At the IMF-World Bank Annual Meetings, the Mood is for Reform

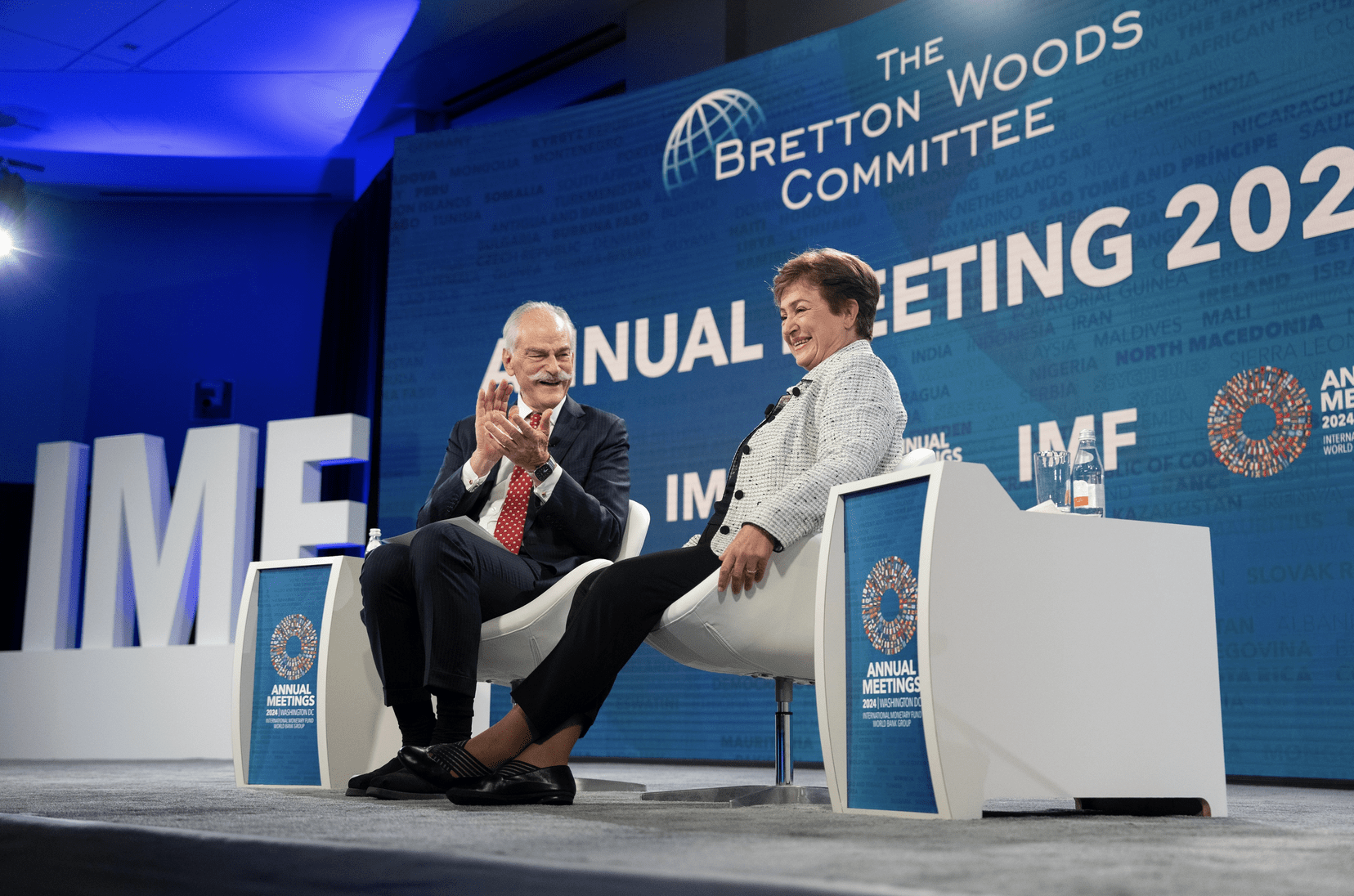

IMF Director Kristalina Georgieva with Bretton Woods Committee Vice-Chair John Lipsky, October 22, 2024/IMF

IMF Director Kristalina Georgieva with Bretton Woods Committee Vice-Chair John Lipsky, October 22, 2024/IMF

By Anil Wasif

October 22, 2024

Eighty years ago, in July 1944, delegates from 44 countries gathered in the serene Mount Washington Hotel in Bretton Woods, New Hampshire, to lay the foundation of a new international economic order. The resulting Bretton Woods system gave birth to the International Monetary Fund (IMF) and the International Bank for Reconstruction and Development (now the World Bank), aimed at fostering global economic stability and post-war reconstruction. Today, as these institutions mark their 80th anniversary, their roles have evolved, but the spirit of reform remains central. This was evident yesterday at the Bretton Woods Committee meeting at the annual IMF-World Bank meetings in Washington, D.C., where Kristalina Georgieva and Ajay Banga, respective heads of the IMF and the World Bank, outlined their vision for navigating the complex challenges of our time.

