Do his Budgets Give Trudeau a Progressive Case?

Justin Trudeau’s breakout political gamble of the 2015 election campaign was to switch fiscal lanes with the NDP by eschewing restraint for deficit spending. It paid off. Now that all four of his government’s budgets are history, are his progressive credentials intact, or can Jagmeet Singh reclaim the NDP’s traditional territory? Former NDP party president and long-time strategist Brian Topp explores the policy particulars.

Brian Topp

Justin Trudeau earned a respectable majority in 2015 because of both who he was and who he was not, and the progressive change he promised. But he won’t be able to run that campaign again. In that campaign, Trudeau wasn’t his opponents — two older men proposing to stick with Mr. Harper’s old, unpopular austerity policies. But both are now gone.

In 2015, Trudeau was relatively young, positive and exciting — down to his thematic novelty socks — all of which represented welcome change and striking contrast. But as was the case with the Trudeaumania that propelled his father in 1968, celebrity excitement about a political figure has a short shelf-life. This year’s controversy over the prosecution of SNC Lavalin reminds us how the business of governing (and the serious mistakes associated with it) inevitably tarnishes celebrity political appeal. Which leaves the Trudeau government’s progressive policies, and whether or not sufficient groundwork has been laid for the classic re-election campaign of a first-term government: Much has been done, but much is left to do; send us back to finish the job.

In numerous speeches and statements, Mr. Trudeau and his team spoke in the 2015 campaign about the growing economic inequality of Canadian society. This is a point Mr. Trudeau has continued to underscore as prime minister in numerous venues including, for example, in 2018 at the World Economic Forum in Davos. Using Clinton/Blair “third way” framing, Mr. Trudeau has spoken about these issues as the crisis of the middle class in Canada. He committed to run a government that would help people remain in the middle class, or to finally join it, up from economic insecurity and poverty.

What progress has been made? The key initiative the Trudeau government took on these issues was Finance Minister Bill Morneau’s substantial reinvestments in Canada’s child tax credit. That is a program with a fairly long history. The federal government has been giving families a helping hand for a long time. The Federal Family Allowance was legislated in 1944, making payments by highly visible cheque to all women with children under the age of 16 who attended school. This author can remember the welcome arrival of these federal “baby bonus” cheques in the 1960s. They were my stay-at-home mother’s only independent income, carefully saved. Austerity budgets during the late Trudeau-the-Elder and Mulroney years shrunk the program. But it got a second look in 1998, re-emerging in its modern, much less visible tax credit clothing as the Canada Child Benefit Initiative. This was a two-part program introduced by Prime Minister Jean Chrétien through the Social Union Framework Agreement (Saskatchewan NDP Premier Roy Romanow and his government were keen on both the Social Union and the Child Benefit Initiative, and Romanow frequently lauded it as the “first new national social program in two decades”). This program, which re-packaged and topped up existing tax credits, launched with a budget of $6 billion.

It proved to be highly resilient. Prime Minister Harper rarely spoke about inequality or new national social programs. But he made a reformulated Universal Child Care Benefit the centrepiece of his own social policy work (along with a laudable emphasis on “housing first” in efforts to combat poverty) — steadily reinvesting in it, side-by-side with a plethora of regressive tax expenditures. And then, to their credit, Prime Minister Trudeau 2.0 and Finance Minister Morneau built on that work. In his 2016 and 2018 budgets, Morneau reformed and substantially reinvested in the rebranded Canada Child Benefit — now a $23 billion program. Mr. Morneau spelled out the results in his fall 2018 economic statement. The Canada Child Benefit, Morneau argued, has lifted over 500,000 people out of poverty, including 300,000 children — dropping the number of Canadians living in poverty from over 12 per cent in 2015 to a bit more than 9 per cent in 2019.

That is a 25 per cent cut in the poverty rate.

Mr. Morneau’s 2019 budget, astonishingly, was titled “Investing in the Middle Class”. Without a doubt, its most important and welcome move was about $1.5 billion more a year to improve indigenous services — an incremental increase on spending increases announced last year.

