25 or Stick to More

By Douglas Porter

October 11, 2024

The sturdy September U.S. employment report had already chilled talk of another 50 bp Fed rate cut, but a high-side CPI put it into the deep freeze. In fact, the debate now is whether the FOMC may pause for reflection in November, or December, after September’s big bazooka move. Egging on such talk is the fact that equity markets remain on a roll—the S&P 500 was at a new high Friday morning—and broader evidence that the U.S. economy is still chugging along, with the Atlanta Fed Nowcast currently pegging Q3 real GDP growth at a solid 3.2% pace. The combination of robust headline data, record stocks, and sticky core CPI even has some already declaring the Fed’s initial 50 bp cut was a ‘mistake’.

We’re not in the business of arm-chair Fed decision-making, at least not on a full-time basis, but it does appear that policymakers may have been a tad over-anxious with the opening rate cut salvo. However, there is still a solid case to be made for further rate cuts, despite the latest developments. Consumers remain wary, as noted by a drop in sentiment in October, according to the University of Michigan. The recent back-up in long-term interest rates, which has seen 10- and 30-year yields jump by almost 50 bps in four weeks, will keep the housing market on ice. And, a rise in initial jobless claims, even if distorted by hurricanes, will cast some doubt on the strength of the job market. Finally, even with the rise in core CPI to 3.3% y/y last month, it still looks like the core PCE deflator will instead dip a notch to an acceptable 2.6% y/y pace in September (assuming a 0.2% m/m rise).

Drawing these factors together, we’re still quite comfortable with our call of a steady series of 25 bp Fed cuts over the next four meetings, taking short-term rates just below 4% by next spring. After that point, we look for the cadence to slow to a cut every other meeting, until Fed funds gets just below 3% in early 2026. Given the volatility of the economic data, it may not be quite that neat and tidy, but the key point is that we look for short-term rates to drop by roughly 200 bps over the next 18 months. And of course it’s not just the data that can disrupt the outlook, as the multitude of geopolitical risks could readily push this call off course. Perhaps the biggest wildcard is the November 5 election, and its many potential economic implications; that’s a topic we’ll dive into more deeply in next week’s Focus Feature, but we do know that the market playbook calls for higher yields and a stronger dollar than would otherwise be the case under a Republican sweep.

The 25 or 50 debate remains very much alive and well in Canada, fuelled this week by a dovish view from a former BoC Deputy Governor. Said former official may well have been a perma-dove, so it’s not obvious this adds much to the cause for 50. There is certainly a case for a more aggressive BoC, including an economy struggling to break out of a 1% growth path, a headline inflation rate back at the 2% target (and expected to drop below it in next week’s CPI report), and a big rise in the jobless rate in the past year—all on top of the Fed opening the way with its own 50 bp cut.

Friday’s two key economic Canadian releases nearly fought to a draw, in the market’s eye. The September employment report aped its U.S. counterpart, with a solid 46,700 job gain (including a gaudy 112,000 new full-time jobs) and a surprising one tick drop in the unemployment rate to 6.5%. Dulling the strength was a curious 0.4% drop in total hours worked, and some relief from piping hot wages, as average hourly wages eased to 4.6% y/y (from 5.0%). The Q3 Business Outlook Survey reported only modest improvement in sentiment, but a nice turndown in the inflation outlook—only 15% of firms now expect inflation of more than 3% (i.e., above the target zone), compared with 54% at the end of last year. The net result of these two key reports was to leave the market almost perfectly split 50/50 on the 25/50 debate for October.

While the October result is in doubt, the market has zero doubt that the Bank will eventually take a bigger bite out of rates, with almost 75 bps of cuts priced in over the next two decisions. The only warnings we would put out there, and a reason why we have not yet budged off our call for a series of 25 bp moves are:

1) After a very calm summer, there is a lot of evidence and anecdotal reports that the housing market is beginning to stir, and potentially in a big way. An outsized BoC cut risks fanning a flame that’s already firing.

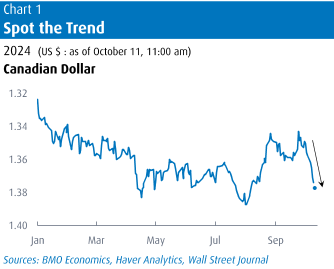

2) The Canadian dollar is suddenly careening lower again, clearly nervous about widening U.S./Canadian short-term spreads (Chart 1). The loonie was working on its eighth consecutive daily drop on Friday, for a cumulative setback of 2% to 72.6 cents (or $1.376/US$). A weaker exchange rate could inflame import costs.

3) After a late-summer lull, energy prices are sparking up again. A major reason why Canadian inflation will drop below 2% next week is thanks to a September slide in gasoline. But given the latest back-up in oil and pump prices, CPI is primed to pop right back above 2% in next month’s release. We suspect core trends will show little further progress in September, holding above 2%.

4) If the equity market could speak, it may well ask “what’s the rush?”. The TSX has quietly rolled 25% higher in the past year to a record high, and up a cool 10% just since the BoC began cutting rates in early June.

5) Finally, there is the small matter that the U.S. economy remains sturdy, and that lessens the urgency of outsized BoC cuts.

Having said all that, we readily recognize that inflation is back at target, the economy is operating below capacity, confidence is sour, and the Bank seems to have a dovish bent. If the market is handing the BoC an opportunity to cut by 50 bps on a silver platter, it’s tough to see them saying “No thanks”.

The title to today’s piece is a strained nod to Chicago’s “25 or 6 to 4”, a raucous anthem recorded 55 years ago—around the time of Woodstock and the first moon landing, for perspective. Somehow, that classic song has been resurrected this year by its starring role in an Amazon ad (after earlier being featured in I, Tonya). The song still could speak to the situation the BoC finds itself in…

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.