IFSD’s Fiscal Credibility Assessments of the Pre-Election Party Platforms

Summary

The Institute of Fiscal Studies and Democracy (IFSD) assesses the fiscal credibility of election platforms of the major parties according to three principles:

- Use of realistic and credible economic and fiscal assumptions;

- Responsible fiscal management;

- Transparency.

The principles and scoring criteria are detailed in IFSD’s platform assessment framework, originally developed ahead of the 2019 federal election.

These assessments are designed to test for coherence between policy proposals and fiscal and economic plans, as well as the realism of assumptions. Platforms are political documents and are expected to provide reliable and realistic proposals, making them different than budgets or government documents that have different requirements for accuracy, realism, and transparency.

The 2025 election takes place in an historic context.

Global economic growth is expected to slow due to the imposition of US tariffs and increased policy uncertainty and geo-political tension.

The OECD (March 2025 interim economic update) highlights risk for macroeconomic volatility ahead including market corrections and an unexpected downturn. Their advice is for governments to take action to preserve fiscal sustainability and ensure fiscal room to address future shocks and spending pressures. Efforts are required, according to the OECD, to reallocate spending towards activities that will support longer term growth.

Canada is on the front line of the US trade war given the strong trading relationship and dependency on the US market. Public threats by President Trump on Canada’s political sovereignty has shocked and unified citizens. The historic political and economic challenges are taking place when Canadian governments continue to address challenges related to affordability from the fallout of the global pandemic and a series of longer term policy challenges related to productivity, income and wealth disparity and climate change.

