Research Briefing: A federal budget for the ages and a possible fall election

Tony Stillo and Michael Davenport

April 20, 2021

This post-budget analysis was originally published by Oxford Economics.

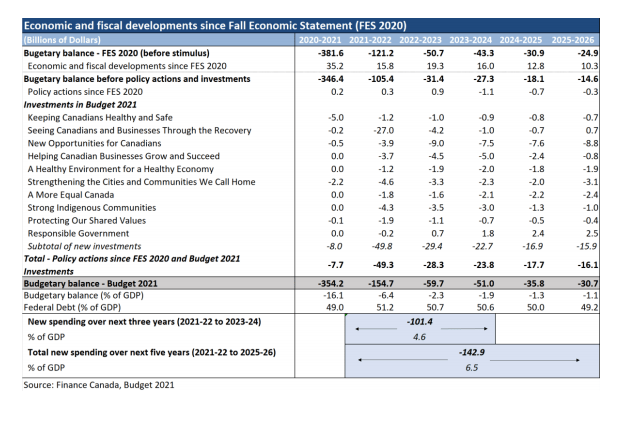

- The 2021 federal budget, the first in two years, proposes C$143bn (6.5% of GDP) in deficit-financed fiscal expansion over the next five years to beat coronavirus, lift Canada out of the pandemic recession and enhance long term prospects.

- We applaud plans for continued government support while the coronavirus still rages and needed new investments in childcare and infrastructure that should boost the economy’s potential. However, we remain concerned about the lack of a “fiscal anchor” and no clear plan for balancing the budget.

- There are also risks that further stimulus in the near term could stoke price pressures and raise borrowing rates, which would hinder the government’s capacity to support the economy if it were to enter another recession.

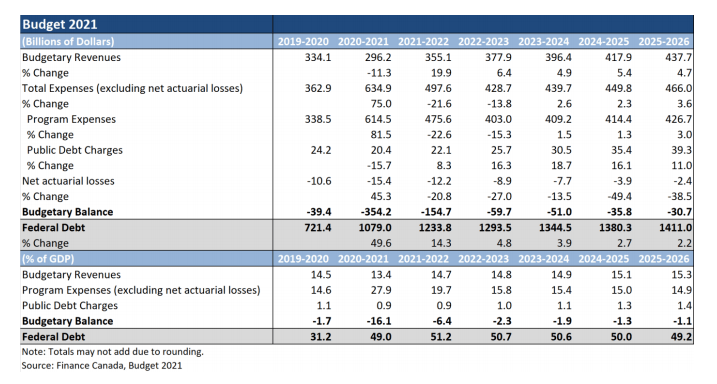

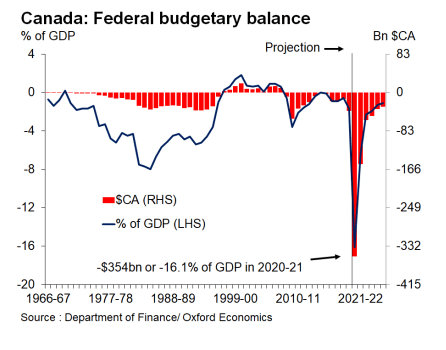

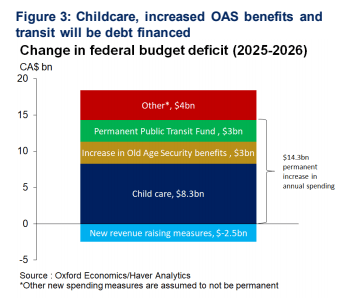

- The federal government expects this wave of new spending will boost the deficit to a record C$354bn (16% of GDP) in 2020-21 and then decline to a still-high C$154.7bn (6% of GDP) in 2021-22 as one-time pandemic response measures expire. But with C$14.3bn in permanently higher spending per year for child care, old age security and transit offset only partially by C$2.5bn annually in new tax revenue measures, the deficit will remain just under C$31bn or 1% of GDP in 2025-26.

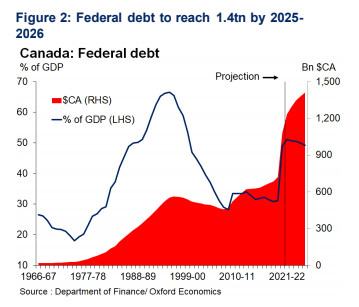

- Accordingly, the budget projects debt will jump from C$721tn (31% of GDP) in 2019-20 to C$1.1tn (49% of GDP) in 2020-21 and further to C$1.2tn (51% of GDP) in 2021-22. A steady string of deficits will cause debt rise to C$1.4tn but dip as a share of GDP to 49% in 2025-26 but still well above its pre-pandemic level.

Government extends pandemic support

The extension and enhancement of pandemic support programs make up about $32bn (23%) of the $143bn in new spending over the next five years, $27bn of which will be spent in the 2021-22 fiscal year. This is highlighted by the extension of the Canada Emergency Wage Subsidy (CEWS) and Canada Emergency Rent Subsidy (CERS) through September 2021. The Canada Recovery Benefit (CRB) will also be extended for an additional 12 weeks, while the Canada Recovery Caregiving Benefit (CRCB) will be extended for an additional 4 weeks, with the scope to lengthen these programs further if necessary.

New permanent spending will be almost entirely debt financed

The largest new spending initiative is the national childcare and early learning program, which is expected to cost $30bn over the next five years and $8.3bn per year thereafter. The program aims to cut average childcare fees in half by the end of 2022 and ultimately reduce the cost of regulated childcare to $10 per day on average by 2026. Along with reducing childcare costs and ensuring access to high quality childcare for Canadians, the government expects the program will help boost women’s labour market participation and raise the economy’s potential. The budget estimates the program will add 1.2% to potential GDP, through the addition of 240,000 people to the labour force.

The budget also introduced other new measures that will permanently raise the path for the deficit over the next five years and beyond. Old Age Security (OAS) benefits will be permanently increased by 10% for seniors 75 and older, along with a onetime $500 payment this August. This is expected to cost $12bn over the next five years and at least $3bn per year thereafter. The government also introduced the Permanent Public Transit Fund (PPTF), which will invest $5.9bn in transit infrastructure over the next five years, and cost $3bn annually from 2026-27 onward.

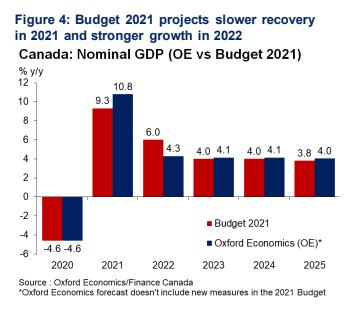

Taken together, these three programs alone will permanently increase the budget deficit by about $14bn per year starting in 2025-26. New revenue raising measures will help pay for only $2.5bn of this annual new spending, leaving the likely path for the budget deficit $11.5bn higher beginning in 2025-26 despite continued strong economic growth. (Figures 3 & 4)