About Those Rate Cuts…

By Douglas Porter

January 5, 2024

Markets ended 2023 in a headlong rush to price in early and often rate cuts by the Fed, but also from the Bank of Canada and the ECB. While we wouldn’t quite call it a hangover, the first week of 2024 saw a more—shall we say?—sober reassessment of rate cut prospects. For example, after probing the 4.2% level in the middle of last week, the two-year Treasury yield briefly popped back above 4.4% post-payrolls (albeit still well down from the near-23-year highs of 5.2% seen in October). Similarly, 10-year yields temporarily pushed back up to nearly 4.1% after dipping below 3.8% last week (from an October high of 5%). A surprisingly soft services ISM result for December undid some of the damage late in the week, but the bigger picture is that yields are well up from last week’s lows.

Equities struggled to digest this week’s sudden back-up in yields, with the S&P 500 welcoming in the New Year with a string of losses before struggling to stabilize on Friday—following last year’s banner 24.2% advance. The index was still headed for roughly a 1% setback to start the year, ending an impressive nine-week winning streak. The TSX held up somewhat better to start 2024, a reversal of fortunes after trailing behind its major counterparts for much of last year. Still, the index did manage to grind out a solid 8.1% advance for all of 2023, courtesy of a powerful 11% rally in the final two months of last year, largely on the prospect of serious rate relief.

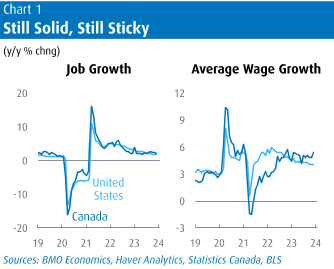

Interrupting the market’s parade to rate cuts were some solid economic results, some sticky inflation data, and a stern reminder from the FOMC Minutes. Topping that list was plenty of evidence that the U.S. job market remains firm, highlighted by a drop in initial claims to just 202,000 last week, and a sturdy 216,000 December payroll advance. While there were downward revisions to earlier months, job growth is still in the “no landing” camp, which is keeping wages bubbling. Average hourly earnings rose 0.4% last month, nudging up the yearly rate to 4.1%, or barely below the full-year average increase of 4.3%. Meantime, the headline unemployment rate held steady at 3.7%, only two ticks above year-ago levels.

Also weighing in on the sturdy side of the ledger, auto sales ended 2023 in good shape, rising to 16.1 million in December, and up 12% for all of last year. We always knew that autos were going to run warm last year as supplies were replenished, but the end-year performance was impressive. In contrast, the key ISM reports were soft, with the factory gauge edging up to 47.4 and services quite sluggish at 50.6. Markets rallied on the services ISM, initially taking the 10-year yield back below 4% and more than reversing the post-payroll move, suggesting that investors are still eager to believe rate cuts are imminent. But tying the loose threads of the economic releases in a bow, the Atlanta Fed is now tracking Q4 real GDP growth of 2.5% (our call is 1.0%)—hardly pointing to any urgency for rate relief.

The faces and names may have been a bit different in Canada, but the major storyline was similar: Yields rose on the week, but came off their highest levels on Friday. As in the U.S., auto sales ended last year strong and were up almost 12% for all of 2023, running directly counter to the narrative of a struggling Canadian consumer. And while the headline employment reading was soft—basically flat in December—wages are far too hot for the Bank of Canada’s comfort. Instead of receding on a higher jobless rate, which was steady at 5.8% last month but up from 5.0% a year ago, wages actually accelerated to a 5.4% y/y clip. At more than 2 percentage points north of current inflation, and with no productivity growth, that points to persistent inflation pressures.

What may have also caught the BoC’s eye this week was a stream of increases in December home sales in many major markets. While it’s always dicey to read much into housing activity in the middle of winter, even a flash of strength on this front could revive bad memories for the Bank of last spring’s surprising snap-back in home sales and prices. That short-lived revival in housing activity was probably a key factor in pulling the Bank off the sidelines and back into the tightening game, so we are highly sensitive to signs that housing may be stirring. As an example, sales in Toronto were up 11.5% from year-ago levels, with an even meatier monthly rise in seasonally-adjusted terms, while new listings were down 6.6% y/y. Activity is still quiet, but even a hint of a firmer demand/supply balance amid pending rate cuts could readily fire the sector back up again.

Even Europe got in the act of casting some doubt on possible near-term rate relief. While not really surprising anyone, headline inflation still took a big step up in December across the Euro Area, rising to 2.9% y/y from just 2.4% the prior month. Base effects and technical factors explain the reversal, and this may mark the extent of the back-up. Perhaps more meaningful was that core dipped a bit further to a 3.4% yearly pace in the region, which happens to be roughly in line with U.S. and Canadian core trends in recent months. While that’s a big improvement from core inflation of above 5% a year ago, it’s still not yet cool enough to open the door to rate cuts.

Market pricing suggests that the above “doth protest too much, wethinks” about the possibility of rate relief. After this week’s run of events and heavy slate of key indicators, markets still believe that the Fed could be cutting rates as early as the March meeting. While that’s also seen as a possibility by the markets for the Bank of Canada, the following meeting (in April) is widely viewed as the more likely option. Suffice it to say that we beg to differ, especially on the Fed, and would lean to a later starting date for both. Still, with Treasury Secretary Yellen crowing today that the U.S. has achieved a soft landing, we can’t fully rule out that the Fed may also declare victory earlier than we expect.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.