Spending to Immunity and Beyond

Douglas Porter, Robert Kavcic, & Benjamin Reitzes

April 19, 2021

This post-budget analysis was originally published by BMO Capital Markets Economic Research.

Canada’s federal government budget for FY21/22, the first official such document in 25 months, is a wide-ranging and ambitious document. Given the huge build-up ahead of the budget, perhaps the one surprise is the absence of any big surprises in the plan. Clocking in at a bulky 724 pages, this is a highly detailed budget that sets the stage for post-pandemic policy in Canada or, if necessary, has all the makings of an election platform. Indeed, a wide range of policy measures spans well beyond just extending current support measures through the current wave of the pandemic, including steps to propel post-COVID re-hiring, address climate change, housing policy and a new national childcare and early learning plan. There are also a few minor and targeted tax measures, but no broad-based tax hikes—more serious changes are held back at this point. All told, and true to form, the amount of spending deployed over the coming three years hits the high end of the $70 billion-to-$100 billion guidance set in the fall. Net new measures announced in this budget amount to $49 billion this fiscal year (or 2% of GDP), and total $101.4 billion over three years.

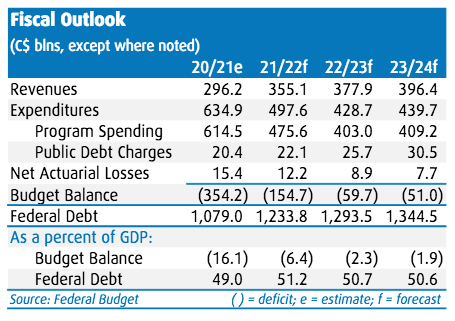

Against that spending backdrop, but also amid a more resilient economy than expected, the deficit will remain wide at $154.7 billion in FY21/22. That is down sharply from the record $354.2 billion in FY20/21, which itself was well down from the fall estimate (of $381.2 billion), thanks in part to a forceful rebound in the economy and some emergency spending measures winding down. Still, the gap remains a hefty 6.4% of GDP (versus 16.1% last year), and lands in the middle of the range of outcomes set in the fall. Total revenues are tracking much better than expected for FY21/22, but that is largely absorbed by new spending measures and the extension of some existing programs.

The debt-to-GDP ratio will rise again to 51.2%, up from 49.0% in FY20/21 and just over 31% before the pandemic. However, this year should mark the peak for that ratio before declining below 50% by FY25/26.

Further ahead, the deficit is pegged at $59.7 billion (2.3% of GDP) in FY22/23, before fading to $30.7 billion (1.1%) by FY25/26. The medium-term fiscal path settles in the mid-to-lower end of the range projected in the fall, thanks to an economy that has trounced prior budget expectations and supported revenues. In other words, Ottawa has been provided the space to double down on stimulus and spending, without significantly denting the medium-term budget outlook.

Fiscal Outlook and Anchor

There is no plan in place to balance the budget, but one area of focus ahead of the budget was whether Ottawa would commit to a specific fiscal anchor. And while a precise figure was not mentioned, the budget states: “The government is committed to unwinding COVID-related deficits and reducing the federal debt as a share of the economy over the medium-term.” With the proviso that the economy recovers roughly in line with consensus expectations, and that borrowing costs don’t flare dramatically higher, this suggests that the anchor is a 50% debt/GDP ratio. For the deficit, this implies a reversion to pre-pandemic levels of around 1% of GDP (or about $30 billion later in the decade). In a sense, then, the pandemic has been “paid for” by a one-time level step-up in the debt/GDP ratio from 30% to 50%.

Notably, the so-called fiscal guardrails—meant to guide when stimulus could be reined in—were relegated to a side-bar box in the document. These measures of labour market developments may have been downplayed a bit, simply because they have mostly recovered much more forcefully than expected in the past five months. For example, total hours worked are now almost back within 1% of pre-pandemic levels, and could easily recoup all recession losses in the months ahead. We suspect that these metrics may well fade from prominence.

