How Do You Like Them Apples?

By Douglas Porter

May 03, 2024

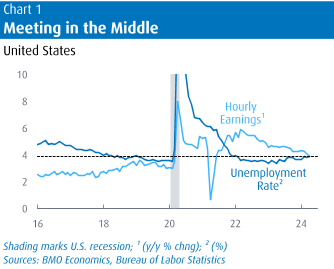

The 2024 tide of higher rates may have just turned. Financial markets enjoyed a rebound week, supported by a non-hawkish Fed Chair, a rare downside surprise in U.S. jobs, calmer oil prices, and an upbeat earnings outlook from heavyweight Apple. The FOMC meeting wasn’t a massive market-mover, although Powell’s reassurance that rate hikes were unlikely and a slightly larger-than-expected dampening of QT (to a $25 billion/month cap on Treasuries) were mildly helpful. But the April employment report really pushed on an opening door of lower yields, with payrolls rising just 175,000, the jobless rate ticking up to 3.9%, and average hourly earnings cooling to the slowest pace in nearly three years at 3.9% y/y. The latter two are both now a bit above their low-3% pre-pandemic level. This is what a Fed lab-created soft-landing jobs report would look like.

The FOMC and jobs hogged the headlines, but it was a data-heavy week, with plenty of conflicting signals. For those who still fret about sticky inflation, there was a Q1 bounce in the important employment cost index (up 1.2% q/q, holding the yearly pace at 4.2%), strong February home prices, and an unnerving rise in the prices component of both ISM reports in April. Yet, on the flip side, there were arguably even more indicators that suggested the economy may finally be chilling after a strong run. Besides the high-profile jobs report, job openings and quits dropped in March, consumer confidence melted last month, and the overall ISMs both fell below the key 50 mark. Note that in the 27-year history of the services ISM, the economy has almost always been in recession when below April’s 49.4 reading.

The net result of the wave of new info was to cut the 10-year yield from its recent high of above 4.7% back down to around 4.5%. That’s still well up from the sub-4% terrain at the start of the year, when thoughts of multiple Fed rate cuts were rife. In a similar vein, the U.S. dollar dipped roughly 1% this week, only partly reversing the 5% run-up in the first four months of the year. Equities took most of their cues from earnings, but milder yields supported a small rebound after April’s 4.2% drop in the S&P 500 (its first setback in six months).

The key takeaway from the onslaught of new information this week was that Fed rate cuts are back on the table for this year, even if they’re not imminent. We pushed back our call on the first move to September last week, fully recognizing the political awkwardness of the Fed cutting in the last FOMC before the November election. But that is now precisely where market pricing is also currently landing, and Chair Powell made another strong statement this week that the Fed will be guided by the economy and not politics in its coming rate decisions. We have pencilled in a second cut in December, and that, too, now roughly aligns with market pricing (by circumstance, not design).

The conventional wisdom is that the Fed will be mostly guided by the inflation data (true), and that they can only begin to cut when the trend in core cracks. But, given that Powell sees policy rates as plainly restrictive, and the job market appears to be softening somewhat, some sustained weakness in growth could alone prompt them to begin loosening—provided inflation stops deteriorating. The combination of even so-so inflation results and chillier growth could do the job. Given an unusual paucity of significant U.S. economic reports on deck for next week, we’ll need to wait until mid-May for the next instalment in the rate cut saga. It’s unlikely to deliver a clear-cut answer just yet, keeping the Fed in place for another quarter.

After likening the Canadian economy to the Maple Leafs two weeks back (too harsh?), the former has sagged while the latter have risen to the occasion. Following a surprisingly hearty start to 2024, Canadian growth has reverted to form, with GDP in the first two months of the year revised lower and March coming in flat. While the preliminary estimate for Q1 growth was thus pegged at 2.5% annualized (a touch below the BoC’s 2.8% forecast), the subsequent weak March trade results suggest a slightly softer read—we have trimmed our estimate two ticks to 2.3%. The soft hand-off to Q2 points to a notably cooler 1% pace for the current quarter, and we continue to expect growth for the full year of 1.2%, or roughly half the U.S. growth rate.

The dash of reality for Canadian GDP, alongside the milder U.S. job growth, helped reignite prospects for near-term Bank of Canada rate cuts. While Governor Macklem was extraordinarily careful not to tip his timing hand at this week’s dual testimonies, he did allow that rate cuts were getting closer and that the Bank could indeed deviate from the Fed—within limits. Said limits remain a mystery, but we’ll stick with our view that the Bank can likely cut twice independent of the Fed, without causing undue strain on the currency.

The coming meeting on June 5 is again seen as a very real possibility for the first cut, especially with the Fed potentially back in play in the summer. We have been calling for the BoC’s rate-cutting cycle to begin in June since late last year, and we are doggedly sticking to that call. While we never want to hang a rate decision on a single indicator, the April CPI (on May 21) looms very large. Macklem has already signalled that the Bank expects inflation to stick close to the current 2.9% pace for a few months, due to a pop in gasoline prices (and we readily concur), but all eyes will be on whether core measures stay cool.

The Bank will also see April jobs (next Friday) and the official Q1 GDP results (May 31) before deciding on rates. But perhaps the second most important indicator tipping the Bank’s decision will be the U.S. CPI (May 15). Even if the BoC can go it alone, it sure would help if it appeared that U.S. cuts would soon follow. So, like Leaf fans, we now look to the south for the next big result, and hope for the best.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.