Leading parties open wallets in pandemic election bid

Tony Stillo, Michael Davenport, & Jacob Dolinar

September 16, 2021

This pre-election briefing on the major parties’ platforms was compiled by Oxford Economics for its global clients, published September 16th, and shared with Policy for re-publication.

- Canada will likely usher in another minority government when voters hit the polls on Sept 20, led by either the incumbent Liberals or the Conservatives, while the New Democrats (NDP) will likely hold the balance of power again.

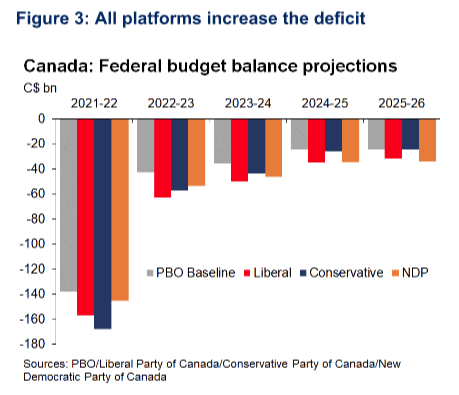

- All three parties are pledging largely deficit-financed expansionary fiscal policies that would provide a short-term boost to the economy but would result in continued deficits and growing public debt over the next five years.

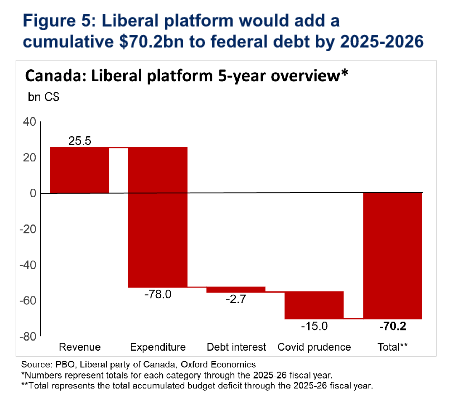

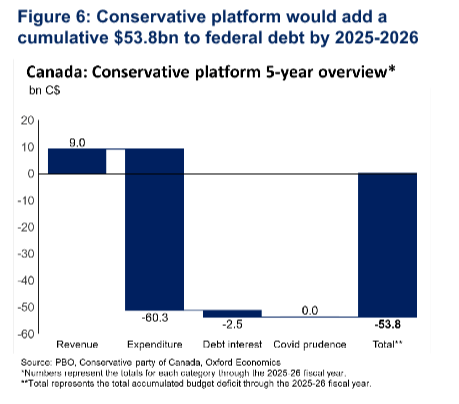

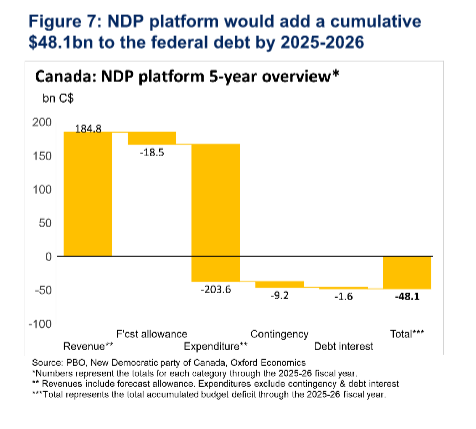

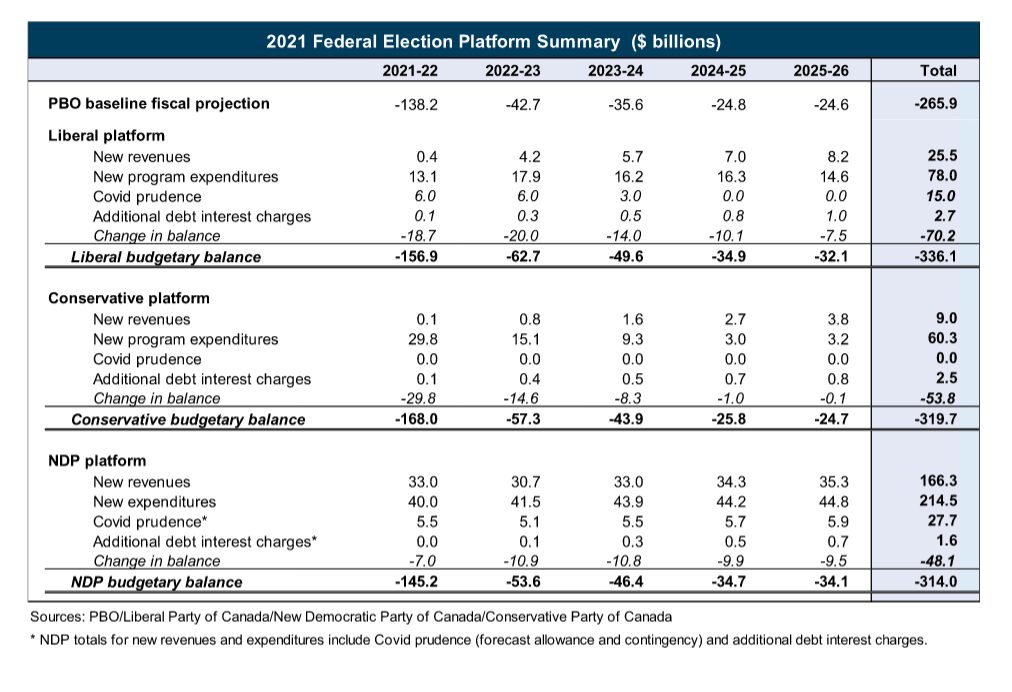

- The Liberal platform would add about $70bn to federal debt by 2025-2026 with promises of $78bn in new expenditures, $26bn in new revenues, and $15bn allocated for Covid prudence. The Conservatives’ plan would increase debt by $54bn over the next five years, with $60bn in new expenditures and just $9bn in new revenues. The NDP is proposing a $204bn spending package, partially funded by $185bn in new revenues. Including Covid-prudence adjustments, the NDP’s plan would add $48bn to federal debt. (See Appendix table for details.)