Economic Assumptions

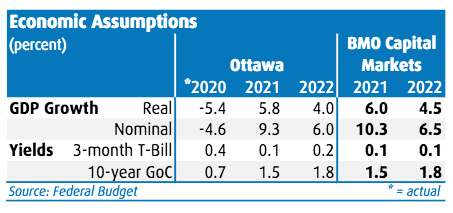

As per the typical convention, the budget projections are based on the private sector consensus forecasts, conducted in March. We view the consensus as reasonable at this point; if anything, we are slightly more upbeat, even with a slight downgrade to our 2021 call on the most recent Ontario restrictions. The budget is based on GDP growth of 5.8% this year (we are now at 6.0%), 4.0% next (4.5%) and then slipping to a more trend-like 2.1% in 2023 (2.5%). The 2021 growth rate is a full percentage point above the fall assumption, even with the second- and third-wave restrictions. Notably, the private sector consensus (and we) look for growth in the longer-term to trend steadily lower to an average growth rate of just 1.8% in the 2024-26 period, which is back in line with the listless pre-pandemic trend. It will be fascinating to see if any of these forecasts change significantly as a result of today’s budget moves—we suspect not.

Above and beyond the upgrade in real growth assumptions, we would highlight the big bump-up in nominal GDP growth forecasts, especially for the current year. Thanks to higher oil and other commodity prices, the GDP deflator has also taken a big step up, and the consensus now expects nominal GDP to rise a whopping 9.3% this year (up from 7.0% last fall). And, the level of nominal GDP will be 3.6% higher than expected by next year than expected, a big support for the revenue outlook. For example, the projected level of revenues is now clocking in roughly $20 billion higher even for the past fiscal year (which ended in March) and again this year.

The only downbeat note on the economic forecast front is that long-term borrowing costs have jumped since the start of the year. The 10-year bond yield assumptions have been lifted by 0.6 percentage points both this year and next, bringing them in better alignment with current yields. However, even that is not entirely bad news for government finances, since its large pension obligations are now discounted at a higher rate. Moreover, it takes time for rate increases to hit the fiscal position; Finance estimates that a 1 percentage point rise in interest rates boosts the deficit by just $1 billion in the first year, rising to $2.5 billion in year two. The bottom line is that economic and financial developments just since last fall leave finances in a stronger underlying position to the tune of nearly $16 billion this year and more than $19 billion next year. And, we do not regard the forecasts as particularly optimistic.

A fundamental question we have often been asked is whether the economy can effectively grow its way out of the problematic deficit of last year, without resorting to big tax increases. We believe that the fiscal forecasts suggest that this is indeed possible, even with the spending increases aimed at priorities such as child care.

Debt Management Strategy

Following a record deficit and issuance in FY20/21, both are expected to decline sharply in the current fiscal year. Gross bond issuance is expected to drop to $286 billion, down $88 bln from the prior year’s record $374 bln. After accounting for maturities, that pegs net issuance at $181 bln, or a bit above the expected budget deficit (of $155 bln). While the issuance figure remains sky-high from a historical perspective, it’s important to keep in mind that the Bank of Canada continues to buy huge amounts of GoCs. The BoC currently buys 13% of auctions and at least $4 bln per week in QE (though that is expected to be tapered to $3 bln per week at Wednesday’s policy meeting).

Last year’s major shift in the Debt Management Strategy to extend the term of the debt with more issuance in the 10-year and 30-year sectors, remains a notable theme in FY21/22. Planned issuance is $84 bln in the 10-year sector (29% of total) and $32 bln in the 30-year sector (11% of total), versus $74 bln (19.8%) and $32 bln (8.6%) respectively in the prior fiscal year. As well, $4 billion in ultra-long bond issuance is anticipated. On the flip side, combined 2-, 3-, & 5-year issuance is falling $107 bln. Benchmark sizes change accordingly, with big declines in 2s, 3s, & 5s, while the 10-year range narrows a bit, and 30-year rises substantially. Along similar lines, Treasury bill issuance is planned at $226 bln, broadly consistent with the $218.8 bln outstanding at the end of March.

A special mention includes plans for the first-ever green bond from Ottawa, with $5 billion in issuance targeted, dependent on market conditions.

The market’s initial reaction was to steepen the yield curve sharply amid the deluge of longer-term issuance.

Summary

It’s no secret that we had misgivings around Ottawa’s proposal to pour an additional $100 billion of stimulus into an economy that appeared primed to recover on its own and following last year’s record deficit. However, there are some important mitigating factors that make us somewhat more comfortable with the plan. First, the deficit is still projected to come off quickly in the next two years, to less than 2% of GDP. Second, Ottawa has set at least a loose fiscal anchor of holding debt at around 50% of GDP. Third, nearly half of the new spending is aimed at the current fiscal year, and not back-end loaded, when it would not be needed. Finally, some of the additional spending will support labour force participation (notably child care and the Canada Worker Benefit), and thus potential growth. Still, the medium-term fiscal outlook depends heavily on a strong recovery over the next year without a big back-up in borrowing costs; both underlying assumptions are key risks to the plan.

