Harris vs. Trump: Comparing the Economic Consequences for Canada

Shutterstock

Shutterstock

By Michael Davenport and Tony Stillo

September 18, 2024

Our conclusions:

- A Kamala Harris presidency wouldn’t materially alter the economic outlook for Canada. Another term for Donald Trump would usher in stiff tariffs and a renewed era of global uncertainty that would likely mean higher inflation, tighter monetary policy, and slower economic growth relative to our baseline.

- Our modelling of a Harris presidency with Democratic control of Congress suggests Canada would see small, temporary boosts to GDP and inflation which largely dissipate by 2029. If Harris wins in November, we don’t think it would alter the path for Canadian monetary policy.

- A Trump victory and Republican control of Congress would result in weaker growth, higher inflation, and tighter monetary policy in Canada and globally, largely due to the imposition of sweeping tariffs on Canada, China, and other major US trading partners. Canada’s GDP would be 0.9% lower than our current baseline by 2029, with substantial hits to business non-residential investment and international trade.

- Both scenarios assume the party that wins the presidential election also gains control of Congress and fully implements their campaign pledges. While we subjectively place higher odds on a divided US government, these scenarios provide reasonable bookends for the potential impacts of the US election on the Canadian economy.

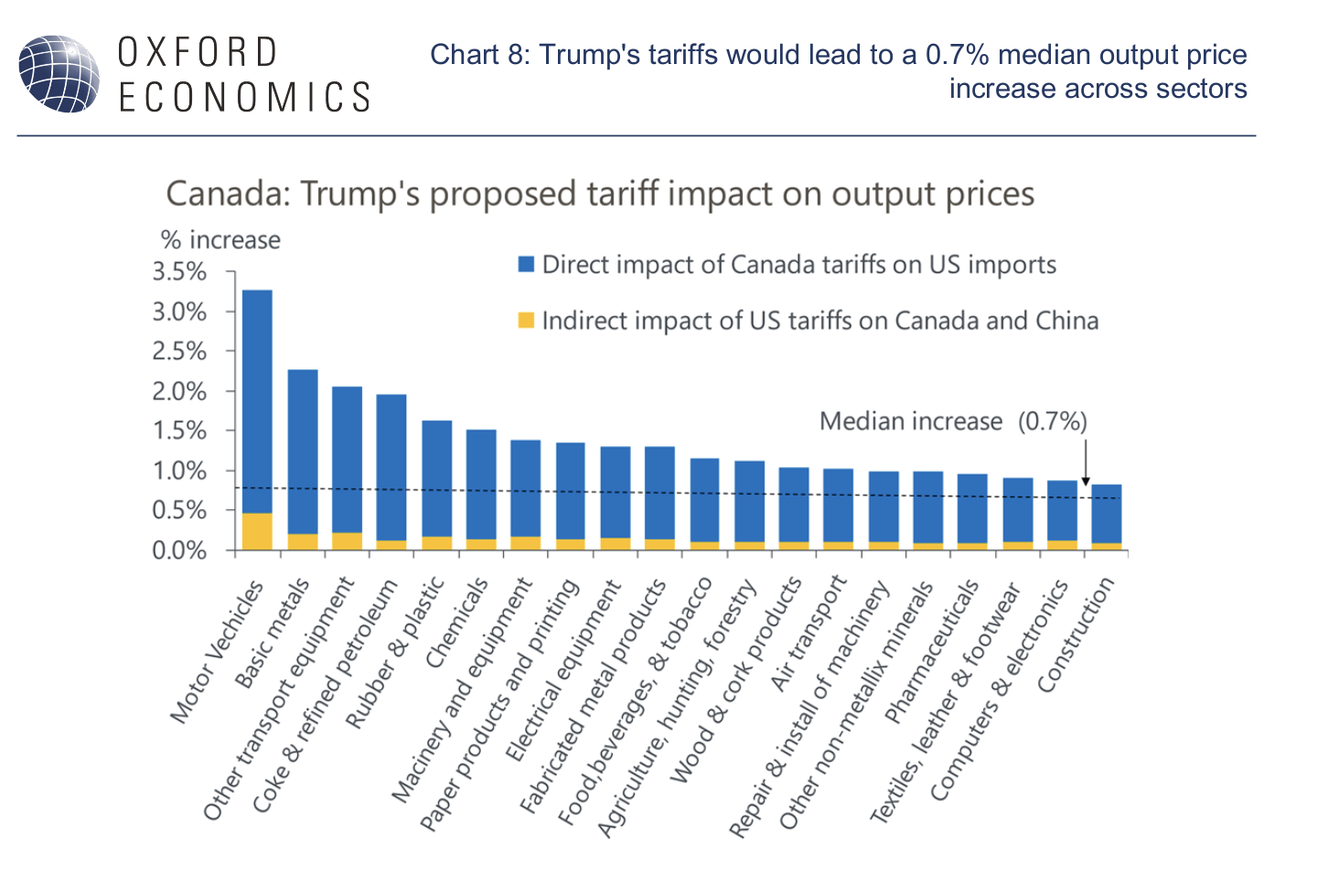

- Harris doesn’t have plans for new tariffs. But Trump’s proposed 10% tariffs on Canadian goods imports would hit Canadian exporters while retaliatory tariffs would disproportionately raise costs for producers that rely on imported intermediate goods from the US. We estimate Canada’s heavy manufacturing sectors like motor vehicles, basic metals, coke and refined petroleum, rubber and plastics would experience the largest cost increases under Trump’s tariffs.

