Fall Economic Statement 2022: Bracing for a Global Slowdown

Deputy Prime Minister and Minister of Finance Chrystia Freeland released the federal government’s 2022 Fall Economic Statement (FES) on November 3rd. The following is our Policy analysis from the excellent team at the Institute of Fiscal Studies and Democracy at the University of Ottawa.

Finance Minister Chrystia Freeland delivering the Fall Economic Statement, Nov 3, 2022/Adam Scotti

Finance Minister Chrystia Freeland delivering the Fall Economic Statement, Nov 3, 2022/Adam Scotti

Kevin Page, Nabila Antora and Matthew Mcgoey

November 4, 2022

The purpose of the midyear update is to inform Parliament and Canadians on the changes to the economic outlook and what this means for the government’s policy agenda and fiscal plan.

In the leadup to the release of the FES, the government faced two principal challenges. One, the economic challenge to align federal fiscal policy with Bank of Canada monetary policy in the fight to reduce inflation expectations and the inflation rate. Two, in the context of a minority Parliament, the political challenge to find an appropriate policy balance among opposition parties to remain in power and positioned to face the next election.

There are three overarching strategic messages in the fall statement.

On the economy: global economic uncertainty is high. High inflation must be addressed. The Canadian economy is headed for a slowdown. Inflation is expected to have peaked. We are estimated to be a year away from having inflation rates within the Bank of Canada’s mandated target range (1 to 3 percent).

On policy: in the current high inflation environment, federal spending must be restrained. New measures must be targeted to help vulnerable people address affordability challenges. The transition to a more competitive, greener, more inclusive and resilient economy is ongoing — new measures are required to stimulate investment and growth, particularly in light of the recent US initiatives (i.e., the US Inflation Reduction Act). More will follow.

On the fiscal plan: federal budget deficits are returning to normal levels. The federal government is fiscally sustainable. Fiscal flexibility exists as needed.

Did the fall statement strike the appropriate direction and balance to address the economic and political challenges? Only time will tell. Politically, it is expected that the New Democratic Party will support the government in the passage of related financial measures. The government will maintain power. Economically, the slowdown will mean higher unemployment. The potential for weaker economic scenarios rises with continued increases in interest rates and geopolitical conflict. Instability complicates the drive to tackle important issues such as climate change.

Finance officials, who crafted the fall statement, are arguing that the updated fiscal plan represents a steady hand in turbulent times. Normalized (small) budgetary deficits and a declining debt-to-GDP ratio will help ensure flexibility to address the impacts of a possible recession and will allow additional public spending in the (low-inflation) future to support growth and job creation.

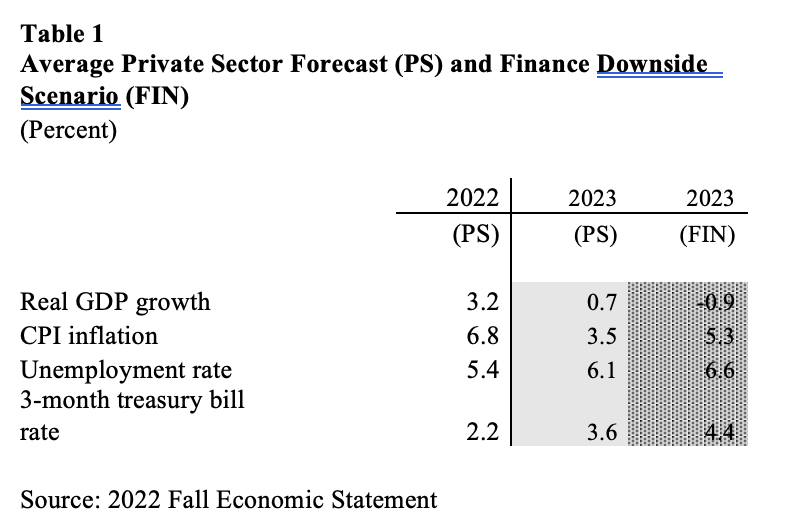

In preparing the economic outlook, Finance Canada undertook a September survey of private sector forecasters. The survey is used for the baseline economic scenario. Economic growth is estimated to fall sharply from 3.2 percent in 2022 to 0.7 percent in 2023 (Table 1). Unemployment rises. This scenario is in line with the recent Bank of Canada outlook presented in its October Monetary Policy Report.

