Wait, What’s Your Rush?

By Douglas Porter

March 28, 2024

With the first calendar quarter of 2024 wrapping up this weekend, so far we have seen: stronger-than-expected growth; hotter-than-expected U.S. inflation; a comeback in commodity prices; new record highs for crypto; and, a 10% advance in the S&P 500 for Q1 alone. Against this backdrop, which way do you think risks lie for the prospect of Fed rate cuts? Governor Waller focused mostly on disappointing inflation results when he suggested that there was “no rush” to cut; and more specifically noted “in my view, it is appropriate to reduce the overall number of rate cuts or push them further into the future in response to the recent data.” The market has been grinding its way to a similar conclusion over the past three months, reeling back early expectations of as much as six cuts this year to fewer than three now.

In tandem with these sober second thoughts on this year’s rate outlook—which align reasonably well with our call—bond yields spent most of Q1 backing up after a ferocious rally in Q4. Two-year Treasuries rose nearly 40 bps on net for the quarter to finish close to 4.6%, while 10-year yields rose more than 20 bps to around 4.2%. Equities were almost completely unfazed by the backup, even after being initially fired up by the Fed’s pivot in Q4. To pick but one example, the MSCI World Index rallied by just over 9% in the final quarter of last year and looks to have nearly matched that in Q1—i.e., barely blinking at a less favourable rate outlook.

To be sure, there are signs that the U.S. economy is losing a little bit of spark after an amazingly robust second half of 2023. The Atlanta Fed’s GDPNow is pointing to just over 2% growth in Q1, which lines up nicely with our call of 2.0%, and down from 3.4% in Q4. Consumer spending cooled slightly through the quarter, while regional Fed surveys mostly remained soft in March. Still, the bigger picture is that overall growth is far from weak, with next week’s payroll survey expected to print yet another 200,000+ advance. Perhaps the most telling takeaway from last week’s FOMC meeting is that the members now expect U.S. GDP growth to be at least 2%, or above potential, in each of the next three years.

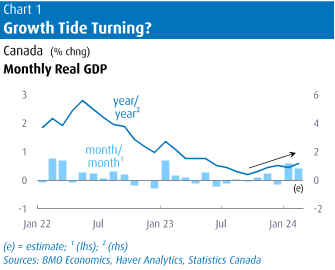

Even Canada is getting into the better-than-expected growth act. Out of the clear blue sky, GDP started 2024 with back-to-back monthly gains of 0.6% and 0.4%. That two-month advance of 1.0% is more growth than seen in the prior 16 months combined. Said differently: from Labour Day 2022 to New Year’s Day 2024, GDP grew by a grand total of 0.8%; in the first 60 days of this year alone, it grew 1.0%. It would be ungenerous to point out that the population surged by nearly 5% over the past 18 months, or nearly three times faster than GDP growth over that period. Still, the recent bounce in activity may calm some of the deepest concerns about plunging GDP per capita—which prompted the BoC to declare a productivity “emergency” this week.

The strong start to the year was no doubt aided and abetted by a mild winter, the end of Quebec’s big public sector strike, and even the end of the Screen Actors Guild strike. But aside from special factors, there is a broader sense that the economy is stabilizing after the heavy blows from high inflation and rapid rate increases. Note that workers are quietly seeing solid real wage gains, with inflation having retreated to 2.8% last month even as average hourly wages are still up 5.0% y/y. Plus, an important sector that often drives downturns is holding up very well—auto sales have been fueled by pent-up demand and rapid population growth. Almost the same can be said for homebuilding; while starts are off the top, they’re still holding near 240,000.

Also setting a better stage for the growth outlook is the strength in financial markets. After all, it’s tough to drone on about a dismal outlook for the economy while the S&P 500 and even the TSX are busily hitting new record highs. But we would point out that rollicking equity markets do not by themselves rule out recession risks. Looking back, there have been a variety of cycles that have seen stock markets blissfully cruising to record highs, only to suddenly run aground when recession realities emerge. Just citing the past two downturns, the S&P 500 hit a record high as late as February 19, 2020, just weeks before COVID lockdowns so rudely interrupted, and the index also hit a record in October 2007, just two months before the worst recession in the post-war era began.

Pushing aside those historical footnotes, the sturdy start to the year has prompted us to nudge up our Canadian growth call for 2024. We’re starting with a provisional two-tick lift to 1.2% (and 2.5% in Q1), which is primed for a further upgrade if the solid February GDP result is confirmed. Note that the most recent consensus forecast was for just 0.7% growth this year, and the BoC was at 0.8% in their January MPR. That’s not a huge miss, but the direction is important, as the bias is clearly to an even higher number. Growth is still expected to be well below the 2.3% U.S. pace this year, but it seems that sturdy stateside activity is at least partly spilling over into Canada, through exports and sentiment.

Where does this leave the Bank of Canada? At the margin, the above-expected growth may cause a bit of discomfort on the inflation outlook, with GDP likely coming in above potential in Q1. But we will see a string of important releases next week, which will help clarify whether the growth bump was simply a seasonal illusion. The quarterly Business Outlook Survey on Monday will be followed by February trade and March jobs late in the week. At this point, we are clinging to our call of four rate cuts, beginning at the June meeting. But suffice it to say that if next week’s data echoes the robust GDP results, the main message in the April 10 decision and MPR may well be “what’s the rush?”.

The news of a strong start to 2024 arrives just as the Canadian budget season winds down. Manitoba is the final province to report its fiscal plan next Tuesday, and then Ottawa will belatedly unveil its budget two weeks later. Many forecasters will be revising up their 2024 calls in the wake of the GDP report, and many of the provinces will (happily) discover that their economic assumptions were overly cautious. Much was made of Ontario calling for a tripling of its deficit in the coming year, yet few noted that the plan was based on expectations of just 0.3% GDP growth—reality may be a full percentage point faster than that. Governments can use all the revenue help they can get. We currently estimate that total provincial debt will see its largest increase on record in the coming fiscal year (up more than $65 billion, or over 2% of GDP), an even larger increase than in 2020/21, and that’s saying something.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.