Happy New Yield

By Douglas Porter

January 10, 2025

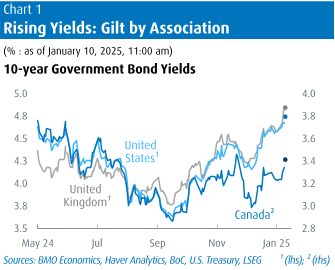

Political events may have grabbed the spotlight to start 2025, but global financial markets are warily spying the sustained back-up in long-term bond yields. A surprisingly sturdy U.S. economy, lingering inflation pressures, a back-up in oil prices, and the prospect of more heavy government borrowing globally are combining to drive long-term rates higher. The 10-year Treasury yield pushed above 4.75% on Friday morning and 30-years were probing the 5% threshold, both up about 100 bps from the nearby lows reached just in September, and only just below the 17-year highs reached in October 2023. The steady rise in rates is spilling into other bond markets, most notably the U.K., but also France, Australia and even Japan.

The rise in yields was given another spark by a much stronger-than-expected U.S. employment report for December. Payrolls handily topped expectations at +256,000, matching the second-largest gain in 2024 and clipping the jobless rate a tick to 4.1%. But even prior to that jolt, the steady upward grind in yields was unmistakable, egged on by a string of solid U.S. reports. Since the year began, we have seen both ISM surveys top expectations, auto sales hit their best level in years at above 17 million, job openings rise above 8 million, and jobless claims drop to barely 200k (historically, a very low reading). Meantime, the Atlanta Fed was tracking Q4 GDP growth of 2.7%, even prior to the jobs data.

Even before this avalanche of firm economic data, Fed officials were already turning much more cautious on the prospect of additional rate cuts. Minutes from the December FOMC meeting suggested that the 25 bp cut was only begrudgingly agreed upon, and most speakers this week heavily hinted at a pause. After the jobs data, there’s not much debate on the late January meeting—no move—but markets are still gamely pricing in chances of a bit more than one additional trim this year. Governor Waller had earlier suggested that rates could still come down more, provided inflation behaves. He also helpfully revealed that many Fed officials struggled with their contribution to the latest dot plot; not surprising, given the immense policy uncertainty coming down the pike. But that reinforces the point that the 50 bps of rate cuts for 2025 in that survey should be treated with the utmost caution.

Risk assets are not enjoying the ascent in yields, not one bit. Stocks are struggling to find direction in the New Year/New Yield, but the S&P 500 is on track to sag for the fourth time in the past five weeks. To be sure, the damage is still relatively light—the index is now down about 4% from its early December peak—but the stutter arrives at a time of year which is typically very friendly for stocks. Meantime, the U.S. dollar continues to roll higher against almost all comers, up more than 5% in the past two months alone. Even cryptocurrencies, which had been the clearest post-election winners, have pulled back sharply from their highs in a rising yield environment.

Canada’s bond market has also come under pressure to start 2025, after diverging massively from Treasuries over the past year. Ten-year GoCs jumped 20 bps this week alone to above 3.4% (albeit still a mammoth 130 bps south of U.S. yields). Canada’s December jobs report managed to even top the strong U.S. result, with 91,000 net new jobs, a 0.5% rise in hours worked and also a 1 tick drop in the jobless rate to 6.7%. Indeed, job growth was a solid 2.0% y/y, versus 1.4% for U.S. payrolls, even as Canadian GDP struggled to stay above 1%. The jobs bounce was not an isolated event—auto sales ended 2024 strong, home sales have revived, and net exports firmed in Q4.

Despite growing signs that the domestic economy is picking up, it’s the external backdrop that may yet keep the Bank of Canada in easing mode. The threat of U.S. tariffs looms like a heavy dark cloud over the recent somewhat sunnier economic reports. Incoming President Trump again warned at a press conference this week that Canada and Mexico face “serious” tariffs, apparently wholly unsatisfied with pledges and actions to tighten border security. With the tariff threat hovering, Canadian officials are busily crafting a potential retaliatory response, which while a necessary evil, could heighten the economic pain for Canada. Partly as a result of the uncertainty, markets are still pricing in a slightly better-than-even chance of a BoC rate trim this month.

Meantime, Canada is sailing into the trade maelstrom nearly rudderless, with the Prime Minister resigning Monday and proroguing Parliament until March 24, and with an election widely expected to soon follow (likely in early May). The Canadian dollar is not taking all this news lying down—more like falling down, as it has now sagged by more than 4% since the U.S. election to 69.3 cents (or $1.444/US$). The currency did not weaken further on net this week, although it quickly gave back Monday’s brief reprieve, and was not at all helped by the show of strength in the domestic jobs data. Notably, even the Canadian equity market, which had surprisingly brushed off the initial tariff threats, has shown a flutter of concern more recently. With rising global bond yields now piling on, the TSX has backed off roughly 4% from the record highs it reached just five weeks ago.

Item from the Wall Street Journal: The Securities Association of China late last month warned brokerages and fund managers to ensure that their economists and analysts “play a positive role” in interpreting government policies and boosting investor confidence. Offenders, according to the association, can be fired. At a meeting this weekend, Cai Qi, Xi’s chief of staff, urged propaganda chiefs across the country to “strengthen economic publicity and expectation management”—a call to snuff out negative commentary about the economy. The China Securities Regulatory Commission said the securities association’s directive mainly targets “chief economists who make unprofessional and irresponsible remarks.”

Oh my. This edict was apparently prompted by the temerity of one Gao Shanwen, Chief Economist at SDIC Securities (a state-owned firm), to raise doubts over China’s economic management and to suggest that actual GDP growth could be about half of the official 5% estimates. While economists may be restrained in their opinions, financial markets are less encumbered—unlike the rest of the world, China’s bond yields are plunging, with the five-year yield dropping 100 bps in the past year to around 1.4% (close to Japan’s yield!), and the yuan has depreciated more than 3% to 7.33/US$ in the past two months. Going back to the directive, and its cease and desist on “unprofessional and irresponsible remarks”; one can only wonder what we would ever write about on Canada if it applied here.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.