Prospects for a global slowdown are increasing. High inflation and rising interest rates are expected to slow demand significantly. Prospects for growth have diminished in China (due to COVID) and Europe (due to Russia’s war on Ukraine and energy supply). Finance Canada has developed their own independent downside scenario: The recession starts early in 2023. Growth shrinks on average 0.9 percent in 2023. There is no upside scenario. This is an unusual development (i.e., risks in baseline outlook are not symmetrical) for Finance. The dark clouds are within view.

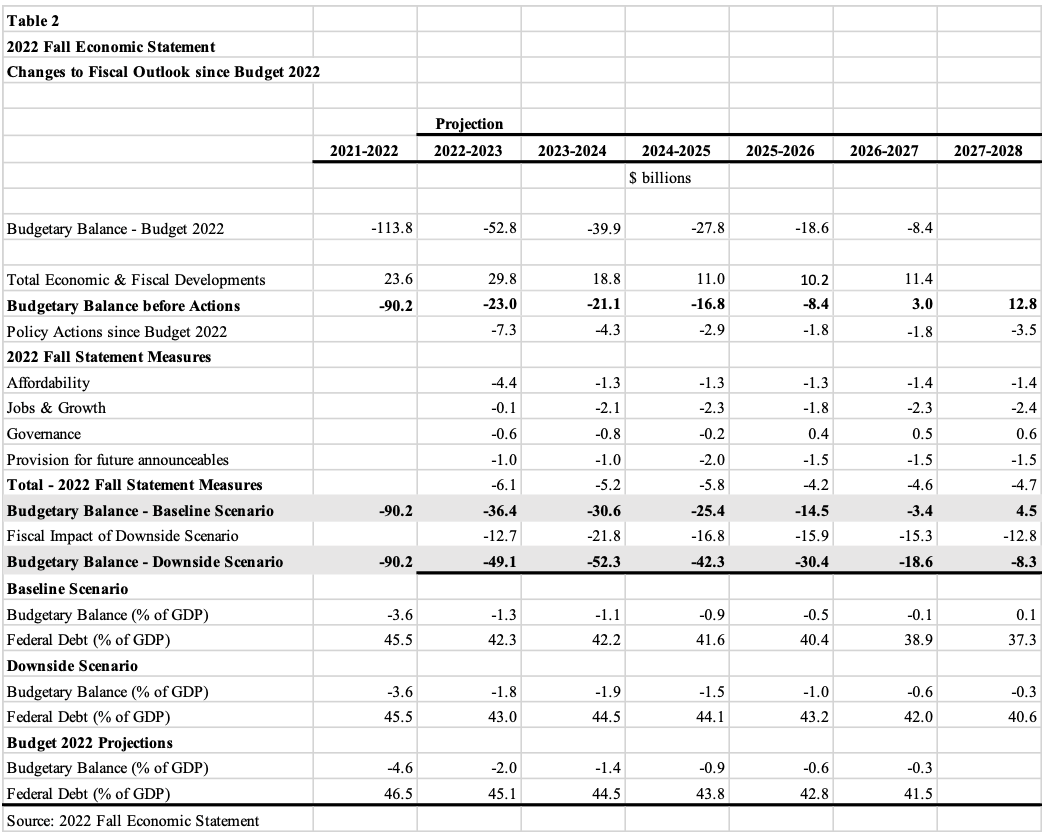

The updated fiscal numbers in the fall statement have some significant moving parts (Table 2).

A relatively strong economy in 2022 and high inflation have elevated budgetary revenues. Economic and fiscal developments since Budget 2022 add $81 billion of new fiscal room over the five years ending 2026-27.

There are about $21 billion in policy actions since Budget 2022. The fall statement adds about $30 billion in new measures. Roughly a third are directed to help vulnerable people (low income workers, renters, students) with affordability challenges; a third is directed to help businesses and workers (e.g., the largest measure is an investment tax credit for clean technology) and a third is related to money set aside for announcements between now and Budget 2023 (stay tuned). Some additional moneys to support government operations are offset fiscally by a new tax on share buybacks to be introduced in 2024 (the US is introducing a similar tax as part of its Inflation Reduction Act).

As has been the practice by the Liberal government since it took office in 2015, if the outlook generates fiscal flexibility, this government will spend most of it. Under the baseline scenario, the budgetary deficit track is lower over the medium term. The budgetary deficit is estimated to fall from $90 billion (3.6 percent of GDP) in 2021-22 to $36 billion (1.3 percent of GDP) in 2022-23 to budgetary balance in 2027-28. This would be considered a very good deficit track in international terms. The debt-to-GDP ratio falls from 45 percent in 2022 to 37 percent in 2028.

