Brave New World Order

By Douglas Porter

January 17, 2025

After a stuttering start to 2025, financial markets found a firmer footing this week as inflation concerns calmed. While most of the attention is now focused on next Monday’s inauguration—and what may soon follow—this week’s market driver was a more mundane economic report. The U.S. CPI for December landed a touch below expectations on the core measure, and that was enough to break the fever in global bond markets and provide some heavy-duty support for stocks. After poking above 4.8% at one point, the 10-year Treasury yield backed off to around 4.6% by week’s end. Even oil prices seemed to finally crest, after first riding a wave of strength to a five-month high above $80 for WTI.

It remains to be seen how long the reprieve for inflation concerns will last. The reality is that the U.S. economy continues to chug along, consistently surprising one and all to the high side. This week alone saw another jump in small business sentiment, a solid advance in all-important December retail sales, a pop in housing starts, and a big rise in manufacturing production. The Atlanta Fed is now tracking 3.0% growth in its GDP Nowcast for Q4, and the economy clearly had solid momentum heading into 2025.

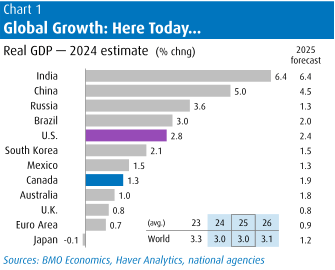

The sustained strength in the U.S. economy was a key factor behind the IMF’s decision to upgrade its global growth forecast. The organization now sees global GDP rising a solid 3.3% in 2025, a tick better than the prior projection and, crucially, also a tick better than last year. Most of the upward revision was driven by its new view on U.S. growth, which it now pegs at a sturdy 2.7% pace this year, barely below last year’s 2.8%. China also got a boost to 4.6%, driven by stimulus measures, and following on the heels of the Q4 results which—conveniently—revealed that growth for all of 2024 hit the 5.0% target on the nose, thanks to a 5.4% y/y jump in Q4.

Suffice it to say that we have a more cautious view on the global economy in 2025 than the IMF, and probably than markets as well (Chart 1). Instead of boosting our global growth call, we have been shaving it in recent weeks to 3.0%, and see the risk tilted to the low side. There’s no big secret behind the caution—trade uncertainty. Just days away from Mr. Trump assuming the Presidency, and we still have no real sense of what the tariff landscape will look like. Canadian National Resource Minister Wilkinson suggested three possibilities: a 25% tariff on Canada (and Mexico); a 10% tariff on all countries; or, a staged escalation in tariffs. None are appetizing prospects (more like outrageous or radical), and all point to serious downside risks for global growth.

While the growth backdrop will undoubtedly be harmed by a trade fight, the outlook for inflation is a bit more nuanced, and will depend heavily on the degree of retaliation to U.S. tariffs. But even if others decide to take a lighter touch on retaliation, the persistent strength in the U.S. dollar will drive up costs elsewhere. Picking a nearby example, the greenback has risen by more than 7% in the past four months alone against the Canadian dollar, pressuring import prices higher. On the flip side, it’s that very run-up in the U.S. dollar that leaves us a tad skeptical that U.S. inflation will see much of a bump from tariffs, and that’s especially so if they are applied in a staged manner or imposed on only specific nations. In the great trade spat with China, the U.S. core goods CPI went from averaging -0.6% y/y in 2016/17, to +0.2% in 2018/19; given its 20% weight in the CPI basket, that swing added just 1-2 ticks to overall inflation—a veritable flesh wound.

Even so, financial markets and even the Fed seem preternaturally calm over the very real prospect of “serious” tariffs. Fed Governor Waller has suggested that the inflation impact on the U.S. would not be significant, and would be temporary in any event (i.e., a one-time hit), so the Fed would look past it. It’s not clear if that’s a widespread view among Fed officials, but Waller is certainly leaning more dovish than others more broadly. He again asserted this week that rate cuts are still quite possible in coming months, even if a pause is all but certain at this month’s meeting. The conventional view is much more cautious; even with the mildly constructive CPI, markets are pricing in little more than one rate cut for all of 2025. Even the faint possibility of the Fed reversing course at some point this year has risen above the whisper stage.

Amid the ongoing strength in U.S. growth and the overwhelming policy uncertainty now in hand, we have pushed back our call on Fed cuts this year. We are maintaining our above-market call of three cuts, but now don’t see them resuming until June, when there should be more clarity on policy and its economic impact. We are also maintaining our view that rates will be trimmed twice more in 2026, taking the overnight rate ultimately down to the 3.00%-to-3.25% range, which can be seen as the new neutral.

Where does this shifting global backdrop leave the Bank of Canada? In stark contrast to widespread expectation that the Fed will pause on January 29, the Bank is still mostly expected to trim again that day. (Sidebar, we will point out that no fewer than five BoC decision dates fall on the same day as the FOMC meetings this year; that’s more times than the two have coincided over the past 20 years.) While the debate in the U.S. is all about how much inflation tariffs may cause, the only question in Canada is how much growth damage they will inflict. As a result, the Bank seems poised to continue cutting despite:

- The recent 7% drop in the Canadian dollar to near 20-year lows.

- The widespread assumption that the Fed will pause.

- A robust employment report for December, which even saw the jobless rate dip.

- More signs that the domestic economy is responding with purpose to prior rate cuts, including a 19% y/y rise in home sales last month, and a pick-up in mortgage borrowing trends.

Canada’s own CPI report for December may provide a bit of home-grown support for rate cuts. The GST holiday, which began mid-month, is expected to help clip headline inflation to 1.8% (more than 1 ppt south of U.S. trends), while favourable base effects may also help shave the yearly core readings. But, ultimately, the Bank’s decision may come down to what unfolds on the tariff front. We continue to believe that the correct response by the Bank to U.S. tariffs would be to cut early, and cut often. Any inflationary impulse from a weaker Canadian dollar and/or retaliatory moves will be swamped by the heavy-duty hit to growth.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.