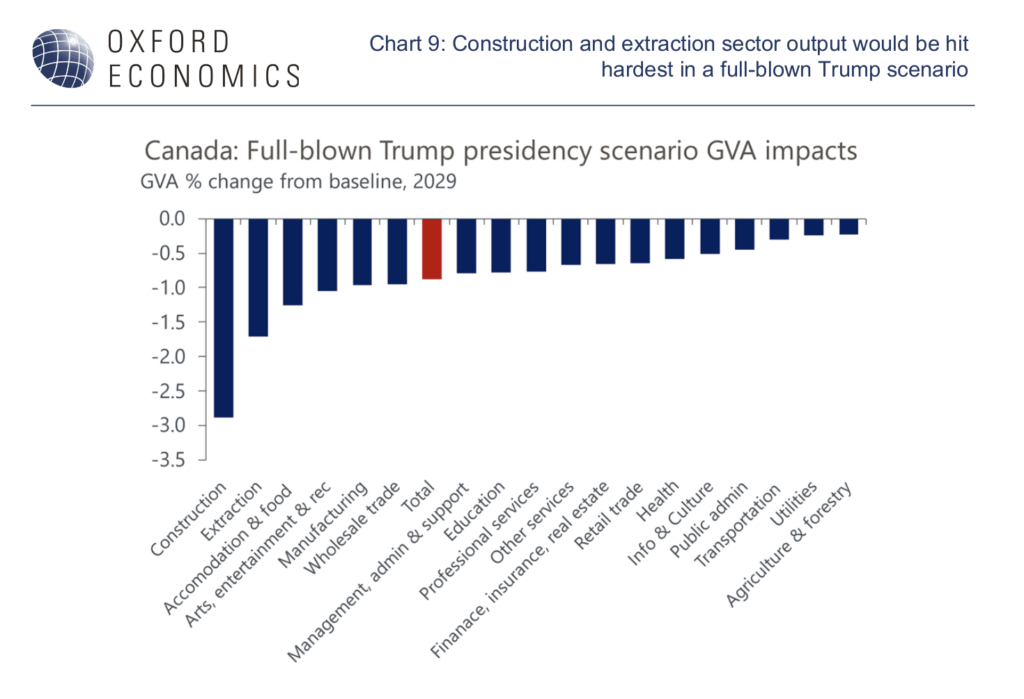

- The direct negative impact on Canadian manufacturers from Trump’s tariffs would be compounded by weaker aggregate demand because of higher inflation, tighter monetary policy, elevated global uncertainty, and lower business and consumer confidence. These same forces would significantly slow growth in Canada’s construction and extraction sectors, along with services such as accommodation and food, and arts, entertainment, and recreation.