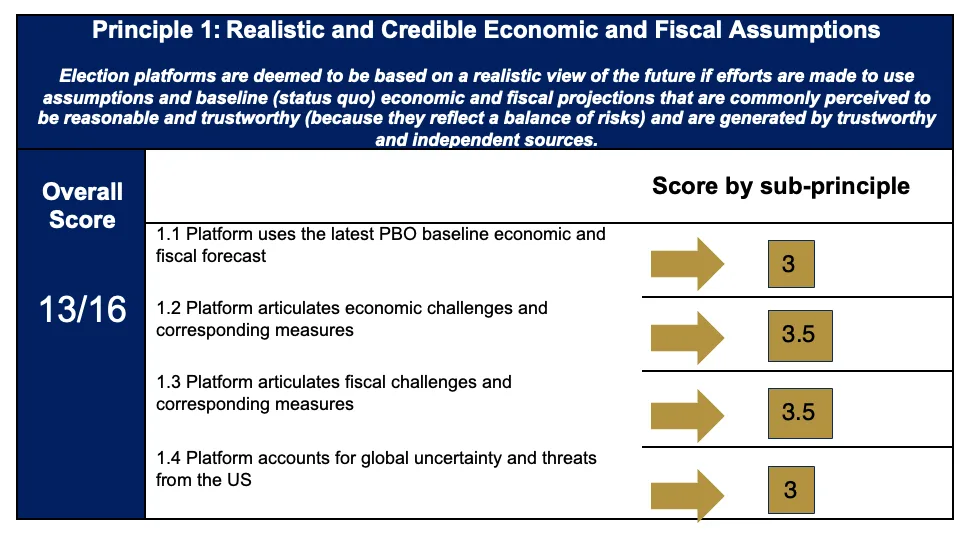

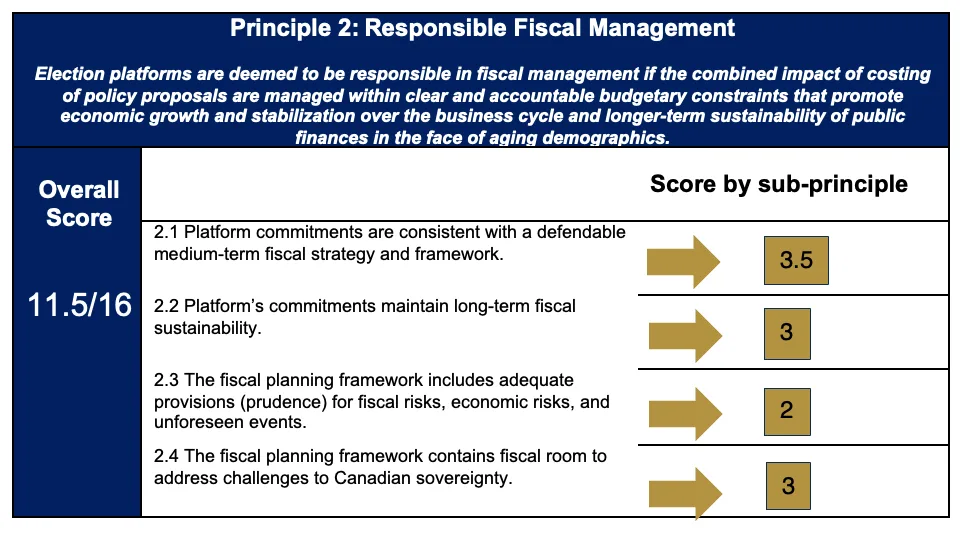

IFSD Fiscal Credibility Assessment Liberal Party of Canada Platform 2025

IFSD finds that the Liberal Party Platform 2025 merits an overall rating of GOOD with ratings of GOOD across the three assessment principles (realistic economic and fiscal assumptions, responsible fiscal management, and transparency). The overall score is 35/44 across the three principles (80 percent grade).

The Liberal Party of Canada’s 2025 federal election platform, Canada Strong, proposes measures to strengthen sovereignty, the economy, and social well-being. There are 4 priorities – Unite, Build, Protect and Secure. There are more than 100 initiatives with direct fiscal consequences. Over the next four years the Liberal Platform proposes new revenues and savings totalling $52 billion and new spending measures (operating and capital) totalling $129 billion. This results in higher debt of $83 billion over the four-year horizon.

The Liberal Platform utilizes the PBO March 2025 Pre-Election outlook which does not incorporate the economic impact of the US tariffs and global fall-out. Higher Canadian import duties on US goods and services are assumed for one year, 2025-26. At this juncture, it is an optimistic planning baseline. The budgetary deficit is projected to increase to $63 billion (2 percent of GDP) in 2025-26 and fall modestly to $48 billion (1.4 percent of GDP) in 2028-29. The debt-to-GDP ratio remains relatively flat in the 42-43 percent range over the next four years. This ratio is below the recent peak in 2020-21 (COVID related) of 47.2 percent and much higher than the modern low of 28.2 percent in 2008-09.

A notable feature of the Liberal platform is the distinguishment of operating and capital spending. Over the next four years increased operating and capital expenditures on an accrual basis are balanced (about $65 billion); on a cash basis, capital expenditures are about two times higher than operating. The policy focus is largely capital spending to address infrastructure gaps and promote longer term growth. New social programs implemented by the previous government with support from the NDP are maintained. There are notable planned spending savings over the medium term that are re-allocated to new initiatives to mitigate an increase in debt and interest charges.

The principal budgetary constraint is a commitment to balance the operating budget in four years, 2028-29. For frame of reference, the PBO baseline outlook projected an operating balance next year, 2026-27. There are no explicit contingency or prudence reserves around the target. The platform acknowledges that the positive economic impact from higher capital spending has not been formally incorporated into a revised baseline. There is a commitment to lower the debt to GDP ratio over the medium term.

The Liberal Policy Platform was released on April 19, 2025 – after the leaders debates; during the advanced voting period; and eight days before election day.

1.1 Platform uses the latest PBO baseline economic and fiscal forecast.

Liberal Party platform score: 3/4

- The PBO Pre- Election (March 2025) baseline is used in the platform’s fiscal and cost analysis and fiscal planning framework for deficit and debt calculations.

- It does not include economic impacts for tariffs. Revenues from higher import duties on US goods are included. It is considered an optimistic planning scenario, at this juncture.

