Following the Money in the 2025 Party Platforms

By Mostafa Askari, Sahir Khan and Kevin Page

April 24, 2025

The three major political parties released their costed policy platforms in the closing days of the 2025 federal election campaign. They are important documents for voters, media and public servants. What do the platform numbers say about party governing choices, strategies to deliver on priorities and the risks (upside and downside) on implementation of their agendas in a fiscally responsible manner?

In the platforms, Canadian voters get to see the list of commitments, expected costs and fiscal plans. As the late American businessman P.T. Barnum once said, “Money is a terrible master, but an excellent servant.” The party platform fiscal plan gives us information on how public finances will be used for the common good: be it strengthening Canadian sovereignty, promoting economic stability, sustainability, reducing inequality, improving public services, or other priorities.

For the past three elections, the Institute of Fiscal Studies and Democracy (IFSD) at the University of Ottawa has published fiscal credibility assessments. This work coincided with (and complemented) an expanded mandate given to the Parliamentary Budget Office (PBO) with respect to providing an economic and fiscal planning baseline and proposal costing support to political parties.

IFSD fiscal credibility assessments are designed to test the coherence among policy proposals, fiscal plans and assumptions. For the 2025 federal election campaign, all political parties scored a pass or better.

Our recommendations, based on this year’s work, for future elections:

All political parties, however, can do better with respect to timing and quality of information provided to citizens. The costed platforms were published too late (Liberals and NDP on April 19; Conservatives on April 22). They were published after the debates and after millions of people had started voting in advanced polls.

In the next federal election, all political parties should commit to publishing costed platforms prior to the official debates and before advance polling.

All political parties can do better with respect to the presentation of financial information. Notwithstanding the release of a detailed PBO pre-election outlook in March, all political parties made it difficult for voters to compare and contrast important financial indicators. There is missing information on critical fiscal indicators and no roll-up of levels of spending, revenues, and debt charges.

In the next federal election, all political parties should commit to publishing a basic statement of transactions that has existed in every federal budget in modern times.

What this election’s platforms say:

With respect to the 2025 federal election, what do the platform numbers say about fiscal balances and revenue and spending commitments? A caveat emptor – back-of-the-envelope arithmetic and a pocket calculator were required to make comparisons.

