Inflation as an Election Issue: A Primer for Leaders

The Bank of Canada’s monetary policy framework is up for renewal by the end of 2021/Reuters

Mostafa Askari, Sahir Khan and Kevin Page

Institute of Fiscal Studies and Democracy, University of Ottawa

August 31, 2021

Should the recent rise in inflation be an important issue in the ongoing federal election campaign? More specifically, should it be raised in the leadership debates — in French on TVA September 2, and the two Leaders’ Debates Commission events in French on September 8 and English on September 9?

Yes and no. Here are the arguments:

Yes: it is fair to ask political leaders about the 2021 renewal of the Bank of Canada mandate and the role that both monetary and fiscal policy can play to support growth and prosperity and influence inflation.

While the Bank of Canada is an independent institution and the operational conduct of monetary policy must be free from political interference, the Bank of Canada Act highlights the importance of consultation on general economic policy (section 14.1). The next minister of Finance must approve the new policy mandate of the Bank of Canada.

No: if it becomes an important issue, then we are taking valuable debate time away from the public health crisis, the climate change crisis and the need to transition Canada through the pandemic and economic recovery to a more sustainable, fair and resilient future. Inflation has not created an immediate affordability crisis. It is a future risk.

The Debate Broadcast Group, a partnership of 10 news organizations selected by the Leaders’ Debates Commission, has indicated that topics for the Commission debates will be announced three days before those events. That French debate, airing on Radio-Canada, will include direct questions from Canadians.

Polling from Angus Reid published August 27th indicates that the number one issue for all age and gender groups is climate change. One in five Canadians will choose which party to vote for based on how they propose to handle this crisis.

At a distant second is the consistent top-five top issue — the quality of health care — followed by that perennial favourite, taxes. Close behind these issues as a primary ballot question are the government response to COVID-19 and the need for transparency and honesty in government. Further behind (at one-in-ten support as the top issue) are the management of the budgetary deficit and affordable housing.

While inflation does not get flagged by pollsters as a major concern among voters, it did get attention in the campaign when the prime minister responded to a question from a Bloomberg journalist about the 2021 renewal of the Bank of Canada inflation mandate.

Prime Minister Justin Trudeau responded: “When I think about the biggest, most important economic policy this government, if re-elected, would move forward, you’ll forgive me if I don’t think about monetary policy…You’ll understand that I think about families.”

The leader of the Conservative Party, Erin O’Toole, responded by saying, “The simple fact is that Justin Trudeau has made life less affordable for Canadians … Regular Canadians are struggling to make ends meet.”

In the interest of all party leaders providing a more nuanced and informed answer if this question comes up in the debates, hereby, a primer:

Facts

The Consumer Price Index (CPI) rose 3.5 percent in July on a year-over-year basis — half a percentage point above the 1-to-3 percent target range of the current Bank of Canada mandate, last renewed in 2016 per the five-year renewal schedule. It is unusual for the year- over-year inflation rate to rise above the Bank of Canada target range. Not unprecedented. We live in unusual times — a global pandemic whose economic impacts have been dictated by rolling, random lockdowns.