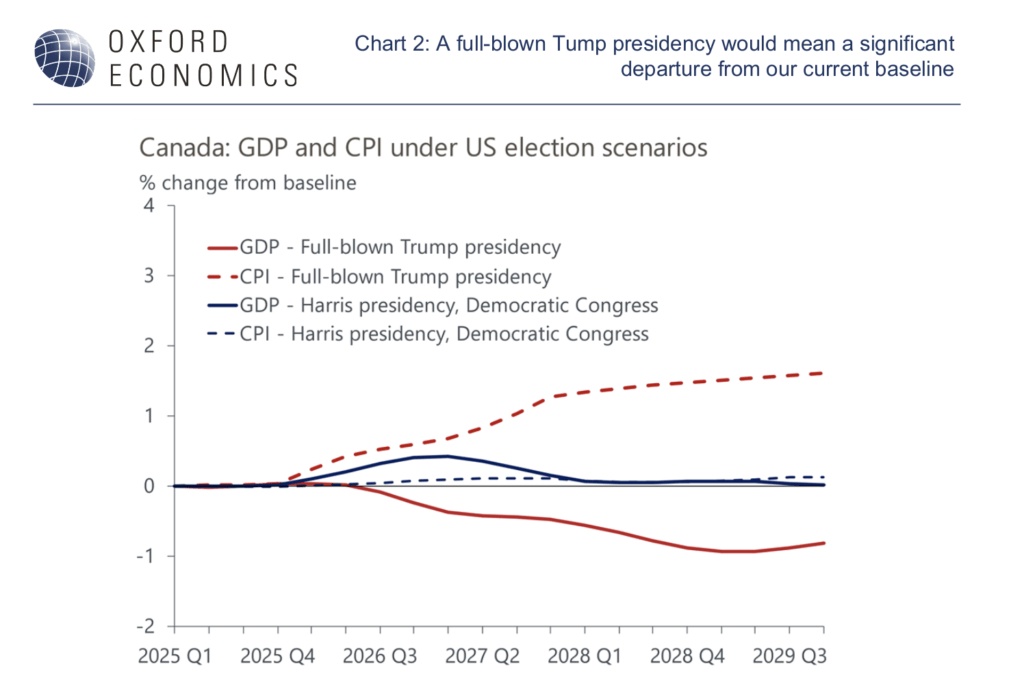

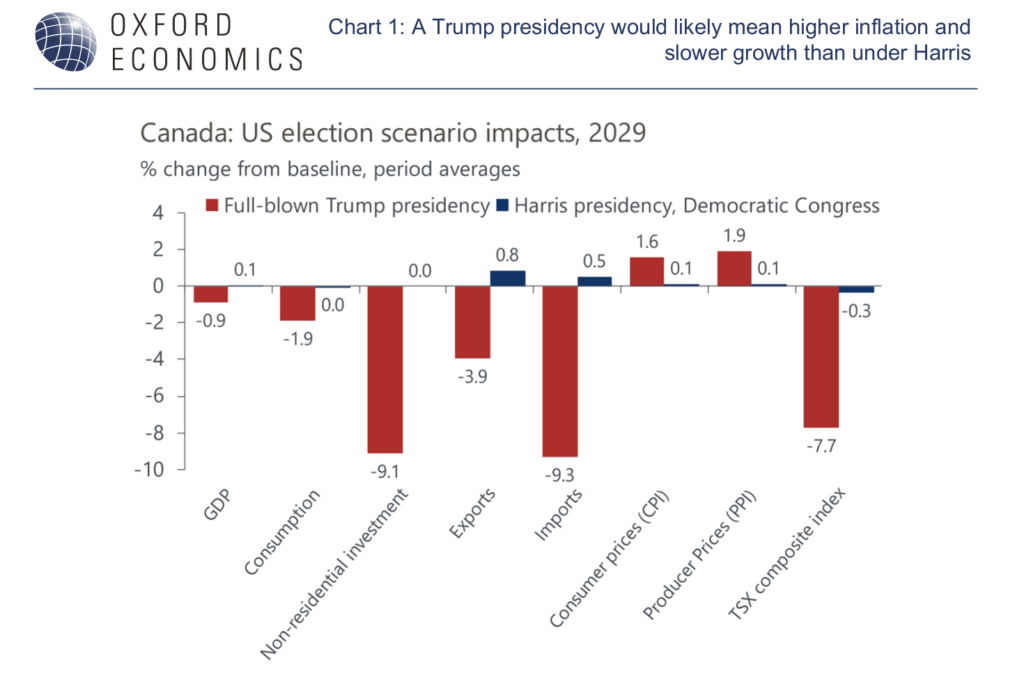

Using our Global Economic Model (GEM), we assess the impact of two US presidential election scenarios on the Canadian economy. In the first scenario, Vice President Kamala Harris wins the presidential election and the Democrats take control of Congress. The second is our Full-blown Trump scenario, where former president Donald Trump wins the presidential election and Republicans also take control of Congress (Chart 1).

Of course, there exists a wider range of potential election outcomes, and we subjectively assign higher odds of a divided government rather than one that is fully controlled by the Democrats or the Republicans. Nevertheless, these scenarios serve as reasonable bookend estimates for the potential economic impacts of the US election for Canada based on stated policies from both the Trump and Harris campaigns (Chart 2).

Harris Presidency, Democratic Congress Scenario

Our Harris presidency scenario assumes full implementation of the “Agenda to Lower Costs for American Families” plan, along with a wider range of social benefit policies focused on childcare, healthcare, housing, and education. These new spending initiatives would only be partially paid for by higher taxes on corporations and wealthy individuals.

In our Harris scenario, the US economy gets an initial demand-side boost from tax credits and higher government spending from the new social benefit programs. Higher taxes on businesses and the wealthy take longer to ramp up, so the net effect on the US economy is modestly higher GDP and inflation in the short run.

US GDP rises 0.6% above our baseline by 2026. Stronger demand puts modest upward pressure on inflation, pushing growth in the US CPI about 0.2ppts above our baseline in 2027. The modest boost to growth and inflation causes the Federal Reserve to cut interest rates at a slightly slower pace, with the target for the federal funds rate reaching its long-term neutral level of 2.75% in mid-2028, about one year later than our baseline forecast.

It is important to note that in both our Harris and Trump scenarios it takes time for the new fiscal policies to be enacted. Therefore, there aren’t material economic impacts until 2026. Moreover, our Harris scenario does not consider any new tariff measures beyond those already in place, nor does it assume any change to US immigration policy.