1.2 Platform articulates economic challenges and corresponding measures.

Liberal Party platform score: 3.5/4

- Broad national interventions are defined to meet challenges to Canada’s sovereignty, economic, and social security. Measures are defined across four categories of activity: unite, secure, protect, and build.

- The measures address infrastructure and human capacity to generate long-term gains. Results, however, will not be immediate.

- Aggregate economic stability is maintained through public intervention resulting in higher budgetary deficits. Increases to the deficit are substantiated through sovereignty protecting, e.g., presence in the North, and national building measures, e.g., emphasis on energy infrastructure.

1.3 Platform articulates fiscal challenges and corresponding measures.

Liberal Party platform score: 3.5/4

- The platform separates operating and capital spending and implicitly suggests that tax revenues must fund operating spending, but, as necessary, the government will borrow for capital investment.

- The platform does not identify rising debt and deficit as fiscal challenges and suggests that in the current global economic turmoil increasing public investment is necessary.

- The platform assumes that revenues from higher tariffs in the first year and increased productivity, and efficiency due to higher investment will soften the fiscal impact. Budgetary deficits are higher than the PBO pre-election baseline.

- The platform makes use of reallocation through a proposed spending review to limit the proposed total spending increases.

1.4 Platform accounts for global uncertainty and threats from the US.

Liberal Party platform score: 3/4

- The measures in the platform, especially the significant increase in capital investment, aim to meet the challenges of the current economic turmoil, but the platform does not adjust the baseline economic and fiscal projections for the tariff shocks. Tariff impacts on revenues are assessed for one year only.

- The platform assumes economic and fiscal forecasts improve in the next fiscal year, and does not include a risk provision.

2.1 Platform commitments are consistent with a defendable medium-term fiscal strategy and framework.

Liberal Party platform score: 3.5/4

- The platform’s commitments are aligned to an optimistic view of the medium-term fiscal framework. There are downside risks to both economic and fiscal forecasts.

- Budgetary deficits decline from 2 percent of GDP to 1.4 percent over the 4 year planning horizon. They are higher than the PBO baseline but lower than projections for most other OECD countries. A 2 percent budgetary deficit in 2025-26 would be considered moderate. It will be difficult to achieve if the economic outlook is worse than anticipated

- The expressed goal of the platform is to meet sovereignty, economic resilience, and affordability through various measures including significant increase in public capital investment

2.2 Platform’s commitments maintain long-term fiscal sustainability.

Liberal Party platform score: 3/4

- While there is an increase to the deficit and debt, the platform commitments are fiscally sustainable over the long-term (debt-to-GDP ratio is expected to decline in the long run) but, the risks associated with the current economic turmoil could undermine long-term fiscal sustainability.

2.3 The fiscal planning framework includes adequate provisions (prudence) for fiscal risks, economic risks, and unforeseen events.

Liberal Party platform score: 2/4

- There is no consideration of prudence and risk in the optimistic assumptions of the economic and fiscal outlooks. The platform provides analysis on potential positive economic impacts from additional capital investment that could boost growth over the medium to long-term.

- Overly optimistic implementation timetables may provide resources through lapsed funding.

2.4 The fiscal planning framework contains fiscal room to address challenges to Canadian sovereignty.

Liberal Party platform score: 3/4

- The platform includes various provisions to address Canada’s territorial and economic sovereignty.

- Fiscal space remains to address unforeseen measures (or resources would be reallocated to achieve them).

3.1 Platform provides economic and fiscal outlook for five years (2025-29) with details on key indicators, which incorporate the proposed policy measures.

Liberal Party platform score: 3.5/4

- The platform provides a fiscal outlook for four years. Analysis is provided on economic multipliers that could result from higher capital investments.

3.2 Platform provides sufficient detail on the proposed measures.

Liberal Party platform score: 4/4

- The proposed measures include priorities and objectives. There are several instances where timelines for implementation are included. However, timelines to achieve results in various instances, e.g., capacity building, will take years to materialize.

