Run Forecasts, Run!

By Douglas Porter

June 07, 2024

This summer marks the 30th anniversary of the release of Forrest Gump. In a deeply complex and volatile world, sometimes it helps to revert to straightforward, homespun logic to cut through the mist. Thus, we invited Forrest to help explain this week’s momentous events, from the initial BoC and ECB rate cuts, to the surprising U.S. jobs report, to the many global election results, and to China’s rebounding trade data. Here are his top 10 pearls of wisdom on the outlook.

On this week’s rate cuts: “Momma always said you’ve got to put the past behind you before you can move on.” Clearly, he is suggesting that both headline and core inflation in Canada and the Euro Area needed to get below 3%, with short-term trends even softer before they were willing to cut. Neither 25 bp rate cut was surprising, but what did surprise Forrest was the dovish tone from Governor Macklem, who brushed off concerns about a divergence from the Fed and the potential for a softer loonie. The only surprise from the ECB was that one member voted against the cut. A follow-up move in July looks unlikely there.

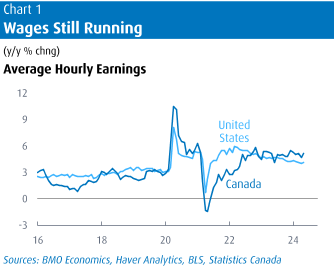

On the May jobs data: “Life is like a box of chocolates. You never know what you’re gonna get.” Obviously, Forrest was as flummoxed as we were by the solid 272,000 headline U.S. payroll gain in May, crossing up the recent narrative that the U.S. economy was losing steam. Adding to his confusion, wages also ran hot at up 0.4% m/m, lifting the yearly rate a tick to 4.1%. However, he also noted the softer aspects in the box, notably a steep 408,000 drop in the companion household survey, which nudged up the jobless rate to 4.0%. He could only nod when we pointed out that household jobs were up only 0.2% y/y. The fact that Canadian jobs were in line with consensus at +26,700, lifting unemployment to 6.2%, yet wages still rose a hearty 5.1% y/y was met with a blank stare—clearly indicating he thought it was a wash for the BoC.

On the timing of the next rate cut: “What’s my destiny? You’re gonna have to figure that out for yourself.” Just as the market was getting comfortable with a couple rate cuts from the Fed later this year, the solid jobs data pushed the first full cut late into the year. While the Bank of Canada certainly seems to be leaning toward a follow-up July move, the market sees it as a close call. Quite clearly, Mr. Gump is telling us that the Fed, and the BoC, are data-dependent, and will simply be guided by incoming inflation reports in particular.

On where inflation is headed next: “I have run for three years, two months, 14 days and 16 hours. I’m pretty tired… I think I’ll go home.” Inflation in fact really did begin to flare up in a big way in the spring of 2021—three years and two months ago—and is finally showing signs of getting closer to normal. Next up is the U.S. CPI this coming Wednesday, just hours before the FOMC announcement. Core inflation is expected at 0.3%, which should clip the annual rate a tick to 3.5%. Gump’s studied silence on that news indicates he doesn’t believe that will change the Fed outlook.

On neutral interest rates: “What’s normal, anyway?” Apparently, he agrees with Governor Macklem’s words of caution against putting too much stock into estimates of r* or neutral. Besides the fact that the Governor was donning an Edmonton Oilers pin, perhaps the most interesting aspect of this week’s press conference was his comment that Canadians shouldn’t spend too much time thinking about neutral interest rates, suggesting that they can’t be gauged precisely. This of course raises some doubts about where rates will ultimately land when this easing cycle is finished; perhaps it’s different from our neutral estimate (of nearly 3%). So, we pressed Forrest for more…

On higher for longer: “My name is Forrest Gump. People call me Forrest Gump.” His version of “it is what it is”, he seems to be suggesting that the market has long since spoken on this issue. After a rally early this week on some signs of softness, payrolls pushed long-term Treasury yields right back up above 4.4% on Friday morning, and took the two-year yield above 4.8%. For reference, prior to the past year, 10s had not been this high since 2007 (or pre-GFC days).

On the prospect for a soft landing: “Some people don’t think miracles happen; well, they do.” Even despite the stickiness of U.S. core inflation, and relatively high bond yields, Forrest is clearly in the soft landing camp. A moderate retreat in oil prices this week, on the OPEC+ meeting and some wavering on its production cuts, will help relieve some pressure on inflation. And the big picture is that U.S. inflation has been chopped down by almost 6 percentage points from the 2022 peak without a recession; that’s likely Gump’s version of a miracle. It’s also been a very positive story for equities.

On surging tech stocks, and the rebound in Apple: “Lieutenant Dan got me invested in some fruit company [symbol AAPL]. So then I get a call from him, saying we don’t have to worry about money no more. And I said, that’s good! One less thing…” His point seems to be that while, yes, leadership in the big rally in the S&P 500 is very narrowly based, it nevertheless generates a lot of wealth and, ultimately, spending power. While stocks wobbled after the jobs data, both the S&P and Nasdaq hit all-time highs this week. Forrest did not disclose his positions in Nvidia or GameStop.

On the snap-back in China’s trade surplus: “Now, momma said there’s only so much fortune a man really needs, and the rest is just showing off.” One concern for the global economic outlook had been the struggling Chinese economy amid the deep real estate woes. May trade data revealed surprising strength, with exports up 7.6% y/y, boosting the surplus well above consensus at $83 billion. This revival drives home the recent upward revisions in many growth forecasts for China to 5%, or better. But what Gump is driving at is concern that China’s over-capacity in many industries will flood other economies. China’s export prices are down 4% y/y; the good news is that this has played a big role in cutting goods price inflation down to size elsewhere.

On this week’s many global elections, and who may win in November: “That’s all I have to say about that.” This past week saw South Africa’s ANC lose its majority for the first time since Forrest Gump was released, and markets fretted; Mexico’s Morena party win a landslide under Claudia Sheinbaum, and markets fretted; and India re-elect Modi with much-reduced support, and markets fretted. When pressed about this, as well as the impact of Donald Trump’s guilty verdict on the U.S. elections, Forrest simply referred us back to his initial comment.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.