Global Outlook 2025: Just Tariffic

By Douglas Porter

December 13, 2024

Heading into the turn of the year, economic forecasters are dealing with a serious bout of cognitive dissonance—we keep projecting steady growth and moderate inflation, even when faced with cascading risks to the outlook, which could easily result in conditions that are the opposite of steady or moderate. In fairness, those risks cut both ways; geopolitical and trade risks point to the downside, but ebullient financial markets point to upside risk for growth in 2025. And we will note that this is not dissimilar to the position we found ourselves in exactly a year ago—fraught geopolitics, robust markets—and 2024’s economy turned out to be characterized as steady growth—in the U.S., Canada and globally—with moderate inflation.

A brief review of last year’s forecasts shows that we and the consensus were again too cautious on the growth outlook, especially for the tireless U.S. economy, but were pretty much on target for the cooldown in consumer price trends. So, after inflation’s two-year reign of terror, central banks were able to begin the process of unwinding heavily restrictive policies, albeit at wildly different paces. While the Fed’s step down wasn’t exactly smooth, the 100 bps of total rate cuts—assuming it meets market expectations with a 25 bp clip next week—was precisely what we were anticipating at the start of the year. The big surprise in the U.S. was another year of nearly 3% GDP growth, but the upside was driven by solid productivity gains, so inflation ebbed and unemployment nudged up, both mostly as expected.

The friendly combination of still-solid growth, calming inflation, and easing central banks helped power global equity markets—the MSCI All Countries index now sits 20.6% above end-23 levels, on track for the second-best year of the past decade (topped only by 2019). Given that stocks tend to lead the economy, and that central banks have aggressively cut rates with inflation back close to target, we would normally be looking for sturdy economic growth in 2025. Even the yield curve is back to normal, with 10-year Treasury bonds moving above 3-month bills this week after more than two years of inversion. But the darkening cloud of trade protectionism counsels caution, especially for Canada, Mexico and China.

What does 2025 hold for the global economy? Even after the Year of the Election in 2024, a variety of major economies face potential power shifts next year as well, including France, Germany, South Korea and Canada, while many others will be dealing with the first full year of a new leader. Despite choppy political waters, the growth outlook remains constructive amid robust financial markets, central bank rate cuts, cooler energy and food prices, and normalized supply chains. Even with the tariff threat, we are looking for the global economy to grind out another year of 3% real GDP growth, or slightly better, just mildly below the long-term average of around 3.5%.

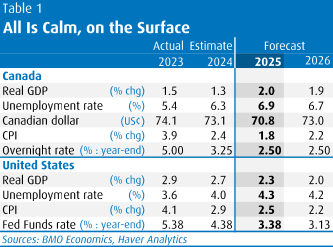

Among the major economies, we look for the U.S. to step back only slightly in 2025 to 2.3% from 2.7% this year. While milder than recent trends, that call is a bit above the latest consensus (closer to 2.0%) and above the Fed’s view of the long-run trend (1.8%). Yet, we look for the jobless rate to drift higher to 4.3% as growth will continue to be driven by solid productivity gains. A less-tight labour market and slightly cooler inflation trends are expected to allow the Fed to continue trimming rates. Similar to this past year, we look for another 100 bps in total rate reductions in 2025, bringing the overnight rate down to 3.25%-to-3.50% by year-end, which is still judged to be slightly on the restrictive side. That call is more aggressive than market pricing for Fed cuts, but we would again highlight the magic word: productivity. Moreover, any tax relief flowing from Washington’s power shift would be a 2026 story, while trade uncertainty and some government spending cuts could bite soon.

In contrast to global resiliency, Europe is struggling with sub-1% GDP growth. Germany is particularly challenged, posting a small drop in output for the second year running. Its major export industries of autos and capital equipment are battling with the full force of Chinese competition. France is burdened with tough fiscal math and a political stalemate. Yet, smaller Euro Area economies are faring much better, and 100 bps of ECB rate cuts to-date will support 2025 growth. It’s a similar story in Britain, where GDP growth has been stuck below 1%, inflation is near 2%, and the BoE is easing—albeit more cautiously than the ECB.

Japan ran against the grain this year, as per usual. GDP dipped into a small contraction in 2024. And, yet, the Bank of Japan still hiked by 35 bps (with a meeting to go), finally leaving behind decades of zero or even negative interest rates. Even as the BoJ was raising rates while others were cutting, the yen still depreciated almost 10%; at one point, the dollar pushed above ¥160 for the first time in more than 30 years, which, in turn, helped the Nikkei to finally top its 1989 high with a 20% y/y gain. With inflation likely to be around 2% and growth close to 1% in 2025, perhaps Japan is truly becoming a normal economy again.

China’s economy actually managed to grind out slightly better growth than we anticipated at the start of the year, although the 4.9% advance was heavily reliant on exports. The property crisis rolls on, weighing on domestic spending, but China has pledged forceful stimulus measures, both on the monetary and fiscal fronts. The economy is going to need it, as incoming president Trump has already threatened an additional 10% tariff on China’s goods on “Day 1”—and few believe he is bluffing on this one. Currency depreciation will somewhat blunt the impact, as the yuan has weakened 2% y/y to around 7.28/US$. Even so, we expect the chillier trade backdrop to shave China’s GDP growth to 4.5% in 2025.

Pulling these strands together for Canada’s outlook, the global growth backdrop and broadly stable commodity prices are mostly neutral. Unfortunately, the trade backdrop is anything but; as the Bank of Canada noted in this week’s rate announcement, the U.S. threat of 25% tariffs “is a major new uncertainty”. Even if Canada is ultimately spared, or the punishment is reduced to, say, 10% for good behaviour, the deep uncertainty will cast a pall on the investment outlook. This threat, and the very real prospect of retaliation, has unfolded just as the domestic side of the economy looked to be improving. Home and auto sales are now clearly responding to rate relief, household debt ratios are falling fast, and some modest fiscal stimulus will further lift spending in early 2025. Alas, growth will do well to reach 2% in a no-tariff scenario, and less than half of that with tariffs (even assuming very stimulative monetary and fiscal responses). Our base case calls for another 75 bps of BoC rate cuts, on top of this year’s world-leading 175 bps, taking the overnight rate down to 2.5% by mid-year. The Canadian dollar is ending the year barely clinging to the 70-cent level (above $1.424/US$), down 7% since end-23. A surprisingly aggressive BoC gave it an initial push, but the U.S. tariff threat and a broad greenback rally were the mightier blows—it will take a trade détente to turn the loonie around. A full trade war will send it much lower.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.