Budget 2021: The Big Spending Plan

Kevin Page

April 20, 2021

Finance Minister Chrystia Freeland’s budget is titled “A Recovery Plan for Jobs, Growth and Resilience”. It is a big-spending budget. There is new deficit spending for COVID relief, economic recovery and a transition to a more sustainable, inclusive and resilient economy. If there is an election in the fall, this is the type of budget the Liberal Party would like to take to the campaign trail. There is something for many, almost all.

The budget strategy is based on three strategic principles.

One, the government needs to act now. The crisis continues. There are economic and social costs to waiting.

Two, the government needs to act broadly. There are many collective needs — an economy struggling with a pandemic; the prospects of significant economic scarring; and the need for the public sector to play a lead role to support long-term adjustment.

Three, in a low interest rate environment with high economic uncertainty, the risk of doing too little with respect to government support is considered to be much worse than trying to do too much.

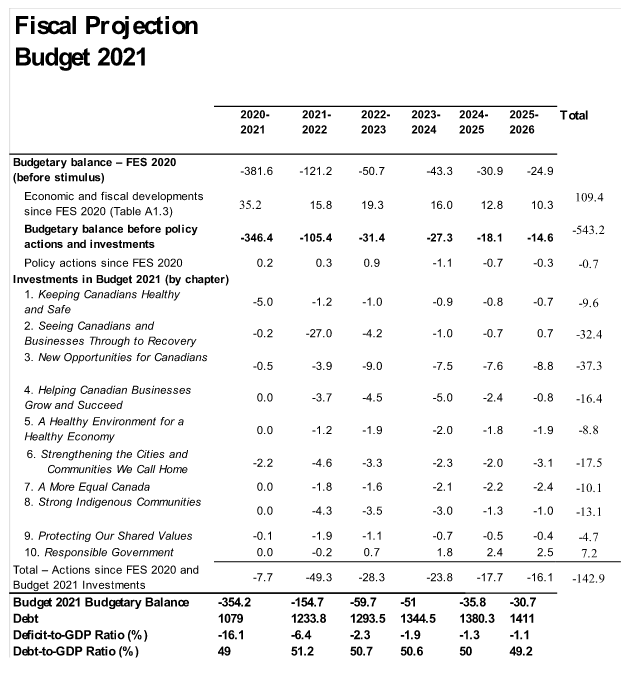

Budget 2021 is big. It has many moving parts. It breaks records. It weighs in at 700 pages. Over six years, there is $143 billion in net new spending. There are 10 priorities. If one takes the time to add up all the line-item spending initiatives for all priorities, you will exceed 250.

Suffice to say, Canadian households and businesses will need many days to wrap their heads around this budget.

This is a spending budget. It is not a spend-and-tax budget. There are relatively few significant tax measures of notable consequence for the fiscal bottom line. Higher taxes for e-commerce; some luxury goods; limits on interest deductibility; and, course, tobacco. Taken together, these taxes will raise about $10 billion over the next five years. Not pocket change, but not enough revenue to fund a higher Canada Health Transfer, a national pharmacare program or a much stronger social safety net system with a basic income component.

Budget 2021 is big. It has many moving parts. It breaks records. It weighs in at 700 pages. Over six years, there is $143 billion in net new spending. There are 10 priorities. If one takes the time to add up all the line-item spending initiatives for all priorities, you will exceed 250.

Among the 10 priorities and hundreds of spending initiatives, one policy proposal stands above all others – a national early learning and child care program. It is the one signature and legacy initiative that carries the greatest prospect of boosting long term growth and well-being. Some $30 billion over five years has been set aside. Negotiations await. Notwithstanding broad public and analytical support, the provinces are living on a tight fiscal string. Quebec already has the model program. Others are playing catch-up. The final shape of a national program will be debated in provincial and territorial capitals in the months ahead.

The government is committed to fiscal stimulus. It signaled this intention in the 2020 Fall Economic Statement. It is allocating more than $100 billion over the next three years with about $50 billion set aside in 2021-22. The scale of the stimulus in 2021 is even larger when you add more than $20 billion in measures announced last fall. It is a lot stimulus (at least three times the federal stimulus provided in 2009) for an economy projected to rebound strongly this year when vaccinations are in place.