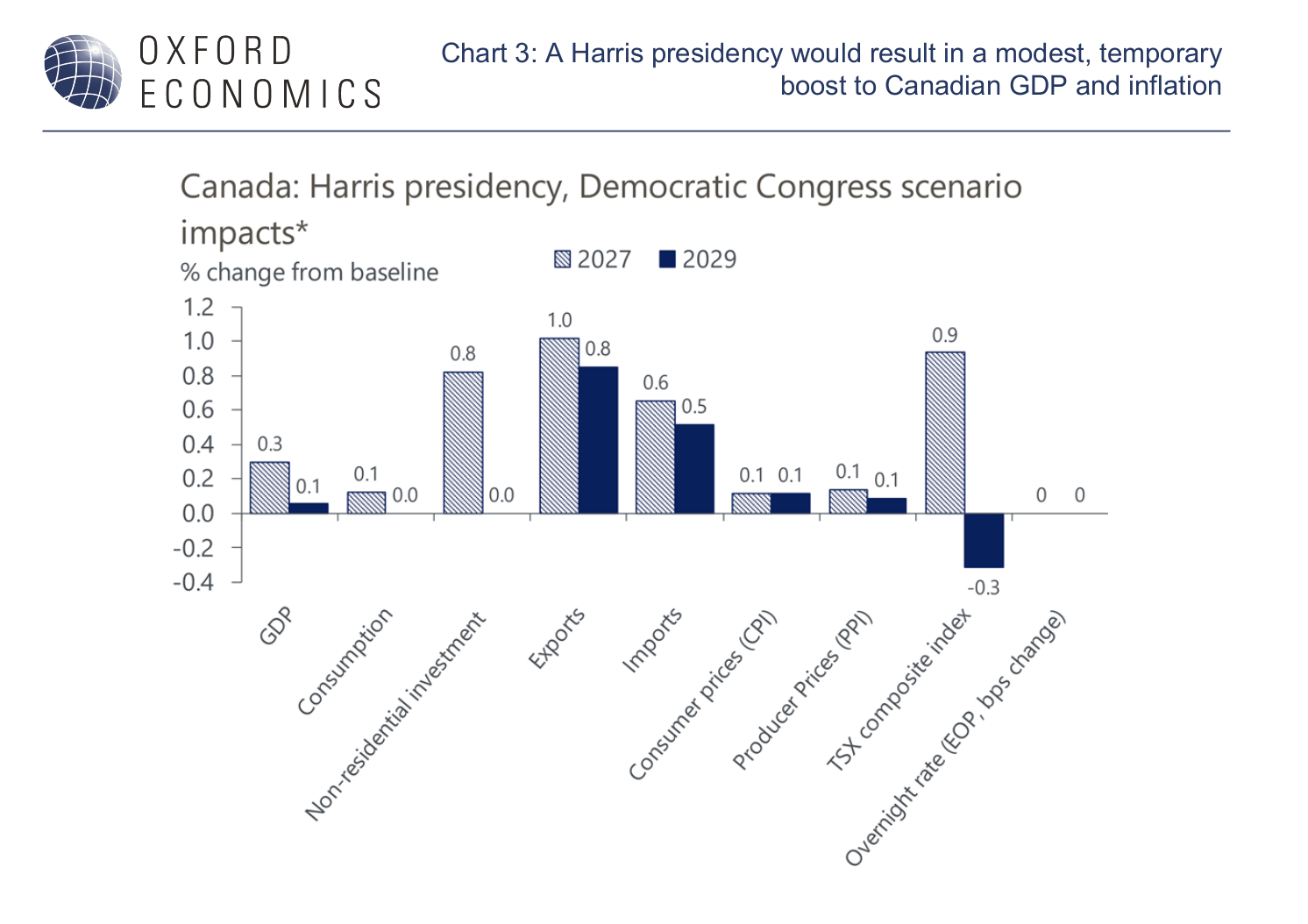

Canadian economy would experience a small, temporary boost under Harris

A Harris presidency would also modestly boost Canadian GDP and inflation. Canada benefits directly from the short-term demand-side boost to the US economy via increased demand for its exports. Total Canadian exports would rise 1.5% above our baseline in 2027, leading to a modest net improvement in Canada’s trade balance.

A stronger US economy from a Harris presidency would also indirectly boost Canadian business non-residential investment, albeit marginally. Business capital expenditures would rise 0.8% above our baseline by 2027. Overall, Canadian economic growth would be 0.2ppts stronger in 2026 than our baseline, and the level of GDP would rise 0.3% above our baseline by 2027. However, the initial boost to Canada’s exports and business investment fades and Canada’s GDP returns to our baseline by the end of 2029 (Chart 3).

The boost to Canada’s GDP closes the economy’s negative output gap more quickly, and stronger global demand causes commodity prices to rise temporarily. Together, these forces push Canadian CPI inflation 0.1ppt higher than our baseline in 2027, but not enough for the Bank of Canada (BoC) to consider tightening monetary policy.

The boost to Canada’s GDP closes the economy’s negative output gap more quickly, and stronger global demand causes commodity prices to rise temporarily. Together, these forces push Canadian CPI inflation 0.1ppt higher than our baseline in 2027, but not enough for the Bank of Canada (BoC) to consider tightening monetary policy.

Other considerations for Canada under a Harris presidency

- A Harris presidency would likely mean a continuation of the current status quo for Canadian policymakers and, on net, less protectionist trade policy relative to Trump. We don’t anticipate a Harris administration would pursue any significant new tariffs, let alone those that target Canada. However, Harris may still enact some protectionist trade measures aimed at Canadian industries, like the recent near doubling of US duties on Canadian softwood lumber by the Biden administration. There could also be ongoing trade disputes, such as Washington’s request under USMCA challenging Canada’s Digital Services Tax.

- Even if Canada doesn’t find itself directly in the crosshairs, the trend towards increasing US protectionism and rising trade tensions with China will likely continue to gain momentum no matter who wins. The potential remains for new tariffs on Chinese imports, such as those recently imposed by Biden on China’s electric vehicles (EVs) and steel. As was the case with EVs and steel, Canada would likely be obliged to follow suit and match any new US tariffs on Chinese exports.

- Moreover, the United States-Mexico-Canada Agreement (USMCA) is set for review on July 1, 2026, and talks between the three countries will likely ramp up in 2025. While under a Harris presidency, the USMCA negotiations may be slightly more favourable to Canada, there will still likely be pressure on Canada to make concessions to increase access to Canadian markets for US exporters.

- There will also be a Canadian Federal election by October 2025, and possibly as early as this fall. A Conservative government led by Pierre Poilievre could complicate the USMCA negotiations and broader US-Canada relations further given the party’s differing political ideologies to a Harris administration.

Full-blown Trump Presidency Scenario

If former president Trump is re-elected and Republicans gain full control of Congress, as assumed in our Full-blown Trump scenario, the economic impact on the US, global, and Canadian economies would be more pronounced than with a Harris presidency. This would result in much more significant US fiscal stimulus, curbs on immigration, and the imposition of substantial new tariffs on major US trading partners, including Canada.

Republicans would double down on tax cuts for individuals and corporations and pursue a wide set of pro-business policies. Tax cuts would be headlined by a reduction in the federal corporate tax rate from 21% to 15%, bringing the US corporate tax rate to the bottom one-third among OECD countries. We also assume that the Trump administration would partially repeal the Inflation Reduction Act’s (IRA) clean energy tax credits by eliminating the clean vehicle tax credits.