- Several large measures are established as funds (e.g., Nation-building Project Fund, Trade Diversification Corridors Fund), seemingly capping fiscal exposure rather than depending on estimates of demand.

3.3 Platform provides a clear implementation plan for key policy measures.

Liberal Party platform score: 3/4

- The platform privileges spending on target issues: sovereignty, economic, and social security.

- The implementation of key measures are mostly defined. Some considerations, e.g., the procurement of ice breaker ships, require closer analysis of implementation plans. The assumption that the ships would be operational within a year implies that the ships are ready for purchase.

- The platform does not discuss the dependence on state capacity to implement the measures.

- The platform includes one of the most significant program reviews, since the 1990’s, as a source of funds (e.g., $28 billion over 4 years). As a strategy for reallocation, it will further emphasize the shift in spending away from social programs towards economic, defence and security. However, should it be implemented as an administrative efficiency exercise, it will likely struggle to hit its fiscal target.

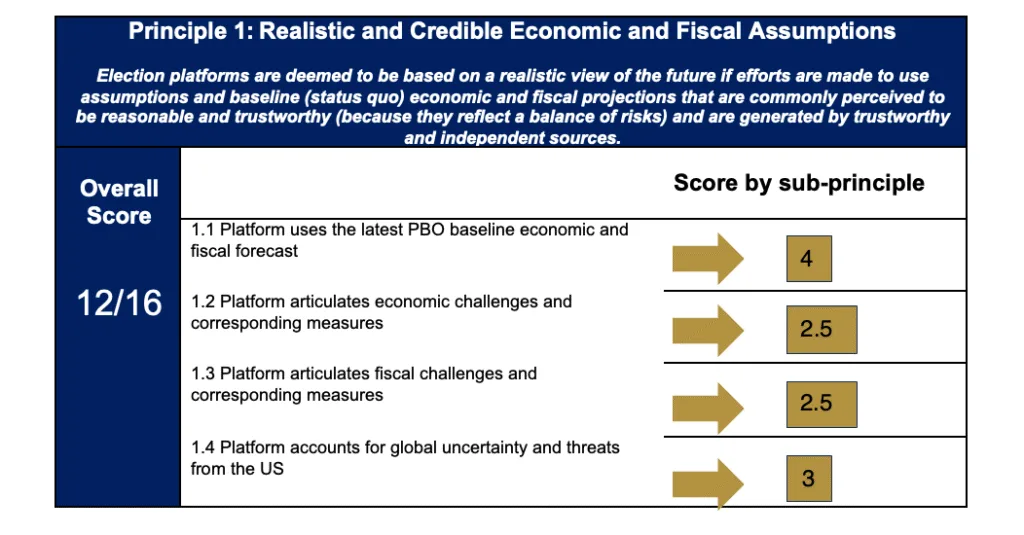

IFSD Fiscal Credibility Assessment Conservative Party of Canada Platform 2025

IFSD finds that the Conservative Party Platform 2025 merits an overall rating of PASS with ratings of Pass, Pass, Good across the three assessment principles (realistic economic and fiscal assumptions, responsible fiscal management, and transparency). The overall score is 33.5/44 across the three principles (76 percent grade).

The Conservative 2025 federal election platform – Change: for an affordable life; for safe streets; for Canada first – emphasizes a smaller government role to address challenges faced by Canadians with a focus on tax reduction, deregulation and limited spending. There are a number of priority policy areas including affordability, housing, public safety, government management, national security, well-being and identity.

There are about sixty costed initiatives including nine economic impact measures that are estimated to result in additional revenues for the federal government.

Over a four-year planning period there are $75 billion in tax reductions (including lower personal rate, capital gains, GST on homes, and seniors). Tariff revenue is assumed to be $20 billion in 2025-26 (one year) and improved tax compliance is assumed to result in about $13 billion over 4 years. The nine economic impact measures are assumed to generate about $60 billion over four years and comes largely from deregulation and greater housing investment.

