Jagged Large Pill to Swallow

By Douglas Porter

November 24, 2023

As you may have heard, today is Black Friday. It’s actually a relatively new phenomenon in Canada, but traces its lineage well back in time to America. Rumour has it that not long after the first Thanksgiving was celebrated in the early 1620s, the Pilgrims and Wampanoag people were soon headed for Ye Olde Corner Shoppe, or the local milliner, haberdasher, or Merchant of Venison. While there’s no word on whether sales of corn, squash and tobacco topped expectations in 1623, it’s pretty clear that prospects for holiday spending are subdued for 2023. And that’s especially true in Canada, where the full weight of the hefty interest rate hikes of the past 20 months is now bearing down more fully, highlighted by today’s news of the bankruptcy filing by toy retailer Mastermind. For the holiday season, survey after survey is pointing to a cautious spending backdrop.

That latter point may not be completely obvious when stacked up against the latest retail sales result. Making a mockery of all the woeful headlines, Canadian sales readily topped expectations in September with a decent 0.6% gain (or +0.3% in real terms), while the flash reading for October points to a 0.8% headline rise. Given that consumer prices fell 0.1% in seasonally adjusted terms last month, and goods prices fell even more heavily, the flash result points to a solid volume gain.

Thus, overall real retail sales are still hanging in there, rising 1.5% y/y, which is in line with the latest tally in real consumer spending. But while that’s simply not in recession territory, it’s far from hearty—especially since the population has risen by more than 3% in the past year. Plus, the decent gains in sales have been supported by a sustained comeback in autos, which are still very much in recovery mode from the 2021/22 chip shortage. Outside of autos, retail sales volumes are about flat from year-ago levels. With that slowing momentum, and in the face of still-high borrowing costs, our official estimate for real consumer spending is essentially zero for next year, versus an average gain of just under 2% for all of 2023.

A cooler consumer is the major reason why we are looking for only 0.5% real GDP growth in Canada for all of 2024, down from this year’s expected modest gain of 1.0%. Both of those estimates are a tick below the latest consensus forecasts, and broadly in line with the assumptions behind this week’s Fall Economic Statement from Ottawa. Yet, the fact that retail sales have not completely wilted is a major reason that the Canadian economy (but even more so the U.S. economy) managed to avoid a full-on recession this year, running against the conventional wisdom at the start of 2023. Dare we ask: Have central banks chilled spending just enough to undercut inflation, but not enough to send the broader economy into a downturn?

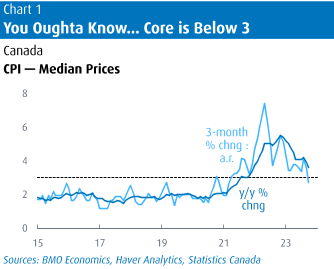

Prospects for arriving at the happy place of a soft landing got a major shot in the arm from this week’s friendly Canadian October CPI. While not far from expectations, it tilted broadly to the mild side, with the headline falling to 3.1% and the four main measures of core calming to an average of 3.4%. The three-month trend on the latter eased to 2.8%, tantalizingly within the Bank of Canada’s 1%-to-3% comfort zone, and the mildest short-term trend seen for underlying inflation since April 2021 (Chart 1). In turn, Governor Macklem turned the dial one more notch to the dovish side in his speech the very next day, intoning that policy may well now be restrictive enough and allowing that the CPI was good news.

Markets are off and running with the ball, as they will do, pricing in better-than-even odds of rate cuts as early as April, a step or two ahead of expectations for the Fed. Not to quibble with the timing, but we would still lean to a slightly later start date for cuts. First, the Bank (and the Fed) have made it amply clear that they will err on the side of caution when it comes to the inflation battle. Second, we doubt that core inflation will moderate quickly enough to fit that neat and tidy timeline. Note that shelter inflation is the very definition of sticky at 6.0% y/y: none of rent (at a towering 8.2% y/y), home insurance (7.7%), property taxes (4.9%), or mortgage interest costs (30.5%) are going down anytime soon.

Looking a bit further out, services inflation in general has now more fully grabbed the baton from goods—as has long been the case stateside. Over the past 12 months, services prices are up 4.6% while goods are up just 1.6% (and durables only 0.3%). Not to oversimplify, much, but services are largely determined by domestic conditions, while goods prices are driven by global factors. And, in turn, services (ex shelter) are largely driven by labour costs. There are many measures of wages in Canada, which often throw off contradictory signals, but most are in the range of 4%-to-5% increases with few signs of receding. Wage settlements averaged a 4.4% rise over the life of the contract in Q3, up from 2.4% in 2022 and the highest read since 1991. With zero productivity growth to offset those gains, this will keep a flame under inflation for some time yet. Hence the Governor’s heavy reluctance to declare victory.

Isn’t it ironic? Next week brings both an important look back for the Canadian economy with Q3 GDP on Thursday, and then a much more current read with the jobs report for November on Friday. (This is the one month of the year that Canada releases the jobs data a week ahead of U.S. payrolls, and it could thus garner a bit more attention than usual.) We’ll be watching the average hourly wage figure closely, and it’s expected to ease a tad from 4.8% y/y. But, perhaps more important will be the unemployment rate, which has been grinding higher—unnervingly—from 5.0% early this year to 5.7% in October. That big step up has met the so-called Sahm Rule, which finds that a 0.6 percentage point rise in the 3-month average jobless rate (now 5.6%) from the low of the past year (5.0%) has signaled recession in Canada. (The so-called BMO Economics Rule is actually +0.7 ppt, and we are almost there too.)

Without piling on, the Q3 GDP result is going to struggle to stay positive—we are expecting a puny 0.2% annualized gain. If it doesn’t quite get there, that would be the second consecutive quarter of GDP decline; that’s not a technical recession, that’s a rough-rule-of-thumb recession. Whatever the label, the reality is that the economy is struggling to grow in the face of the major monetary tightening and record household debt. Yet, despite that sour reality, we would be remiss to not point out that the equity market is quietly enjoying a banner month. The TSX is headed for a near-7% gain in November, which could be the second-best month since 2010, aside from the wild volatility of 2020. In other words, despite the soggy near-term outlook, markets are looking further ahead to rate relief and better economic times by late 2024.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.