Our Full-blown Trump scenario also assumes the new administration phases in 60% tariffs on all Chinese imports and 10% blanket tariffs on imports from all other major trading partners, including Canada, by 2027. We assume Canada and other targeted countries would respond with retaliatory tariffs of the same magnitude on US imports, except for China which responds with a less than proportional 40% tariff in line with past experience. This re-ignites a US trade war with China, which has a significant negative impact on global trade. This leads to rising global uncertainty and negatively impacts consumer and business confidence.

The US economy strengthens initially as substantial tax cuts and new spending boost demand. However, inflation rises and growth soon begins to slow sharply amid the reignited trade war. US GDP growth slows to just 1.5% in 2028, 0.6ppts slower than our baseline. US CPI inflation also reaccelerates to 2.7% in 2027 and 2.8% in 2028, forcing the Federal Reserve to prematurely pause interest rate cuts. Asset prices take a hit, with the S&P 500 falling by around 10% in 2026. Meanwhile, US 10-year treasury yields increase by nearly 70bps relative to our baseline.

Canada would see rising inflation, higher interest rates, and slower growth

Given its close ties with the US, the Canadian economy would be hit hard in a full-blown Trump presidency. The rekindling of the US-China trade war and weaker US and global demand would weigh on Canadian goods exports. Non-fuel goods exports would fall 0.1% in 2027, 2ppts slower than our baseline forecast, before dropping 1% in 2028. This would be the largest annual decrease since the Global Financial Crisis and the coronavirus pandemic.

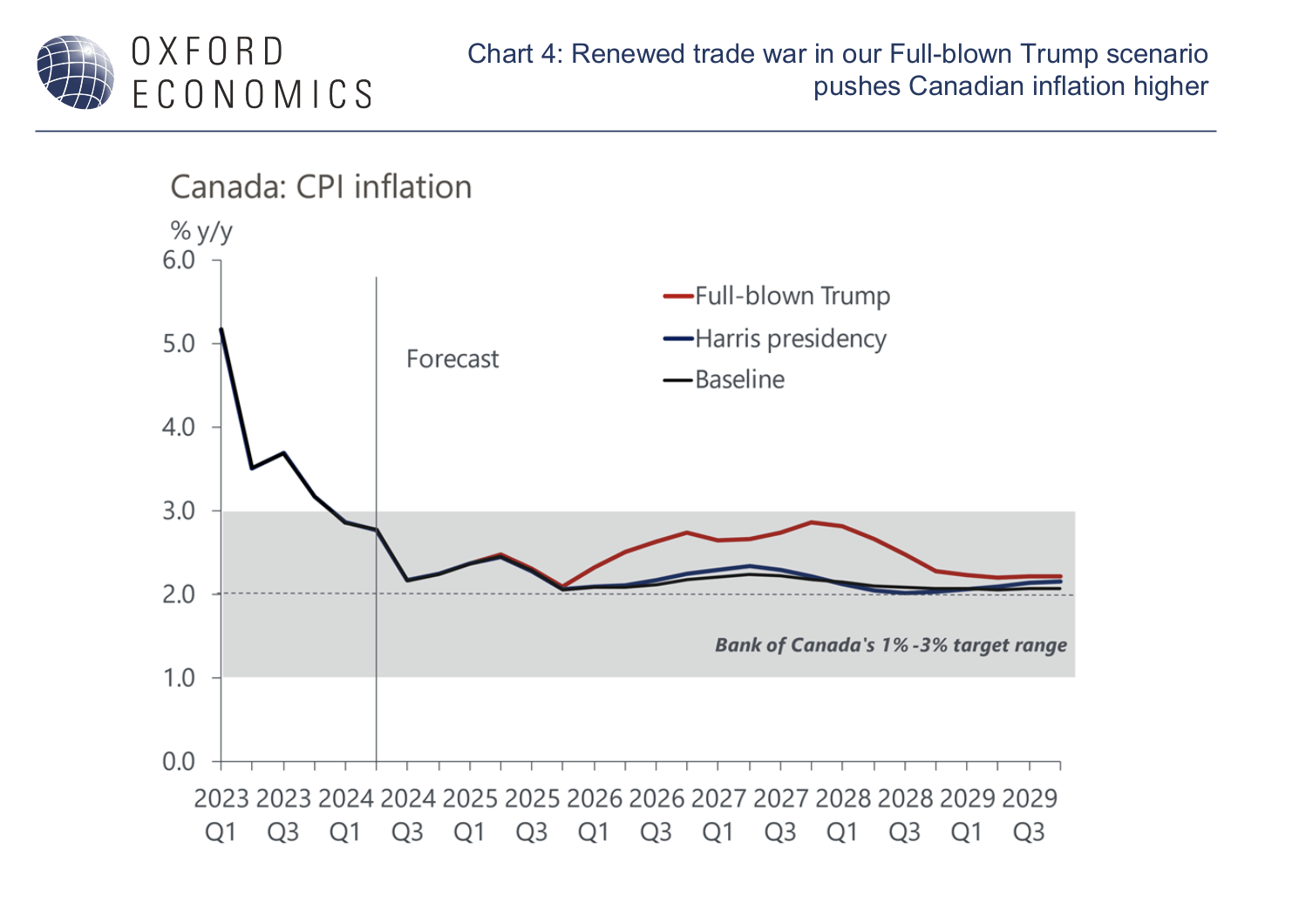

Canadian domestic demand is also hit hard as the retaliatory tariffs and a weaker Canadian dollar put upward pressure on CPI inflation. After easing back to the BoC’s 2% target in mid-2025, CPI inflation rises to 2.6% on average in 2026 and 2.7% in 2027, much faster than our baseline forecast for 2.1% and 2.2% inflation in both years respectively (Chart 4).

