Inflation: Not Dead Yet, but Pining for the Fjords

By Douglas Porter

June 28, 2024

Financial markets are finishing the first half of 2024 with a flourish, led by a powerful 15% advance in the S&P 500 to yet more record highs. While other major equity markets are also mostly in the green this year, there’s no doubt who’s leading. And that top American performance has been echoed in a sturdy U.S. dollar, which is up roughly 5% this year on a trade-weighted basis. Accompanying robust equities, key commodities have also been solid, with oil prices rising $10/barrel in the first half to nearly $82, and gold up almost 15% to above $2300/ounce.

This unusual combination of a strong greenback and strong commodities is an issue for other economies, providing a two-fisted punch of inflation pressure. And the one market that did not enjoy a banner H1 was government bonds. Longer-term Treasury yields rose again this week, with 10s forging above 4.3%, leaving them up almost 50 bps since the start of the year. Other markets saw a bigger back-up, as Europe fretted about the French election (first round this weekend), while Australia and Canada fretted about some surprisingly tough May inflation results.

We opined in this space last week that the U.S. may not be quite the inflation outlier on the high side that its CPI suggests—highlighting the much milder trends in core PCE and the semi-obscure harmonized CPI. That message was driven home by the aforementioned high-side readings elsewhere, and the mild U.S. May core PCE deflator. The latter arrived as expected, nudging up a mere 0.1%, and clipping the annual rate to a manageable 2.6% y/y pace. While no surprise, both of those readings are notable in their own right. Taken to a few decimal places, the monthly increase was the smallest since November 2020, while the annual rise was the slowest since March 2021.

Because of the unfortunately hot start to the year, the six-month trend in U.S. core inflation has picked up to an uncomfortable 3.2% annualized clip. But the more recent milder readings suggest that the early-year blast was an outlier, which may have been driven by an extra dose of seasonality (i.e., start-of-the-year price hikes above and beyond normal). And there is good reason to believe that underlying trends could ebb a bit further in coming months. This week’s Feature points to some moderation in wage pressures, including fewer job vacancies and a rise in the unemployment rate. The latter is expected to hold at 4.0% in June’s jobs report, but hourly earnings should dip back below that figure.

Providing a fundamental factor for cooler inflation trends, there is mounting evidence that the U.S. economy is losing some steam. The housing market is stuck in place by near-7% mortgage rates, while recent real consumer spending trends have moderated to below a 2% pace. Following last year’s surprisingly perky 3.1% Q4/Q4 rise in real GDP, growth appears to have cooled to around half that pace in the first half of this year (Q1 was 1.4%), and we don’t look for a pickup in H2. In some ways, this is the very definition of a soft landing, and very much keeps a possible September Fed rate cut in play.

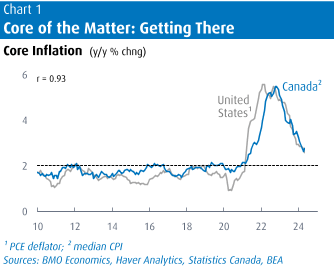

Canadian markets had a different tone this week, as was the case through much of the first six months of the year. The TSX managed to grind out a solid 2% rise, but that left its H1 advance at a modest 5%. The bigger contrast was in bonds, where Canadian yields rose sharply across the curve this week, after seeing milder increases earlier in the year. The X factor was Canada’s CPI clunker. After a series of surprisingly tame results to start the year, May came in hot, with seasonally adjusted prices rising more than 0.3% on both headline and core. Suddenly, after seemingly separating itself from the U.S. on the core inflation front, there’s now no daylight between the two—at least on the measures the two central banks prefer: median CPI for the BoC, core PCE for the Fed (Chart 1).

The theme of still-sticky inflation abroad was amplified in Australia, where headline inflation popped back up to 4.0% last month, two ticks above expectations. Not only is the RBA now a long way from cutting rates, many are openly muttering about the possibility of rate hikes. Australian policy rates never climbed as much as elsewhere during the hiking cycle and, at 4.35%, the cash rate is still just barely above current inflation. Aside from the BoJ, the RBA may well be the last major central bank to cut rates this cycle, which is providing some support for the Australian dollar. It has managed to hold its own against the US$ at around 67 cents, and has risen almost 4% against the loonie over the past year (to a bit above 91 Canadian cents).

Turning back to Canada, no one is talking about the BoC needing to reverse course after the sour CPI result. But the inflation back-up doused expectations for a follow-up rate cut in July. The door has not been completely shut, but we will need to see some spectacular results for June inflation the week before the July 24 decision. The Bank’s Business Outlook Survey and next week’s jobs data will also feed into the deliberations, but it’s gone from a case of the data needing to dissuade the Bank from cutting, to it needing to convince the Bank to cut.

The latest Canadian GDP results did little to help the rate cut cause, with April growth matching consensus at +0.3%, and May expected to print +0.1%. This leaves growth on track for almost 2% a.r. for Q2, or roughly in line with the Q1 actual of 1.7%. There’s no debate that overall growth remains generally lacklustre, but the economy has shown a bit more life so far in 2024 than the near-zero growth of the last nine months of 2023. And note that after woefully trailing the U.S. last year, Canada’s GDP may be on the verge of posting somewhat faster growth than stateside for the second quarter in a row. Just as Canada’s apparently milder core inflation results are reverting to U.S. trends, we may also be on the cusp of seeing the prior North American growth gap close as well. Now, about closing that gap in relative equity market performance… well, that’s something completely different.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.