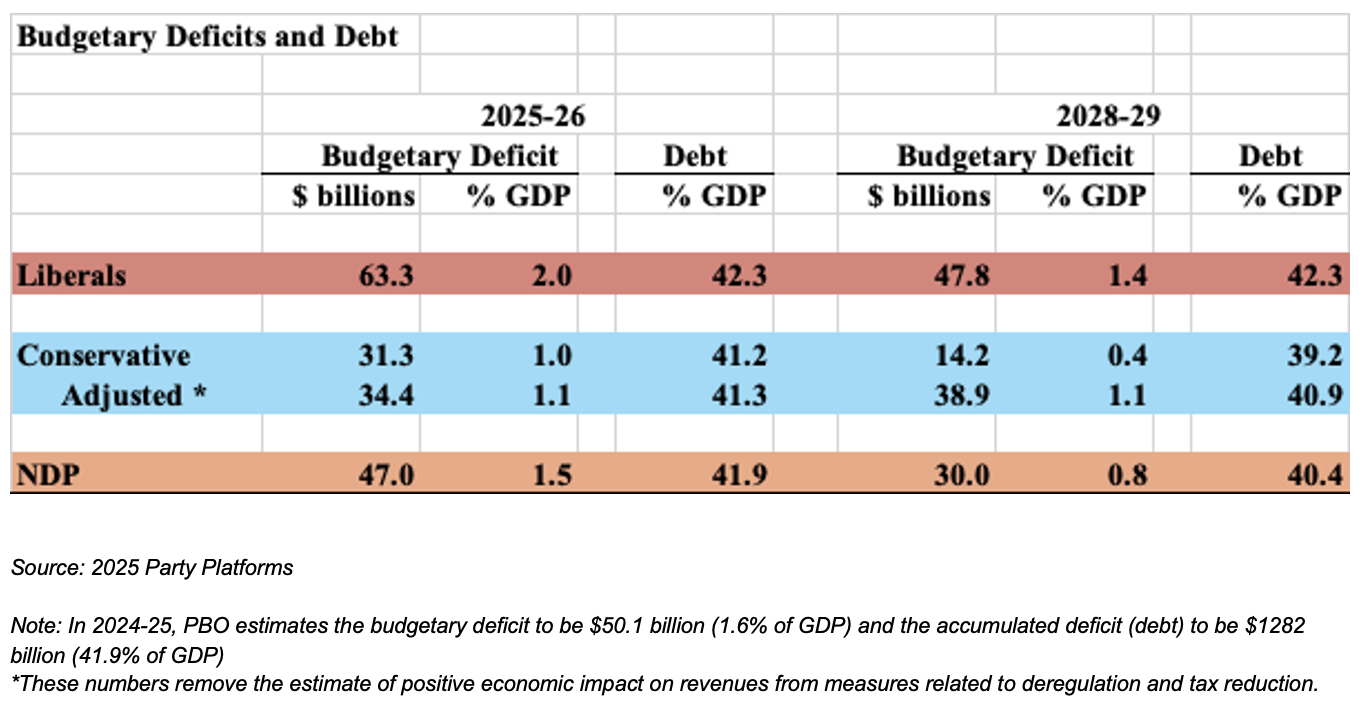

Table 1

The three political parties have modestly different planning tracks for deficits and debt (perhaps, surprisingly so). The Liberal and Conservative fiscal outlook are based on the PBO pre-election (March) assumptions that are generally considered optimistic in the evolving macro environment. The NDP present their fiscal planning framework using the more up to-date Bank of Canada April outlook (a bravo to the NDP). The table above presents the NDP platform using the Bank of Canada scenario 1 (i.e., it is more similar to PBO March baseline).

The three political parties have modestly different planning tracks for deficits and debt (perhaps, surprisingly so). The Liberal and Conservative fiscal outlook are based on the PBO pre-election (March) assumptions that are generally considered optimistic in the evolving macro environment. The NDP present their fiscal planning framework using the more up to-date Bank of Canada April outlook (a bravo to the NDP). The table above presents the NDP platform using the Bank of Canada scenario 1 (i.e., it is more similar to PBO March baseline).

Both the Liberals and NDP have platforms that allow the deficit to rise in 2025-26 to support economic stability in the face of US economic aggression on trade and decline modestly over the four-year political planning cycle. The Conservatives have the deficit declining in 2025-26, putting a policy emphasis on fiscal control over economic stability, and remain flat over the next four years in nominal terms.

For the record, there are no fiscal targets and plans to balance the budget.

The Liberals commit to a balanced ‘operating’ budget in 2028-29. They would allow deficit financing for capital investment (i.e., the golden rule in public finance). The Conservative and NDP fiscal tracks are consistent with a declining debt-to-GDP ratio (the Liberal Plan would hold the ratio flat over the next four years).

The Conservatives have a political commitment to offset new spending with measures to keep the deficit neutral. One presumes this commitment would be altered in an economic recession period where fiscal supports could be required to stabilize the economy. They also have a commitment to hold a referendum before taxes are increased. Political gimmickry or useful fiscal commitments? Voters must decide.

No political parties have built adequate reserves around their deficit projections or targets. The NDP have allotted a small contingency reserve built around the size of new measures and not volatility in the size of the economy. The Liberals highlighted potential growth from additional capital investment (the so-called multiplier effect) but did not imbed it directly into their fiscal planning outlook.