Navigating the Tightrope of Fiscal Policy and Development

Georgieva emphasized the delicate balancing act facing policymakers: how to maintain fiscal prudence while addressing urgent global needs like energy transitions and digital transformation. She noted that governments are under pressure to invest in long-term transformations, but the appetite for fiscal restraint has waned. “Our message is clear: fiscal consolidation must happen, but gradually,” she remarked, underscoring the need to manage debt without stifling growth.

The global landscape, according to Georgieva, has become increasingly fragmented. Over the past 18 months, more than 4,000 new industrial policy measures have been introduced globally, with 60% coming from advanced economies. While these shifts address critical priorities such as national security and the green transition, they have also altered trade dynamics. This change poses unique challenges for emerging markets, many of which are still reeling from recent economic shocks and grappling with high levels of debt.

Addressing Debt Vulnerabilities: A Shared Responsibility

Georgieva highlighted the diverse realities of emerging markets and low-income countries. While some have built robust institutions to weather economic shocks, others, including Pakistan, Sri Lanka, and Argentina, remain heavily burdened by debt. For these nations, the IMF is pursuing a three-pronged approach: facilitating debt restructuring, improving liquidity for countries facing cash flow issues, and providing long-term concessional support through the Resilience and Sustainability Trust (RST).

The RST, an innovative financing tool, offers 20-year concessional loans aimed at helping countries build fiscal space for climate resilience and adaptation. Georgieva proudly shared that the program has already mobilized $48 billion, exceeding its initial $40 billion target. This shift signifies a new direction for the IMF, expanding its role beyond crisis management to include long-term development support.

Ajay Banga’s Vision: Speed, Simplification, and Private Investment

In a parallel discussion, World Bank President Ajay Banga outlined his vision for a more agile and efficient World Bank. He emphasized the need for speed and simplification in project approvals, which are critical for delivering timely support to countries in need. The Bank has already made significant progress, reducing average project approval times from 19 months to 16 months, with some projects in Africa and the Pacific achieving even faster timelines.

Banga’s focus on private investment is central to closing the financing gap needed to meet the United Nations Sustainable Development Goals (SDGs) and climate targets. Recognizing the limitations of public financing, he stressed the importance of creating conditions that attract private capital, such as regulatory reforms and streamlined guarantees that reduce investment risks. “The task is to find what holds back private investment,” he noted, highlighting initiatives that aim to unlock new streams of capital for development projects.

The Intertwined Nature of Modern Challenges

Both Georgieva and Banga emphasized the interconnectedness of today’s challenges. Banga argued that issues like poverty, inequality, climate change, and economic stability cannot be addressed in isolation. Instead, investments in one area, such as education, should be designed to support broader outcomes, including job creation and economic resilience.

Georgieva echoed this sentiment, emphasizing that climate change has become a “macro-critical” issue for the IMF. By incorporating climate risks into country assessments and supporting climate-vulnerable nations with targeted financing, the IMF aims to help countries manage both the risks and opportunities of the green transition. This shift reflects the broader responsibility of institutions like the IMF and World Bank to adapt to the evolving needs of their member countries.

Reimagining Development: A Call for Collective Action

As the IMF and World Bank celebrate their 80th anniversary, they face a world that is far more complex than the one in which they were founded. The discussions at the Bretton Woods Committee meeting underscored the urgency of adapting to a multipolar world, where emerging markets are asserting new roles and expectations of international institutions are shifting.

Banga’s efforts to leverage the World Bank’s knowledge and expertise to build local capacity, alongside increased coordination with regional development banks, represents a pragmatic approach to modern development challenges. Similarly, Georgieva’s commitment to inclusive engagement and the IMF’s role as a reliable partner in both crisis response and long-term development showcases a determination to meet the diverse needs of countries.

Yet, significant challenges remain. Both leaders acknowledged the difficulties of implementing reforms amid political constraints, fiscal limitations, and rising geopolitical tensions. The struggle to secure funding for IDA21 in the face of donor fatigue, currency depreciation, and fiscal constraints in wealthy countries illustrates the ongoing tension between ambition and reality.

No Risk, No Reward

As the world navigates the aftermath of multiple global crises, the Bretton Woods institutions stand at a crossroads. The need for greater speed, flexibility, and innovation in addressing the intertwined challenges of debt, climate, and development is clear. Both Georgieva and Banga are steering their institutions toward a more adaptive and inclusive approach, but the success of these efforts will depend on the collective will of the international community to prioritize long-term stability over short-term interests.

The future of global development hinges on whether the IMF and World Bank can deliver on their promises of reform while adapting to a rapidly changing global landscape. For countries in the Global South, this moment represents a chance for renewed hope and investment. But without a concerted effort to bridge the gap between aspiration and action, the risk of deeper economic divides and social instability looms large. As Banga aptly put it, “1.2 billion young people in the Global South are entering the workforce—either as an opportunity or as a challenge.” The time to act is now, and the stakes could not be higher.

Policy Contributing Writer Anil Wasif is Manager of Research at Infrastructure Ontario. He sits on the advisory board of the Max Bell School at McGill University and the Governing Council at the University of Toronto. He is Trustee and Director of Strategy at BacharLorai, and is its Official Civil Society Representative to the United Nations and the World Bank Group.

His opinions are his own, and do not reflect the views of any organizations with which he is affiliated.