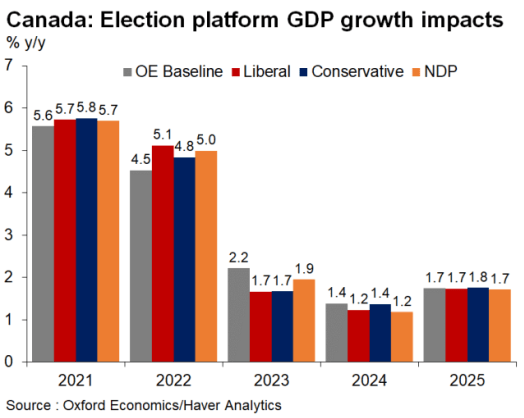

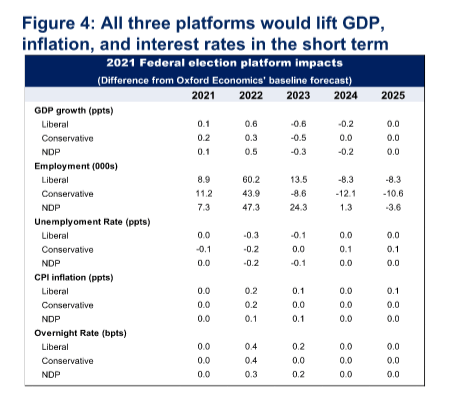

- Our preliminary modelling shows that the Liberal’s platform would provide the largest lift to the economy, boosting growth 0.6ppts above our baseline forecast to 5.1% in 2022. The NDP’s plan would add 0.5ppts to GDP growth next year, while the Conservative’s plan would result in a more moderate 0.3ppt uptick.

- Given our already robust economic outlook, additional fiscal stimulus under any party would add 0.1ppts-0.2ppts to inflation next year. Our analysis suggests this would prompt the Bank of Canada to begin raising interest rates by mid-2022, ahead of our current forecast for hikes to commence in early 2023.

- Although debt-to-GDP is projected to gradually ease under all parties, we remain concerned about the lack of a “fiscal anchor” and no clear plan to balance the budget. There’s also a risk that higher debt would hinder the government’s fiscal capacity to support the economy during another downturn.

Polls suggests another minority government

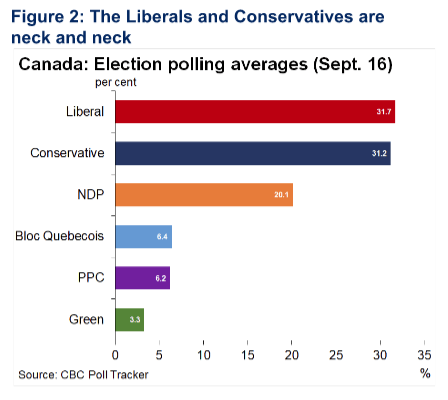

The latest polls show a neck and neck race between the incumbent Liberals and the Conservatives, making a minority government a very likely outcome. Another minority government would continue the uncertainty in federal policy making witnessed during the past two years.