The Conservatives were widely criticized for incorporating estimated revenue gains from proposed measures directly into their fiscal outlook. This is not a standard budget practice in advanced economies. It is fine to illustrate potential gains but not count on them in a planning context (i.e., management of debt). The estimates were also exaggerated. Assuming $60 billion in additional revenues over four years from deregulation and tax reduction would be equivalent of adding 3 percentage points in additional GDP growth over a four-year period. It is not that easy to grow the economy (nor probable). On a more positive note, these estimates were hiding in plain sight. As the US Supreme Court Justice Louis Brandeis once said: “Sunlight is the best of disinfectants”.

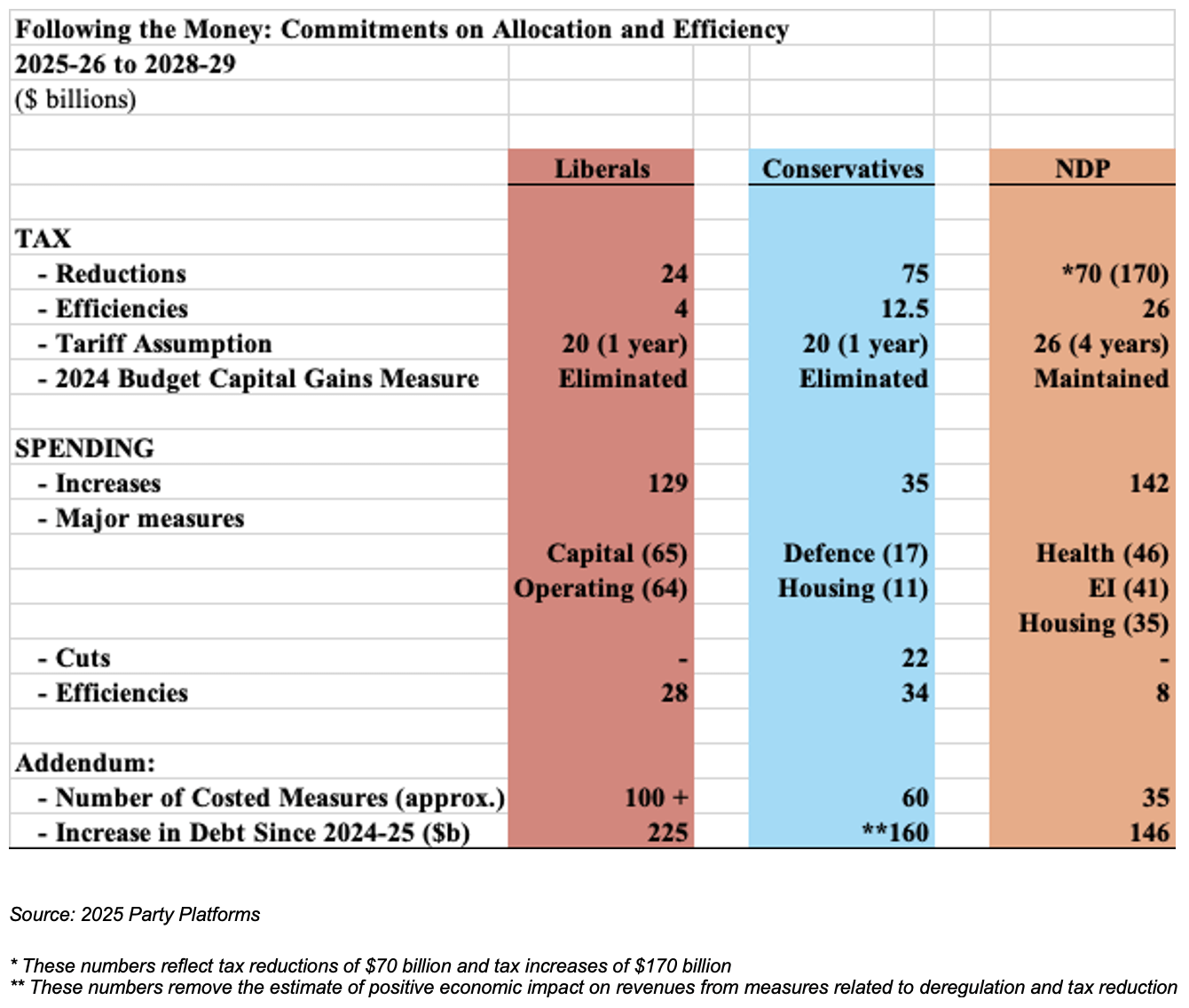

All of the political parties are expecting savings from efficiencies; notoriously difficult to harvest on an ongoing basis in government. The NDP are hoping for $8 billion in savings, the Liberals at $24 billion and the Conservatives at $34 billion (on top of $22 billion in program cuts). Voters will want to know what the parties would do once confronted with the difficulty of harvesting such efficiencies. Also, none of the parties have discussed the challenges of state capacity and how their respective agendas might be affected by them.

Bottom line, on deficits and debt, there are only modest differences in the proposed planning frameworks – less than 1 percentage point of GDP on the annual planned deficit over the four-year period: less than 2 percentage points on the planned debt-to-GDP ratio in 2028-29. All platforms would have their fiscal credibility enhanced with explicit reserves around fiscal targets and rules. All medium-term fiscal outlooks are likely optimistic given the high levels of economic uncertainty and prospects for a global slowdown. The IMF released their spring economic outlook this week and revised down global real economic growth by half a percentage point to 2.8 percent in 2025. We have significant downward economic risk. Expect, as always, fiscal policies and numbers to evolve with the changing context.

In platforms, fiscal balances are like the tips of icebergs. They are markers. Balances that do notreflect sustainability should be avoided. All three political parties have fiscal balances and structures that are consistent with fiscal sustainability (i.e. debt will not rise faster than the growth of the economy). We want fiscal sovereignty.

For political parties and citizens, what is also important is what lies beneath – the tax and spending commitments. Table 2 follows the money.

