The First Cut is the Deepest… and the Toughest

By Douglas Porter

May 31, 2024

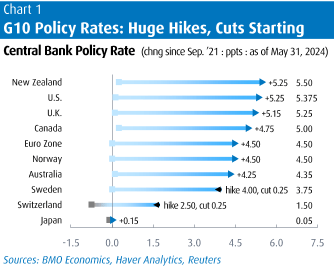

We have now reached a moment of truth for at least two major central banks. With the Fed all but certain to keep rates steady at the June FOMC meeting, and most likely in late July as well, the ECB and the Bank of Canada must decide whether to essentially go it alone at rate decisions next week. There actually doesn’t seem to be all that much debate at the ECB. Even with a mild upside disappointment in the early read on Euro Area May inflation—both headline and core CPI came in a tick high at 2.6% and 2.9%, respectively—officials have heavily signalled a rate cut is coming on Thursday. Following the earlier lead of first Switzerland, and then Sweden, the ECB is widely expected to clip its refi rate 25 bps to 4.25%, nearly two years after first lifting it from zero.

The picture for the Bank of Canada is much less clear-cut. With its much tighter linkages to the U.S. economy, it’s a much bigger decision for Canada to carve out a quasi-independent policy path. But, unlike the U.S. experience so far in 2024, Canada has seen a run of better-than-expected inflation results, cutting all major measures of core to below a 3% annual pace, and below a 2% trend in the past three months. And the final piece of the Bank’s puzzle—Q1 real GDP—came in much lighter than expected at 1.7% growth, on the heels of a big downward revision to the prior quarter to just 0.1% (from 1.0%). Even with a rebound in April, the bigger picture is that GDP is up less than 1% in the past year, compared with almost 3% y/y U.S. growth over the same period.

In other words, the U.S. economy has outpaced Canada’s by more than 2 percentage points in the past year, a very wide gap indeed. U.S. core CPI is running at 3.6% y/y, almost a full point above the comparable measure in Canada. And, the U.S. unemployment rate has nudged up a half point in the past year to a still-low 3.9%, while Canada’s jobless rate has jumped a full point to 6.1%. Reinforcing that message, the job vacancy rate in Canada has fallen all the way back to pre-pandemic levels at 3.4%. Pulling these threads together, there is a very good case for the Fed to remain patient, but there is an equally good case for the Bank of Canada to begin trimming rates, forthwith.

We have previously noted that one of the biggest obstacles to BoC rate cuts was a potentially weaker currency, which could then blow back onto inflation. Yet, the loonie has been a picture of calm and good behaviour of late. Even as markets upped the odds of a BoC rate cut, the currency managed to firm slightly this week to 73.3 cents (or $1.364/US$), which is not far from the 74 cent average level of the past 12 months. Moreover, it’s not like import prices are a big driver of domestic inflation these days; the import deflator was down 0.5% y/y in Q1, compared with a 3.4% y/y rise in domestic prices.

Another big concern for the Bank has been the stickiness of wages, and persistent inflation expectations. The latest consumer expectations survey shows that while short-term inflation is expected to remain high, it’s expected to cool to closer to 3% over the next five years. True, that’s a full point above the Bank’s target, but it’s actually below the expected rate back in pre-COVID days. On the wage front, fixed-weight average hourly earnings rose 4.1% y/y in March, up from 3.5% last year. But the looser job market should more meaningfully cool pressures in the year ahead.

Perhaps slightly helping the rate cut cause were some signs this week that even the mighty U.S. economy is losing some of its zip, opening the door to potential U.S. rate relief later this year. First quarter GDP was revised down to a mild 1.3% pace, and just 1.7% for final sales. Consumer spending started Q2 on a soft footing, with real outlays dipping 0.1% in April. Home sales have stalled out amid 7% mortgage rates, and the trade deficit is widening again. Meantime, the headline indicator of the week came in largely as expected, with the core PCE deflator rising a mild 0.2% in April (okay, 0.249%), holding the yearly pace steady at 2.8% (okay, 2.754%).

As a result of the downward revision to Q1 and the sluggish April result, we have clipped our full-year estimate of U.S. GDP growth two ticks to 2.2%. While not a huge change, suffice it to say that we have not cut our growth estimate in a very long time—it’s mostly been a one-way street higher for more than a year. That change in direction is potentially a very big deal, as it reinforces the message from the economic surprise index, which has been consistently on the weak side in recent months. The key takeaway is that the upside surprises in the U.S. economy for both growth and inflation seem to have drawn to a close, raising the chances of Fed rate cuts in the second half of 2024. We are circling the September and December meetings.

The slightly increased chances of Fed rate cuts in 2024 add one more arrow to the quiver of factors favouring a BoC rate reduction on Wednesday. It also helps the cause that the ECB is highly likely to cut the next day, providing the Bank with some cover. While it may well be a watershed decision, we believe that the combination of sub-1% growth, sub-3% core inflation, and a plus-6% jobless rate are all the reasons the Bank needs to pull the trigger.

We’re not in the DJ business, but do occasionally take requests. And one dedicated listener told us they would be powerful disappointed had we not referenced the song in today’s title ahead of the first BoC cut. But who do you think of when you hear the phrase “The First Cut is the Deepest”?

- Cat Stevens

- P.P. Arnold

- Keith Hampshire

- Rod Stewart

- Papa Dee

- Sheryl Crow

- Gordon Ramsay and an unfortunate kitchen accident?

The artist formerly known as Cat Stevens actually wrote the piece in the mid 1960s, and it has been a hit in four different decades, covered by at least 40 different artists, as well as countless economists whenever central banks begin cutting rates. Not to date ourselves, but we admittedly lean “4”, with echoes from “3” and “6”. Perhaps Sir Stewart would weigh in on the BoC with Tonight’s the Night, or My Heart Can’t Tell You No? More likely, he’d say I Don’t Want to Talk About It.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.