Ordinary People, Extraordinary Prices

By Douglas Porter

June 21, 2024

“Why don’t you knock it off with them negative waves? Why don’t you dig how beautiful it is out here? Why don’t you say something righteous and hopeful for a change?” — Donald Sutherland (as Sergeant Oddball in Kelly’s Heroes)

“In order to excel, you must be completely dedicated to your chosen sport. You must also be prepared to work hard and be willing to accept constructive criticism. Without 100% dedication, you won’t be able to do this.” Willie Mays

Even in otherwise quiet conditions, U.S. equity markets just keep on marching. While the S&P 500 pulled back somewhat from Tuesday’s record high, it nevertheless finished up on the week and is a resounding 25% above year-ago levels. In turn, the All-Country MSCI is up roughly 20% y/y, and has managed to rise 11% so far in 2024 as we approach the mid-year mark (yes, already). Markets are warming to the view that the global economy appears to have pulled off the great escape from inflation’s clutches, without the pain of a full-blown recession. True, not every nation would fit the neat and tidy definition of a soft landing but, from a broader lens, that appears to be precisely what just unfolded in the past year for the global economy.

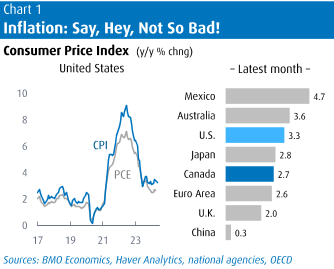

This week’s various inflation reports didn’t receive a lot of fanfare, but the key theme is that many major economies are now regularly printing headline results that begin with a 2. At the top of the list, U.K. inflation eased right down to the figure (2.0%) in May, the lowest reading in nearly three years and putting the double-digit results of little more than a year ago into the distant memory bank. While not enough to convince the BoE to cut rates just yet—core inflation remains a bothersome 3.5%—it seems to be just a matter of time. Sadly for Prime Minister Sunak, that “time” will be long past the July 4 election; more like the August decision.

The Euro Area confirmed its May inflation rate at 2.6%, with core at 2.9%, and some key members are much lower. For example, Italy, which is not exactly known for a history of low inflation, now boasts one of the lowest in the OECD at 0.8% y/y. (Finland actually takes the low-inflation crown at 0.5%, but have you been to Finland?) Switzerland is also at the low end at 1.5%, a key factor behind this week’s second rate cut from the Swiss National Bank, which trimmed rates 25 bps to 1.25%. Even Japan is in the 2-zone, albeit national inflation perked up in May to 2.8%, but the major core measures are milder there.

The U.S. has seemingly been the major outlier in this happy inflation story. Even with a much milder reading for May, headline CPI inflation is still sticky at 3.3% y/y, with core a tick higher. But here’s where the plot thickens: measured on the same way as the Euro Area results—on a so-called harmonized basis—U.S. consumer price inflation in May was just 2.0%, the same as Britain and even lower than Europe. Over the past 25 years, this harmonized U.S. measure has been 0.1-to-0.2 ppts lower than its CPI, so the current 1.3 ppt gap is especially wide.

Perhaps not everyone is willing to read much into the semi-obscure HICP measure. But the Fed’s own preferred inflation metric is suggesting something roughly similar—that U.S. inflation is not the big outlier that CPI would suggest. The key economic release next week is personal income and spending for May on Friday, and much of the focus will be on the PCE deflator. We look for the core measure to rise just 0.1%, which would clip the yearly pace two ticks to 2.6%. That would be the lowest since March 2021, and clearly within reach of the Fed’s 2% target. Headline prices look to have been flat, with the annual rate also at 2.6%. Based on these key measures, the U.S. is right in line with the Euro Area on inflation, but is many steps behind on the rate cut timetable.

That timetable may need adjusting. A variety of Fed speakers have opined since last week’s FOMC that there is no rush to cut, and they can easily wait until late this year to begin proceedings. Essentially, they are reinforcing the dot plot message of one cut in 2024. But the economy is starting to cast some doubt on that view, with signs of strain emerging in recent weeks. One can see it in sluggish retail sales, which have barely grown in the past six months, or in the underlying rise in jobless claims and the unemployment rate, or in the broad-based softness in homebuilding activity in recent months. There are undoubtedly offsets, and we don’t see growth cracking in a major way, but the downside surprises in growth are now dominating. And, ultimately, we believe that the combination of more contained inflation and softer growth will open the door to two Fed rate cuts this year. The market is leaning the same way.

“One measurement is worth a thousand expert opinions.” — Donald Sutherland

That almost certainly is not an original quote, but it holds true for the week ahead for Canada. The May CPI on Tuesday looms large and may well decide whether the BoC follows through with a rate cut in July. Syncing very much so with the global theme, headline inflation is expected to slip a tick to 2.6% y/y, which would be the lowest since March 2021. Thanks to slightly lower gasoline prices and a broader moderation in grocery inflation, we look for prices to nudge up only 0.1% in seasonally adjusted terms in the month. (Stop us if you have heard this rant before, but for some undetermined reason, the focus in Canada remains squarely on the unadjusted numbers, and they likely rose 0.3% in May. But do we report unadjusted job tallies? Did you know that employment was actually up 345,000 in May (true story)? But does anyone care? Rant done.) The major core measures are also expected to remain calm, holding just below the 3% threshold.

The Bank appears to be leaning to a July cut. The Summary of Deliberations from the June meeting revealed, unsurprisingly, that there was some debate about waiting to cut, but the series of mild CPI readings won out. As well, the Bank noted that while it had concerns about restoking housing, conditions there were not a block. This week’s many housing reports suggested that sales and prices have drifted below year-ago levels, but new building is picking back up—close to an ideal combination for a market suffering from serious affordability issues.

Of course, there’s only so much policymakers and builders can do to improve affordability when population growth remains so steamy amid exceptionally tight rental conditions. While some pointed to tentative signs of a slowdown in the latest quarterly population figures, the reality is that Q1 still saw 0.6% q/q growth, the exact same as a year ago. This left the yearly increase at a towering 3.2% y/y clip (up 1.27 million), or three times the typical yearly increase over the past 40 years. The real test will be what happens over the summer and fall in the student and temporary worker categories, but count us as skeptics that growth is poised to slow abruptly. In turn, we’re also doubtful that affordability will soon improve in a meaningful fashion, even if the BoC is able to trim rates further.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.