Canadian domestic demand is also hit hard as the retaliatory tariffs and a weaker Canadian dollar put upward pressure on CPI inflation. After easing back to the BoC’s 2% target in mid-2025, CPI inflation rises to 2.6% on average in 2026 and 2.7% in 2027, much faster than our baseline forecast for 2.1% and 2.2% inflation in both years respectively (Chart 4).

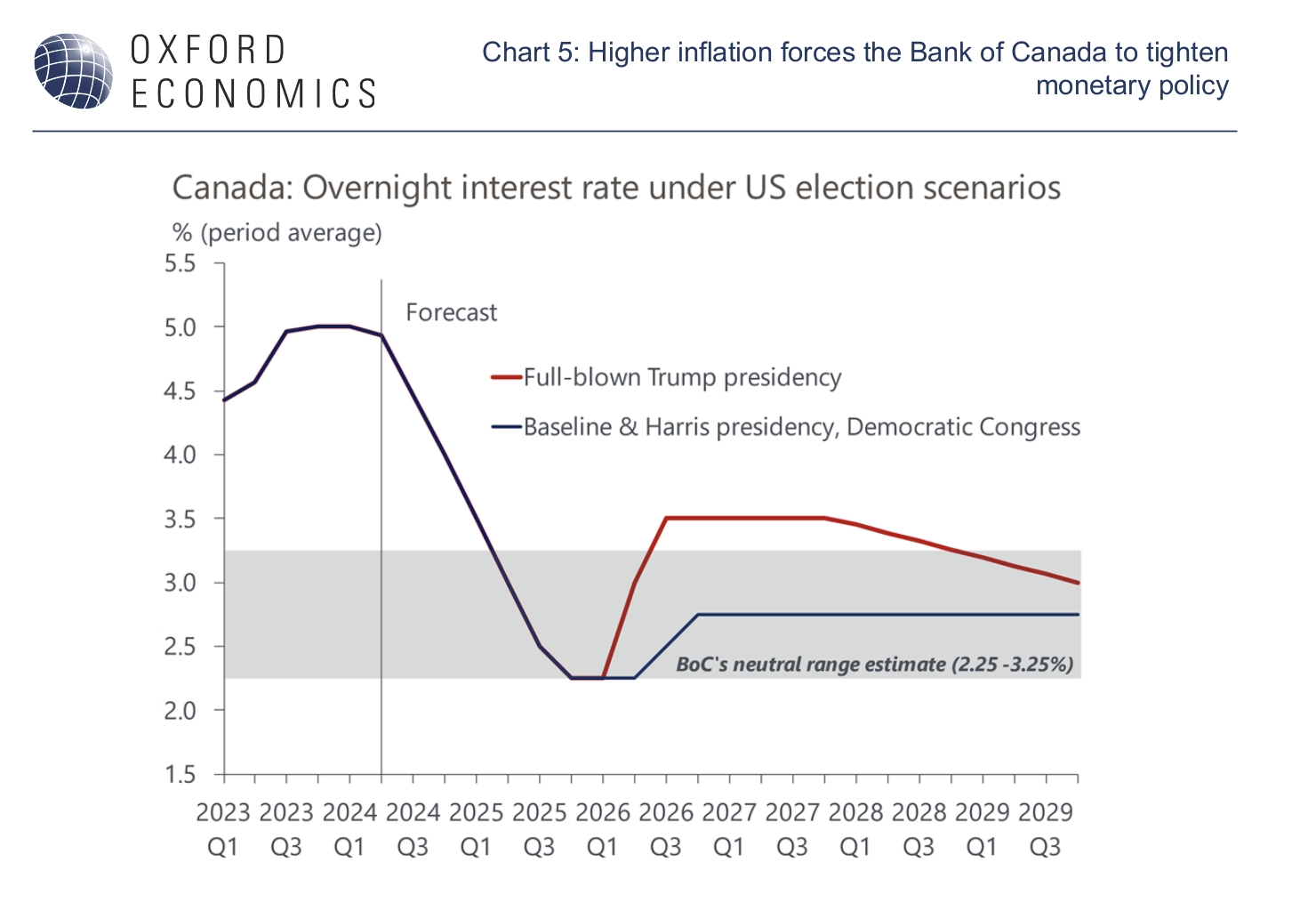

Rising inflation and a weaker Loonie prompt the BoC to hike interest rates by a cumulative 125bps to 3.5% by early 2026 and hold the overnight rate in restrictive territory for longer (Chart 5). Canadian financial assets also take a hit, with the TSX composite index falling 8% relative to our baseline in 2027.

The combination of rising inflation and higher interest rates squeezes Canadian household disposable income, causing consumer spending growth to slow. Growth in private investment also weakens as higher interest rates, weaker corporate profits, and elevated global uncertainty deter business capital spending. Weaker consumer and business confidence compound these effects.

