While Canada’s employment gain was a perfectly respectable 22,100 last month—that would have been regarded as a strong result 5-10 years ago—the labour force popped by 82,500, lifting the unemployment rate two ticks to 6.6%. That’s not a particularly high jobless rate from a historical perspective; even since just 2000, the median rate is 7.0%. But the rapid rise from the low 5s early last year is troubling. And, famously, conditions have especially deteriorated for young people and new arrivals, who in some cases are one and the same. Meantime, the employment rate, or the share of the adult population with a job, has dropped to just 60.8%, its lowest ebb since 1999 (aside from 2020). The main point is that the job market has rapidly morphed from the tightest in a generation two summers ago, to squishy soft.

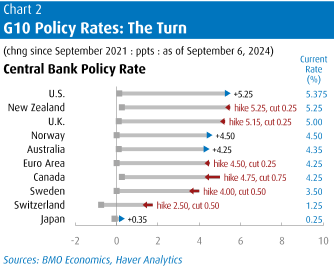

From the external side, the deepening slide in energy prices is a gift for central banks everywhere looking to ease. But more importantly, prospects of an easier Fed have taken the pressure off the Canadian dollar, leaving the BoC essentially a free hand to do what it sees fit. Despite this week’s many cross currents—including some domestic political drama, with the end of the NDP/Liberal deal—the loonie ended the week only slightly weaker at just below 74 cents (or just above $1.355/US$). An interesting sidebar at this week’s press conference was Governor Macklem again discussing the limits on how far the Bank could deviate from the Fed—with him concluding that it’s not going to be a binding constraint with the Fed poised to kick into gear. Notably, the Bank’s third 25 bp cut this week leaves it at the very top of the G10 tables as the most aggressive rate-cutter so far this cycle (Chart 2). And they say Canada doesn’t lead the world in anything!

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.