Identity Crisis, What Identity Crisis? The New Battle of Bretton Woods

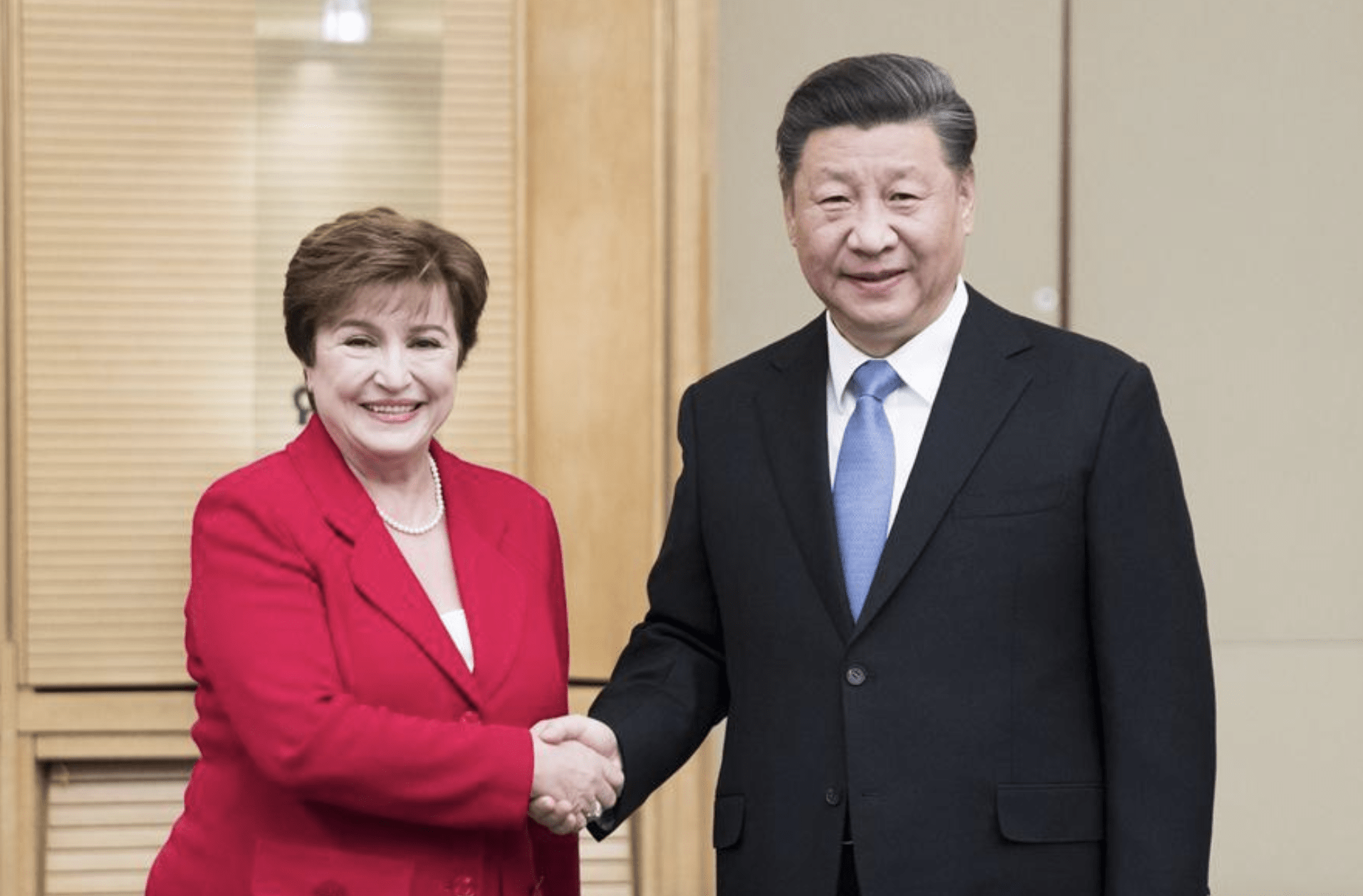

Happier times: IMF Managing Director Kristalina Georgieva and President Xi Jinping in 2019/Xinhua

Happier times: IMF Managing Director Kristalina Georgieva and President Xi Jinping in 2019/Xinhua

Lisa Van Dusen

April 8, 2023

“The Bretton Woods saga unfurled at a unique crossroads in modern history. An ascendant anticolonial superpower, the United States, used its economic leverage over an insolvent allied imperial power, Great Britain, to set the terms by which the latter would cede its dwindling dominion over the rules and norms of foreign trade and finance.”

Benn Steil, The Battle of Bretton Woods: John Maynard Keynes, Harry Dexter White and the Making of a New World Order

(Princeton University Press/2013)

It can be useful to remember, in this age of narrative warfare, that — per the Hollywood cliché — there are only so many stories. While the number varies from Tolstoy’s assertion that all great literature is one of two stories, “a man goes on a journey or a stranger comes to town,” to the Jungian tasting menu of Christopher Booker’s The Seven Basic Plots to Joseph Campbell’s The Hero with a Thousand Faces, boy-meets-girl was never the only game in town.

Our current geopolitical tension has been characterized by Harvard’s Graham Allison in Destined for War: Can America and China Escape Thucydides’s Trap? as the latest iteration of an emerging power threatening to displace an existing great power, the Thucydidean trap being the likelihood of war in such confrontations. Since China’s 21st-century rise has been achieved through the largely non-military means of cyberespionage, old-school espionage, cross-border collaboration and economic coercion, Beijing’s role in the aspiring-world-order kinetic adventure of Russia’s illegal invasion of Ukraine may be the first real test of Allison’s thesis.