Total planned spending is reduced by $23 billion over four years as new spending is more than offset by program cuts and efficiencies. There is $35 billion in higher spending with 80 percent targeted to national security and housing. Program cuts total $22 billion over four years with the majority coming from a reduction in foreign aid and spending on crown corporations like the CBC. Spending efficiencies total $34 billion with more than two thirds coming from the reduction in the use of (external) professional services.

The Conservative platform utilizes the PBO March 2025 Pre-Election outlook which does not incorporate the economic impact of the US tariffs and global fall-out.

Higher Canada import duties on US goods and services are assumed for one year, 2025-26. At this juncture, it is an optimistic planning baseline.

The projected budgetary deficit falls from $31 billion (1 percent of GDP) in 2025-26 to $14 billion (0.4 percent of GDP) in 2028-29. The Conservative planned deficit track is lower than the PBO pre-election outlook, notwithstanding proposed tax reductions ($75 billion) because of the incorporation of estimated budget savings from de-regulation and additional housing investment ($60 billion over four years), estimated efficiencies ($34 billion) and specified program reductions ($22 billion).

It is noted that the reduction of the budgetary deficit in a period of economic weakness caused by a trade war and high uncertainty is unusual and typically not advisable for advanced economies with strong credit ratings. Normally, the government balance (deficit) is allowed to rise to help stabilize the economy. Traditionally, positive estimated economic impacts from measures are not shown to impact the planning balance. The estimates used in the Conservative platform are considered excessive relative to Department of Finance rules of the thumb (1 percent increase in real GDP generates about $5 to 6 billion reduction in the deficit after one year). The economic impact estimates could be highlighted for use of prudence in a planning context. As with other platforms, there is considerable execution risk with proposed efficiencies measures resulting in slippage of fiscal savings.

The Conservative platform does not have an explicit fiscal target. They have fiscal rules with respect to deficit offsets on new spending measures (one for one) and a commitment not to raise taxes without referendum. The Conservative fiscal planning framework is consistent with a declining debt-GDP-ratio and overall fiscal sustainability.

The Conservative platform was released on April 22, 2025 – after the leaders debates; after the advanced voting period; and six days before election day.

1.1 Platform uses the latest PBO baseline economic and fiscal forecast.

Conservative Party platform score: 3/4

- The PBO Pre- Election (March 2025) baseline is used in the platform’s fiscal and cost analysis and fiscal planning framework for deficit and debt calculations.

- It does not include economic impacts of tariffs. Revenues from higher import duties on US goods are included.

- The platform also includes nearly $60 billion in additional revenue generated from the proposed measures, something that the other major federal parties did not include.

- The platform also includes nearly $13 billion in revenue from more aggressive enforcement of the use of tax havens.

- It is considered an optimistic planning scenario, at this juncture.

1.2 Platform articulates economic challenges and corresponding measures.

Conservative Party platform score: 3.5/4

- The platform focusses on the housing crisis, affordability issues, and burdensome regulations. The platform claims that reducing taxes and regulations and providing incentives for building new houses will unleash significant economic activity, which will address those economic challenges.

1.3 Platform articulates fiscal challenges and corresponding measures.

Conservative Party platform score: 3.5/4

- The platform underlines the rise in the budget deficit and debt over the last ten years.

- The platform focuses on reducing the size of government through tax reductions ($75 billion), program cuts and administrative savings.

- Additional focus areas are on housing, through the subsidizing lower development charges; defence spending to reach the NATO target by 2030 and border security.

- Achieving the fiscal objective of a deficit of $14 billion in 2029-29 fiscal year, with $35 billion in new spending measures over that period, is heavily dependent on generating nearly $60 billion in additional revenue through growth, $22 billion in spending cuts; $34 billion in administrative efficiencies.

- The fiscal plan is dependent on growth through the reduction of “red tape” and deregulation.

