Don’t Fear the Leaper

Douglas Porter

June 16, 2023

Equity markets paused momentarily in sympathy with the Fed’s mid-week decision to hold rates steady for the first time in 11 meetings, before rolling to yet new highs. By Friday morning, the S&P 500 was working on a seven-day heater, up almost 24% from last October’s lows. While the Fed and Chair Powell did their level best to warn one and all that the rate hike campaign was not finished, and there was plenty more work to be done, and core inflation was far too high for comfort, and the dot plot shows two more rate hikes, and you better mind your manners, investors are simply showing no fear of the Fed.

Part of the reason for the quiet confidence among investors is that the long-awaited, much-anticipated recession is still missing in action. This week’s slate of economic data was mixed but showed no serious signs of rolling over. Retail sales were a prime example, grinding out a decent 0.3% gain in May and still up modestly from year-ago levels. While the Philly Fed Index slipped further into the red, the Empire State measure bounced back into the black. Initial jobless claims do seem to be moving higher, in tune with the recent bump in the unemployment rate, but the job market is still very tight. And, as this week’s Focus Feature notes, even housing is stabilizing despite the cumulative 500 bp hike in short-term rates in the past 15 months.

Part of the reason for the simmering market optimism is that inflation continues to climb down the mountain. Along with the FOMC, the May CPI was this week’s other big event, and the headline did not disappoint. Rising just 0.1% m/m, the annual inflation rate tumbled almost a point to 4.0%—and it’s poised to take another big step down in June to the low-3s on very friendly base effects. True, core inflation remains sticky and stubborn at 5.3% y/y, barely off a point from last year’s peak, and with all the short-term metrics stuck above 5%. However, the weighty shelter components are expected to cool notably in coming months (especially owners’ equivalent rent), while a recent flare-up in used car prices should reverse. And even an unreformed inflation hawk (ahem) would concede that Powell’s supercore measure is fading to more manageable levels—3% on a three-month annualized basis.

Part of the reason for the surprisingly sturdy equity performance this year are some favourable external factors. The global inflation fight is getting a big helping hand from calmer commodity prices; one index is down 30% from year-ago levels, with even ex-energy prices down 10% y/y. Oil seems stuck around $70, despite Saudi Arabia’s series of production cuts and the upside surprise on global growth this year. Calmer energy has helped carve Euro Area inflation from last year’s 10.6% peak to 6.1%, and it, too, looks ready to fall fast in coming months. Still, core is right in line with the U.S. at 5.3%, keeping the pressure on the ECB to keep going after this week’s no-drama 25 bp hike to 4.0% on the refi rate. Meantime, China weighed in with a 10-bp interest rate trim this week, amid a sluggish recovery and meagre 0.2% CPI inflation—a true outlier (besides the BoJ).

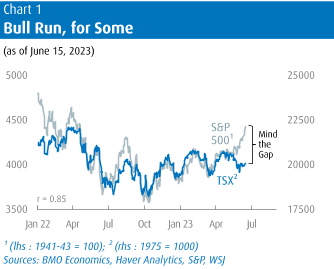

And, finally, part of the reason for the S&P 500’s bull run is simply a snapback in the tech sector, led by anything AI, which has been notably narrow in scope. Famously, this year’s rally has been powered by seven stocks, while the S&P 493 has largely lagged. Amid all the chatter about a new bull market, some investors would be forgiven for wondering what all the fuss was about. Exhibit A would be the TSX, which has been essentially range-bound in the past six months (Chart 1). However, Canada may actually be the big outlier here, as the MSCI world index excluding the U.S. is up 17% from the October low, with Japan leading the way (up 29% just this year). So, while the tech mega-caps have hogged the limelight, there are indeed some other important pockets of strength.

And, finally, part of the reason for the S&P 500’s bull run is simply a snapback in the tech sector, led by anything AI, which has been notably narrow in scope. Famously, this year’s rally has been powered by seven stocks, while the S&P 493 has largely lagged. Amid all the chatter about a new bull market, some investors would be forgiven for wondering what all the fuss was about. Exhibit A would be the TSX, which has been essentially range-bound in the past six months (Chart 1). However, Canada may actually be the big outlier here, as the MSCI world index excluding the U.S. is up 17% from the October low, with Japan leading the way (up 29% just this year). So, while the tech mega-caps have hogged the limelight, there are indeed some other important pockets of strength.

The over-riding message is that the economy has managed the heavy-duty tightening remarkably well, at least so far, and investors are gradually regaining confidence that a soft landing can indeed be achieved. That view is gaining support with headline inflation falling, mostly on plan, with lower oil prices adding an assist. However, the key question looking ahead is whether core inflation can be cracked without some real economic pain. If anything, the equity market’s comeback may make it even tougher to quell underlying inflation—well-heeled consumers are highly unlikely to pull back when stocks are on a tear. We expect the Fed to be back at the tightening well next month, and the risk is that there could be yet more to come.

The Wall Street Journal suggested this week that the stock rally was the market’s way of telling the Fed: “You haven’t done enough”. We would submit that the Canadian housing market is sending the Bank of Canada the same message. Existing home sales rose for the fourth month in a row in May, and are now up from a year ago, to a level that would not have stood out in a pre-pandemic crowd (i.e., normal). Note that sales began to rise in February, the month immediately after the BoC signalled a pause. Prices have also begun to respond, especially with new listings at a low ebb, rising 2% in each of the past two months. While national prices are still down 12% from last February’s mountaintop, sellers again have the upper hand.

We suspect that for all the Bank’s talk about Q1 GDP, April CPI and a strong job market, the rekindling in the housing market really hit a nerve. As we noted relentlessly in recent weeks, if the most interest-sensitive and most cyclical sector of the economy is on the comeback trail, policy can’t nearly be tight enough. And, this is even with Canadian households burdened with debt/income ratios stuck above 180% in Q1. There are preliminary signs that the latest rate hike, and the back-up in longer-term mortgage rates, have put a new chill into the housing market, but the BoC is unlikely to send another all-clear signal anytime soon. In fact, we lean to a follow-up rate hike in July, to really drive home the message to potential housing investors. The much more hawkish BoC outlook has also helped revive the loonie, which snapped up to a nine-month high of 75.8 cents ($1.32/US$), as Canada/US two-year spreads narrowed to -15 bps.

At least the Bank only has to contend with mundane price drivers like homes, vehicles, air fares, and butter. Spare a thought for Sweden (and you just know I couldn’t let this one pass). Already dealing with one of the fastest inflation rates in Europe—9.7% on its national measure last month—prices reportedly also got a bump from Beyonce. The pop diva’s decision to begin her tour in Stockholm brought a flock of fans to the city—apparently including many Americans, working on the arbitrage between U.S. and Swedish ticket prices. In turn, this drove up hotel and restaurant prices, with one estimate pegging the effect as adding 0.2% to core inflation. Presumably, the BoC is now nervously scanning the concert calendar, with a particular eye on Shania Twain in June, and Lynyrd Skynyrd on the radar for August.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.