H1 Recap: Barrel Half Empty

Douglas Porter

June 30, 2022

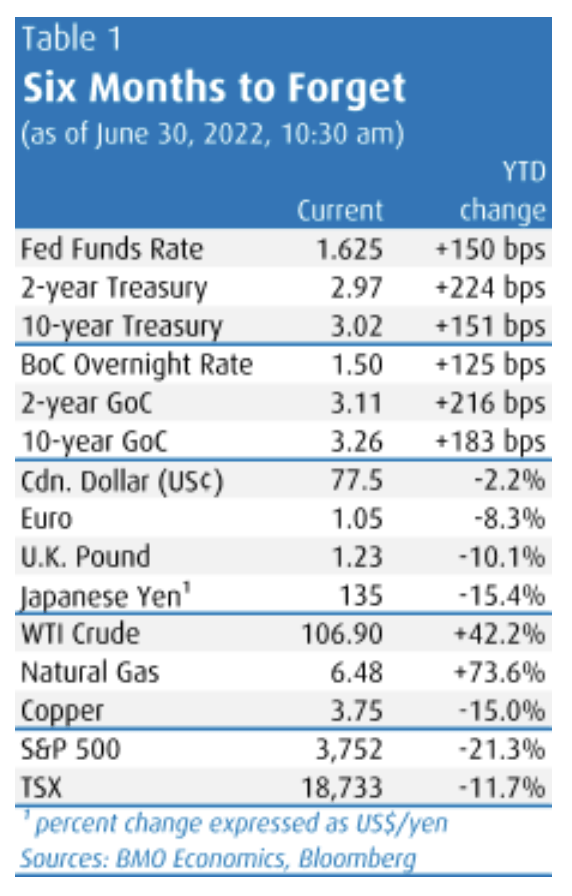

And it started with so much hope. The S&P 500 reached an all-time high on the very first trading day of the year, but then promptly suffered through one of its toughest first-half performances ever, along with a pummeling in most major financial markets. The challenging environment started and ended with inflation—and the increasingly urgent central bank campaign to control it—further aggravated by the Ukraine invasion in late February. With the energy-driven supply shock haunting the global economy, growth expectations were marked down heavily even as inflation forecasts were boosted across the board. Global growth expectations have taken such a hit that even a broad measure of ex-energy commodity prices ended the first half barely above where it started the year. In a word, there was almost nowhere to hide in the first half of 2022.

It can often be a humbling experience to look back in December on the projections made 12 months earlier. Well, we are only six months deep into this year, and it is already patently obvious that 2022 is going to be an 11 on the humbling scale for forecasters. At the start of January, the Blue Chip consensus expected a leisurely lift-off for Fed tightening this year, perhaps a 25 bp hike in Q2, and then one or two more such moves in the second half of the year. Two-year Treasury yields were seen nudging up to just over 1% by late this year, and 10s were expected to gently push above 2% over the same timeframe. How quaint. In fact, the market is now expecting more than 300 bps of Fed rate hikes in this calendar year (with 150 bps of hikes already under the belt), and almost all Treasury yields are dancing around 3%, after a visit with 3.5% a few weeks back.

The dramatic shift in the interest rate landscape over the past six months was driven both by the dawning realization that inflation was proving to be tenacious, not transitory, and by the abrupt shift in central bank rhetoric associated with that awful realization. The entire yield structure has blasted higher since the start of 2022, with 2-year yields up more than 200 bps in both the U.S. and Canada, 10-year Treasury yields rising more than 150 bps and GoCs surging an even greater 185 bps for the similar maturity—the steepest such rise since 1994. The sharp back-up was not confined to North America, with German 10s starting the year in negative terrain before leaping to nearly 1.4%. Borrowing costs rose even more sharply for the private sector, with one closely-watched corporate spread measure widening more than 50 bps in H1, while high-yield spreads jumped more than 230 bps.

