Reddit or Not, Here Come Rate Cuts

By Douglas Porter

March 22, 2024

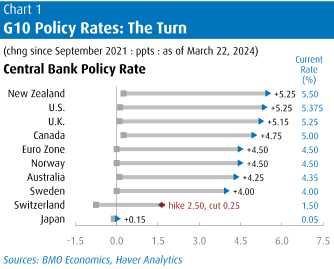

This was always going to be a big week for central bank watchers; too bad everyone was looking at the wrong one(s) for direction. While the FOMC meeting was busy hogging the spotlight, and saying little that was new, and the BoJ finally did the expected and abandoned negative rates, some other lower-profile banks were actually getting on with rate cuts. Along with indications from Chair Powell that QT will be tapered before long, the reality of some global rate reductions added fuel to a fiery equity market, pushing the S&P 500 above 5200, and even helping the TSX reach a record high for the first time in two years on Thursday.

The Swiss National Bank became the first central bank in the developed world to trim, slicing its policy rate 25 bps to 1.5%, as the combination of slow growth and 1% inflation has chopped Switzerland’s nominal GDP growth to just 1.3% y/y. Soon after, the Bank of Mexico also delivered its first cut, of 25 bps to 11.0%. Mexico was a leader on the way up, first lifting rates in June 2021, and the full cycle saw 725 bps of hikes, outdoing the Fed by 200 bps in total. But Brazil has truly been in the vanguard, first tightening in March 2021—a full year before the Fed—and hiking rates by a staggering 1175 bps (from 2.0% to 13.75%). Brazil began cutting last August, and chopped another 50 bps this week to 10.75%.

The point of this brief trip abroad is that the emerging markets that sniffed out the inflation trouble early on, and responded accordingly, are now beginning to send out the almost-all-clear signal. And while the SNB wasn’t exactly early on the hiking side, its rate cut is an important development, acting as a counterpoint to the BoJ’s small rate hike this week. Amid the wave of central bank news, bond yields reversed about half of last week’s heavy sell-off, with 2-year Treasuries backing off 14 bps to below 4.6%, and 10s skidding 10 bps to around 4.2%. Markets now expect a little more than three rate cuts this year from the Fed and the BoC, and the dot plot remains in sync with that call—just.

A notable aspect of the steadfast conviction that U.S. rates are coming down is that the economy, inflation, and financial conditions are hardly crying out for relief. This week’s thin set of data was generally stronger than expected, with home sales and starts well above expectations, the Philly Fed still in positive terrain, and jobless claims holding at low levels. In what may well qualify as irony, the U.S. leading indicator has turned positive for the first time in two years, just as the world is gearing up for rate cuts. Rising equity markets have turned the tide in the LEI, supported by building permits and hours worked in manufacturing. In light of the persistent strength in the U.S. economy, as well as stubborn underlying inflation, we have succumbed, and pulled one of the Fed rate cuts from our call, and now expect 75 bps of trims this year, beginning in July. It is by accident, not design, that this largely lines up with the Fed and market pricing.

Even with that small shift in our Fed call, we are maintaining our Bank of Canada call of 100 bps of cuts in 2024, beginning in June. While there are good arguments both ways, we have long been of the view that the BoC will move ahead of the Fed, just as they did on the way up. Leaning in the direction of our view:

- Headline and underlying inflation is a bit cooler in Canada, with the low-side surprise in February driving an even bigger wedge. Looking at CPI ex food & energy—which admittedly is not the main core measure for either central bank, but is at least comparable—Canada is a full point lower at 2.8%.

- Growth is clearly suffering much more in Canada, due to the much greater interest rate sensitivity of the consumer. While retail sales volumes managed a small 0.2% rise in January, the 1.5% y/y advance pales in comparison to 3% population growth. Taking out stable services, real consumer spending on goods in the past year has edged up just 0.6%, versus a U.S. rise of 3.4%.

- The job market is less tight in Canada. Adjusted for measurement differences, Canada’s unemployment rate is more than 1 point above the U.S. rate of 3.9%. The job vacancy rate is back down to pre-pandemic levels, in part due to the surge in non-permanent residents.

It’s by no means a slam dunk that the Bank will cut first, however, and Governor Macklem has sounded a bit more hawkish than Powell in recent months. The main counterpoints are:

- The ever-present threat of a housing snapback haunts Canadian policy. With affordability at its worst level in four decades, and shelter costs the main driver of lingering inflation, the last thing Ottawa wants to see is a fast rebound in housing sales and prices. This week’s February results showed some cooling after a winter bounce, but we all know this market is prone to roar when left to its own devices.

- The Canadian dollar is already in a soggy state; it’s a bit more than 3% below its five-year average, and down nearly that much so far in 2024. With the market not expecting the Bank to be more aggressive, an earlier BoC move would undercut the loonie, adding to imported inflation.

- The starting point for Canadian rates is lower, as the Bank hiked less through the cycle, and its policy rate is 25-to-50 bps below the Fed funds target. (Counter-counterpoint, that spread in short-term rates just happens to precisely match the current gap in headline inflation; so on that very narrow definition, real short-term rates are equal.)

In the grander scheme, this debate is akin to angels on the head of a pin, and the main point remains that rate relief is still on track for the middle of this year.

With the wave of boomer retirements now washing over the North American economy, this year’s U.S. election combatants are going to try to show that age is just a number. Turns out that one Deanna Stellato-Dudek already proved that last night at the World Figure Skating Championships in Montreal, becoming world champ in the pairs at the tender age of 40, along with partner Maxime Deschamps (who’s a pup at 32). To be clear, they compete in pairs (not dance), the one where the woman gets thrown in the air at least three times and has to do multiple triple jumps. Her closest competitors, from Japan and Germany, were 22 and 24. Stellato-Dudek had initially retired from singles skating way back in 2000 (after winning a silver at the World junior level at age 17), but came out of retirement 16 years later with the goal of competing at the 2026 Olympics. Tom Brady almost certainly will be getting some ideas from this news, if not Wayne Gretzky (to fend off Ovechkin from his record), Michael Jordan, Martina Navratilova, or even Bjorn Borg. Next thing you know, rock stars in their 80s will be out touring again… oh, wait.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.