Otherwise, the government wanted to underline its commitment to addressing inequality — within its help-the-middle-class frame — by speaking to the justified concerns of first-time housing buyers about affordability, and concerns that seniors have about their income levels in retirement. So, to make a long story short, lower- and middle-income first-time home buyers got help with their down-payments — particularly those remarkable unicorn buyers who combine low incomes with large RRSP savings they can now borrow more from. Seniors benefited from some tweaking to the Guaranteed Income Supplement rules.

Jagmeet Singh and his NDP caucus attacked the 2019 budget for its omissions: no real progress towards universal public pharmacare; no action on tax evasion and tax havens; no protection for workers’ pensions in bankruptcies; no tax fairness from internet giants; no action to increase the supply of housing (the only real way to make housing more affordable); nothing on childcare.

So, after four years of help being on the way for the middle class, most of it focused on building the Canada Child Benefit: are these good efforts?

Yes, they are.

Are they a roadmap to a fundamentally more equal (dare we say “just”) society in Canada?

No, they’re not.

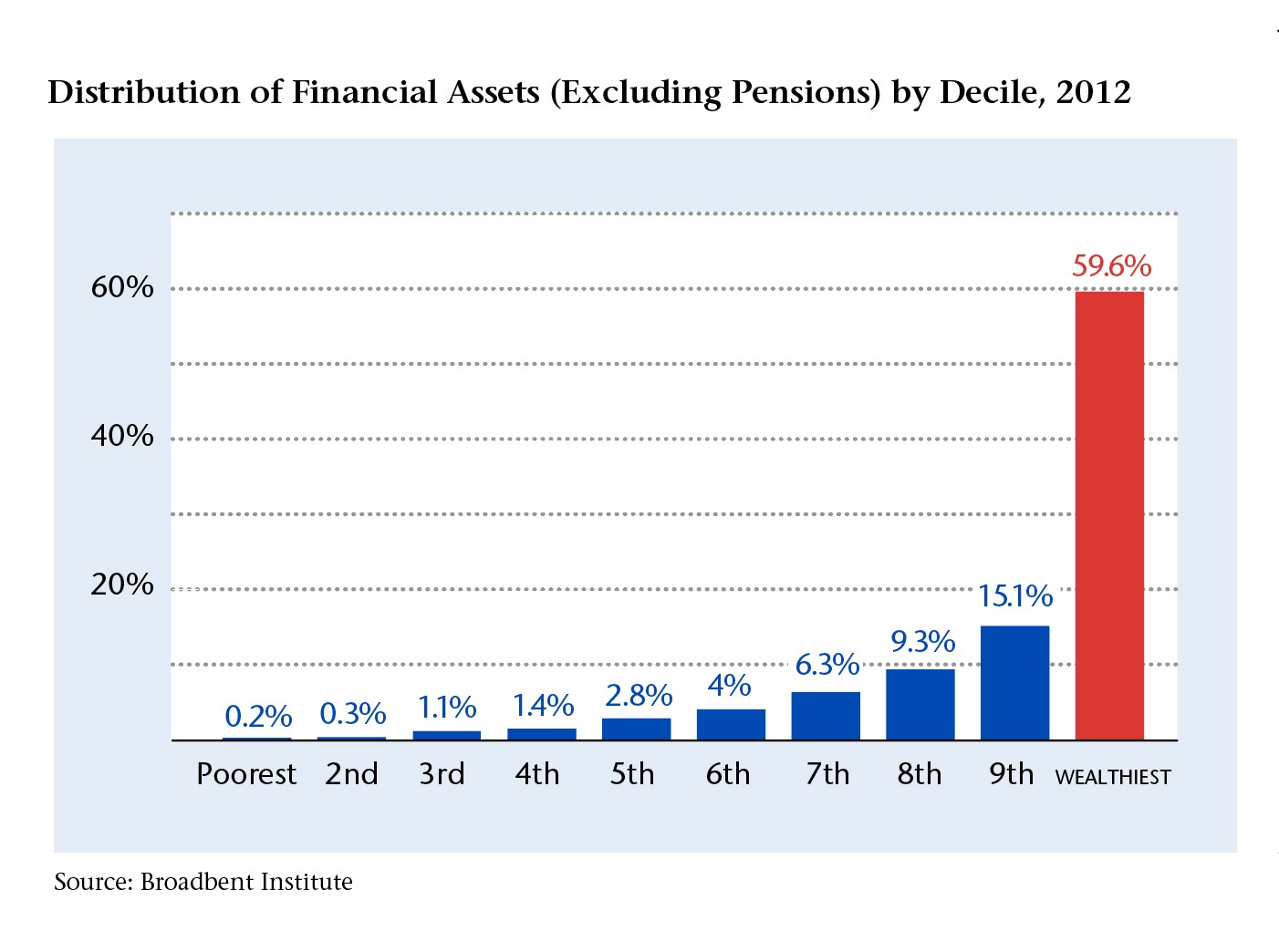

We would be in a worse way today without the Canada Child Tax Credit. But the hard facts of wealth distribution in Canada since the 1980s — when Canada chose to join the era of Reagan-Thatcher regressive taxation and austerity — remain. Consider this chart, from the paper Haves and Have-Nots: Deep and Persistent Wealth Inequality in Canada by the Broadbent Institute (I’m a member of their board, full disclosure):

The top 10 per cent of Canada’s population own almost 60 per cent of Canada’s wealth, excluding pensions, which are deferred income most people will draw in sip cups (it’s 50 per cent if you price in pensions). Meanwhile, 60 per cent of the population of Canada own, comparatively, nothing. This is an abstract way to talk about lives lived from paycheque to paycheque; of kiting between credit cards; of working multiple precarious jobs — the daily experience of far too many Canadians. “Progressive policies” that are about nibbling at the poverty rate haven’t changed this reality of inequality in Canada in any fundamental way.

The top 10 per cent of Canada’s population own almost 60 per cent of Canada’s wealth, excluding pensions, which are deferred income most people will draw in sip cups (it’s 50 per cent if you price in pensions). Meanwhile, 60 per cent of the population of Canada own, comparatively, nothing. This is an abstract way to talk about lives lived from paycheque to paycheque; of kiting between credit cards; of working multiple precarious jobs — the daily experience of far too many Canadians. “Progressive policies” that are about nibbling at the poverty rate haven’t changed this reality of inequality in Canada in any fundamental way.

