It Ain’t Over ’Til the Fat Core Slims

Douglas Porter

May 19, 2023

Forget about rate cuts later this year—the bigger risk is that many central banks will still be hiking in the months ahead. Bond markets on-boarded that growing reality this week, driving yields aggressively higher across the curve to levels not seen since SVB collapsed 10 weeks ago. To pick but one example, two-year Treasuries rocketed 25 bps to around 4.25%, even with a partial reversal on Friday (on indications the debt ceiling talks were suddenly at an impasse). Initial optimism on the debt ceiling, hawkish Fed talk, and more signs of economic resiliency lit the fire, although the debt limit still looms large. Canadian bonds saw an even more fiery move, stoked by a surprisingly sturdy CPI result and further evidence that housing has bottomed. By week’s end, the important 5-year GoC was near 3.3%, up from barely 3% last Friday.

While steady selling in Treasuries set the tone, what really put the cat among the pigeons in Canada’s bond market was the meaty inflation reading for April. After a steady stream of fast-falling headline results since last summer’s 8.1% peak, inflation defied consensus and ticked up to 4.4%. We would never dream of saying “we told you so”, but we have been loudly warning for months that it was not going to be a straight-line, bump-free descent for inflation back to the 2% target. (And, for the record, CPI was only one thin tick above our call for April.) In fact, the mild high-side surprise puts us in the odd position of actually talking the number down a bit—that is, it really wasn’t that much of a shock, and we don’t believe the fundamental inflation outlook has changed.

First, it’s almost certain that headline inflation will take a mighty step down next month—possibly by a full percentage point to the low 3s—as the base effects are very friendly and gasoline prices have ebbed a tad in May. Moreover, every major measure of core inflation in Canada dipped further in April, at least on a yearly basis. The Bank’s two preferred measures (trim and median) both eased to 4.2% y/y, while their prior core crush (CPIX) eased to 4.1% y/y, down 2 ppts from last year’s high. The latter measure has the benefit of removing mortgage interest costs, which are now the single fastest growing item in the basket. True, the monthly core moves were sturdier than expected, averaging 0.4% in seasonally adjusted terms. But the three-month trends on most core measures are holding steady around 4%.

The persistence in core simply reinforces our point that the Bank will need to keep rates restrictive for some time yet to fully break underlying pressures. No less an authority than Governor Macklem seemed to agree that the latest CPI was a nuisance, but not cause for a course correction. While markets took heed of his comments, the persistent back-up in U.S. yields kept the upward pressure squarely in place. And a few analysts are now openly calling for the Bank to start hiking rates again as soon as the June 7 meeting. That would likely be a mistake, and a better option would be to at least await the May jobs and CPI data, not to mention an early look at Q2 GDP, for a more complete picture of how the economy is faring. There’s also the small matter of first making sure the U.S. doesn’t default before we start predicting more rate hikes.

Having said that, we readily recognize the case for additional rate hikes, with the July 12 decision date a very likely candidate. To be clear, our official call is that the Bank (and the Fed) will keep rates steady at current levels through the remainder of the year. But the risks of further moves are growing, especially after we are on the other side of the debt ceiling drama. And a key reason why those risks have risen is the resiliency in the housing sector. As we have opined, ad nauseum, if the most interest-sensitive and cyclical sector of the economy is firming up again, then monetary conditions are most likely not sufficiently tight.

And the latest Canadian home sales data for April definitely displayed some firming, as sales spiked 11% m/m, one of the largest monthly rises on record. Prices are starting to nudge up again, while the market balance has swung decisively back in favour of sellers, at least for the time being, pointing to further price increases. Suffice it to say, this is not what the Bank of Canada doctor ordered. U.S. housing is also showing a pulse, even without the helping hand of strong population growth, with the Home Builders’ survey rebounding to its best level since last summer.

If it was just some bottoming in housing, then central banks would not necessarily need to keep hiking rates. After all, the better housing backdrop could reflect the brief respite seen in longer-term borrowing costs after the spring banking stress. With yields back on the upward march, this could help calm any budding enthusiasm in housing. A bigger issue for central banks would be if the consumer stays strong. U.S. retail sales rebounded 0.4% last month, which wasn’t a surprise, but core measures were even stronger, which was a surprise. Similarly, Canadian retail sales fell as expected in March by 1.4%, but the early April read is for a 0.2% comeback. To be sure, the North American consumer is hardly firing ahead, but it’s also not meekly shrinking.

The bottom line is that if the debt ceiling can be adequately dealt with in a timely manner—still a big “if”—market focus will swing back to the possible need for even higher rates. U.S. equities celebrated early signs of progress on debt limit talks this week, but the interest rate reality may yet bite. Curiously, the TSX struggled to swim sideways this week despite firmer oil prices, perhaps better recognizing the still-present rate risk.

There is no joy in Toronto-ville this week, after the latest Leaf strike out. But there is no bitterness either, as 56 years of experience provides a Zen-like response to such disappointment. Having travelled to Edmonton this week, to commune with like-minded fans, it’s notable how the wounds are fresher there, since it’s only been 33 years (a trifling!) since they last hoisted the Cup. And I’m sure the NHL is perfectly okay with none of the final four teams being much north of the 36th parallel. It’s not at all weird that the most northerly city left is Las Vegas—it’s true, look it up—which is roughly in line with Gibraltar and much of North Africa. No, the NHL’s southern push is surely a huge success… just look at Arizona’s thriving franchise. Like I said, not bitter at all.

There is no joy in Toronto-ville this week, after the latest Leaf strike out. But there is no bitterness either, as 56 years of experience provides a Zen-like response to such disappointment. Having travelled to Edmonton this week, to commune with like-minded fans, it’s notable how the wounds are fresher there, since it’s only been 33 years (a trifling!) since they last hoisted the Cup. And I’m sure the NHL is perfectly okay with none of the final four teams being much north of the 36th parallel. It’s not at all weird that the most northerly city left is Las Vegas—it’s true, look it up—which is roughly in line with Gibraltar and much of North Africa. No, the NHL’s southern push is surely a huge success… just look at Arizona’s thriving franchise. Like I said, not bitter at all.

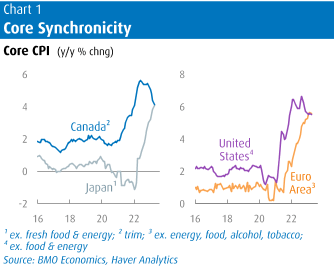

The 36th parallel also runs right through southern Japan, just north of Tokyo. Besides hosting the G7 meeting, Japan is back on the radar for financial markets. Famously, the Nikkei is up 18% so far this year to its best level since 1990 (yes, the last time the Oilers won). While Warren Buffett’s seal of approval for Japanese stocks has helped, the market has also been supported by a consistently dovish Bank of Japan. Even as core inflation has pushed above 4% (nearly kissing Canada’s rate; Chart 1), the BoJ has stuck doggedly with its zero-rate policy. It’s understandable that after 30 years of no inflation that Japan may welcome a little inflation, but one really has to wonder how long until that patience wears thin, and the BoJ will crash the equity party.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.