Sahm-er Time: Economy Crashes the Party

By Douglas Porter

August 2, 2024

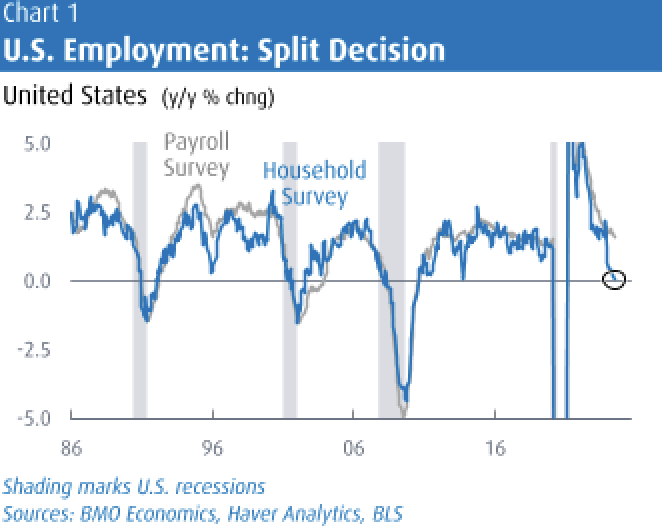

We rudely interrupt your regular summer programming, and the Olympics, to bring you tidings from the economy: It’s suddenly slowing. While much of this week’s focus—when it wasn’t trained on Paris—was on the mid-week FOMC meeting, the two big U.S. economic reports for July proved to be notably clunky. A surprisingly soft manufacturing ISM at 46.8 sent a warning signal, and then payrolls rose by a modest 114,000, replete with downward revisions to earlier months, and another back-up in the jobless rate. The latter rose two ticks to 4.3%, up 0.8 ppts from a year ago, and has met the so-called Sahm Rule on recessions (to one decimal place). Behind that soft result, the companion household survey reports that only 57,000 more Americans have jobs now than a year ago, a growth rate of 0.04% y/y. That’s a pace that has typically preceded downturns, and hints that even the sluggish payroll readings may be overstating the economy’s strength (Chart 1).

Markets are not waiting around for any further official signs that the economy is abruptly slowing or for the Fed to start cutting rates. Bonds had a ferocious rally this week, and stocks pulled back hard from a post-FOMC rally. The 10-year Treasury yield cascaded lower, plunging more than 35 bps to around 3.8%, while 2-year yields fell nearly 50 bps to just above 3.9%. Both got a bit lower during the spring of 2023, following the regional banking woes, but both are also miles away from the recent peaks hit just three short months ago. For example, as recently as late April, the two-year yield was above 5%, when sticky inflation was the concern, and the jobless rate still gripped a three handle.

The sudden signs of much chillier growth caught the equity market totally unaware. Stocks had been wobbling in recent weeks after reaching an all-time high in mid-July, but rejoiced following Fed Chair Powell’s dovish tone at this week’s press conference. While the FOMC meeting predictably produced no change in rates, for the eighth time in a row, and the Statement was only mildly dovish, Powell then offered that rate cuts could be on the table for September, and openly fretted about too much job market weakening. He didn’t have to wait long for concerning signals on that front, with the July jobless rate of 4.3% already 3 ticks above the Fed’s latest projection for the end of 2024, and higher than the long-run tendency (i.e., above the natural rate). Suddenly, bad economic news has become bad news for stocks, and the S&P 500 promptly retreated sharply, dropping more than 5% from its July high. The TSX saw an even more startling reversal; it hit a record high above 23,000 on Wednesday, only to then retreat 4% the next two sessions.

Besides the sag in stocks and bond yields, commodity prices have also pulled back abruptly, with one index falling more than 7% in a month. Oil prices, which had already been softening on growth concerns around China, fell heavily in the wake of the U.S. jobs report to around $73/bbl. The good news here is that wholesale gasoline prices are now down 17% from a year ago, potentially setting up some friendly headline inflation news in the months ahead. Also dinged by the soft data was the U.S. dollar. The weaker greenback was a mixed bag—it pulled back hard versus the yen (down almost 5%) as the Bank of Japan hiked rates more aggressively than expected, but held its own against the U.K. pound, as the BoE trimmed rates 25 bps to 5.0%. And the Canadian dollar actually softened a touch on net, with the sag in commodity prices and a risk-off move countering prospects of Fed rate cuts.

And, now, whither the Fed? Markets and analysts were busily revising down their forecasts for fed funds in the wake of this week’s developments. To be clear, it’s not just driven by the employment figure—indeed, payrolls weren’t overtly weak, they could easily be revised, and they’re still up a sturdy 1.6% y/y. No, the much bigger concern is the grinding rise in the jobless rate and the lack of growth in household employment. We believe that the case for restrictive rates has almost vanished, and the Fed will now proceed with haste to get back to something approaching neutral. Accordingly, we are revising our call to include a series of consecutive cuts, including in the final three meetings of this year, and the first two of next year. We are maintaining our call on cumulative cuts of 225 bps, for now, but see the Fed getting there much faster. And any serious stumble by the economy could prompt bigger gulps than 25 bp steps, although we’re not quite there yet.

In turn, we are also revising our Bank of Canada call somewhat. With the Fed expected to get a bit more forceful, this opens the door for the Bank to match its own dovish stance with faster action. We now look for the BoC to cut in each of the next four meetings, quickly taking their overnight rate down to 3.5% by January (from 4.5% now), and then to 3.0% by mid-2025. That means the Bank will arrive at the presumed end point more than half a year earlier than expected. We had warned that the risk was for sooner/faster, and a milder Fed certainly provides the cover for the Bank to follow. As Ferris might say, life moves pretty fast when the economy slows.

Canada’s job numbers aren’t out until next Friday, but that volatile series has taken on added import amid renewed concerns on the growth outlook. We have been saying for more than a year that the firmness in headline employment is wildly overstating the health of the economy, as it is being artificially inflated by rapid population growth. More meaningful has been the steady rise in the unemployment rate, which has deteriorated even more forcefully than stateside. There’s no argument about decimal points on the Sahm Rule in Canada, as the jobless rate has blasted higher by a percentage point in the past year and is up 0.8 ppts from the 12-month low on the 3-month moving average. The number of unemployed people was up 22% y/y in Q2, right on the cusp of meeting the “BMO Rule” (which finds that a rise of more than 25% y/y has always been associated with recession in Canada).

But we don’t need to rely on any obscure rules or official data to appreciate that the labour market has rapidly morphed from very tight to loose. The eye-opening stat this week was that the Canadian National Exhibition (CNE) received 37,000 job applications this year, for roughly 5,000 positions at the summer annual fair. The CNE’s manager noted that’s more than double year-ago applications. And, memo to Ottawa, one teen applicant said that finding a job was now “crazy hard”. It seems that both supply—extreme population growth—and demand—a chilly economy—are now fully at play.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.