A Loonie in the Court of King Dollar

By Douglas Porter

November 22, 2024

While components of the Trump Trade have been ebbing and flowing in the wake of the election, there remains one constant—the U.S. dollar continues to grind higher. Since hitting a nearby low in late September, the greenback has been on an eight-week roll, rising by roughly 6% on a trade-weighted basis against the major currencies. Compounding the dollar’s ascent are gathering woes in Europe, with the euro among the biggest losers, dropping 5% just since Election Day. The dollar’s strength is particularly notable in the face of the BRICS’ goal of moving the global economy away from the greenback. But talk is cheap—note that 3 of the 5 top members of that club have actually boosted their holdings of U.S. Treasuries in the past year, and China has only shaved them by $6 billion.

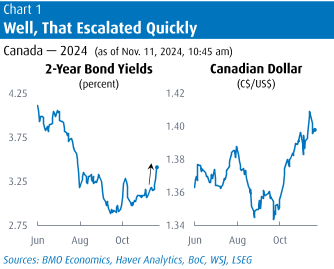

One currency that managed to seriously buck the dollar’s trend this week was none other than the lowly loonie. After dipping its beak below the 71 cent waterline (or $1.41/US$) on Monday, the Canadian dollar managed to rise nearly 1% this week, driven largely by a reassessment of just how dovish the Bank of Canada will be in coming meetings. Three factors drove the market rethink: 1) The more cautious tone from the Fed, and the ensuing deep drop in the loonie itself, may put some chill into the Bank’s aggressive rate cut ambitions. 2) The October CPI came in a bit hot, with a two-tick rise in the yearly core readings a minor rude surprise. And 3) Ottawa’s newfound largesse, including cash handouts and a GST holiday, could bump growth by 0.3 ppts, thus reducing the onus on the Bank to cut hard and fast.

One could add a fourth, and perhaps more fundamental, factor to the list. The underlying Canadian economy is displaying some more positive signs of late. Late last week we learned that existing home sales popped 30% y/y in October, moving above the 10-year average for the first time since the BoC first began to hike rates way back in early 2022. And, recall, the Bank carved rates another 50 bps late in that month, paving the way for potentially more gains. Homebuilding also rebounded in October after a late-summer lull, rising back to the average of the past two years at just above 240,000 units. And, after a tough go, the Canadian consumer has found a pulse—real retail sales have risen by 2.6% in the three months to September (or more than a 10% a.r.) after declining 0.6% in the prior 12 months. The early read on October is for another solid gain (+0.7% for nominal sales).

As a result of these many forces, two-year GoC yields popped more than 20 bps this week to around 3.4%. That wouldn’t be such a shocking move if the BoC was in the process of hiking, but we’re knee-deep in an aggressive rate-cutting cycle. In perspective, this week’s back-up ranks as the third-largest weekly rise in short-term yields in the past 18 months, or since the Bank stopped raising rates. Longer-term yields rose only a little less ferociously, with 10s up almost 20 bps to 3.45%. Last week’s piece noted that Canada/U.S. 10-year spreads had hit a record wide of below -120 bps; that gap has quickly crumbled to -95 bps on the major rethink on the BoC outlook. Meantime, Canadian equities are on a tear, with the TSX jumping 2% this week to a new record high and now up more than 26% y/y. Domestic stocks even responded positively to Ottawa’s stimulus announcement, with retailers and restaurants poised to benefit.

After this week’s developments, we have tweaked our Canadian call on a few fronts. The key points are:

- We are lifting our Canadian GDP growth outlook for 2025 by 3 ticks to 2.1%, a notable pick-up from this year’s expected growth rate of barely above 1%. That may seem a tad surprising in light of the uncertainty that is now overhanging Canada’s trade relationship with the U.S., as well as the impending deep slowdown in population growth. But the outlook for the consumer has strengthened markedly, courtesy of more than $11 billion of combined stimulus measures that are poised to wash over the economy in the next four months. That, and interest rate cuts, should more than offset the two big drags.

- We are shaving our inflation call around the turn of the year, but then bumping it back up later in 2025. Since sales taxes do directly feed into CPI, the GST/HST holiday will mechanically cut inflation in the next two months, but will quickly rebound later, with perhaps an added push from more consumer spending power. Moreover, as noted, the October result came in a bit hot at 2.0%. Overall, this leaves the annual call on CPI unchanged at 1.8% next year, down from a 2.4% average inflation rate this year (and more than two points south of 3.9% in the bad old days in 2023).

- As a result of the somewhat firmer growth outlook, we are tweaking our BoC view. We still look for a 25 bp cut in the December meeting, taking the rate to 3.5%, and—for now—we look for rates to keep falling to a 2.5% terminal in 2025. But the path to that low now looks a little windier, with the Bank unlikely to get there until September, with a couple pauses in between. And the downside risk to the rate call has been removed; if anything, there is now a bit more chance that the Bank will not take rates that low—in fact, markets are now pricing in a low of around 3% for the BoC next year.

- One call we are not adjusting is the Canadian dollar. We had been assuming that the loonie would hold its ground around current levels through the early part of next year, before making a modest recovery later in 2025 to around 74 cents (or $1.35/USD). In part, that’s driven by the assumption that the U.S. dollar itself will moderate somewhat, as some of the recent enthusiasm fades and as the Fed grinds rates lower. Given the somewhat brighter outlook for near-term Canadian growth, we are comfortable with that call.

The coming week is shaping up to be a bit quieter on the economic front, with U.S. Thanksgiving weighing in, literally. Our focus will be on Canada’s Q3 GDP release on Friday. It’s not so much the quarterly result that will garner attention—it’s widely expected to post punk growth of little better than 1%. The flash reading for October will be helpful, along with the September result (flash of +0.3% likely overstated things), in informing if the economy is finally gathering a bit of rate-cut momentum. But what we’re really keenly anticipating—and please, no judgement—are the revisions to history. The expected big upswing in the past three years, a cumulative addition of 1.3% of GDP, may be accentuated by an uptick in the first half of this year—initially pegged at just under a 2% pace. Prior estimates of a massive growth gap between the U.S. and Canada, and the latter’s horrendous per capita performance of recent years, may be dulled down to something less ragged.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.