Ottawa’s COVID-19 Economic Response Plan and Budgetary Balance

“Nobody knows how deep the recession will be nor the nature of the recovery. We are in uncharted territory. This is the first pandemic global recession in one hundred years.”

Mostafa Askari, Sahir Khan and Kevin Page

March 18, 2020

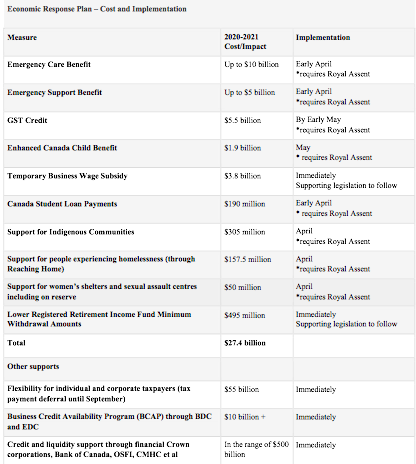

Prime Minister Justin Trudeau and Finance Minister Bill Morneau released the Government’s Economic Response Plan for COVID-19 on March 18. It is an impressive package of support measures for individuals and businesses. The core support package weighs-in at $27.4 billion (table below) for 2020–21 — more than 1 percent of GDP. There is another $55 billion to help business liquidity through tax deferrals, for a total of $82 billion. The measures are above and beyond the $1 billion package (monies for health, employment insurance, etc.) announced by the Prime Minister on March 11.

The government should be commended for constructing a large emergency support package. It was clear from the announcement that additional measures are coming — possibly to help the health sector, affected industries and to facilitate economic recovery. In this regard, possible comparisons with support packages being developed in other countries like the U.S. may be premature.

Challenges facing the government and public sector on today’s announcement now shift to the quick passage by Parliament and delivery to citizens and businesses in desperate need. Time pressures will rise with each passing day.

In the press conference following the announcement, Morneau and Bank of Canada Governor Stephen Poloz were asked what COVID-19 means for the economy. Are we in recession? How deep? Is it a fair question? How could citizens know if the support package is the right size if our leaders are not frank about the size of the problem?

It was also fair for the finance minister and the governor to duck the question. Nobody knows how deep the recession will be nor the nature of the recovery. We are in uncharted territory. This is the first pandemic global recession in one hundred years.

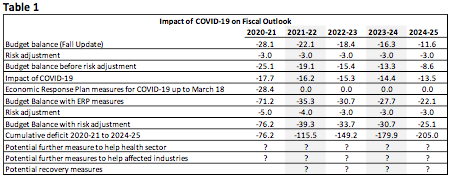

For planning purposes, we assume a notional 2.1 percent decline in real GDP and a 5.1 percent decline in nominal GDP in 2020. This is based on an assumption of a no-growth first quarter, to be followed by two quarters of decline (a double-digit decline in the second quarter) followed by a return to growth in the fourth quarter. The sharper decline in nominal GDP reflects the steep drop in oil prices.

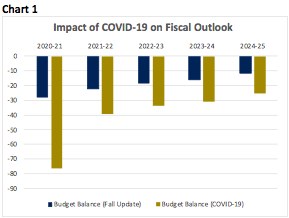

Table 1 highlights the possible impact on the government’s projection for the budgetary balance. With a weaker economy and the incorporation of the government’s support measures to-date we are currently looking at a 2020-21 budgetary deficit of about $76 billion. Projected deficits in outer years will be higher because of the downward adjustment to GDP (see Chart). We also think the projected deficit numbers will go up with the likelihood of additional support measures.

Context is important. IFSD does not believe a projected federal budgetary deficit of $76 billion in 2020-21 represents a fiscal problem for the federal government. This support is essential to address the health and economic impacts of the COVID-19 pandemic.

Mostafa Askari is chief economist of the Institute for Fiscal Studies and Democracy at University of Ottawa and a former deputy Parliamentary Budget Officer; Sahir Khan, executive vice president of IFSD, is a former financial official at the Privy Council Office. Kevin Page, founding President and CEO of IFSD, was Canada’s first Parliamentary Budget Officer.