It’s Earlier than You Think

By Douglas Porter

March 08, 2024

Central banks continue to preach patience on the prospect of rate cuts, albeit while also dangling tantalizing hints that it may be only a matter of time. The February jobs data mostly delivered the same message, with both the U.S. and Canada reporting above-consensus employment gains—hence, the need for patience—but also an uptick in unemployment and calmer wage growth—hence, the prospect of rate cuts. Rare is the day that the dual North American job reports are in sync, but this may have been one of those days. Both were flashy on the surface, suggesting zero stress in the economy, but both had rather obvious details that were far from stellar.

February U.S. payrolls topped expectations, yet again, with a sturdy 275,000 advance, although the two prior months were revised down heavily to much more moderate advances (averaging 260,000). However, the companion household survey reported a third consecutive job decline, lifting the unemployment rate two ticks to 3.9%. That is the highest rate in over two years, and half a point above last year’s low—approaching Sahm Rule terrain. And, after lurching higher to start the year, average hourly earnings rose just 0.1%, trimming the annual pace to an acceptable 4.3% clip. That’s still more than one point above pre-pandemic norms, but not especially troublesome in light of stronger productivity growth.

Prior to the payroll report, markets were enthused when Fed Chair Powell mused that: “When we get that confidence (on sustainably returning to 2% inflation), and we’re not far from it, it will be appropriate to begin to dial back the level of restriction so that we don’t drive the economy into recession.” This appeared to be a somewhat dovish turn from his by-the-book midweek testimony to the House, which had made few waves.

On net, bond yields took another step back on the week, with 10-year Treasuries dipping below 4.1% for the first time in a month. With a mid-year rate cut coming into better focus, equities continue to do their thing, with AI-related stocks lifting the major averages to yet new record highs. Notably, other markets are also rallying hard as the steam comes out of rates—both bitcoin and gold hit highs this week.

To keep the broad rally going, the inflation news must head in the right direction. Next Tuesday’s CPI now looms large, with the headline expected to post another meaty rise of 0.4%, holding the annual rate steady at 3.1%. The news on core is expected to be slightly better than last month, with a 0.3% m/m read clipping the yearly rate two ticks to 3.7%. That result will not settle any debate, but at least it won’t rule out a June move. Our view is that there are likely to be some bumps along the road to lower inflation, especially with growth still chugging along and financial conditions loosening. In turn, this points to a lack of urgency to cut rates, and we continue to expect the first move to arrive in July.

One caveat is that there are the particulars of the political calendar which could weigh in, as much as the Fed attempts to stay above the fray. And the reality is that politics will intrude into the commentary after any decision this year, now that we have the two main combatants in place. The Fed may not be interested in politics, but politics are very much interested in the Fed.

Politics are even intruding into the Bank of Canada’s radar, as the Prime Minister recently suggested after the latest CPI that: “We’re optimistic that the Bank of Canada will start bringing down interest rates sometime this year—hopefully sooner rather than later.” While many economists immediately clutched their pearls, the PM did generously add “But that’s their decision to make”.

Increasing the pressure, Finance Minister Freeland has specifically pledged that this year’s fiscal plan will be crafted to set conditions for rates to come down, implying little or no net new stimulus is forthcoming in the April 16 budget. A small issue on that front is that the provinces are not playing ball—it’s early days still, but the theme from this year’s round of provincial budgets is more spending, larger deficits.

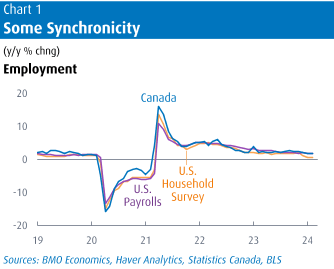

For the Bank of Canada’s part, this week’s rate decision offered no surprises and the language in the statement and at the press conference was decidedly neutral. Markets were slightly disappointed that the Bank didn’t make a clearer step to rate cuts, and Macklem flatly suggested it was just too early. Canada’s solid job gain of 40,700 last month reinforces the point that growth is hanging in there, and rate cuts are not urgently required. However, as always, we will add the big fat asterisk of surging population growth, which is exaggerating the strength of a wide variety of indicators—especially headline job gains. Canadian job growth has been right in line with U.S. payrolls over the past year at 1.8% y/y, but miles above the U.S. household pace of just 0.4% y/y (Chart 1). Still, a rise in the unemployment rate to 5.8% and some modest cooling in wages suggest that the job market is indeed loosening—gradually—setting the stage for eventual rate cuts.

The crucial housing market is eagerly awaiting rate relief in Canada. The early results for February home sales suggest they stepped back after a brief bounce around the turn of the year. Of course, the irony is that if housing rebounds too vigorously to lower rates, it will by itself limit the scope for lower rates. While the important five-year bond yield has risen about 25 bps from end-2023 lows, and appears to have stabilized just below 3.5%, it’s still down almost 100 bps from last fall’s high—a key reason home sales perked up to start this year.

Our call has consistently been that the Bank will start trimming rates in June, and cut by a cumulative 100 bps this year. The combination of Macklem’s studied caution and still-firm job gains suggests the risk to this call is a) later and b) slower rate cuts. Note also that the Bank specifically pointed to robust equity markets in its statement this week, and looser financial conditions in their comments. While the TSX may be lagging, the reality is that Canadians are also active investors in hot U.S. tech stocks, if not crypto and precious metals. Overall, even with daylight savings time arriving this Sunday, the risk is that it’s still earlier than you think for rate relief, it seems.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.