- The platform does not set a fiscal target except for a one-for-one rule for new spending.

1.4 Platform accounts for global uncertainty and threats from the US.

Conservative Party platform score: 2.5/4

- The platform briefly discusses the economic challenges resulting from the increases in tariffs by the U.S. government, but neither proposes new measures to meet those challenges nor accounts for the uncertainty created by the threats from the U.S. in its own estimates of revenues and spending.

- Other than the defence and border spending commitments, the measures in the platform do not specifically address the geopolitical and economic risks.

- The platform leverages tax cuts of $75 billion over four years, “red tape” reduction and targeted spending to address Canada’s economic issues

- The platform assumes economic and fiscal forecasts improve in the next fiscal year and does not include a risk provision.

- The platform cuts many of the significant climate-related programs of the federal government without proposed replacements to address climate change and economic transition.

2.1 Platform commitments are consistent with a defendable medium-term fiscal strategy and framework.

Conservative Party platform score: 2.5/4

- The platform’s commitments are aligned to an optimistic view of the medium-term fiscal framework. There are downside risks to both economic and fiscal forecasts.

- Budgetary deficits decline from 1 percent of GDP to 0.4 percent over the 4 year planning horizon. They are lower than projections from the PBO and for most other OECD countries. The strategy to reduce the budgetary deficit in a period of economic weakness and high uncertainty can increase economic stability risks.

- While most of the spending cuts can be accomplished, most of the revenue increases are based on a significant increase in economic activities, which may not materialize, especially in the current period of heightened economic uncertainty.

2.2 Platform’s commitments maintain long-term fiscal sustainability.

Conservative Party platform score: 3.5/4

- The platform shows a decrease in deficit and debt over the forecast period. The platform commitments are fiscally sustainable over the long-term (debt-to-GDP ratio is expected to decline in the long run); but,

- The risks associated with the current economic turmoil and the lack of measures to address the slowing economic performance, could undermine long-term fiscal sustainability.

2.3 The fiscal planning framework includes adequate provisions (prudence) for fiscal risks, economic risks, and unforeseen events.

Conservative Party platform score: 2.0/4

- There is no consideration of prudence and risk in the optimistic assumptions of the economic and fiscal outlooks.

- The fiscal planning framework for the Government of Canada does not typically book additional revenues for new measures and should not book efficiency savings before having been achieved, since past results have proven disappointing.

- However, given the relatively small size of the spending package, $35 billion, the risk to the revenue and expenditure forecast are largely mitigated, in this context.

2.4 The fiscal planning framework contains fiscal room to address challenges to Canadian sovereignty.

Conservative Party platform score: 3.5/4

- The platform includes two principal provisions, defence spending and border security, to address Canada’s territorial and economic sovereignty.

- There are few significant economic measures to address resilience of infrastructure and supply chain, other than planning to maintain the measures of the previous government.

- Significant fiscal space remains to address unforeseen measures (or resources would be reallocated to achieve them).

3.1 Platform provides economic and fiscal outlook for five years (2025-29) with details on key indicators, which incorporate the proposed policy measures.

Conservative Party platform score: 3/4

- The platform provides a fiscal outlook for four years. There is little analysis beyond the basic presentation of numbers (e.g., no presentation of analysis of positive economic impacts).

3.2 Platform provides sufficient detail on the proposed measures.

Conservative Party platform score: 3.5/4

- The proposed measures include priorities and objectives. There are several instances where timelines for implementation are included. Timelines to achieve results in, where there are revenue dependencies, in particular, appear to be short. This creates a risk to the integrity of the fiscal plan.

- Significant regulatory changes maybe outside of the scope of the federal government to achieve on its own. This puts both the policy plan and the fiscal plan at significant risk.

3.3 Platform provides a clear implementation plan for key policy measures.

Conservative Party platform score: 3/4

- The platform privileges tax cuts, spending cuts and administrative efficiencies to drive the fiscal plan.