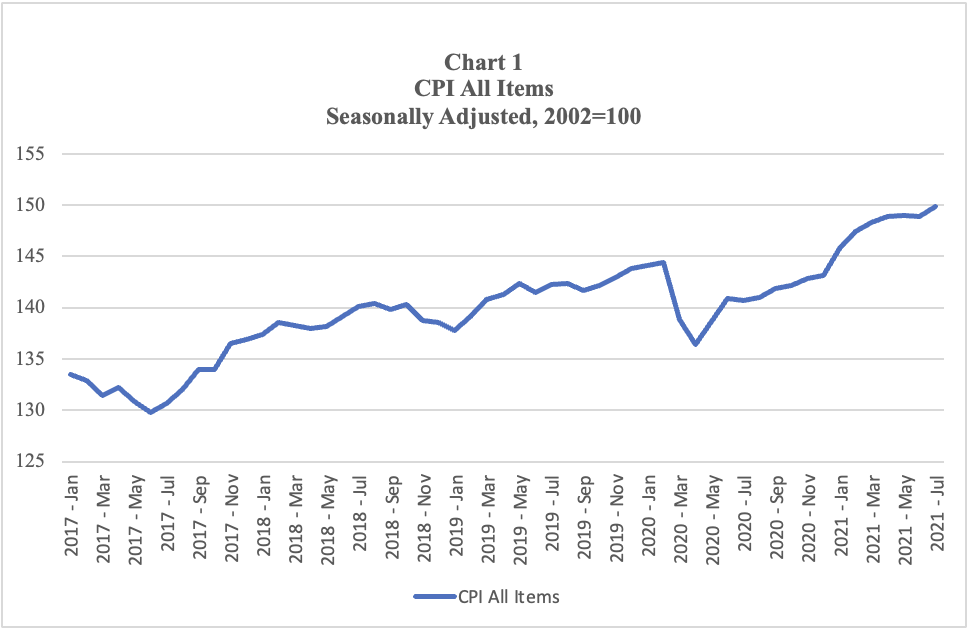

When the current governor of the Bank of Canada talks about base effects and transient factors impacting this inflation number you can see the impact when you look at the evolution of the level of the CPI (Chart 1). A drop in the price level when the economy went into a lockdown in the spring of 2020 and a return to trend in the level over the year that followed. No crisis.

Source: Statistics Canada, Haver Analytics

Also, when we look at the performance of the CPI over the past two years, we see an accumulated increase of just under four percent (Table 1). Not runaway inflation. We do see spikes in shelter costs and gasoline prices.

Table 1

| Increase in the Consumer Price Index

from July 2019 to July 2021 (not seasonally adjusted) |

Per cent |

|

All Item |

3.9 |

| Food | 4.0 |

| Shelter | 6.4 |

| Household operations, furnishings and equipment | 1.7 |

| Clothing and footwear | -1.1 |

| Transportation | 5.5 |

| Gasoline | 11.4 |

| Health and personal care | 4.2 |

| Recreation, education and reading | -1.2 |

| Alcoholic beverages, tobacco products and recreational cannabis | 2.3 |

| All-items excluding food and energy | 3.3 |

| All-items excluding energy | 3.4 |

| Energy | 9.7 |

| Goods | 4.8 |

| Services | 3.1 |

Source: Statistics Canada, Haver Analytics

Inflation analysts will break down these specific higher prices by studying supply and demand factors.

Let’s be frank; low interest rates have encouraged borrowing and pushed up demand and prices for housing. The pandemic has had a deleterious impact on housing supply. Downward pressure on global oil inventories in 2021 is pushing up gasoline prices. If we get carbon prices right in the future, expect higher and higher gasoline prices. Markets must help with the conversion to electric vehicles.

Are Canadian voters struggling to make ends meet? Sadly, some are. People facing poverty need support. If you look at the numbers, however, most people are not struggling.

