Where are the Costed Party Platforms? The Clock is Ticking.

Shutterstock

Shutterstock

By Mostafa Askari, Sahir Khan and Kevin Page

April 15, 2025

Canadian voters have an information problem. We are two weeks away from a federal election and we have no costed party platforms. How do we assess fiscal responsibility of our political parties in these uncertain times without platforms that roll up initiatives in a fiscal plan? What are the budgetary constraints that will promote trade-offs on priorities, good economic management and fairness to future generations with respect to public debt?

Party platforms are important. They provide information on the priorities of a political party that would shape their behavior as a government. They provide citizens and parliamentarians with information to hold a future government to account.

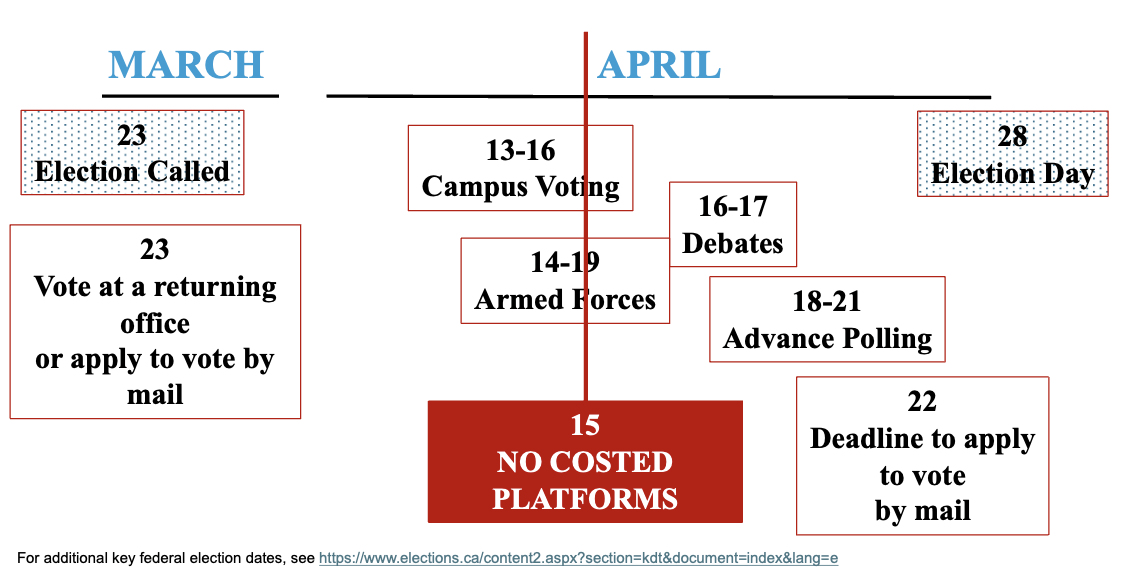

Voting is underway. Televised debates among party leaders take place on April 16 and 17. There are no costed platforms to inform the exchanges. Advanced polls run from April 18 to 21. Prime Minister Mark Carney signalled a platform release during the advance polls. This is too late for all political parties.

Canadians have learned from experience that evolving economic and fiscal situations require governments to adjust their priorities. Canada is facing a third economic shock in less than two decades – 2008 financial crisis; 2020 global pandemic; and 2025 US trade conflict. Canadians understand that proposals to cut taxes or increase spending require consideration of economic and fiscal contexts. How do you cut taxes and increase spending on national security and maintain a fiscally prudent and responsible path for budgetary deficits and debt. Where is the plan?

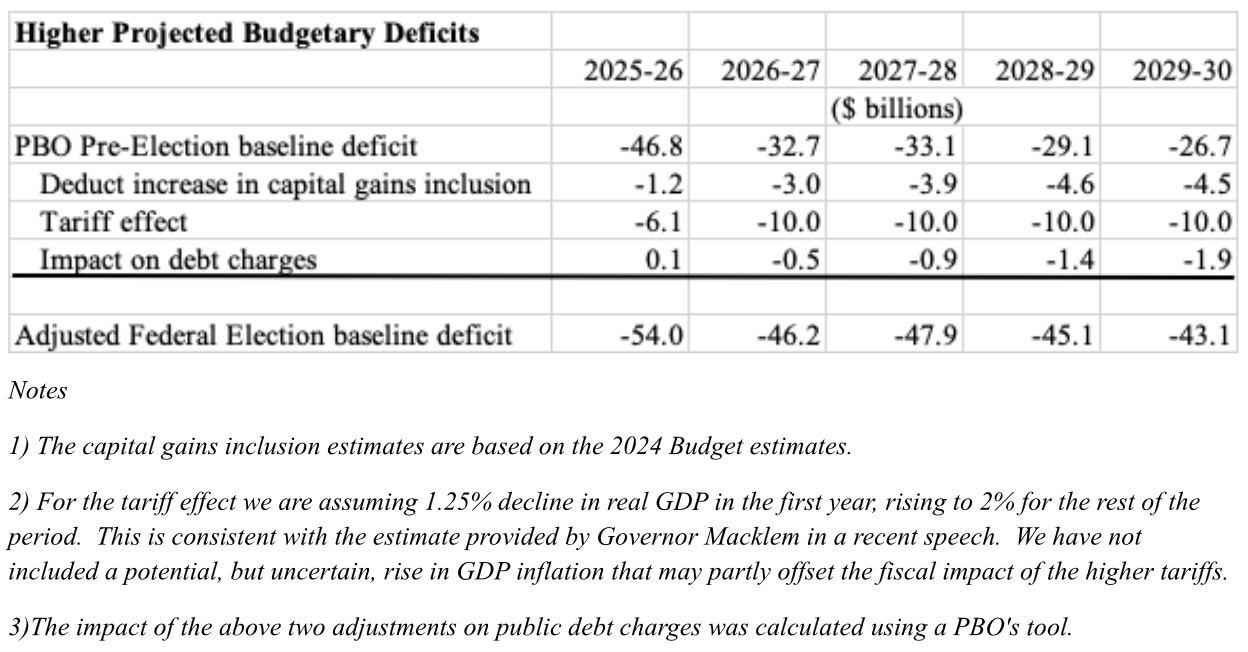

The economic and fiscal outlook has deteriorated since the Fall 2024 Economic Statement and the Parliamentary Budget Officer (PBO) Pre-Election Outlook (table above). US tariffs will slow the Canadian economy. Measures like the proposed changes to capital gains taxation did not become law prior to the prorogation of Parliament and the associated planned revenues will not be available to the treasury. IFSD estimates that these effects will add $68 billion in additional deficits over the planning horizon.

In recent weeks, Canadians have seen party proposals worth tens of billions of dollars in new spending measures, tax reductions and claims of fiscal savings. While parties have been working with the PBO to cost individual proposals, we still don’t know how that math adds up. Will the plans be credible? Will the federal government’s books remain sustainable? Will voters get to see how parties intend to deliver on promises? The clock is ticking.

Mostafa Askari, Sahir Khan and Kevin Page work at the Institute of Fiscal Studies and Democracy at the University of Ottawa.