You’re Gonna Need a Bigger Boat

Douglas Porter

September 16, 2022

September has a long history of proving to be a challenging month for financial markets, and this year’s version is providing its own set of deep hazards. Just when many thought the inflationary waters were becoming safer, the U.S. CPI attacked unsuspecting markets with a much harsher-than-expected core bite (+0.6% vs. consensus +0.3%). The fact that underlying inflation is not instantly sinking really should not come as a major surprise—and we were looking for +0.5%, for the record—not with the tightest job market in generations, and a persistent mismatch between demand and supply. Almost nothing suggests that the 6%+ trend in core inflation is set to break soon. Yet, the consensus and markets seem to want to believe that the price wave will rapidly crest, and that we can soon put this unfortunate inflation episode behind us, setting up for periodic disappointment.

Above and beyond the latest inflation shock, markets were also grappling with renewed recession risks this week. In part, those concerns were stoked by the meaty CPI, which pointed to the need for higher-for-longer interest rates. But Fed concerns morphed into FedEx concerns late in the week, as the latter warned on weakening demand and pulled their 2023 guidance. Following hard on the heels of stark warnings from both the IMF and the World Bank on the global growth outlook, this simply accelerated the sell-off. After a brief reprieve at the start of the month, the S&P 500 resumed its decline, dropping by more than 5% on the week by mid-Friday. While still above its June low, the index is now down more than 10% since mid-August and again off nearly 20% since the record high set on the first day of 2022.

As has so often been the case this year, bonds did not benefit from the sag in stocks. Ten-year yields were again swimming close to the 11-year high hit earlier this year (of just below 3.5%), before ebbing slightly on a milder inflation-expectations reading from the University of Michigan. The rest of the curve has long since pushed through the 3.5% threshold, with 2s now taking aim at the 4% level. As foreshadowed in this space two weeks back, markets are increasingly coming to the view that the Fed will ultimately need to take rates above 4%—and possibly even higher—to crack underlying inflation. The heavy CPI all but locked in a 75 bp hike at next week’s FOMC meeting (see Focus for the full preview), with some muttering about the possibility of a 100 bp step. We will review our call for the remainder of 2022 after the Fed’s September 21 decision, but it’s clear that the risks remain squarely tilted to the upside for short-term rates—at present, we look for the overnight target range to end the year at 3.75%-to-4.00%.

The prospect of even greater Fed tightening and mounting concerns on the global outlook gave a renewed charge to the U.S. dollar. The high and rising bill to partially shield consumers from soaring energy costs is weighing on European currencies, with the euro dipping back below par and the pound at its lowest ebb since 1985. The yen held in amid some verbal intervention by the BoJ, but remains near its weakest level since the 1990s. Meantime, the Chinese yuan softened beyond the 7/US$ threshold late in the week for the first time in more than two years, and has now depreciated by 10% since early this year. Amid a broad risk-off move, the Canadian dollar was pulled along for the ride, and then some. The loonie also fell to a two-year low of 75.3 cents ($1.328/US$), down 4% since the start of the year.

The sag in the loonie threatens to aggravate an already problematic inflation backdrop. Canada’s CPI for August is the main item on the domestic deck next week, and the headline tally is expected to recede to 7.2% (from 7.6%), largely due to another heavy fall in gasoline. But, like the U.S. result, beware the core trends. The BoC specifically cited the ex-gasoline measure in last week’s Statement, which has flared to 6.6% y/y from just 2.8% a year ago. A weaker currency could further fuel consumer goods and imported food prices. To this stage, Canadian grocery prices have actually been less fiery than their U.S. counterparts (9.9% y/y vs. 13.5% y/y).

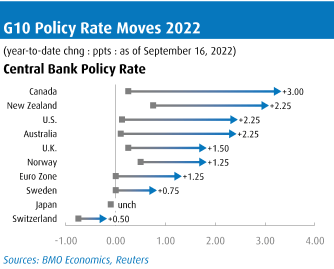

Notably, the Canadian dollar has failed to benefit one iota from the fact that the Bank of Canada has been the most aggressive rate-hiker in the G10 in 2022 (Chart). At least until next week’s Fed action, the Bank has delivered both the largest cumulative rate hike (300 bps), and the highest policy rate (3.25%). Similar to the Fed, the risks to our official call (3.75% by year-end) are tilted to the high side. Not to wade close to political waters, but the steady stream of fiscal support measures flowing from both the provincial and (now) federal levels will, on balance, nudge the risks of higher rates a bit further upward. We peg total such measures at around $11 billion, or roughly 0.4% of GDP.

However, the main arguments for the Bank ultimately doing a bit less tightening than the Fed are two-fold: 1) Both wage and inflation pressures are a tad less intense in Canada, at least so far; and, 2) the heavier burden of household debt (again at a record high as a share of income) suggests the economy is much more sensitive to the rapid rate hike campaign. Recall that the housing sector, which is now clearly in full-blown retreat, is more than twice as large a share of the economy in Canada (7.1% of real GDP) than in the U.S. (3.4%) at present. The Bank is certainly not going to calibrate policy based on housing alone, but the coming downward pull from that important sector will likely be enough to forestall even more aggressive hikes further down the line. Having said that, we don’t regard overnight rates of around the 4% level as being particularly aggressive when every measure of core inflation is running at 5% or above.

However, the main arguments for the Bank ultimately doing a bit less tightening than the Fed are two-fold: 1) Both wage and inflation pressures are a tad less intense in Canada, at least so far; and, 2) the heavier burden of household debt (again at a record high as a share of income) suggests the economy is much more sensitive to the rapid rate hike campaign. Recall that the housing sector, which is now clearly in full-blown retreat, is more than twice as large a share of the economy in Canada (7.1% of real GDP) than in the U.S. (3.4%) at present. The Bank is certainly not going to calibrate policy based on housing alone, but the coming downward pull from that important sector will likely be enough to forestall even more aggressive hikes further down the line. Having said that, we don’t regard overnight rates of around the 4% level as being particularly aggressive when every measure of core inflation is running at 5% or above.

With the Toronto International Film Festival in person again after a two-year hiatus, we wanted to give a small nod to a great movie quote. This week’s title is obviously lifted straight from Jaws; Roy Scheider’s character deadpans the line after first seeing the Great White up close, and it’s widely considered to be one of the all-time top 50 film quotes. Second choice was a top 10 classic: Fasten your seatbelts, it’s going to be a bumpy night. Arguably, that’s the most used movie quote in relation to financial markets (over-used?) and incredibly appropriate, but probably few know its original source—All About Eve (1950).

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.