The new Battle of Bretton Woods will be gracing your timeline April 10-16 during the International Monetary Fund-World Bank spring meetings in Washington. This time, per the limited number of plot twists in international affairs as in all melodrama, an aspiring colonial superpower (by today’s standards of economic expansionism and borderless covert warfare), China, is using its economic leverage over an existing superpower, the United States, to set the terms by which the latter will cede its dominion over the rules and norms of foreign trade and finance. Of course, the difference in the stakes this time for both the global balance of power and the future of humanity is that the existing superpower is a democracy and the challenging power is an authoritarian surveillance state — a fairly important sequel distinction as to both collaborationist alliances and the fate of human freedom.

This system, often referred to as ‘debt-trapping’, has recently come under closer scrutiny as its infrastructure premise has collapsed under the weight of post-pandemic debt amid the preponderance of so many IOU chickens coming home to roost everywhere all at once, including Sri Lanka and Zambia.

This battle has played out since the turn of the millennium through Beijing’s use of its membership in the multilateral institutions of the existing world order — from the United Nations and its agencies, including the World Trade Organization, to Interpol to the IMF/World Bank — to undermine those institutions. In the case of the IMF, that has included systematically establishing a parallel lending regime whereby developing nations — many of them fragile democracies whose tilt into the non-democracy column has coincided with a surge in FDI from China — are rendered financially beholden to Beijing as a means of leveraging a range of governance, multilateral, propaganda and other behaviour modification. This system — facilitated through China’s Belt and Road infrastructure investments and often referred to as “debt-trapping” — has recently come under closer scrutiny as its infrastructure premise has collapsed under the weight of post-pandemic debt amid the preponderance of so many IOU chickens coming home to roost everywhere all at once, from Sri Lanka to Zambia. US Treasury Secretary Janet Yellen was criticized by Beijing as “irresponsible” recently after she said Beijing’s lending activities had left developing countries “trapped in debt.”

“Between 2008 and 2021, China spent $240 billion bailing out 22 countries that are ‘almost exclusively’ debtors in Xi Jinping’s signature Belt and Road infrastructure project,” per CNN’s coverage of a study published last month by researchers from the World Bank, Harvard Kennedy School, Kiel Institute for the World Economy and the US-based research lab AidData.

“China has been very slow to recognize that multilateral debt restructuring requires China to play by the rules that are already established,” IMF Managing Director Kristalina Georgieva said in an April 6th Bloomberg interview. “Now is the time for China to demonstrate that they are capable of playing by these rules.” While Georgieva’s attribution of Beijing’s rogue-state, rule-flouting to ignorance rather than less benign factors was diplomatic, the French newsweekly Le Point wasn’t as delicate in its recent cover thematic, Chine: l’empire des mensonges. (Forget that if the anti-democracy empire of lies were contained within China’s borders, or even just the Eastern hemisphere, Donald Trump’s presidency, quite a few other political and legal trajectories, and vast terabits of the content sphere would look considerably different).

Meanwhile, at The Economist, the evolution of the IMF as a target of the same disruption, manufactured intractability, subterfuge and corruption tactics that have beleaguered other high-value targets in the war on democracy from the WTO to the Biden presidency to journalism is being portrayed ahead of the spring meetings as something more organic and existential.

The IMF faces a nightmarish identity crisis, per the April 4th online headline or, if you prefer, the more Hollywood-esque print headline, Nightmare on 19th Street, referring to the IMF-WB HQ in Washington. “The fund is caught between America and China, and its purpose is unclear,” per the subhead, which portrays a binary conundrum whose non-binary nature is revealed in the story itself. “Three factors explain the IMF’s enfeeblement,” per the piece. “First, the intransigence of Chinese creditors that have lent to poor countries,” which is really about China, see above, “debt trap”. “Second, the parlous state of middle-income countries in perennial distress, for which loans are as much about geopolitics as economics,” also really about China, see above, “debt trap”. “Third, the IMF’s inability to execute a plan, pushed by its leadership, to use resources for purposes that are less diplomatically controversial, such as big-ticket climate loans and health policies,” also mostly about China, see above, “manufactured intractability”. In other words, in a narrative warfare environment in which orchestrated, status-quo-degrading and democracy discrediting chaos operas, crises, wars, institutional self-sabotage operations and reputational cannonballings are frequently framed as self-inflicted or misrepresented as inevitable, the principal source of the IMF’s problems is neither organic nor mysterious, though the slasher-film reference may not be entirely misplaced.

Xi Jinping’s attempt to consolidate power by recalibrating global economic leverage isn’t just about China and it’s not an isolated manifestation of leverage recalibration as a feature of the clash of world orders. If it were, Benjamin Netanyahu would not be flouting all the longstanding tenets of Israel’s relationship with America to hasten his country’s slide out of democracy and into a Nightmare on Kaplan Street. That’s not an Israeli identity crisis, it’s just a classic Jungian shapeshifter responding to a whole new set of incentives.

Policy Magazine Associate Editor and Deputy Publisher Lisa Van Dusen was a senior writer at Maclean’s, Washington columnist for the Ottawa Citizen and Sun Media, international writer for Peter Jennings at ABC News and an editor at AP National in New York and UPI in Washington.