The latest polling averages from the CBC show the Liberals (31.7%) with a 0.5ppts advantage over the Conservatives (31.2%) as of September 16. While the NDP trails by a large margin, polling in third place at 20.1%, the party will likely hold the balance of power once again (Figure 2). Furthermore, if the Conservatives were to secure a minority victory, there’s still a chance of a Liberal-NDP coalition, as seen at the provincial level in Ontario in 1985.

Platforms and budget projections

As during the last federal election, political parties submitted their platforms to the Parliamentary Budget Officer (PBO) for an independent and non-partisan estimate of their financial costs. As of August 2021, the PBO baseline projects a federal deficit of $138.2 billion in the 2021-2022 fiscal year that will gradually fall to $24.6 billion by 2025-2026. According to the PBO, the deficit will be higher under the platforms of all three leading parties (Figure 3).

Liberal plan builds on 2021 Budget

The Liberals are building on their 2021 Budget and are willing to go even deeper into debt to steer Canada out of the pandemic, proposing $78bn in additional spending over the next five years, largely funded by further deficits. Just over 100 new spending initiatives will ensure that there is something for everyone in the Liberal platform.

Significant investments in health and long-term care, housing, transfers to households, and indigenous communities highlight their priorities. To partially offset the myriad of new programs, $26bn in proposed revenue-raising measures over the next five years are targeted mainly at taxing higher-income Canadians, big banks, and insurance companies, as well as closing tax loopholes by increasing enforcement at the Canada Revenue Agency (CRA).

PBO costing shows the budget deficit under the Liberals would increase $18.7bn to $156.9bn in 2021-2022, before falling to $32.1bn in 2025-2026. Cumulatively, the Liberal platform would add $70bn to federal debt over the next five years, but debt would rise by a lesser $55bn if the $15bn allocated to Covid prudence is not required (Figure 5).

Conservatives also plan to run deficits

The Conservatives are taking a different approach than in previous election campaigns and have pledged to outspend the Liberals in fiscal year 2021-2022, largely reflecting $7.6bn for the Canada Job Surge Plan and $9.7bn to modify the Fiscal Stabilization Program (FSP) and provincial transfer agreements. New expenditures over the next five years totaling $60bn would be focused on increasing tax credits for childcare and other transfers to households, as well as providing businesses with funding and targeted tax breaks to incentivize hiring and capital investment.

Despite significant new spending, the Conservative plan falls short on new revenue-raising measures, with most of their funding originating from scrapping $26.7bn from the proposed Liberal childcare plan. PBO costing shows the budget deficit increasing by $29.8bn to $168bn in 2021-2022 (the highest of the three parties), before falling to $24.7bn in 2025-2026. The Conservative plan does not incorporate any Covid prudence adjustments and would add a cumulative $54bn to federal public debt by 2025-26 (Figure 6).

NDP platform swings for the fences

The NDP is proposing massive spending initiatives backed up by significant revenue drivers in their 2021 platform. Over the next five years, the NDP proposes $203.6bn in new net expenditures across 70 different initiatives. Key pledges target housing affordability, transfers to households, indigenous community funding, $11bn for universal dental care, and $38.5bn for a national pharmacare program.

To ensure fiscal sustainability, the NDP has also proposed sweeping tax changes aimed largely at the wealthiest Canadians and large corporations, as well as eliminating fossil fuel subsidies. These and other revenue measures would generate $184.8bn in net revenues over the next five years, with the new wealth tax contributing $11bn-$13bn annually.

Likely due to the uncertain behavioural response to some of the proposed tax measures, the NDP has taken a cautious approach and included a forecast allowance of $3.5-$4bn each year and an annual contingency fund of $1.8-$2bn. PBO costing shows the budget deficit under an NDP government would increase by $7bn to $145.2bn in 2021-2022 (the lowest of the three parties), before falling to $34.1bn in 2025-2026. The NDP platform would add a cumulative $48.1bn to federal debt by 2025-26, but the debt would rise by just $20bn if the $18.5bn forecast allowance and $9.2bn contingency are not required (Figure 7).

Oxford Economics is a leader in global forecasting and quantitative analysis, with the world’s only fully integrated economic model and 250 full-time economists to help clients track, analyze, and model country, industry, and urban trends. Tony Stillo is the Director of Canada Economics, Michael Davenport is an Economist and Jacob Dolinar is an Economic Research Analyst.