Five Takeaways from the 2024 Fall Economic Statement

Kevin Page with Showtell Browne

December 17, 2024

Government House Leader Karina Gould tabled the 2024 Fall Economic Statement (FES) in Parliament on December 16, 2024.

Here are five takeaways:

1. The Cost of Political Turmoil

History was made when (former) Deputy Prime Minister and Finance Minister Chrystia Freeland announced she would no longer serve in the federal cabinet on the day of the release of the mid-year economic and fiscal update. There is no principle of double jeopardy in politics. December 16 was a bad day for Prime Minister Justin Trudeau, for Freeland, the government and confidence in Canada’s public finances. Guilty as charged; one and all.

The immediate and downstream costs of this level of political turmoil are yet to be determined. What does this mean for the confidence of the Prime Minister and the government? Will the government survive a confidence vote early in the new year? Correspondingly, will any, some, or all of policy measures requiring new legislative authority be approved by Parliament in 2025?

The 2024 FES indicates “The economic outlook is clouded by a number of key uncertainties, which could impact the trajectory of inflation, interest rates and economic growth.” Why add unnecessary political uncertainty? Why are we at our worst when we need to be at our best?

The 2024 FES indicates “Canada’s cost of borrowing is lower than both the US and UK – a reflection of our prudent fiscal stewardship”. If Canada faced rates similar to the UK and US it notes that public debt charges would be $16.5 and $15 billion higher, respectively. Prudent fiscal stewardship includes strong budgetary practices and stable political processes. There is a cost to political turmoil.

2. Better Late than Never, But Sooner is Better

The government did right by tabling the 2024 FES, notwithstanding the political turmoil and delays. Parliament, the bond markets and Canadians needed the mid-year update. It had been nine months since Budget 2024. They needed to hear from the government on the state the economy, the fiscal outlook, policy priorities, and strategy and proposed measures.

The 2024 FES is a transparent fiscal document. It has medium-term economic and fiscal projections with comparisons with Budget 2024 assumptions. It has a base case and two alternative economic scenarios. It has financial estimates for some 60 line-item changes in the policy chapters plus a similar number of adjustments between Budget 2024 and the FES. It has a statement of financial transactions. There is information on the debt-management strategy and measures requiring tax and non-tax legislative change. It is a substantive document (270 pages with additional backgrounders).

Further delay to tabling the 2024 FES would have been a mistake. More uncertainty. Less debate. Less accountability.

Note, the 2024 Public Accounts were tabled in Parliament on December 17, 2024. This is nine months after the end of the fiscal year. Too long. There should be a government commitment to release audited financial statements for the previous fiscal year in September.

3. A Policy Shift?

The 2024 FES had 3 priorities (policy chapters) – affordability; productivity (investing to raise wages); and governance. If one follows the money, the policy focus has shifted to growth with a focus on tax reduction and less regulation. Does this mean Finance public servants are winning debates in the backrooms with political leaders?

The 2024 FES includes $24 billion in new measures over six years. It is a modest amount of ‘new’ money in a $3 trillion economy. There is $17 billion to extend the Accelerated Investment Incentive (tax); $1 billion to strengthen the Scientific Research and Experimental Development (tax) incentive; $1.6 billion for the temporary GST break (tax); and $1.3 billion to secure the border (spending).

4. Best Efforts at Realistic Planning Assumptions

The 2024 FES makes use of a September survey of private-sector forecasts. While the survey is out of date, the economic forecast numbers come across as prudent. Real GDP is assumed to grow 1.3 percent in 2024 and 1.7 percent in 2025. The 2025 assumption is weaker than numbers assumed by other institutions. Given the clouds of uncertainty surrounding US trade policy, a weaker planning assumption is prudent. There is no effort to present disaster scenarios of high US tariffs. There is a general consensus that the planning outlook will change when US trade policy is clearer.

5. Fiscal Guardrails Off-Duty

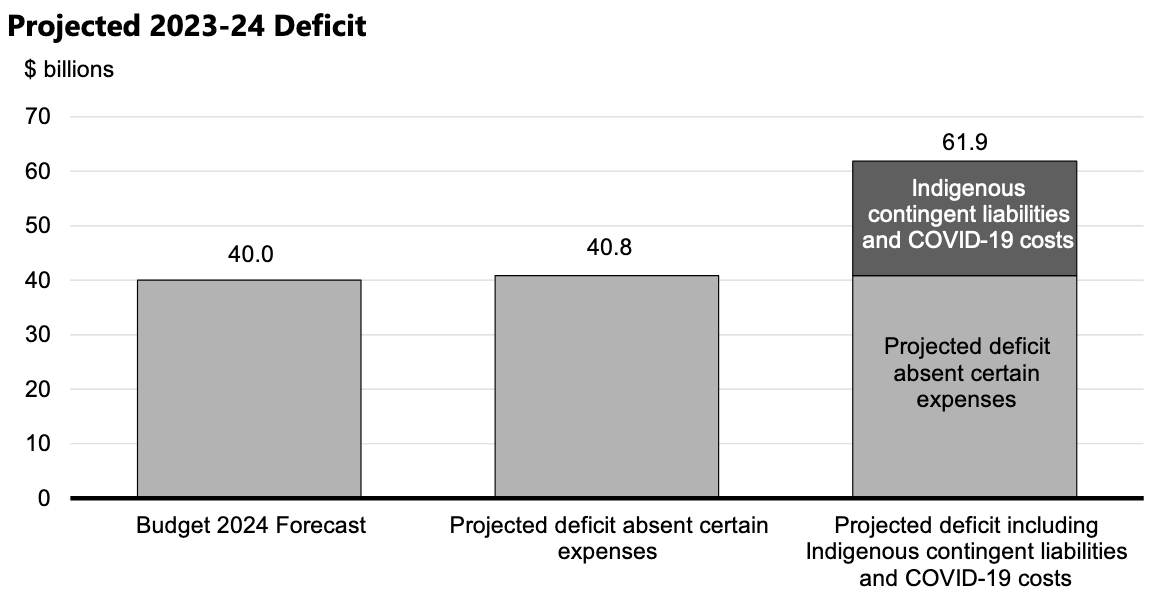

The fiscal bombshell in the 2024 FES was a $61.9 billion deficit (2.1 percent of GDP) in 2023-24, up from $35.3 billion (1.2 percent) in 2022-23. The government planning estimate and fiscal target was $40 billion. It was an enormous miss. The miss reflects the addition of $16.4 billion related to Indigenous contingent liabilities and $4.7 billion in liabilities (write-offs) related to COVID-19 pandemic fiscal supports. Clearly, the government was not expecting the need to ‘book’ these liabilities. The Auditor General had a different opinion. It is a hit to the government’s fiscal planning credibility. A broken fiscal target or guardrail.

The new estimate for the budgetary deficit in 2024-25 is a $48.3 billion deficit (1.6 percent of GDP). It is up from a $39.8 billion deficit in Budget 2024. This means that the inclusion of a proposed $250 cheque to many Canadians (not happening) in early 2025 would have meant a deficit higher than $50 billion this year, and reportedly one reason the “Working Canadians Rebate” was such a major source of contention between the former Finance Minister and the Prime Minister.

Showtell Browne is a fourth-year economics student at the University of Ottawa.

Kevin Page is the President of the Institute of Fiscal Studies and Democracy at the University of Ottawa, former Parliamentary Budget Officer and a contributing writer for Policy Magazine.