Fiscal Policy in a Time of Radical Uncertainty

In a turbulent world shocked by pandemic and war, policymakers struggle to design a build back better agenda. Kevin Page, Sahib Dhaliwal and Meagan Frendo of the Institute of Fiscal Studies and Democracy look at how monetary and fiscal policy could provide a more stabilizing macro environment. With high planning and policy uncertainty, they make the case for a budget that emphasizes vision, objectives and collaborative processes.

Kevin Page with Sahib Dhaliwal and Meagan Frendo

We are living in turbulent times. The federal government is planning its first budget since the 2021 election. We need a budget strategy with vision. We need objectives that will shape expectations. Processes that will facilitate collaboration and guide policy direction. Policies that are measured and responsible. We need to build hope, confidence and trust in a better future.

Peter Drucker, the late Austrian-American expert on management said: The greatest danger in times of turbulence is not the turbulence: it is to act with yesterday’s logic”. Let’s be frank, yesterday’s public policy logic downplayed risks — geopolitical; economic, social, environmental and others. The logic over emphasized short term (political) timeframes that favoured consumption and deficit financing over genuine investment in institutions and infrastructure. Negative risks are materializing.

The global outlook is more complex and uncertain since the Fall 2021 Economic and Fiscal Outlook. At this writing, Russia’s invasion of Ukraine betrays an agenda to upset world order arrangements. There will be an unnecessary loss of human life. Increased volatility in global financial markets and higher energy prices will slow the post-COVID-19 recovery.

Inflation is back. It is not as transitory as policymakers had hoped. Central banks are behind the proverbial curb in adjusting policy rates.

Monetary and fiscal policies must be recalibrated for a post-Covid recovery. These policies support the implementation of economic, social and environmental solutions critical for our collective well-being. Here, policy stimulus must be reduced to dampen inflation pressures and expectations.

The Consumer Price Index (CPI) rate of inflation is now running above 5 percent on a year-over-year basis. This is up sharply from the pre-Covid period and well above the Bank of Canada target of 2 percent. Industrial and raw material price increases are much higher. Inflation is a pestilence that undermines our monetary system. It must be anchored to facilitate the exchange of goods and services. Market systems with flexible exchange rates thrive on financial stability.

Canada’s central bank has signaled a series of policy rate adjustments. The more forward guidance (transparency) on the future path of rate increases the better likelihood for smoother economic adjustment.

We should expect general interest rate increases of 1 to 2.5 percentage points over the next few years. Given the record low level of interest rates, increasing policy rates represents a normalization of monetary policy – more akin to taking the foot off the accelerator than applying the foot to a brake.

Forward guidance and anticipated rate increases are considered essential to return target inflation rates to the 1 to 3 percent range over the short-term horizon. They represent higher interest rates than assumed in the government’s 2021 fall planning outlook. They will increase debt-carrying costs for all – consumers, businesses and governments – and dampen increases in the prices of financial (equities) and physical assets (houses).

Forward guidance and anticipated rate increases are considered essential to return target inflation rates to the 1 to 3 percent range over the short-term horizon. They represent higher interest rates than assumed in the government’s 2021 fall planning outlook. They will increase debt-carrying costs for all – consumers, businesses and governments – and dampen increases in the prices of financial (equities) and physical assets (houses).

Similarly, fiscal policy must be constrained to reduce economic and financial instability risks and promote sustainable growth. In hindsight, fiscal supports provided by governments in Canada (and around the world) were much larger than the overall declines in output and income resulting from the Covid pandemic. Large fiscal supports and increased growth in the monetary base combined with global supply issues from the Covid lockdowns created the inflationary context for the economic recovery. It was the perfect storm for the return of inflation.

Levels of spending, revenues and deficit finance must be geared to the economic cycle as well as longer term fiscal sustainability. Published analysis on the cyclically adjusted budgetary balances (what would the budgetary balance be if the economy was operating at full capacity?) and related fiscal guardrails linked to economic indicators are needed to guide the evolution of fiscal policy. We need more growth in the real economy (volume of goods and services), which can support higher wages and salaries, and less price inflation.

