It’s a Small (Rate) World, After All

By Douglas Porter

September 27, 2024

This week saw a global response to last week’s aggressive 50 bp Fed rate cut. The big step by the world’s most important central bank, combined with another slide in crude oil prices, has taken the shackles off policymakers almost everywhere. China got the ball really rolling with a series of long-awaited stimulus measures, including 20-30 bp interest rate cuts and a drop in reserve requirements. Sweden, Switzerland, and Mexico cut rates by 25 bps, all three for the third time this cycle. Just a few short weeks ago, we crowed that the Bank of Canada was leading the world with 3 cuts of 25 bps—well, the world just caught up.

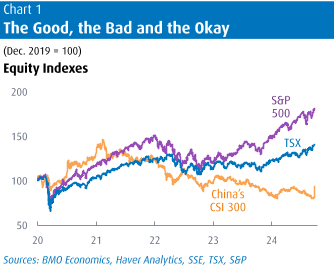

Equities are thriving in a backdrop of fast-falling short-term rates and still-decent economic growth. The OECD nudged up its estimate of global growth by a tick to 3.2%, and sees the same for next year (matching our call for 2025). While 3.2% is a bit below the average growth rate of the past decade, it’s close to what’s seen as current potential global growth. That appears to be just the right pace to weigh on inflation while also supporting decent earnings growth. Juiced also by China’s stimulus, stocks rose broadly this week, taking the World MSCI to a new high and up more than 10% from the early August lows. Even the previously laggard TSX is on a roll, closing above 24,000 for the first time, and now up 28% from last October’s lows. There have been only two 11-month periods in the past 15 years that the Toronto market has managed to rise more than that: emerging from the deep 2008 plunge and rebounding from the 2020 plunge.

Amid all the excitement in equity markets, bonds played it cool, having long ago priced in relatively aggressive rate cuts. Treasury yields were almost unchanged on net this week, with 2s holding just below 3.6% and 10s close to 3.75%—thereby maintaining the mild upward sloping yield curve. Canada’s curve was also broadly unchanged, albeit at much lower levels, with 2s staying close to 2.9% and 10s just a touch higher. Thus, the GoC curve is also now slightly upward sloping, a place it only returned to last week after more than two years of inversion.

The Treasury market was also responding to a mixed bag of economic data. Perhaps we can best capture the jumbled picture on the U.S. economy from this week’s two major consumer sentiment surveys. First, the Conference Board reported that confidence took a large step back in September, suffering its biggest monthly setback since 2021. Yet, just days later, the University of Michigan reported that sentiment, in fact, rose nicely in September, as the one-year inflation expectation dipped to 2.7%. Making matters even murkier, the UofM’s measure is still below the lows hit during the depths of the pandemic in 2020, which runs 180 degrees counter to the record highs for equities. Regional Fed metrics also muddied the picture, with many of the manufacturing surveys printing weak, but the Chicago Fed reporting that the broader national economy grew above trend last month.

Even the most important U.S. indicator of the week didn’t really set a clear direction. The core PCE deflator was milder than expected in August, rising just 0.1% despite a 0.3% rise in core CPI for the same month. However, that was just firm enough to nudge up the annual rise in this key inflation gauge to 2.7%, and also pulled up the 3-month trend to just above 2%. Fed Governor Waller had specifically cited the drop in the latter to below 2% as a driving factor behind his newfound dovishness. And while real consumer spending came in a bit light last month at up 0.1%, it’s still on track for Q3 growth of just above 3% annualized. At the same time, weekly jobless claims fell again to 218,000, suggesting no significant strain in the job market.

Looking beyond the monthly and weekly noise, the bigger picture—which stocks appear to have their eye on—is that the U.S. economy remains amazingly resilient amid the battle to tame inflation. The big news in this week’s GDP result was not that the U.S. economy did indeed grow at a stellar 3.0% pace in Q2, although that’s impressive enough, but rather that prior years were revised markedly higher. Growth is now pegged at 2.9% for all of last year—the consensus call at the start of 2023 was for growth of just 0.5%, a massive misfire. Since the end of 2019, or just before the pandemic began, the U.S. is now estimated to have grown by a cumulative 10.7% (or about 2.3% annualized). While that may not sound particularly robust, it compares with just 5.5% growth in Canada over the same period, 3.9% in the Euro Area, 3.0% in Japan, and 2.3% in Britain. America’s productivity growth will also now likely be revised higher, another area that the U.S. is separating itself from other major economies.

In contrast, Canada’s economy has struggled to gain momentum after a respectable start to 2024. Monthly GDP did manage to rise 0.2% in July, but the early read on August points to a flat performance last month. This leaves the economy on course for growth of 1.3% in Q3 (our call), less than half the initial estimate of 2.8% by the BoC. It’s a similar story for the year as a whole, with real GDP on track for little more than 1% growth, even as the U.S. economy is headed for a 2.6% full-year advance (or more).

The job market is also sending signals of further cooling, with the vacancy rate dropping to just 3.0% in July, and the ratio of unemployed to job openings jumping to 2.7—at its tightest in 2022, that ratio had dropped to 1.0, or essentially full employment. We’re a long way from that happy place now. Meantime, Canada’s population keeps growing in leaps and bounds, driving further slack in the labour market. While many read the latest quarterly population growth figures as “slowing”, that’s only compared with the super-heated pace of 2023. We would note that only 7 quarters in the past 50 years have seen the population grow by more than a quarter million people, and all 7 have been in the past three years alone, including the latest quarter. The bottom line is that the population has still grown by 3.0% in the past year or double the growth rate in the economy over the same period.

With the Bank now openly fretting about weak economic growth, confirmation that Q3 is coming in light of expectations will simply fire up talk of a 50 bp cut at next month’s decision. We could thus soon be again pointing to the Bank of Canada as the global rate cut leader.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.