- The implementation of key measures are somewhat defined. Considerations are lacking on the synchronization of implementation with revenue and savings assumptions.

- The platform does not discuss the impact of administrative reductions on service delivery for Canadians.

- The platform does not discuss what cuts might be undertaken should the aggressive revenue and expenditure assumptions not materialize.

IFSD Fiscal Credibility Assessment New Democratic Party (NDP) Platform 2025

IFSD finds that the NDP Platform 2025 merits an overall rating of PASS with ratings of PASS across the three assessment principles (realistic economic and fiscal assumptions, responsible fiscal management, and transparency). The overall score is 31/44 across the three principles (70 percent).

The NDP’s 2025 federal election platform – Made for People. Built for Canada – emphasizes social spending and tax redistributive measures to strengthen the economy and address a range of policy challenges across eight priority areas – health care, housing, affordability, taxes, stronger Canada, green economy, Indigenous reconciliation and democratic institutions.

There are about 35 costed initiatives. Over a four year period, revenues are increased from wealthy Canadians and corporations by about $170 billion (including wealth tax, capital gains corporate surtax, minimum tax, reduction of loopholes, tariff revenue). There are about $70 billion in tax reductions to middle and lower income people over four years through GST savings (essential goods, Canadian made cars) and an increase in the Basic Personal Amount. Program spending is increased by about $142 billion with large increases going to health care, housing and a strengthening of the employment insurance system. There are no spending restraint (or reallocation) measures. In sum, these represent significant policy and financially material changes to spending and revenues. Significant changes do carry higher execution risk in both policy and financial terms. In static terms, the budgetary deficit is increased by about $48 billion over 4 years including higher interest charges and a modest (10 percent) contingency reserve tied to the higher deficit (not GDP).

The NDP platform does not use the PBO March 2025 Pre Election baseline which is a pre tariff outlook. It presents the fiscal outlook using the Bank of Canada (April) scenarios 1 (tariffs remain through 2026) and 2 (trade war escalates). In scenario 1, the real GDP assumption approximates the growth profile in the PBO baseline whereas in scenario 2 growth is modest in 2025 (0.8 percent versus 1.6 percent) and the economy shrinks by 0.2 percent in 2026. In scenario 1, the budgetary deficit is estimated to be

$47 billion (1.5 percent of GDP) and falls to $30 billion (0.8 percent of GDP) in 2028-29. In scenario 2, the budgetary deficit is higher and the profile more flat for the next four years. The NDP platform does show a declining debt-to-GDP ratio over the medium term in scenario 1 (not scenario 2).

The NDP Policy Platform was released on April 19, 2025 – after the leaders debates; during the advanced voting period; and eight days before election day.

1.1 Platform uses the latest PBO baseline economic and fiscal forecast.

NDP platform score: 4/4

- The PBO Pre-Election (March 2025) baseline is used in the platform’s cost analysis.

- For the fiscal planning framework (presentation of budgetary balances and accumulated deficit) over the next four years, the NDP platform uses the Bank of Canada (April 2025) outlooks (both scenarios 1 and 2) which addresses the impact of tariffs.

1.2 Platform articulates economic challenges and corresponding measures.

NDP platform score: 2.5/4

- Economic challenges are defined largely through experiences of individuals and households. They include US tariff impacts on the economy, but also ongoing challenges related to health care, housing and affordability.

- Significant strengthening of employment insurance (a key automatic stabilizer) is proposed, and funded in part from higher import duties.

- Capital investment measures, e.g., major national infrastructure, security and defence, that could incent economic development (based on priority areas) are largely absent.

- While support for individuals is necessary to navigate economic challenges, they are alone insufficient to meet the complex threats to Canada’s economic and territorial sovereignty.

1.3 Platform articulates fiscal challenges and corresponding measures.

NDP platform score: 2.5/4

- The platform assumes that fiscal challenges will be managed with increased taxation of wealthy Canadians and corporations. These efficiencies are not guaranteed, e.g., wealthier Canadians will have advice to work around a tax system. The negative economic impact of such a large increase in taxes is not taken into account.