Clearly, the federal government is willing to risk the potential for an overheated economy and higher short-term inflation should the release of pent-up demand, higher savings and optimism become a reality. It wants a strong kickstart. It wants to put COVID-19 in the rearview mirror.

The scope of the stimulus is broad over the full three-year period — there are extensions to current COVID relief programs through to the fall, enrichment of the worker benefit, new training programs, additional supports for youth to seniors, and subsidies for business to hire and invest.

There are significant new resources for Indigenous peoples, particularly with respect to infrastructure, education and child welfare. Like the proposed national child care program, the key to success will mean collaboration and coordination with governments responsible for implementation. In this case, First Nations.

Infrastructure and innovation are the big-ticket policy items to facilitate transition to a post-COVID economy that is more sustainable, inclusive and resilient.

In addition, to spending increases on social infrastructure (child care, training), there are additional monies for physical infrastructure. Some of these expenditures were announced just prior to the budget (e.g., public transit) and others were highlighted in Budget 2021 (e.g., trade corridors, long term care). Monies were set aside to launch a national needs assignment — a much needed and novel initiative, that once again will require lots of collaboration and coordination.

New monies to support innovation ranged from health (pandemic preparedness capacity related biosciences and vaccine development) to clean energy to digital transformation. More money is set aside for improvements in rural broadband.

How does the federal government finance $143 billion in net new spending over six years with-out destroying the fiscal bottom line? Well, one way is to assume the economic outlook will be much more positive than just a few months ago. The economic adjustment to the forecast has added about $70 billion to GDP in 2021 and $90 billion in 2022. This is a big adjustment to a $2.4 trillion economy. The higher revenues and lower spending that follow the outlook adjustment offsets about 75 percent of the higher overall policy spending over the six-year period.

Budgetary deficits are large but are projected to decline with the unwinding of COVID supports and economic recovery. The budgetary deficit falls from an estimated $354 billion in 2020-21 (16.1 percent of GDP) to $155 billion in 2021-22 (6.4 percent of GDP) to a more normal pre-COVID level of $31 billion in 2025-26 (1.1 percent of GDP).

How does the federal government finance $143 billion in net new spending over six years with-out destroying the fiscal bottom line? Well, one way is to assume the economic outlook will be much more positive than just a few months ago.

In downhill skiing terms, this would be a world class descent with a few treacherous turns. It is possible with assumptions of continuous strong growth and low interest rates.

The federal debt-to-GDP ratio will hover around 50 percent over the medium term. This is a 20-percentage point increase over pre-COVID levels. The government is arguing that this increase in debt is necessary. It was necessary to support Canadian households and business during the lock down. It will be necessary to support them through the recovery.

What happened to all the talk about a fiscal anchor and guardrails in the 2020 Fall Economic Statement? Not much.

The government indicates it is comfortable with a debt-to-GDP ratio in the 50 percent range. If you look carefully, you will see that it does trend down. In essence, the government has resurrected its pre-COVID fiscal anchor of a projected decline in the debt-to-GDP ratio. It remains much lower than the debt-to-GDP ratios of other G7 countries.

The fiscal guardrails appear to have largely come and gone. Labour market indicators suggest we are currently operating well below February 2020 (pre- COVID) levels. This is the justification for the full $100 billion stimulus for three years. There is no sense that stimulus will pared back based on projected improvement in labour market indicators. Not a lot of guard in the rails.

Will this be enough of a fiscal anchor for the bond rating agencies? Do we need to do more to repair our fiscal buffers for the next economic or public health crisis? Good questions. In a 700-page budget there were only a few pages on the fiscal plan that deal with constraints. Opportunities abound for the Official Opposition to make the case that they have a more responsible fiscal plan.

If you want a budget to take to the next election, there is a clear strategy in Budget 2021 — spend lots; spend broadly and do your best not to make taxpayers angry. Also, hope to be at the polls when most people are vaccinated and the economy is firing on all cylinders. Could we see an election in the fall?

While there will be pressure by political parties for budget amendments, this budget strategy is expected to pass. The NDP do not want an election. The government will need to look for other mechanisms to trigger a return to the polls. Stay tuned.

Contributing Writer Kevin Page is the founding President and CEO of the Institute for Fiscal Studies and Democracy at University of Ottawa. Previously, he was Canada’s first Parliamentary Budget Officer.