To use the Liberal frame — the middle class is still under siege.

Social democrats would argue that what we need is a return to true progressive taxes and a wealth tax in Canada — and an appropriate redistribution to the poor and the working poor. And also a decisive enhancement of public pensions in an economy in which a generation of workers is nearing retirement on precarious defined contribution plans, with a generation following behind them with no private pensions at all. And also a hard, determined run at racialized poverty — which in Canada centres on First Nations, Métis and Innu people. And also, some determined federal-provincial work to roll back precarious employment in all of its forms — that blight on the lives of young and immigrant workers, especially women.

After four years of self-defined progressive government, we remain in a reverse-Robin Hood fiscal regime that transfers wealth from the poor to the rich, in part through public debt, who owns it, and who pays it off in a regressive tax system. We are standing by and watching while the private pension system phases itself out. We are largely standing by and watching while multi-generational poverty besieges Canada’s first peoples. And we are standing by and watching while the future of work promises our children less — possibly much less – prosperous lives than their parents enjoyed. Hardly a formula for reinforcing the middle class.

Four progressive budgets later, the social and political consequences of these facts give the Conservative Party its opportunity. Mr. Scheer, his party, his provincial co-religionists, and his third-party allies are creeping towards the same vicious rightwing populism blighting the politics of Europe and America. Their audience is the army of the dispossessed you see in those charts. People who see no benefit in big-government tinkering with the status quo. The same people who were looking for hope in 2015, and found it in Mr. Trudeau’s talk about inequality and the reinforcement of the middle class.

Just possibly, Jagmeet Singh (in the very first months of his elected federal career) will do to Mr. Trudeau what Mr. Trudeau did to Mr. Singh’s predecessor, and judo-throw him into third party status, replacing him at the head of Canada’s progressive majority. Otherwise Mr. Trudeau might be needing one bull moose of a new offer in 2019 to ward off the populist right, and the deeply regrettable opening that still lies before it.

Brian Topp is a former President of the New Democratic Party of Canada. He served as Jack Layton’s national campaign director in 2006 and 2008. He was director of research and deputy chief of staff to Saskatchewan Premier Roy Romanow, and was chief of staff to Alberta Premier Rachel Notley.