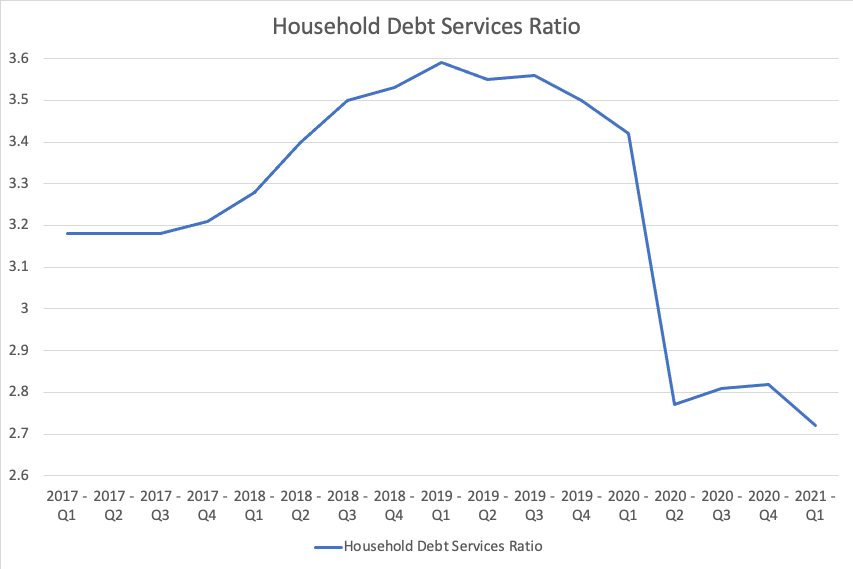

On average, household debt (mortgage and non-mortgage) ratios have fallen well below pre-Covid levels (Chart 2). Disposable incomes were protected with large government support payments. Consumption of goods and services fell during the lockdown. Borrowing rates have also fallen. Are consumers better positioned to spend more than before the pandemic? Will this lead to higher inflation when the economy fully opens? It could. The future is uncertain.

*Household spending on mortgage and non-mortgage debt divided by disposable income

Source: Statistics Canada, Haver Analytics

Policy Context

The Bank of Canada five-year mandate review started (hard to believe) four years ago. Thousands of people have been consulted. There have been conferences, roundtables, and surveys. Discussions have been supported by research papers examining potential implications for a change in mandate — average inflation targeting; dual mandate with a focus on inflation and employment; nominal gross domestic product targeting; and price level targeting.

All this material is available by accessing the Bank of Canada web site. If political parties and leaders want access to information on Canadian history, norms and protocols involving inflation, monetary policy and mandate renewal, they do not need to look too far.

When the election is over, Canada’s next government, and in particular the next Finance Minister, should be prepared to formalize an agreement on the framework that will serve to guide monetary policy until 2026.

Our bet is that we will end up with a similar framework focused on maintaining inflation rates in the 1 to 3 percent range. It has served Canada well in anchoring inflation expectations. Forward guidance and the use of more unconventional tools like quantitative easing will continue in uncertain times.

If the Bank of Canada can conduct open consultations with citizens and experts on possible monetary policy frameworks, our political leaders need to prepare for questions. At the very least, on the process and policy objectives and how monetary and fiscal policy must work together.

Fiscal Strategy

In sharp contrast to the very public, extensive and deliberate consultation conducted by the Bank of Canada, there has been virtually no debate and direction by our political parties on the fiscal policy framework necessary to help Canada transition through the pandemic to a more sustainable, fair and resilient country.

It is true that the Bank of Canada is run independently by public servants. They are not elected. The proverbial bar must be high for transparency to promote confidence and trust. That bar is high.

But why must the bar be set so low on how political parties will manage fiscal policy in the form of reconciling revenues, spending, budgetary balances and debt based on promises, policies and contingencies?

The Liberal party has provided cost estimates for its platform promises, detailing $78-billion in new spending over five years, partially offset by $25-billion in new revenue from tax hikes focused on large corporations and the wealthy. The Conservative leader says he will eliminate the exceptional pandemic deficit over the next decade “without cuts” and the multibillion-dollar platform he unveiled on August 16th is reportedly still being costed by the Parliamentary Budget Officer.

Low interest rates can be destabilizing. We have seen this in the housing market. Will we see this with deficit-financed government spending? What is the path to reduce federal deficits so they do not promote excessive inflation in the years ahead? How much government current spending should be paid for by future generations? Political leaders need to be prepared for these questions.

We look forward to the debates.

Mostafa Askari is chief economist of the Institute of Fiscal Studies and Democracy at University of Ottawa and a former deputy Parliamentary Budget Officer; Sahir Khan, executive vice president of IFSD, is a former assistant Parliamentary Budget Officer. Kevin Page, founding President and CEO of IFSD, was Canada’s first Parliamentary Budget Officer.