Risks Get Back: A Beatles-Tribute Weekly Economic Recap

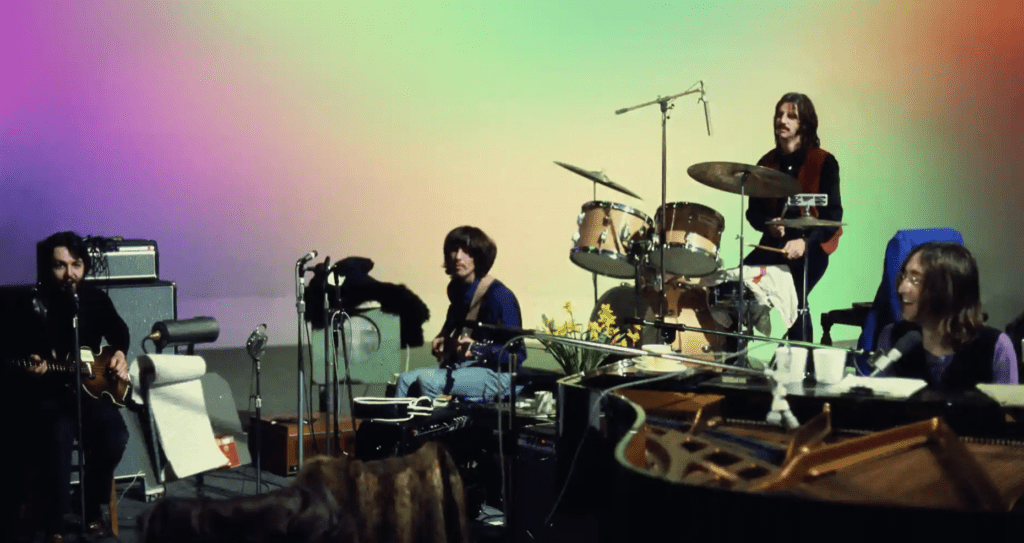

Linda McCartney/2020 Apple Corps Ltd/PA

Douglas Porter

November 26, 2021

Giving a whole new meaning to Black Friday, financial markets took a big step back at the end of the week on concerns over the Nu variant from South Africa. While it is far too early to draw any strong conclusions on the significance of this development, thin holiday markets and earlier big gains meant investors were in little mood for details. Yields, equities, commodity currencies, and especially oil, all were sold heavily on Friday, after mostly pushing higher earlier in the week. Prior to the Nu news—which slashed rate hike expectations—global central bank tightening was more firmly in focus as inflation pressures continued to bubble. Since nearly everyone is looking at the inflation of the 1970s as a guide, let’s harken back to that time. In honour of the new Get Back movie about some little, transitory band out of Liverpool, here’s a recap of the key developments of the week using the songs from the album:

The Long and Winding Road: COVID had seemingly been put in the rear-view mirror by financial markets until recently. However, a surge in Delta cases in Europe and the emergence of the Nu variant have suddenly sent shivers through risk assets, and travel-related stocks and oil in particular. While the immediate market move may be an overreaction, the point is that the pandemic remains with us nearly two years after beginning. At the least, it is likely to continue throwing sand in the gears of the global economy in 2022, restraining the recovery, keeping kinks in the supply chain, and possibly cooling the most hawkish central banks.

Let it Be: Another big story this week was the reappointment of Jay Powell as Fed Chair for another four-year term. While far from shocking, there was some suspense, as the decision had been drawn out for weeks. Lael Brainard was the main contender, and she was instead given the Vice-Chair role; some had thought she would instead be named Vice-Chair of Supervision, but that position was held open for a yet-to-be-named candidate. Given that there will soon be three (count ‘em!) openings on the Board, President Biden still has lots of opportunity to put his stamp on the Fed.

I’ve Got a Feeling: The initial market response to the Powell news (as opposed to the dovish alternative) was to bake in more Fed rate hikes. Prior to Friday’s set-back, markets had fully priced in three rate hikes in 2022, beginning as early as June. In turn, this would imply that the pace of QE tapering would likely need to ratchet up early next year. Even with a late-week pullback, traders are still looking for two moves in the second half of next year, which we are largely in agreement with at this point.

One After 909: Did you say 199k? Initial jobless claims fell to that low, low level last week—the last time they were below 200k was 1969, or around the time Get Back was shot. Amid the cornucopia of mid-level U.S. data releases this week, this one jumped off the page as an indication of a rapid improvement in the job market. It may well overstate the strength of employment, but it hints that one of the Fed’s main goals may be at hand. Meantime, the other goal has long been hit, with the core PCE deflator punching up to 4.1% y/y last month. Quashing any doubt about the ‘sustainability’ of the rise, this metric has now averaged a 2.2% pace over the past five years.

