Time Has Come Today…

By Douglas Porter

September 13, 2024

…to let go of the sticky inflation mantra. Faithful readers of this space will know that we have been pounding the drum since early 2021 that we had a very real and non-transitory inflation episode on our hands. Self-quote from April 2021: “If you’re not just a bit worried about real inflation, then you’re not paying attention.” However, recent trends in goods prices, the job market, and even underlying services prices have prompted us to finally stand down, aided and abetted by a drop in oil prices to below $70/barrel. There is no doubt that shelter costs remain a thorn for both U.S. and Canadian inflation trends, but that’s not enough to overly concern policymakers. The flip side of this greater comfort with inflation trends is a more complete re-think on the interest rate outlook.

In the U.S., the Federal Reserve is also clearly on the same wavelength, preparing for its first rate cut of the cycle at next week’s FOMC. This week’s so-so August CPI seemingly locked in a 25 bp cut, although there are still plenty of voices opting for a more aggressive 50 bp start. It’s true that many rate-cutting cycles have indeed begun with a heftier chop, but typically against the backdrop of financial market stress—with the S&P 500 just 1% off its peak, and U.S. household net worth at a record high, it’s tough to point to financial stress. Moreover, we are sympathetic to the argument that a bigger cut could signal that “the Fed knows something we don’t”, when they actually don’t.

So, there’s no change in our view on a 25 bp trim in September, which we have been circling for many months now. But what has changed for us is what happens afterwards—given the calmer, much-improved underlying inflation landscape, as well as the rise in joblessness to above 4%, we look for a steady series of 25 bp cuts, slowing only in the second half of next year and ultimately ending at just below 3% by early 2026. The risk to that call continues to be a faster and eventually deeper drop in rates, especially if the job market weakens materially further. True, the only new net change this week in our official view is one extra cut in the first half of 2025, but the important point is a steady step down that takes us below 3%.

In Canada, we also now expect that 3% level to be breached, and probably more forcefully, and almost certainly much sooner. We are adding two additional 25 bp cuts in the first half of 2025, and now see the Bank on a forced march of seven consecutive quarter-point rate cuts (after the cuts at the past three meetings). That combination of 10 consecutive 25 bp cuts will exactly slice the overnight rate in half from its prior peak of 5.0% to 2.5% by July of next year. The key change there is we now see the Bank taking the rate below what we consider to be neutral (closer to 3%), and that change has been prompted by the run-up in the jobless rate to 6.6%. Two weeks ago, we asked: “After all, if the jobless rate keeps rising, and the output gap keeps widening, while inflation is better behaved, why would the Bank stop at 3%?” And the only answer we can come to is that they won’t. Like the Fed, the risk is clearly that the Bank will proceed even more quickly than we expect, and Governor Macklem himself intoned in his London speech that “if inflation is weaker than we expect, it could be appropriate to lower rates more quickly.”

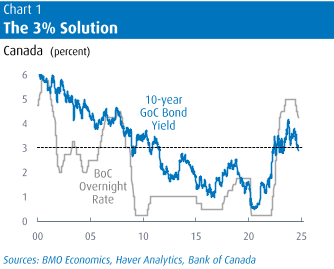

Financial markets are miles ahead of events, as is their wont. While we and others are debating about a possible move in overnight rates to maybe, eventually below 3% at some point next year, markets have swiftly cut the 10-year GoC yield in a veritable stroke to well below 3% in recent days. In fact, almost the entire Canadian yield curve from two years and out is now anchored below 3%, with a very small concession for the risk of holding such paper 20 or 30 years at the very long end of the curve. (Translation, the 30-year yield is just below 3.1% as we speak.) Long-term inflation expectations in the market have mostly reverted to pre-pandemic norms of around 1.6%, while real yields have dipped a little below that level.

The market is thus telling us in very loud terms where it considers neutral to be—below 3%—and fully expects the Bank to get there with pace. This 3% level appears to be the new normal for interest rates in Canada. While markets don’t always get it right, we’re not quarreling with this conclusion: Expected inflation and real rates have normalized after the extreme disruptions of the past five years. We look for next week’s CPI report to print just 2.2% inflation, the lowest since early 2021, and within sight of target. With ex-shelter CPI trends now running at just above 1% in both the U.S. and Canada, it’s also time to fully let go of the higher-for-longer inflation mantra. Good riddance.

Numbers game. Today is Friday the 13th and, contrary to conventional wisdom, we would assert that it’s one of the luckiest days of the year. First, it’s a Friday… enough said. Second, for those of us who happen to have been born on the 13th day of a month (a different month in this case), it’s obviously a great day, not one to dread. And, after all, fully 3.3% of the world’s population was born on the 13th day of a month, and almost 0.5% on a Friday the 13th. Are you trying to say they are all cursed?

We will tell you who is cursed: The Chicago White Sox. Even if you have absolutely zero interest in baseball, it’s worth noting just how epically bad their season has been. Unless something miraculous unfolds in the next couple weeks, they will go down as the worst baseball team since the Cleveland Spiders in 1899 (or about the last time Canadian housing was affordable). For more than 60 years the New York Mets had held that dubious crown in modern times, having lost 120 games versus 40 wins in their inaugural season in 1962, exactly a .250 winning percentage. A few pretenders have come close, but no team has managed to match that ineptitude…until the ChiSox came along. They now stand at 33 wins and 114 losses, or a .224 winning percentage. They will need to win 8 of their 15 remaining games to best the Mets—fat chance. Amazingly, the Sox won their division just three years ago, but their offence has since gone completely AWOL. The only economic parallel that comes even close to such a staggering and disappointing collapse is Canadian productivity. To complete the circle, the winning percentage of the unlucky Spiders with their 20-134 record in 1899—0.13.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.