The upswing in inflation forecasts was nearly as dramatic in the past six months. Around the turn of the year, the consensus expectation for 2022 U.S. CPI inflation was for an average rate of just above 4%—we now believe it will be closer to 8.5%, and then just above 5% next year. The spike has been even more staggering in Europe, which has been jolted by soaring natgas prices. The consensus call on average CPI inflation for the Euro Area at the start of the year was drifting up to around 3%, while the reality will be closer to 8%. Canada was not left out, with the similar tallies reading close to 3% before, and just above 7% now. To be clear: Russia’s invasion aggravated the situation, but we had a very serious inflation episode on our hands even prior to that dark day—recall that U.S. inflation was already almost 8% in February while Canada was just shy of 6% at that time.

The single biggest factor lifting inflation globally, and putting that much more pressure on central banks, has been the sustained surge in energy costs. Certainly there are many, many factors at play—Canada’s inflation rate ex-energy is a meaty 6.6% (versus a 7.7% headline pace). But energy costs have been the lead item, and arguably causing the greatest inflation angst for consumers. Even with another pullback this week, oil prices are still up $30/bbl since the start of the year (or more than 40%), while wholesale gasoline (+64%) and natgas (+76%) have been even hotter. We would assert that the single biggest factor that could provide rapid relief to the inflation outlook, and thus a less-fraught economic outlook globally, would be for a retreat in oil and gas prices. A modest upswing in U.S. production in recent weeks and recent price action offer some hope on that front, but we continue to assume that WTI will stay close to $100 in the year ahead.

The complete rethink on the inflation outlook—at least over the next year or so—and the shifting interest rate landscape has, in turn, sideswiped the growth outlook, and a variety of financial assets. We came into the year expecting a robust performance by the global economy, led by a more complete reopening in many sectors. While global GDP had rebounded by more than 6% in 2021, that did not completely make up for the heavy damage in the prior year, and we thus looked for an above-average 4.5% advance in 2022. Instead, we are now expecting growth to sag below 3% this year and next—below the global economy’s medium-term average pace (of about 3.25%-to-3.50%), and a clear disappointment given the rebound in travel and entertainment.

A massive chop to Russia’s economy, and the zero-COVID restrictions in China weighed most heavily. But we have also sliced the outlook for U.S. GDP to just 2.0% for this year (from 3.5% at the start of the year), and carved a like-sized amount from the Euro Area projection as well (to 2.5%). Not surprisingly, the commodity-driven economies have seen a lighter hit, although we have reduced Canada’s growth estimate by 0.6 ppts to 3.4% this year and have taken a bigger hatchet to next year’s call (to a modest 1.5% pace). With consumer confidence falling fast, seemingly everywhere, and business sentiment now also souring, the risks to our growth call are tilted to the downside, even with some further snipping this week for both the U.S. and Canada. Ex-central bank head Mark Carney may have put it best—recession risks are “uncomfortably high”—but we’re still not quite there in our official call, despite the rough ride for financial markets in the past six months. To finish on a slightly brighter note, we would assert that despite the downbeat message consumers are sending to pollsters, their actions matter more than their words—and while almost everyone is grousing about the economic outlook, it doesn’t seem to be holding anyone back from actually spending. To wit, have you been to an airport recently?

Central bankers seem determined to make us all feel even worse about the economic outlook. At this week’s Central Bank Forum and chin-wag in Sintra, Portugal, it sometimes appeared that officials were almost admitting defeat. For example, ECB President Lagarde said she doesn’t think “we are going to go back to that environment of low inflation”. That topic is worthy unto a full feature on its own, but it’s not at all clear that the inflation outlook has permanently been altered just yet—and this is coming from an avowed inflationista. The bond market is certainly not in agreement with Lagarde, as the five-year forward implied U.S. inflation rate has come back down to around 2.1% in recent days, or roughly where it averaged in the years leading up to the pandemic. And, without being snippy, should we really put much weight on central bank inflation forecasts given the experience with such over the past 18 months?

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.