Two of Us: The two factors of President Biden’s drive to tap petroleum reserves and Nu jitters combined to hammer oil prices this week. WTI sagged 12% on Friday alone to below $69, after starting last week closer to $80. In fact, crude had initially held up reasonably well on the SPR news. After all, the proposed 50 million barrel draw represents total global consumption for about half a day. However, a prolonged dent in global travel from the newest variant could land a much more serious blow on oil demand. Notably, natural gas went the other way this week, strengthening to around $5.25, largely unaffected by either the prospect of less travel and/or the SPR draw.

Get Back: Canada was not left out of the gyrations on central bank expectations. Prior to the Friday back-up, markets had fully priced in 150 bps of BoC tightening in 2022. To put that in perspective, one would need to go back to 1994 to find a time that the Bank hiked that much in a single calendar year. It is true that, in each of the past four tightening cycles, the BoC tended to start fast with hikes at back-to-back meetings. But, not 150 bps fast. Even with some backing off late in the week, traders still have roughly 125 bps of rate hikes built in for 2022, with the first move fully priced in for April. We still believe 125 bps looks aggressive, given both the ongoing uncertainty around the pandemic as well as the vulnerability of the household sector to fast rate hikes (especially with variable mortgages so favoured by borrowers in the past year).

Across the Universe: It’s not just North America where central banks are turning to tightening. This week saw the both New Zealand and Korea hike by 25 bps (to 0.75% and 1.0%, respectively), the second such move by each this cycle. No doubt, the new variant at the very least put a temporary chill into rate hike prospects for those central banks sitting on the fence. One central bank going the other way has been in Turkey, where rates have been cut despite flaring inflation. In turn, this has sent the lira skidding; it has dropped 33% just since the end of August and has now lost half its value over the course of the pandemic.

I Dig a Pony: Or really any beast, as employers need help! Having already vaulted above the 10 million mark stateside, job vacancies have surged in recent months to above 1 million in Canada. This has pushed the job vacancy rate to 6%, doubling just since the start of the year. Unsurprisingly, the hospitality sector is leading the way with a towering 14.4% rate (versus barely 4% a year ago). This week’s Focus Feature digs further into the implications for wages—higher, in the near term. The wage metrics will be one of the key areas of focus for next Friday’s dual November jobs reports. Canada’s release will be dealing with a variety of cross currents, including the cessation of CEWS and CRB, as well as the B.C. floods and a more complete reopening in Ontario. On balance, we expect the job market to tighten further, possibly markedly so.

For You Blue: Prior to the big risk-off move on Friday, the Japanese yen had been particularly blue, weakening to the 115/US$ level. That represented its softest point in five years, with the currency depreciating more than 10% just since the start of 2021. The BoJ just can’t join in the tightening moves by all of the other central banks, with inflation in Japan still pinned at near zero. However, along with gold, the yen was one of the few winners on Friday in a classic risk-off fashion. On the flip side, the Canadian dollar fell more than 1% to around 78 cents ($1.278/US$). Notably, the supposed great new hedge—crypto—was hammered across the board on the new variant.

I Me Mine: Sorry, I’ve got nothing to give on this one about selfishness. With that, I’d like to say thank you on behalf of the group and ourselves, and I hope we passed the audition.

Above and beyond the November jobs reports and any further information on Nu, next week is chock-full of key economic releases and events, especially for Canada. The Q3 national accounts will be released, with the balance of payments on Monday, and GDP on Tuesday. Even with a nice upturn in trade in the quarter, and another solid current account surplus, we are expecting only modest GDP growth (just over 3% a.r.) after the stunning slip in Q2 (-1.1%). For monthly GDP, watch for a strong flash reading for October after a stall in September. In addition, auto sales for November will be watched for any signs of improvement after a tough fall, and the U.S. ISMs for the month will also give an update on supply challenges.

As well, we are anticipating a Fall Economic Statement in coming days from Ottawa, following this week’s Throne Speech. Even as the economic backdrop has ebbed and flowed since the April budget, the bottom-line deficit numbers are not expected to change dramatically. Real GDP growth looks to have come in roughly 1 percentage point shy of expectations in the budget (at 4.8%), but a spike in nominal GDP (to roughly 12% growth this year) will more than compensate.

In fact, the surprise across all levels of government has been a revenue windfall from strong incomes and spending. Province after province has reported much smaller than expected deficits due to the swell in revenues—combined, they are now looking at a $40 billion shortfall versus $77 billion expected in the spring budgets (almost a 50% chop in half a year). A repeat performance is not expected from Ottawa due to two factors: 1) part of the reason provinces are doing so well is due to support from federal transfers, and 2) Ottawa has unveiled a range of new spending measures, with more possibly ahead following election pledges. And with the newest variant sending a harsh reminder that the pandemic is far from over, don’t look for any major drive to rein in spending anytime soon.

Doug Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.