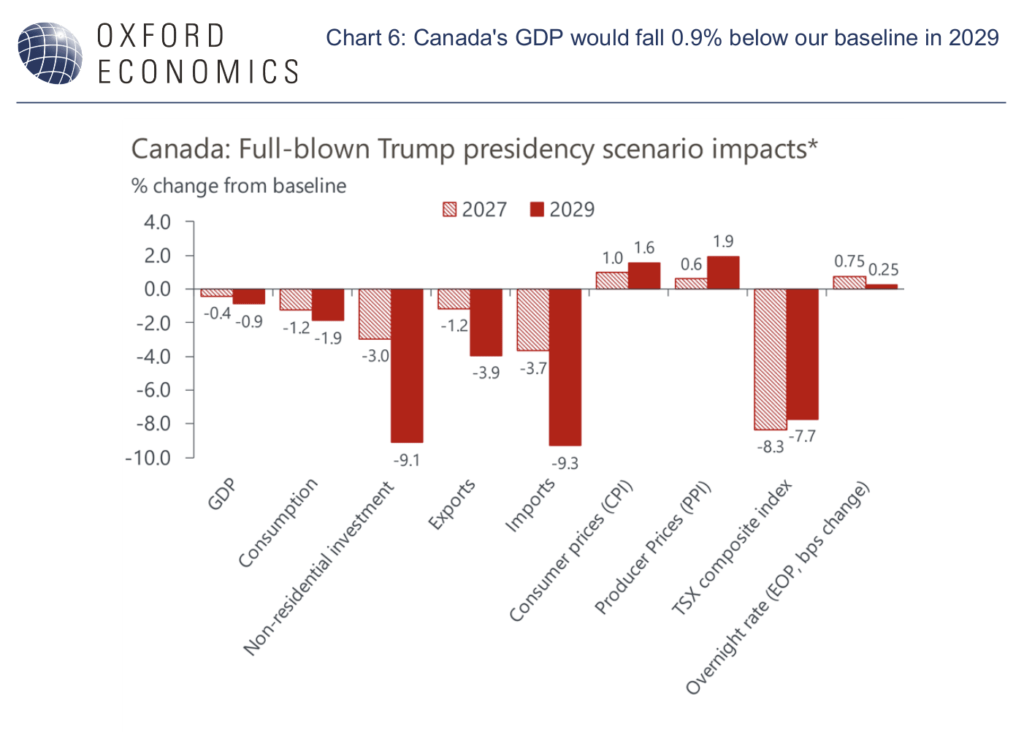

Non-residential business investment falls 9.1% below baseline by 2029, while residential investment declines 7.7% relative to our baseline in 2029. Slower domestic demand and higher import prices from the tariffs would also cause Canadian imports to fall, partially offsetting the hit to the overall economy from weaker exports, consumer spending, and business investment, buffering the impact on Canada’s trade and current account balance.

Overall, in the Full-blown Trump scenario, Canada’s economy evolves broadly in line with our baseline in 2025 and 2026, but GDP growth slows sharply thereafter. GDP growth would decelerate to 2% in 2027 and 2028, 0.4ppts and 0.3ppts below our baseline forecast, respectively. In 2029, the level of Canada’s GDP would be 0.9% below baseline (Chart 6).

Other considerations for Canada under a Trump presidency

- The 10% blanket tariffs on Canadian goods imports proposed by the Trump campaign would directly contradict the USMCA agreement, one that the first Trump administration negotiated and celebrated as an important win for US industry and consumers. It’s very likely that a Trump administration would instead use tariffs as leverage to negotiate a more favourable trade agreement with Canada, as it did with steel and aluminium tariffs during the initial USMCA negotiations in 2018. If Trump wins the US presidential election this November, this will likely be a key feature of the USMCA renegotiations as they pick up steam in 2025.

- There’s also a risk that Trump’s corporate-friendly policies such as cutting the corporate tax rate, 100% bonus depreciation, and bringing back the ability of US firms to deduct R&D expenses could hurt Canada’s competitiveness and weigh further on Canadian business investment. This risks further constraining Canada’s lacklustre business capital formation and exacerbating already weak productivity growth. In our Full-blown Trump scenario, non-residential business investment falls nearly 10% below baseline by the end of 2029.

- The Trump campaign has also called for the repeal of the Inflation Reduction Act (IRA). We think it’s unlikely that a Republican-controlled US government would fully repeal the IRA, but our Full-blown Trump scenario does assume existing tax credits for EVs would be eliminated. A partial or complete repeal would be a mixed bag for investment in Canadian clean energy technology, battery production, critical minerals, and EVs.

- The IRA provides tax credits for EVs whose batteries contain critical minerals extracted or processed in Canada because of its free trade agreement with the US. There is another separate credit for EVs whose battery components were manufactured or assembled in North America. These have helped bolster battery and critical mineral investments in Canada since the IRA was passed in mid-2022.

- On the other hand, if Trump is successful in eliminating the IRA’s tax credits for green industries, it could make Canada relatively more attractive for green investments. The IRA spurred Canada’s federal government to introduce a series of measures designed to keep up with the US, such as the clean energy tax credits introduced in the 2023 budget which provided incentives for clean electricity, hydrogen, and other green technology manufacturing including EVs. So, to a degree, a full repeal of the IRA could work in Canada’s favour if it makes investment in Canadian clean energy and green technology relatively more cost competitive.

- The tightening of US immigration policy under a Trump presidency could also put increased pressure on Canada’s immigration system, especially if it leads to an increase in asylum seekers looking to enter Canada. This may present challenges for the Canadian federal government as it moves to reduce the share of temporary residents to 5% of the population by 2027, especially with growing public opposition to Canada’s open immigration policy.

What sectors would be hit hardest by Trump’s proposed tariffs?

Canada’s close physical proximity and substantial trade ties with the US mean many Canadian industries are highly exposed to tariffs in our Full-blown Trump scenario. Trump’s proposed 10% tariffs on other major trading partners, including Canada, would directly hit Canadian exporters, while retaliatory tariffs on US imports would also raise costs for Canadian producers.