Table 2

The political choices and fiscal numbers are different, clear and big. The Liberal and NDP will grow the government relative to the economy, the Conservatives will shrink it. Voters must decide how they want their government to navigate the country in the difficult times ahead.

Liberals want the public sector to help drive capital investment (residential, non-residential, machinery and equipment, defence) with the plan to drive growth and economic resilience in the face of threats to Canadian sovereignty. The size of the planned capital investments is significant, relative to the economy and federal budget. With money available, the challenge will be for the public and private sectors to work together to execute.

The NDP want the public sector to support workers in the face of enormous economic challenges, improve health care and address housing challenges while at the same time addressing growing income and wealth inequalities with tax reform. History will give them credit for helping to reform the social safety net over the past 10 years. The fiscal numbers (tax and spend) are large. The tax measures — including the introduction of a wealth tax and higher corporate taxes — would be large structural changes. While needed to fund priorities on health care and reduce disparities, they would also carry instability risks that would need to be managed.

The Conservatives want to reduce the size of the public sector through net-spending reduction and drive economic growth in the private sector through tax reduction and deregulation. The shifts in spending and revenues would not be radically different from the current baseline but would represent a fundamental shift from the past 10 years and a marked contrast with both the Liberal and NDP platforms. The challenge for the Conservatives is that they do not have strong commitments for addressing the economic aggression from the US. The Liberals and NDP have plans for the use of tariff revenues to help specific workers and sectors. At this stage, the Conservatives are willing to use tariff revenue to help fund a reduction in the deficit in 2025-26.

William Shakespeare said, “There is nothing either good or bad, but thinking makes it so”. Canadians are fortunate to have strong political leaders, political parties and democratic institutions. The platforms help us understand our choices. Please vote.

Mostafa Askari, Sahir Khan and Kevin Page work at the Institute of Fiscal Studies and Democracy, at the University of Ottawa.