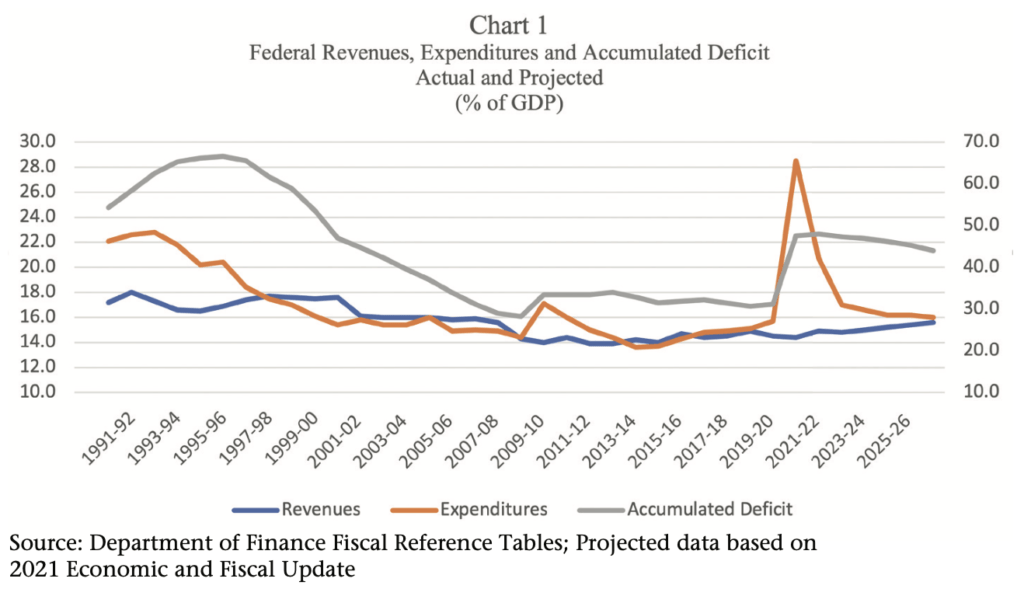

Chart 1 highlights the historic spending adjustments that are required over the next five years to restore more sustainable budgetary balances and stabilize debt-to GDP ratios, albeit at a much higher level. The fiscal cost to stabilize the Canadian economy during the pandemic was enormous. It is important that Budget 2022 set out a spending plan with adequate transparency and guiding rules to ensure confidence in the path to normalcy.

Former Bank of England Governor Mervyn King and economist John Kay, in their book Radical Uncertainty: Decision Making Beyond the Numbers (2020) make the case that we are living in a world of uncertain futures and unpredictable consequences. Think inflation. Think Russian invasion of Ukraine. In their view, updating information, keeping options open and keeping strategy simple are strategic necessities.

Jens Beckert and Richard Bronk, in their book Uncertain Futures: Imaginaries, Narratives, and Calculation in the Economy (2018) make the case that with widespread radical uncertainty (i.e., impossible to assign probabilities), expectations are often structured by contingent narratives. Expectations are not anchored with a pre-existing sense of a future reality (i.e., what will a net zero economy look like?) because we do not have a shared view grounded in experience. Nonetheless, expectations play a crucial role in shaping the future. Contingent narratives (e.g., bigger government/more taxes; more green energy/ less fossil fuels) must be shaped and debated by political leaders, markets and societies.

The challenge for Budget 2022 in these turbulent times is to lay out a responsible fiscal plan for a policy vision and contingent policy narratives that inspire hope, confidence and trust in a better future. The (post-Covid) build back better agenda(s) in advanced economies generally have four key policy priorities – economic growth; sustainability, inclusion and resilience.

In all of these policy areas, government at all levels in Canada, indigenous peoples, not-for-profit and private sectors have a vested interest. Policy work is ongoing. What’s missing is the collective vision, context for change and collaborative processes that are essential for strategies, decision making and execution.

Budget 2021 had 10 priorities and more than a hundred separate line-item initiatives. Most of the initiatives received small amounts of funding designed more to capture political support with targeted groups of citizens than address fundamental policy challenges and risks.

Budget 2022 should be different. Fewer priorities. Larger and more informed strategic spending.

On economic growth, for example, budget policy should set out the policy vision of the government for Canada. What are the objectives related to productivity and labour force growth? Can we use the report of the 2016 Advisory Council on Economic Growth to the Minister of Finance and the 2020 Industry Strategy Council to drive policy debates and collaborative processes on competitiveness, innovation, infrastructure, and training? How do we make growth more sustainable, inclusive and resilient?

Future budgets would provide measured investments against policy objectives supported by analysis. Investments in institutions, such as an independent commission that could conduct a national infrastructure needs assessment, would support data creation, analysis and consultation. In a world of radical uncertainty with uncertain futures and unpredictable consequences, good processes are critical success factors.

If additional public resources are required, say for example an increase in the escalator of the Canada Health Transfer as demanded by provincial premiers, then there would be a decision to make to find the necessary fiscal room. The options are simple – reallocate from existing resources or raise additional revenues to maintain the current fiscal stance. Long-term structural program adjustments should not be deficit-financed.

This approach to building vision and policies on economic growth could be repeated with other build back better policy objectives related to sustainability, inclusion and resilience. In times of turbulence, we need a new approach to public policy development and budgeting.

Kevin Page, is the President of the Institute of Fiscal Studies and Democracy at the University of Ottawa, former Parliamentary Budget Officer and a contributing writer for Policy Magazine.

Sahib Dhaliwal and Meagan Frendo are undergraduate economics students at the University of Ottawa.