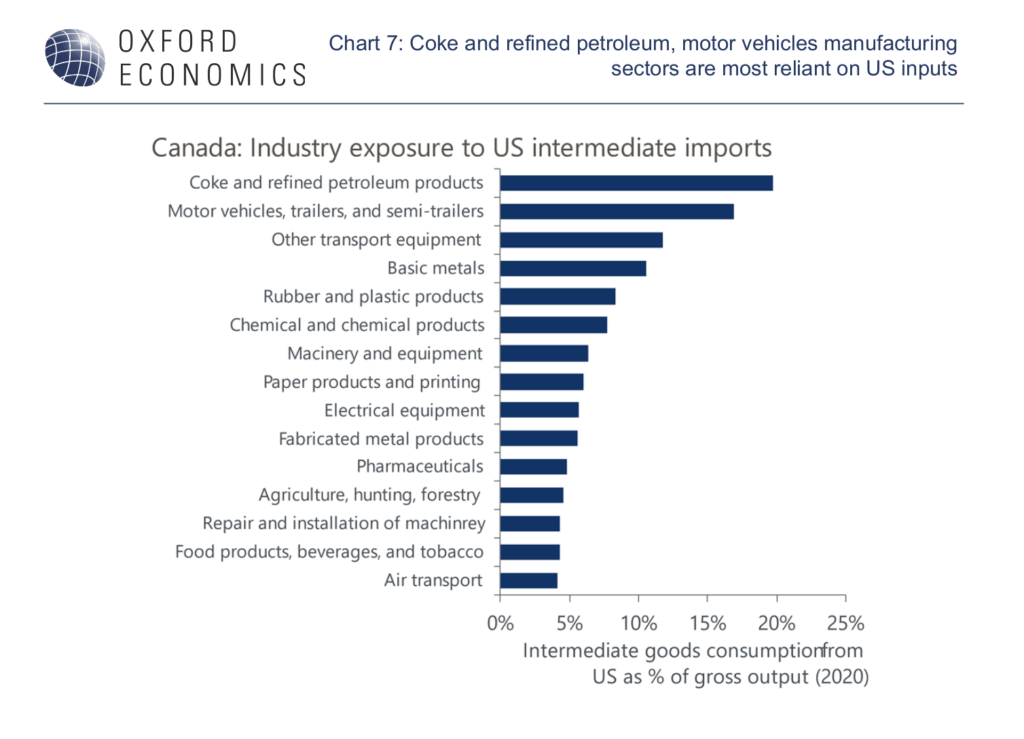

To assess industry-specific vulnerability to the tariffs, we used the OECD’s 2020 intercountry input-output (IO) tables to calculate each Canadian industry’s intermediate goods imports from the US as a share of its gross output (Chart 7). Canada’s coke and refined petroleum product sector and motor vehicle manufacturing sector each import just under one-fifth of their intermediate inputs from the US, making them the most exposed to a potential trade war and retaliatory Canadian tariffs on US goods. This speaks to the high level of integration in North America’s energy and auto sectors. Other industries most vulnerable include producers of other types of transportation equipment such as aircrafts, basic metals, plastics, rubber products, chemicals, machinery, paper products, and electrical equipment manufacturing.

We also construct a Ghosh price model to estimate the impact of tariffs in our Full-blown Trump scenario on sectoral output prices in Canada. This helps identify which industries would see the biggest cost increases from the tariffs, and how this would impact output prices across sectors. Our approach measures the direct impacts of Canada’s 10% retaliatory tariffs on US goods imports, as well as the indirect impact of Trump’s proposed 10% tariffs on Canadian goods imports, 60% US tariffs on Chinese goods imports, and China’s retaliatory 40% tariff on US imports.

Most industries would experience modest cost increases, with the median increase in output prices around 0.7% across sectors (Chart 8). However, those sectors that rely heavily on the consumption of US and Chinese intermediate goods would see more sizeable increases in input costs, which we assume are fully passed onto final output prices. Sectors such as motor vehicles, basic metals, other transportation equipment, coke and refined petroleum, rubber, plastics, and chemical manufacturing experience the largest output price increases from the tariffs.

It is worth noting that these figures likely represent an upper bound estimate, since the underlying methodology assumes the quantities produced by sectors are fixed and therefore there is no substitution of production for lower cost inputs. It also assumes changes in input prices due to the tariffs are fully passed on and profit margins are maintained.

It is worth noting that these figures likely represent an upper bound estimate, since the underlying methodology assumes the quantities produced by sectors are fixed and therefore there is no substitution of production for lower cost inputs. It also assumes changes in input prices due to the tariffs are fully passed on and profit margins are maintained.

Canada’s construction, extraction, and manufacturing in the crosshairs

Although Canada’s manufacturing would be most directly exposed to rising input costs from Trump’s proposed tariffs, a much larger hit to output would likely come via weaker aggregate demand due to higher inflation, tighter monetary policy, elevated global uncertainty, and lower business and consumer confidence. Canada’s construction sector output would experience the largest hit in a full-blown Trump scenario as both non-residential and residential business investment fall well below baseline. Construction gross value-added falls 2.9% below our baseline by 2029. Extraction and manufacturing would also see significant impacts amid weaker growth in domestic and foreign demand, and higher interest rates. Rising input costs due to tariffs would also hit these industries disproportionally, as highlighted above.

On the services side of the Canadian economy, accommodation and food, and arts entertainment and recreation would experience the largest negative impacts. Higher interest rates and increased inflation would squeeze household budget, while consumer confidence would weaken demand. Wholesale trade would also see an above-average reduction in gross value-added output relative to our baseline, partially due to the sector’s key role in North America’s supply chain and its high integration with goods-producing industries such as manufacturing, extraction, and construction.

Tony Stillo is Director of Canada Economics at Oxford Economics and Michael Davenport is an Economist at Oxford Economics.