Off the B-oil?

Douglas Porter

August 5, 2022

A rollicking U.S. payroll gain for July, in the face of a wall of recession chatter, wasn’t even the most positive development this week for the economic outlook. Instead, that honour goes to a large drop in oil prices, taking them back to around $90 and down from levels prevailing prior to the invasion of Ukraine. In fact, a broad basket of commodity prices is now lower than pre-invasion levels, with items as diverse as copper, lumber, wheat and oil all down since late February. We were fond of saying around the middle of this year that everything that could have gone wrong on the inflation front had gone wrong for 18 months. It appears that fortunes have finally shifted, between signs that supply chains are improving and the pullback in energy costs. Even so, markets were mostly in a cautious mood this week, amid a variety of geopolitical flashpoints, and the dawning reality that even if headline inflation backs off, the Fed still has a long-term fight on its hands.

Notwithstanding much cooler oil prices, bond yields rocketed higher this week on hawkish Fed speakers and the robust July employment report. The 528,000 payroll advance was more than double expectations, the strongest in five months, and lifted employment to a new high—finally recouping the pandemic losses. Meantime, even the household survey squeezed out a decent 179,000 rise, helping clip the unemployment rate to match a five-decade low of 3.5%. Total hours worked kept churning ahead nicely, while average hourly earnings stayed firm at 5.2% y/y—curiously close to the rise in the core PCE deflator in the past year, and also the Q2 employment cost index. Reflecting this broad-based show of job market strength, two-year Treasury yields powered up 35 bps on the week, while 10s rose a hearty 19 bps—more than reversing the prior week’s rally and further inverting the yield curve.

Yields had been under upward pressure even ahead of the jobs report, as a wave of Fed speakers attempted to dissuade the markets from expecting rate cuts next year. In amazingly clear language, a variety of officials noted that the Fed was far from finished, that they may need to go further and stay longer than the market expects, and that a recession is entirely possible. To cite but one example, Minnesota Fed President Kashkari—who at one point was seen as the most dovish of them all—flatly stated that he didn’t know what markets were seeing in pricing in 2023 rate cuts, and that it was much more likely the Fed would need to keep rates relatively high for an extended period to calm inflation. We tend to concur.

Markets partly got on board with the harsh message, building in a higher terminal Fed funds rate—now back in line with our year-end call of 3.50%-to-3.75%, or up 125 bps from current levels. However, the derision of rate cuts in 2023 was largely ignored—markets still look for the Fed to partially back off next year amid, presumably, much cooler growth and calmer underlying inflation.

Equities largely fought to a draw amid this push and pull of better-than-expected growth and lower energy costs on the positive side, but the prospect of a tougher Fed and geopolitical concerns on the negative side. Tech stocks stood out as the Nasdaq powered up to almost 20% above its mid-June low by Thursday, dulling some of the pain in the first half of the year. On the flip side, the TSX fell moderately for the week, and has underperformed other major markets recently on the commodity retreat.

The relative softness in Canadian stocks was compounded by a renewed pullback in the loonie, which skidded more than 1% on the week to just above 77 cents (or $1.294/US$). The currency was pounded by the mix of a robust U.S. jobs report and a surprisingly soggy Canadian result. After posting a much faster and more complete labour market recovery through 2021, Canada has labored this year. Employment fell 30,600 in July, following a 43,200 decline in the prior month—the first two-month drop since the spring of last year, when new COVID restrictions were put in place.

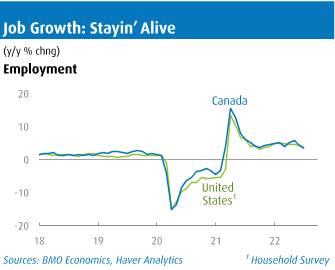

The relative softness of Canadian employment versus the U.S. picture is particularly odd given the relative north-side strength of GDP in recent months. We would put this recent divergence down to the U.S. playing catch-up on the jobs front—as the chart reveals, growth in the two household surveys is now almost precisely in line on a year-over-year basis, after Canada charged ahead in the early days of the recovery. This week’s Focus Feature digs much more deeply into some of the labour market supply factors that may now also be weighing heavily on Canadian employment. But whether it’s due to cooler demand for workers or a lack of available supply, there’s little debate that job growth will slow further. Even so, note that in both Canada and the U.S., household surveys report that employment is still up a powerful 3.6% y/y, versus a pre-COVID trend of less than 1.4%, keeping the recent sluggish monthly results in context.

Looking ahead, a moderation in energy and other commodity costs would go a long way to making the Fed’s and the Bank of Canada’s job of controlling inflation expectations much easier. In turn, it could lessen recession risks by removing some of the squeeze on consumers. We may get a very small taste of that in next Wednesday’s key U.S. CPI release, when a big drop in gasoline prices is expected to cut the headline inflation rate back below 9%. However, it’s going to take many such months to bring inflation back to even 5%, let alone the 2% target. The $2 snapback in crude oil on Friday morning is but one sign that policymakers can scarcely let their guard down in the inflation fight, and why we tend to agree with Fed officials that it is truly premature to be looking for rate cuts in 2023.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.