Loonie’s Spring Fever Dream

Douglas Porter

April 14, 2023

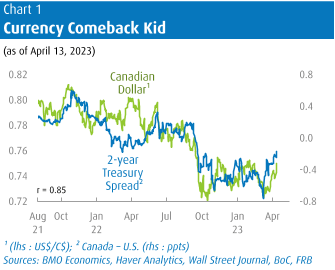

In the five weeks since the failure of Silicon Valley Bank, the U.S. dollar has dropped roughly 4% against a basket of major currencies. And the Canadian dollar has been right on the other side of that, bouncing from near-three-year lows to almost 75 cents now (or $1.338/US$). The sudden turn in the greenback was driven by much more modest Fed rate hike expectations in the wake of the banking turmoil. This, at a time when the Bank of Canada had officially paused, carved into a previously wide gap in Canada/US spreads (Chart 1). So, we have had the very unusual situation of financial stress leading to a firmer Canadian dollar, thereby crushing our old saying “the loonie has never met a financial crisis it didn’t want to join”. Well, it just met one, and the currency played it cool for a change.

A curious development is that the U.S. dollar continued to fade even as the banking stress calmed, and as Fed expectations nudged back up again. Even with a mild pair of CPI/PPI results this week and a 1% drop in retail sales for March, markets are now mostly convinced that the Fed will follow through with a final 25 bp hike at the early May meeting. The sturdy March jobs report mostly sealed the deal. True, the assumed terminal rate of 5.00%-to-5.25% is lower than the loftiest expectations from pre-SVB days, but we’re a long way from last month’s dire predictions of big rate cuts.

A curious development is that the U.S. dollar continued to fade even as the banking stress calmed, and as Fed expectations nudged back up again. Even with a mild pair of CPI/PPI results this week and a 1% drop in retail sales for March, markets are now mostly convinced that the Fed will follow through with a final 25 bp hike at the early May meeting. The sturdy March jobs report mostly sealed the deal. True, the assumed terminal rate of 5.00%-to-5.25% is lower than the loftiest expectations from pre-SVB days, but we’re a long way from last month’s dire predictions of big rate cuts.

Beyond the U.S. dollar’s broader path, a couple of other factors have helped buoy the loonie in recent weeks. First, oil prices have snapped back with purpose from their recent lows, supported by the surprising production cuts from OPEC+. After dropping below $65 at one point in mid-March, WTI has since popped almost 25% to around $83, its highest level since last November. Yes, oil prices have not been the primary driver of the Canadian dollar that they were in days of yore (i.e., five years ago), but crude still accounted for 18% of total merchandise exports in the past year. Less prominently, natural gas exports account for more than 4% of the total, and those prices have plunged 70% y/y, careening to their lowest ebb since 2020.

Second, the Canadian economy has largely held up better than expected so far this year. Employment has been on a tear, and GDP forecasts have been steadily bumped up in the past three months. This week’s Monetary Policy Report from the BoC saw a four-tick lift in the 2023 GDP call to 1.4% (we’re at 1.0%). While Governor Macklem suggested that a mild recession couldn’t be ruled out—a theme that was amplified by Fed staffers in the FOMC minutes—the Bank is expecting modest growth through the rest of the year after a solid Q1. And, as we discuss in this week’s Special Feature in Focus, there is now growing evidence that even housing is forming a base. A paucity of listings has tightened the market, pushing the national sales-to-new listings ratio to 63.5% in March, right back into tight terrain. The economic backdrop can’t be that glum if even the most interest-sensitive and most cyclical component is hanging tough.

Amid these signs of a resilient economy, the Governor openly pushed back against market pricing of rate cuts later this year. The verbal intervention had some impact, as five-year GoC yields are up 40 bps from last week’s lows to around 3.25%, but they are still well down from last autumn’s highs of above 3.8%. That pullback has prompted some cuts in long-term mortgage rates, which is pretty much the last thing the BoC wants to see at this point. While the Bank’s message this week was mixed, the overall tone was mildly hawkish, reminding one and all that rate hikes are still under consideration. And the market has slightly obliged by pricing in faint odds of higher rates at the June meeting.

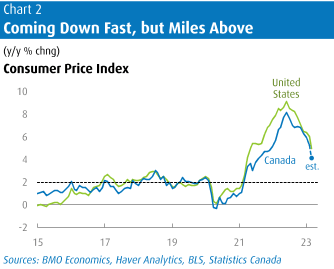

The Bank couldn’t really come out swinging because even as growth has held up, inflation has come down a bit faster than expected in recent months. Next Tuesday’s CPI release for March is likely to be the highlight of the week for Canada, and it will reveal a heavy drop in headline inflation. We have already seen the U.S. rate fall one full point to 5.0%, and the Euro Area plunge 1.6 ppts to 6.9%, as the base effects really kick in—last March saw massive price increases in almost all economies as oil fired above $120. The Netherlands provided an extreme example as inflation there was halved in a month to 4.5%. Canada will go even lower, falling from 5.2% to likely just 4.1%, one of the lowest rates in the OECD.

This expected outcome for CPI will extend the streak of Canadian inflation coming in below U.S. trends since the start of the pandemic (Chart 2). In turn, that justifies the Bank’s decision to pause proceedings at a lower level than the Fed. The Canadian dollar has fully absorbed that reality and is now looking forward to a time when the Fed may lead the way down on interest rates. But given the better-than-expected start to growth broadly in 2023, that trip down the mountain is likely to be a story for 2024.

The world of policymaking is full of unexpected consequences. You hand out stimmy cheques to support the economy, and people start day-trading meme stocks and drop out of the labour force. You broadcast that you are going on pause, and the housing market immediately perks up, raising doubts that you can stay on pause. But the leaders of Major League Baseball likely didn’t see this one coming—you introduce a pitch clock to shorten games (it works!), and beer sales plunge because… you shortened the games. Thankfully, there is no such risk of short games in the NHL playoffs, which start next week—in fact, here’s to many, many weeks of high beer sales in Toronto. Hope springs eternal.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.