Dog Days of Cycle

Douglas Porter

August 11, 2023

Prospects of a soft-ish landing were handed some reinforcement by the mild U.S. CPI for July, as it showed that core inflation is indeed cooling even as the jobless rate stays low at 3.5%. Still, the debate remains open amid a somewhat heavier PPI, rising oil prices, a renewed back-up in bond yields, and a struggling Chinese economy. As a sign of just how finely balanced the outlook is, the latest Blue Chip Survey (conducted this week) finds that precisely 50% of forecasters now expect a U.S. recession in the next 12 months—the proverbial coin flip. That share has been steadily drifting down this year, from 56% a month ago (and we were part of the 6% who flipped in the past month) and 65% at the start of 2023. Investors have been gravitating in that more benign direction as well, with the MSCI World Index now up 13% this year, even with a 2% stumble from the end-July high.

While we no longer have two consecutive quarterly GDP declines in our official forecast, that’s not to suggest the outlook is cloud-free. The ferocious 525 bps of Fed tightening has yet to fully weigh in, and we still expect sub-1% growth on average over the next four quarters, which will lift the jobless rate from its multi-decade lows. But two major factors have kept the U.S. economy churning forward in the face of the stiff headwind of rising rates: 1) flush consumers and 2) powerful fiscal support. The consumer was well-armed with pandemic savings, and real earnings have stayed strong—driven first by the snap-back in employment, but now by positive real wage growth. After trailing inflation for nearly two years, the 4.4% rise in average hourly earnings is now more than a point north of price increases.

The second big support has been the delayed impact of massive fiscal measures, with some only kicking in now. While no doubt bad news for the nation’s long-term fiscal outlook—as vividly noted by Fitch’s recent downgrade—the enormous rise in the budget deficit in the past year has boosted activity. Washington reported this week that the budget deficit widened to $221 billion for July alone, lifting the 12-month sum to a towering $2.26 trillion (or more than 8% of GDP). Just one short year ago, that 12-month tally was just under $1 trillion. So, over the past year, the deficit has surged by $1.3 trillion. To put that in perspective, U.S. nominal GDP has risen by $1.6 trillion. That short-term wave of support for the economy will inevitably ebb—it’s simply not sustainable—and may well go into reverse over the coming year, yanking one source of support. That’s one key reason why we, and the consensus, see growth being chopped in half next year, even if the economy stays out of recession.

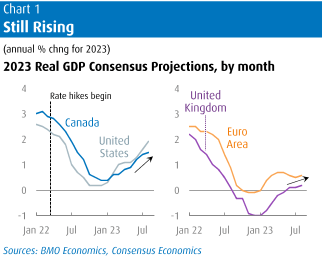

The still-sturdy U.S. growth backdrop is a major factor behind how the Canadian economy has also managed to stay out of the red, at least so far. We like to say that if you know what the U.S. economy is going to do, you have 75% of the answer for Canada’s outlook. And, largely mirroring the shift in U.S. growth expectations for 2023, Canada’s GDP forecast has been grinding steadily higher since the start of the year (Chart 1). However, we detect some daylight opening up between the two economies, as we now have Canada growing 1.6% this year, a half point slower than stateside, and less than 1% in 2024 despite the helping hand of much stronger population growth. Some of this dimmer forecast reflects the more exposed consumer sector, due to greater debt loads with shorter duration. And some reflects much less aggressive fiscal policy.

The moderately diverging outlook between the two economies is perhaps most clearly highlighted by the jobless rates. While the U.S. rate has been quite stable over the past year in the mid-3s, the Canadian rate has lurched notably higher in the past three months. It’s somewhat astonishing that the 0.5 ppt rise in the unemployment rate from April (and 0.6 ppt from last year’s low) hasn’t generated more attention, as it’s a clear warning flag that conditions may be softening abruptly. Adding to the sense that something has changed recently, one of the nation’s largest retailers (Canadian Tire) noted a drop in discretionary spending late in Q2, corroborating the preliminary estimates from StatCan that retail activity stalled around mid-year.

Beyond the consumer, Canada’s export machine also appears to be sputtering. After adding heavily to growth for three consecutive quarters, it now looks like net exports will drag in Q2, and likely Q3 as well. Merchandise trade has sunk back into deficit, seemingly on a sustained basis, as the rush of last year’s commodity spike has worn off and net volumes have turned south as well. Meantime, on the construction front, Canada is not seeing the factory building boom that the U.S. is experiencing, and the nascent rebound in housing looks to be smothered by the latest 50 bps of Bank of Canada rate hikes. Notably, construction employment has dropped 1.6% y/y in Canada, even as it has risen 2.5% for U.S. payrolls, a stark divergence.

While markets are still debating whether the BoC or the Fed will hike again, we believe that the case for the Bank to now stand aside is very strong. Next week’s CPI is likely to largely mimic the U.S. report, with a moderate monthly rise boosting the annual inflation rate a bit above 3% due to challenging base effects (with more to come in August). But the notable softening in the domestic job market, and the slippage in spending, construction, and trade, all suggest that underlying price pressures should ebb further.

This is not meant to poke fun, but rather to highlight just how complicated the current economic backdrop is for all analysts and commentators. The front page of one of Canada’s national newspapers’ business section carried these two items nearly on top of each other on Thursday:

- “Return of the ‘R’ word? Slumping gauges of manufacturing activity suggest a soft landing is far from certain”

- “Boom times: Global travel has recovered to 90 per cent of prepandemic levels despite higher costs”

Talk about mixed messages. Yet, both headlines are basically correct, and again highlight the deep divergences between various sectors as we continue to see the global economy return to quasi-normal. There was much attention on China’s very weak July trade data (exports down 14.5% y/y and imports off 12.4%), as well as the dip into outright CPI declines (-0.3% y/y). As the factory of the world, much of China’s apparent struggles simply reflect the shift back to services spending (e.g., travel, entertainment) and away from goods, after China had thrived earlier in the pandemic when the shoe was on the other foot. Even in the U.S., the gap between the services ISM and the factory version is stark, as it is in Europe. So, for every sign of factory stress—which is real—we have an offsetting sign that spending on leisure is on fire. And we will pointedly refrain from even mentioning Ms. Swift and/or Barbie ever again, although they do kind of aptly prove the point.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.