The decline in the budgetary deficit in recent years to more modest levels as a share of the economy and the relatively modest new spending ($30 billion over six years in a $3 trillion economy) is used by the Liberal government to make the case that this spending plan is not inflationary and is consistent with the Bank of Canada efforts to lower the inflation rate. A parsing of measures tends to support the contention with much of the money focused to help vulnerable people and support clean technology investment. What is, of course, not clear is how the $8.5 billion over the next six years will be spent on future announcements. This is a transparency problem.

By comparison, the Finance downside scenario is less rosy from both an economic and fiscal perspective. The increase in deficits over the next 6 years (cumulatively) rises from $106 billion to $201 billion. The debt-to-GDP ratio rises over the short term before it turns downwards.

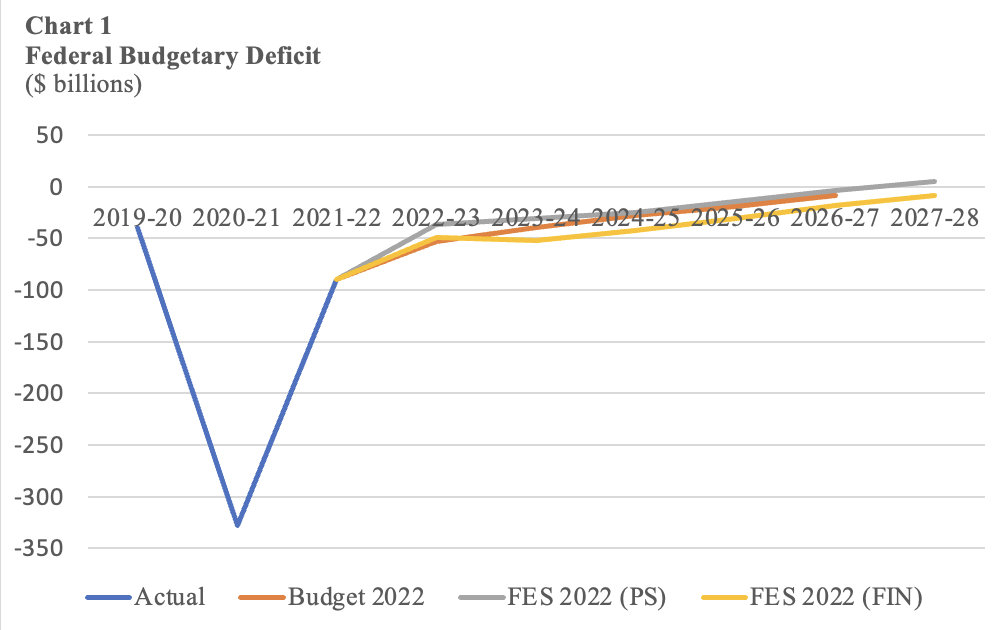

Notes: FES (PS) refers to the average private sector outlook. FES (FIN) refers to the Finance Canada downside scenario. Source: 2022 Fall Economic Statement

Chart 1 highlights the enormous movements in deficit numbers over the past few years. Who would have thought in 2020 that we could see a budgetary deficit of $328 billion (14.9 percent of GDP) in 2020-21 and a deficit of $36 billion (1.3 percent of GDP) in 2022-23 – just two years later. A strong economic rebound and a disciplined unwinding of COVID supports were key success ingredients.

Parliament and Canada needed this update. We have seen three monetary policy reports from the Governor of the Bank of Canada since Budget 2022. Each of these reports presented outlooks that were less optimistic. If the current outlooks are correct, Budget 2023 will be tabled in a period of a significant economic slowdown. Canada will be in recession.

The Dalai Lama said “A tree with strong roots can withstand the most violent storm, but the tree can’t grow roots just as the storm appears on the horizon.” Canada was tested in the 2008 financial crisis and the 2020 global pandemic. Prospects are growing that we will be tested again in 2023.

Kevin Page is the President of the Institute of Fiscal Studies and Democracy at the University of Ottawa, former Parliamentary Budget Officer and a contributing writer for Policy Magazine.

Nabila Antora and Matthew Mcgoey are undergraduate economics students at the University of Ottawa.</strong