- Fiscal space is attributed to social measures targeting individuals and households with less concern for productivity challenges important to potential output growth and fiscal sustainability. No efforts are highlighted to improve efficiency in the public service or reallocate resources from underperforming programs.

- The large tax redistribution from wealthier households and corporations to middle and lower income Canadians will reduce income and wealth inequality which slows productivity growth. The higher taxes are used to fund new priorities which limits debt growth.

1.4 Platform accounts for global uncertainty and threats from the US.

NDP platform score: 3/4

- The platform considers economic risks beyond the PBO, with provision for a gloomier economic outlook. With assumptions that trade and other economic impacts will persist beyond a year, the NDP’s platform proposes a small contingency fund to respond to unforeseen events.

- Full marks, however, cannot be attributed because of the emphasis on individual and household measures at the expense of economy impacting ones. The contingency reserve ties to measures and not GDP (economic outlook).

2.1 Platform commitments are consistent with a defendable medium-term fiscal strategy and framework.

NDP platform Score: 2.5/4

- The platform’s commitments are costly and rely on efficiency measures from increased personal and corporate taxation, including eliminating corporate subsidies in certain sectors.

- Additional fiscal space is being sought through the reduction of consultants ($8 billion), the closing of tax loopholes (nearly $25 billion); neither of which is articulated in the platform.

- Affordability and worker protection are the focus of the measures. There are limited measures that directly aim at protecting Canada’s economic and political sovereignty.

- The platform results in a modest deficit over the medium term and a declining debt-to-GDP ratio (under scenario 1, Bank of Canada). This would preserve fiscal room for future economic shocks.

2.2 Platform’s commitments maintain long-term fiscal sustainability.

NDP platform Score: 3/4

- While generally fiscally sustainable, the measures present an overall growth in the size of the state. Large tax increases are proposed which could result in economic instability and lower investment. Given global economic turmoil, long-term fiscal sustainability could be at risk.

2.3 The fiscal planning framework includes adequate provisions (prudence) for fiscal risks, economic risks, and unforeseen events.

NDP platform Score: 3/4

- The NDP platform has a small contingency reserve for unforeseen economic and fiscal risks tied to the increase in the deficit. It is likely inadequate.

- The fiscal planning framework makes use of the Bank of Canada scenarios which include tariff impacts on the Canadian economy.

- Large tax increases are proposed to fund priority spending which limit increases in budgetary deficits and debt.

2.4 The fiscal planning framework contains fiscal room to address challenges to Canadian sovereignty.

NDP platform Score: 2/4

- The platform’s measures respond to challenges from trade and sovereignty at the individual and household level.

- There is limited consideration of the macro level economic actions to incent sustainability and resilience.

3.1 Platform provides economic and fiscal outlook for five years (2025-29) with details on key indicators, which incorporate the proposed policy measures.

NDP platform score: 4/4

- The platform presents proposed measures across four fiscal years.

- The planning outlook accounts for gloomier forecasts and includes policy measures.

3.2 Platform provides sufficient detail on the proposed measures.

NDP platform score: 2.5/4

- The measures are defined and substantiated relative to the NDP’s eight priorities.

- The details on implementation of the measures is limited relative to the complexity of interjurisdictional arrangements required to execute them.

- Several major sources of funds, including the closing of tax loopholes, are not fully articulated in the plan.

3.3 Platform provides a clear implementation plan for key policy measures.

NDP platform score: 2/4

- The platform is focused on policy matters often outside of the jurisdiction of the federal government. Most measures require provincial participation and agreement for execution, e.g., tenant protections, health care changes, etc.

- The political, time, and resource commitments required to execute many of the measures are missing.

Focused on public finance and its intersection with politics and institutions, the Institute of Fiscal Studies and Democracy (IFSD) provides evidence-based support for decision-making, budgeting, planning, due diligence, and institution-building.