Appendix: Highlights of Major Measures

The budget contains an absolutely enormous array of measures, covering almost every conceivable aspect of the economy. While we can’t do them all justice, here are the most significant measures or proposals:

Child Care: Clearly, the show-piece announcement in today’s budget is the national Early Learning and Child Care Plan, which will attempt to cut fees by 50% by the end of next year for regulated child care and to standardize $10/day for care across the country within five years, similar to the model currently used in Quebec. While this budget leaves out many details—and will require extensive negotiations with the provinces—dollars could flow predictably to provincial governments through a standard transfer similar to the Canada Health Transfer or Canada Social Transfer. This headline item is expected to cost $3.1 billion this year, rising to $8.3 billion per year when it is fully in place. Beyond the price tag, Ottawa firmly believes that this plan can support the economy’s long-term growth rate by supporting higher labour force participation, a reasonable assumption. One also may wonder how it will interplay with the already very generous (for lower-income households) Canada Child Benefit.

Additional pandemic support for businesses and individuals: While perhaps attracting less attention than the child care proposal, further pandemic support carries an equally large price tag over the forecast horizon. CEWS and rent subsidies are extended to late September (notably just after the majority of the population will be vaccinated), while EI will be made more flexible and with expanded eligibility. CEWS will be gradually reduced starting in July, “to ensure an orderly phase-out”. The total price tag for these measures is over $30 billion over the forecast horizon, but heavily built into the current year.

Enhancing the Canada Workers Benefit: The benefit is expanded to include lower wage workers, with a goal to attracting low- or minimum-wage workers back into the labour force. This step is expected to benefit up to 1 million workers and will cost $1.8 billion this fiscal year.

Hiring incentive for small- and medium-sized businesses. The Canada Recovery Hiring Program will start in June and run to late November and initially subsidizes 50% of remuneration up to $1,129 per employee. It can be used to hire new workers or increase hours of existing employees.

Grant and loan program for small- and medium-sized businesses to help with technology adoption, for example to support costs associated with ramping up ecommerce technology. A total of $1.1 billion will be spent this year to help SMEs grow.

Canada Student Grants will be doubled for two years, costing a total of $3.1 billion. And, over $370 million will be spent on supporting summer jobs for students in 2021.

Federal minimum wage will be set at $15/hour. While of limited scope (only applicable to federally regulated industries), this sends an important signal.

Increasing old age security payments (OAS): Carrying a price tag of $12 billion over the forecast, Ottawa will provide a one-time $500 payment this August to OAS recipients and will increase payments by 10% by next year.

Green economy measures: While climate change may not have been the headline event in today’s budget, it still saw a wide variety of programs receiving a total of $1.2 billion this year and $8.8 billion over five years.

Housing: We suspected that the budget would carry only limited housing measures, thereby keeping the focus on other areas. Still, there will be a 1% vacancy tax on non-resident owners of Canadian real estate. Note that B.C. and Ontario have already implemented measures to attempt to dampen out non-resident demand. While this is certainly an issue that needs addressing (perhaps even more aggressively than in this budget), domestic demand and psychology are the real issues in the market today that this measure is unlikely to cool. The Budget provides $1.8 billion this year to cities in a push to build affordable housing units, and aims to create or repair over 35,000 units.

Measures to increase housing affordability for first-time buyers, include a cut in the GST on purchases of newly built properties, to zero on units costing $300,000 or less, but phased out by $450,000. As we often note, such measures just stimulate demand at a time when demand is already off the charts. But since few properties now run below $300,000, this will likely have little net impact.

Indigenous infrastructure: the budget has an “historic” support effort, including $6 billion for infrastructure spending investments over five years.

On the tax front: The big story here is the absence of major, broad-based revenue increases. However, there were a variety of targeted moves, aimed at specific policy goals or to address perceived unfair conditions. For example, Ottawa will proceed with a digital services tax in 2022, and it is expected to eventually raise $700 million per year. As well, the vacant home tax on non-residents, will be coupled with a luxury tax on high-end items like yachts and expensive vehicles. Finance will also put limits on interest deductions and cross-border “schemes”. And, despite all the pre-budget chatter, there are no changes to the overall capital gains inclusion rates or on principal residences—neither of which is a surprise.

Douglas Porter is chief economist, Robert Kavcic is a senior economist, and Bejnamin Reitzes is director of Cdn Rates & Macro Strategist with BMO Financial Group.